Kroger Revamp Bears Fruit -- WSJ

June 22 2018 - 3:02AM

Dow Jones News

By Heather Haddon

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 22, 2018).

Kroger Co. delivered stronger than expected earnings and sales,

sending its stock up 9.7% as investors welcomed evidence that the

grocer is growing even as it overhauls operations to compete with

Amazon.com Inc. and discounters.

The largest U.S. supermarket chain by stores and sales reported

revenue of $37.5 billion in the quarter ending in May, up from

$36.3 billion the prior year. Earnings per share on an adjusted

basis more than doubled, to 73 cents per share on $626 million in

earnings from 32 cents per share on $303 million in the prior

year.

Kroger has been overhauling its operations to face rising

competition in the retail food sector, particularly as Amazon rolls

out food delivery and discounts at the Whole Foods chain it bought

last year.

European discount chains Aldi and Lidl are also expanding in the

U.S., putting pressure on established supermarkets to keep prices

low. Kroger is cutting prices on some groceries to keep customers

loyal.

"We've been aggressively working to transform our business and

accelerate where we are going," Kroger Chief Executive Rodney

McMullen said in an interview.

Mr. McMullen said the company would continue to invest in

technology while working with suppliers to keep costs down.

Cincinnati-based Kroger said last month that it was t aking a

roughly $250 million stake in British online grocer Ocado Group PLC

to run its automated warehouses and process online orders. That

will help bolster the deliveries that Kroger offers through

third-party providers and in-store pickup points it is introducing

for online orders. Walmart Inc. is also expanding delivery and

in-store pickups to compete with Amazon.

Kroger executives said Thursday that digital sales grew 66%

during the company's first quarter. They said they hope eventually

to offer digital orders across the country, even in regions such as

the Northeast, where Kroger doesn't operate stores.

Kroger also said last month that it was buying Home Chef and

would sell that company's meal kits in its stores. That is part of

a broader culling of the products sold at nearly 2,800 Kroger

stores to emphasize better-selling products and store-brand

goods.

Some analysts believed the big changes on Kroger's shelves could

weigh on sales if customers struggle to find familiar goods. Kroger

said Thursday that the changes would damp sales until around the

fall.

"It actually takes our associates and our customers a while to

actually find things in the store," Chief Financial Officer Mike

Schlotman said at an investor conference last month.

Mr. McMullen said Thursday that the restocking program was "off

to a fantastic start" and that it contributed to the company's

strong performance this quarter. Executives said cost savings also

helped. Shares in several other food retailers also rose early

Thursday. Kroger's percentage jump was on track to be the stock's

biggest one-day gain since March 2009, since September 2010, with

its stock closing at $28.73.

"Kroger is making progress on its transformation," Telsey

Advisory Group wrote in a note to investors. "That said, the

ongoing pressure from strong competitors is not going away, and

many of these strategic initiatives are pressuring

profitability."

To pay for its investments, Kroger and its competitors are

opening fewer new stores. The company last week said it would sell

all 14 Kroger stores in the Raleigh-Durham area of North Carolina

in August. Lidl and Aldi and specialty regional supermarkets such

as Publix Super Markets Inc. have expanded rapidly there.

"We have not been able to grow our business the way we would

like in this market," said Kroger division President Jerry

Clontz.

Kroger also sold its chain of convenience stores for $2.15

billion in April. The sale contributed to the $2 billion in total

profit Kroger made in the recent quarter.

Write to Heather Haddon at heather.haddon@wsj.com

(END) Dow Jones Newswires

June 22, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

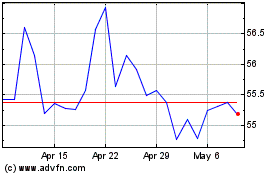

Kroger (NYSE:KR)

Historical Stock Chart

From Aug 2024 to Sep 2024

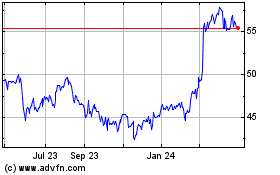

Kroger (NYSE:KR)

Historical Stock Chart

From Sep 2023 to Sep 2024