Intuit Sees Revenue Growth, Higher Profit -- Earnings Review

May 22 2018 - 5:03PM

Dow Jones News

By Aisha Al-Muslim

Intuit Inc. (INTU) reported its third-quarter results after the

close of trading on Tuesday. Here's what you need to know.

PROFIT: The business-software company, whose products include

TurboTax, reported net income of $1.2 billion, or $4.59 a share,

compared with $964 million, or $3.70 a share, for the same quarter

a year earlier. Adjusted earnings were $4.82 a share, beating the

$4.68 a share analysts polled by Thomson Reuters were looking

for.

OPERATING INCOME: Operating income rose 12% to $1.62

billion.

REVENUE: Revenue rose 15% to $2.93 billion, ahead of the

consensus forecast of $2.85 billion. The company saw a boost in

quarter by 41% online ecosystem revenue growth and share gains in

TurboTax.

GUIDANCE: For the fourth quarter, the company guided revenues of

$940 million to $960 million, an increase of 12% to 14%, compared

with analysts' estimates of $891.51 million. The company also

guided adjusted earnings per share of 22 cents to 24 cents in the

fourth quarter, compared with analysts' estimates of 29 cents a

share.

For the full fiscal year 2018, the company raised its revenue

outlook to $5.92 billion to $5.94 billion, up from earlier

estimates of $5.64 billion to $5.74 billion. It also raised its

outlook for adjusted per-share earnings to $5.51 to $5.53, up from

$5.30 and $5.40. Analysts have modeled per-share earnings of $5.43

and $5.79 billion in revenue.

STOCK MOVE: The stock has fallen more than 1% to $188.10 in

after-hours trading Tuesday. Shares are up 50% in the last

year.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

May 22, 2018 16:48 ET (20:48 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

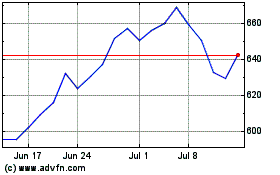

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Apr 2023 to Apr 2024