Comcast's Pursuit of Fox Just Got Tougher

July 13 2018 - 4:00PM

Dow Jones News

By Shalini Ramachandran

Comcast Corp.'s bid for 21st Century Fox hit a setback after the

Justice Department said Thursday it would appeal a federal judge's

decision to bless a merger of AT&T Inc. and Time Warner

Inc.

Comcast had used the earlier ruling to rebut concerns from Fox

that its bid would face regulatory risk. AT&T's deal for Time

Warner married a company primarily focused on distributing content

with one that produced it, just like Comcast's bid for Fox. Comcast

made its $65 billion offer for Fox a day after the ruling last

month.

The government's appeal of that earlier decision could weaken

Comcast's position in the eyes of Fox's board as the cable giant

battles with Walt Disney Co. over Fox. Disney followed Comcast by

raising its offer to purchase most of Fox's assets to more than

$71.3 billion.

Comcast executives believe that the Justice Department is likely

to lose its appeal given the strong wording of the prior decision

and industry precedents, including Comcast's own 2011 acquisition

of NBCUniversal, people familiar with their thinking said. However,

the appeal could push Comcast to narrow its focus to one of the

main prizes in the Fox chase: European pay-TV operator Sky PLC.

Smead Capital Management, a long-term investor in both Disney

and Comcast, believes Disney is likely going to end up as the

winner of the Fox assets. "We like the deal for Disney. We liked it

for Comcast as well, but we need Comcast to be reasonable and

rational in what they pay, " said Tony Scherrer, director of

research at Smead.

Other personal dynamics are at play. Fox Executive Chairman

Rupert Murdoch and his sons view Comcast with wariness after years

of tough dealings with the cable giant and would prefer to own

stock in a combined Disney-Fox, The Wall Street Journal has

previously reported.

"This is a clear gift to Disney," wrote Craig Moffett, analyst

at MoffettNathanson LLC, in a research note Thursday after the

Justice Department filed its appeal. "Fox's board has been looking

for a justifiable reason to choose Disney over Comcast."

Comcast executives believe their situation is distinct from

AT&T's because the phone giant operates nationwide as a

wireless carrier and satellite TV provider through DirecTV, while

Comcast, though large, still only operates in some regions of the

country, the people said.

Fox has put up for sale entertainment properties including its

Hollywood movie and TV studio, some cable channels and regional

sports networks, as well as a stake in streaming service Hulu. That

deal also would include its 39% stake in Sky and other

international assets.

Already Disney had a leg up. Last month, the media giant won the

Justice Department's approval for its Fox deal on the condition it

jettisons Fox's 22 regional sports networks. Some in the Comcast

camp were surprised at how fast Disney won regulatory approval for

its Fox deal, given that the two compete in similar industries like

TV and filmmaking, the people said.

Comcast's advances on Sky could continue to hobble Disney's

pursuit of Fox. Earlier this week, Comcast raised its offer for Sky

to GBP14.75 per share, valuing the company at $34 billion. That is

a 5% premium to an offer Fox, which had been seeking to consolidate

ownership, announced earlier Wednesday. It is 18% above Comcast's

earlier bid.

The role of the U.K. Takeover Panel, a regulatory body that

polices corporate deal making, has created an unusual situation

where as Disney and Comcast bid up Fox's assets, the implied value

of Sky also rises, forcing the two sides to raise their bids for

Sky. Comcast is loath to bid against itself, the people said.

Depending on how the auction for Sky plays out, Comcast could

decide to focus its efforts on the European operator and drop its

pursuit of Fox's assets, people familiar with the matter said. Back

at home, the cable giant hasn't yet topped Disney's latest bid, a

sign some Wall Street analysts took to suggest that Comcast is

hinting to Disney that it would be willing to split up the assets,

taking home Sky and leaving Disney with the other operations.

But BTIG analyst Richard Greenfield in a note earlier this week

said Disney and Comcast aren't allowed to talk to each other and a

splitting-the-baby scenario may not be in the best interests of Fox

and Sky's public shareholders. Moreover, Disney has talked up the

value of Sky for its plans to challenge Netflix Inc. globally.

"Honestly, it feels as if Comcast could now come away with

nothing, beyond an even more fractured relationship with one of

their most important programming partners in Disney," Mr.

Greenfield wrote.

Write to Shalini Ramachandran at

shalini.ramachandran@wsj.com

(END) Dow Jones Newswires

July 13, 2018 15:45 ET (19:45 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

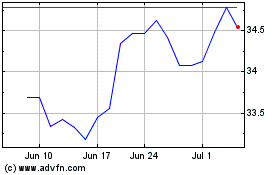

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Mar 2024 to Apr 2024

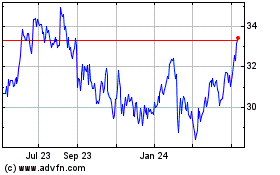

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Apr 2023 to Apr 2024