Oil Companies' Profits Fall Short of Crude-Price Rally

July 27 2018 - 9:39AM

Dow Jones News

By Bradley Olson

The world's largest oil companies continue to disappoint

investors with underwhelming profits that have fallen far short of

a rally in crude, reflecting the fragile nature of a recovery from

one of the worst price crashes in a generation.

Exxon Mobil Corp. said quarterly net income rose to $4 billion

from April to June, up 18% compared with the same period a year ago

but substantially below the more than 50% that oil prices rose in

that time. Production fell to 3.6 million barrels of oil and gas a

day, the lowest in more than 20 years, as an earthquake in Papua

New Guinea, led to lower volumes.

Profits at Chevron Corp. more than doubled to $3.4 billion and

the company announced plans to begin buying back about $3 billion

in shares annually. Shares at both companies declined early Friday

as the results fell well short of Wall Street expectations.

While the oil giants are set to generate record amounts of cash,

they have been slow to give more of that back to investors, another

factor that has sowed dissatisfaction. Exxon, Chevron and other

large companies posted their highest second-quarter profits since

2014, when oil prices began a decline that bottomed out at below

$30 a barrel. Yet as crude has recovered to about $70 a barrel,

many are still holding back on spending and shareholder payouts as

they recover from the painful downturn.

Together with European oil giants Royal Dutch Shell PLC, BP PLC

and France's Total SA, the five largest Western companies are set

to generate about $90 billion a year in excess cash in 2018 and

2019, exceeding records set in 2008 when oil sold for almost $150 a

barrel.

Yet they are paying out far less of their cash haul to

investors. In 2008, the five companies generated about $85 billion

in excess cash, the highest ever, and bought back more than $50

billion in shares, according to FactSet.

This year, the buyback total is unlikely to exceed $12 billion,

just 14% of the free cash flow expected by analysts at the five

companies. The demand for more cash reflects shareholder skepticism

about long-term oil and gas investments. As oil prices rose above

$100 a barrel, many companies increased spending by tens of

billions of dollars and failed to boost production or returns.

"Oil companies spent like drunken sailors in the last decade

without generating great returns," said Mark Stoeckle, chief

executive of Adams Funds, which owns about $175 million in Exxon

and Chevron shares. "Investors now are much more interested in

spending discipline and stock buybacks."

Smaller oil and gas producers are paying out far more, and

shareholders are rewarding them for it. Anadarko Petroleum Corp.,

which has a market capitalization of $37 billion, bought back

almost $3 billion in shares from September to March.

The company announced it would buy back an additional $1 billion

through June of 2019. Including reinvested dividends, shares are up

62% in the last year, more than double the average increase among

large companies like Exxon and Chevron. ConocoPhillips, which has

authorized the repurchase of about 20% of its shares outstanding,

has risen 67% in the last year, including dividends. That is more

than three times the gain on the S&P 500 index.

Shell fell by more than 3% Thursday after profits fell short of

expectations. The company announced a buyback of $25 billion

through 2020, yet some shareholders were disappointed that only $2

billion shares will be repurchased in the next two months, analysts

said.

BP shares fell slightly in premarket trading Friday after the

company announced plans to spend $10.5 billion to buy most of the

U.S. shale business of BHP Billiton Ltd. Last year, BP returned to

buying back shares to offset the dilution from its scrip dividend

program, but the company has yet to embrace a multibillion-dollar

share buyback program.

Exxon and Chevron, which collectively bought back $15 billion to

$25 billion in shares annually when oil sold for more than $100 a

barrel before the crash, have yet to return to large-scale buyback

programs.

"The market loves capital discipline and shareholder returns,"

said Kris Nichol, an analyst at consultancy Wood Mackenzie Ltd.

"The majors, so far, have been adhering to capital discipline, but

they haven't been on the front foot in terms of shareholder

returns."

Write to Bradley Olson at Bradley.Olson@wsj.com

(END) Dow Jones Newswires

July 27, 2018 09:24 ET (13:24 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

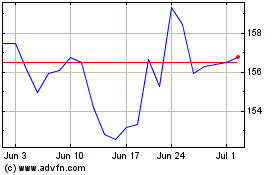

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

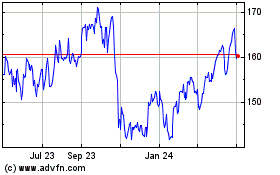

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024