A.M. Best has removed from under review with developing

implications and affirmed the Financial Strength Rating (FSR) of B+

(Good) and the Long-Term Issuer Credit Rating (Long-Term ICR) of

“bbb-” of Genworth Life and Annuity Insurance Company

(GLAIC) (Richmond, VA). Concurrently, A.M. Best has removed from

under review with developing implications and affirmed the FSR of

B- (Fair) and the Long-Term ICRs of “bb-” of Genworth Life

Insurance Company (GLIC) (Wilmington, DE) and Genworth Life

Insurance Company of New York (New York, NY). Additionally,

A.M. Best has removed from under review with developing

implications and affirmed the Long-Term ICRs of “b” of Genworth

Financial, Inc. (Genworth) [NYSE: GNW] and Genworth

Holdings, Inc. (both domiciled in Delaware), as well as their

Long-Term Issue Credit Ratings (Long-Term IR). The outlook assigned

to these Credit Ratings (ratings) is stable.

A.M. Best has removed the under review status on all existing

Genworth ratings based on its assessment of potential outcomes

given the successful completion of the Committee on Foreign

Investment in the United States process in June 2018. This

represented a key step toward the pending acquisition of Genworth

by China Oceanwide. Other regulatory regimes also need to approve

the transaction. For now, Genworth management has formulated

adequate financial flexibility, given a limited ability to access

the public debt and equity markets.

Genworth addressed the May 2018 $600 million of senior debt with

the issuance of a $450 million senior secured term loan in March

2018. In addition, the holding company maintains an adequate level

of liquidity. Also, cash flow from the domestic and international

mortgage businesses remains good.

The ratings of GLAIC reflect its balance sheet strength, which

A.M. Best categorizes as strong, as well as its marginal operating

performance, limited business profile and appropriate enterprise

risk management (ERM).

The ratings of GLIC reflect its balance sheet strength, which

A.M. Best categorizes as weak, as well as its marginal operating

performance, limited business profile and appropriate ERM.

GLIC’s operations remain focused on the long-term care (LTC)

market, which A.M. Best has on its product continuum at the high

end of risk. A.M. Best continues to view GLIC’s risk-adjusted

capital level as weak, as measured by Best’s Capital Adequacy Ratio

(BCAR), for year-end 2017. The LTC block continues to rely solely

on premium rate increases and associated benefit reductions to

prevent capital to further decline. A.M. Best notes the company has

been successful at securing rate increases across its various LTC

blocks, but operating performance remains volatile, and with the

limited product profile, prevents meaningful organic capital

growth. On the other hand, GLAIC’s risk-adjusted capital, as

measured by BCAR, remains strong. However, this has continued to

give rise to marginal and volatile operating performance with a

limited business profile, reflective of the company’s decision to

halt sales of its traditional life insurance and fixed annuity

products in 2016.

Given the information at hand, A.M. Best believes the successful

closing of a transaction with China Oceanwide will have neither a

positive nor negative impact on the ratings of Genworth. However,

A.M. Best will revisit that view when and if the transaction

closes, and is presented with additional plans and company

intentions, including capital contributions to any rated

entities.

The following Long-Term IR has been assigned with a stable

outlook:

Genworth Holdings, Inc. (guaranteed by Genworth

Financial, Inc.)—-- “b” on $450 million floating rate senior

secured term loan, due 2023

The following Long-Term IRs have been removed from under review

with developing implications and affirmed with assigned outlooks of

stable:

Genworth Holdings, Inc. (guaranteed by Genworth

Financial, Inc.)—-- “b” on $400 million 7.70% senior unsecured

notes, due 2020-- “b” on $400 million 7.20% senior unsecured notes,

due 2021-- “b” on $750 million 7.625% senior unsecured notes, due

2021-- “b” on $400 million 4.9% senior unsecured notes, due 2023--

“b” on $400 million 4.8% senior unsecured notes, due 2024-- “b” on

$300 million 6.50% senior unsecured notes, due 2034-- “ccc+” on

$600 million fixed/floating rate junior subordinated notes, due

2066

The following indicative Long-Term IRs on securities available

under the universal shelf registration have been removed from under

review with developing implications and affirmed with assigned

outlooks of stable:

Genworth Financial Inc.—-- “b” on senior unsecured debt--

“b-” on subordinated debt-- “ccc+” on preferred stock

Genworth Holdings, Inc.—-- “b” on senior unsecured debt--

“b-” on subordinated debt-- “ccc+” on preferred stock

Genworth Global Funding Trusts—The program rating of

“bbb-” has been removed from under review with developing

implications and withdrawn, as the vehicle is empty.

This press release relates to Credit Ratings that have been

published on A.M. Best’s website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please see A.M.

Best’s Recent Rating Activity web page. For

additional information regarding the use and limitations of Credit

Rating opinions, please view Understanding Best’s Credit

Ratings. For information on the proper media use of Best’s

Credit Ratings and A.M. Best press releases, please view

Guide for Media - Proper Use of Best’s Credit Ratings and A.M.

Best Rating Action Press Releases.

A.M. Best is the world’s oldest and most authoritative

insurance rating and information source. For more information,

visit www.ambest.com.

Copyright © 2018 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180725005955/en/

A.M. BestBruno Caron, FSA, MAAA, +1 908-439-2200, ext.

5144Financial

Analystbruno.caron@ambest.comorKen Johnson, CFA,

CAIA, FRM, +1 908-439-2200, ext. 5056Senior

Directorken.johnson@ambest.comorChristopher Sharkey,

+1 908-439-2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorJim Peavy,

+1 908-439-2200, ext. 5644Director, Public

Relationsjames.peavy@ambest.com

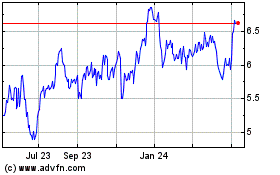

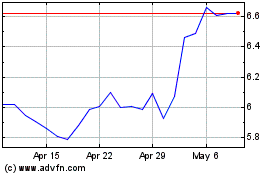

Genworth Financial (NYSE:GNW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Genworth Financial (NYSE:GNW)

Historical Stock Chart

From Apr 2023 to Apr 2024