AmEx Lifts Revenue Outlook -- WSJ

July 19 2018 - 3:02AM

Dow Jones News

By AnnaMaria Andriotis and Maria Armental

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 19, 2018).

American Express Co. raised its revenue forecast for the year,

following a second consecutive quarter of strong results on higher

card-member spending and loan growth.

The company on Wednesday said that given its financial

performance for the first half of the year, it now expects revenue

for the year to increase at least 9%, up from its earlier view of

at least 8%. It maintained its view of earnings to be at the high

end of $6.90 to $7.30 a share.

Second-quarter consolidated total revenues net of interest

expense were a record $10 billion, up 9% from $9.2 billion a year

ago, the highest level of growth for the company since the last

financial crisis. The increase reflected ongoing growth in card

spending and borrowing as well as more consumers signing up for

AmEx cards that charge annual fees.

The second quarter marks the first full quarter for AmEx's new

Chief Executive Stephen Squeri since he took over from longtime

chief Kenneth Chenault in February. Mr. Squeri laid out the

company's top priorities under his leadership on the earnings call,

including expanding AmEx's position in the premium consumer-card

market and in commercial payments. He added that in response to

shareholders' requests to hear his views more often, he plans to

join AmEx's earnings calls going forward, a departure from Mr.

Chenault who often wasn't on the calls.

Overall, AmEx reported a 21% increase in second-quarter profit

to $1.62 billion, or $1.84 a share. Revenue, net of interest

expense, rose 9% to $10 billion.

Analysts surveyed by Thomson Reuters projected a profit of $1.82

a share on $9.84 billion in revenue.

Shares, which are up 3.7% this year, fell 3.4% to $99.50 in

after-hours trading.

AmEx card loans surged as the company continues its efforts to

ramp up lending. The company reported $75.4 billion in card-member

loans, up 14% from a year prior. The company has been increasing

lending as part of its strategy to fuel revenue growth.

There are signs that is becoming an expensive play. Loan-loss

reserves for cards increased 39% from a year prior. AmEx's loan

losses, which remain among the lowest in the industry, are on the

rise. Its net write-off rate, including unpaid principal, interest

and fees, reached 2.5% in the second quarter, up from 2.1% a year

prior.

Card-member spending rose 10% in the most recent period, the

company's third consecutive quarter of double-digit growth. AmEx

also added 2.9 million cards.

Mr. Squeri on the earnings call touted the company's recent

Supreme Court win: Wednesday's financial report is the first since

the company won a key legal challenge on its policy of preventing

retailers who accept AmEx cards from offering customers incentives

to pay with cheaper cards. "Their ruling was a welcome end to a

long legal battle," he said.

Discount revenue, which reflects the fees charged to merchants

for accepting its cards, remained the company's largest revenue

source at $6.19 billion, up 8% from the year earlier. While the

company used to charge some of the highest so-called swipe fees, it

has been lowering those costs as part of its effort to gain

acceptance with more merchants and to reach parity with Visa and

Mastercard acceptance.

Overall, expenses rose 7% from the year-ago period. Card-members

rewards, the company's largest single expense that includes points

redeemed for hotels and airfare, reached $2.43 billion in the

second quarter, up 11% from the year-ago period.

On the premium front, the company said a significant share of

people signing up for its Platinum card are millennials. Mr. Squeri

added that AmEx has been expanding the number of its Centurion

airport lounges that premium card members can access.

He also said the company plans to continue investing in the

commercial payments sector, including the small-business segment.

The company last month announced a new small-business credit card

with Amazon.com Inc.

The company also said last month it would raise quarterly

dividend payouts and buy back up to $3.4 billion of common shares

through next year's second quarter after clearing the Federal

Reserve's annual stress test. The company temporarily stopped

buying back its stock after a roughly $2.6 billion charge tied to

the U.S. tax overhaul pushed it into its first quarterly loss in a

quarter-century.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com and

Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

July 19, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

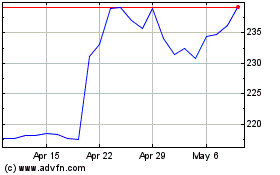

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2024 to May 2024

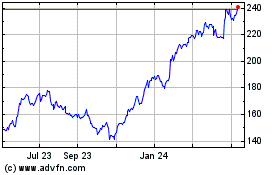

American Express (NYSE:AXP)

Historical Stock Chart

From May 2023 to May 2024