Rule Change May Help Online TV -- WSJ

July 09 2018 - 3:02AM

Dow Jones News

By Michael Rapoport

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 9, 2018).

Is it a TV show or a really long movie? In the streaming,

binge-watching era, the line between the two has gotten blurry --

and that could eventually help nudge earnings upward at companies

like Amazon.com Inc. and 21st Century Fox Inc.

Accounting rule makers have tentatively agreed that companies

should account for their costs of producing TV shows in the same

way that movie production costs are already handled. Right now, TV

producers have to immediately expense many of those costs, cutting

into profits; moviemakers can bleed them into results over

time.

The difference between shows and movies "is no longer as

relevant" for purposes of gauging companies' finances, said Jason

Bond, coordinator of the Emerging Issues Task Force, a part of the

Financial Accounting Standards Board. The group decided upon the

change last month.

If the change is ultimately enacted by the full FASB, TV

producers could record profits more quickly than they do now.

Mr. Bond said the impact will vary among companies. But in a

market where TV producers are in an arms race, spending billions of

dollars on original content, any additional lift to their profits

could be important.

Under current rules, companies that make movies can fully

"capitalize" their production costs -- they are placed on the

balance sheet and filtered into earnings over time instead of being

recognized in earnings all at once.

That isn't always the case for companies that make TV shows --

often housed within companies that also have units making movies.

TV show makers can only capitalize a portion of their expenses,

while the rest are charged to current earnings. The only production

costs they can capitalize are those they can show are matched by

revenue they have contracted for, or by future revenue from other

markets like syndication or DVD sales.

The arrangement made sense when the current rules were

formulated back in 2000. Back then, all TV shows were released one

episode at a time, often on platforms that the producing company

didn't control, and there was a big risk a show could flop and be

canceled quickly, making it harder for the producer to make back

what it had spent. So limiting the degree to which companies could

capitalize their costs seemed appropriate.

Today, streaming-TV companies often put out all episodes of a

show at once, like a movie, on their own platform. There are new TV

business models, like subscriptions. The avenues for distributing

TV shows have mushroomed.

All that made TV production less of a crapshoot. It also left

accounting rule-makers questioning whether there was any point to

continue drawing a distinction between TV and movie production, Mr.

Bond said.

Last month, the FASB task force, which handles new and

specialized accounting issues, tentatively decided all production

costs could be capitalized, whether for movies or TV shows. For

companies that currently expense some of their costs, that could

mean they will record lower current expenses, boosting earnings,

although the capitalized costs will ultimately be reflected in

earnings down the line.

The proposed changes will ultimately have to be approved by the

full FASB, and wouldn't take effect until some point in the

future.

Not all TV producers will necessarily benefit. Netflix Inc., for

one, said in its annual report that it already capitalizes

production costs for its original productions. Netflix couldn't be

reached for comment.

Amazon, which has become a major force in streaming original TV

shows, has indicated it does count some of its production costs

against current earnings. The company said in its annual report its

capitalization of those costs is limited, and so some of them are

expensed as they are incurred. An Amazon spokeswoman declined to

comment.

Similarly, 21st Century Fox said in its annual report that TV

production costs "incurred in excess of the amount of revenue

contracted for each episode in the initial market are expensed as

incurred on an episode-by-episode basis." A Fox spokeswoman

declined to comment. 21st Century Fox shares common ownership with

News Corp., the parent company of The Wall Street Journal.

Write to Michael Rapoport at Michael.Rapoport@wsj.com

(END) Dow Jones Newswires

July 09, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

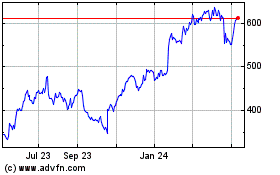

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

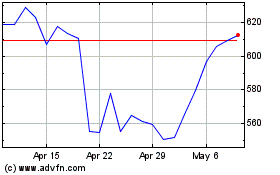

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024