SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

May 2, 2018

Commission File Number: 001-32827

MACRO BANK INC.

(Translation of registrant’s name

into English)

Sarmiento 447

Buenos Aires C1 1041

Tel: 54 11 5222 6500

(Address of registrant’s principal

executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

INDEX

|

|

1.

|

Translation of a submission from Banco Macro to the CNV dated

on May 2, 2018.

|

RESOLUTIONS ADOPTED BY THE GENERAL

AND SPECIAL SHAREHOLDERS’ MEETING HELD ON 04/27/2018

ITEM # 1:

For a majority

of 663,221,350 votes for this motion and 129,040 abstentions, the Shareholders decided to appoint the representatives of Mr. Jorge

Horacio Brito and The Bank of New York Mellon, to sign the minutes of this meeting.

ITEM # 2

:

For a majority

of 653,593,260 votes for, 9,757,110 abstentions and 20 votes against this motion, the Shareholders resolved to approve the documents

under Section 234, subsection 1, of Law 19550, for the fiscal year of the Company ended December 31, 2017.

ITEM # 3

:

For a majority

of 663,212,450 votes for, 137,690 abstentions and 250 votes against this motion, with the appropriate abstention in each case of

the shareholders members of the Board with respect to their own performance, the Shareholders resolved to approve the performance

of the Board and the acts and proceedings carried out by the Supervisory Committee during the fiscal year 2017.

ITEM # 4

:

For a majority

of 663,217,620 votes for this motion and 132,770 abstentions, the Shareholders resolved to apply the accumulated retained earnings

as of December 31, 2017 totaling AR$ 9,388,771,818.55 as follows:

a) the

amount of AR$ 1,877,754,363.71 to the Legal Reserve Fund;

b) the

amount of AR$ 7,511,017,454.84 to the optional reserve fund for future distribution of profits under Communication “A”

5273 issued by the Central Bank of the Republic of Argentina.

ITEM # 5

:

For a majority

of 663,226,560 votes for this motion and 123,830 abstentions, the Shareholders resolved to approve (i) the separation of AR$ 3,348,315,105

from the optional reserve fund, representing AR$ 5 per share, for the payment of a cash dividend; and (ii) delegate to the Board

the powers to determine de date of the effective availability to the shareholders of the approved cash dividend in proportion to

their respective shareholdings.

ITEM # 6

:

For a majority

of 443,333,330 votes for, 28,356,130 abstentions and 191,660,930 votes against this motion, the Shareholders’ Meeting resolved

(i) to approve the remunerations payable to the members of the Board of Directors for the fiscal year ended December 31, 2017,

on the amount of AR$ 393,452,078, this amount representing 4.98% of the computable profit, i.e., after deducting the legal reserve

fund from the net profit for the year. In accordance with Exhibit I, Chapter III, Title II of the Rules of the Argentine Securities

Exchange Commission or CNV, taking into account that the proposed dividend represents 42.36% of the computable profit of the year

2017, the limit for remunerations to Directors is 14.95% of the computable profit; and (ii) to delegate to the Board of Directors

the allocation of the approved remunerations to each member of the Board.

ITEM # 7

:

For a majority

of 620,599,890 votes for, 35,531,180 abstentions and 7,219,320 votes against this motion, the Shareholders’ Meeting resolved:

(i) to approve an amount of fees for the Supervisory Committee equal to AR$ 1,305,540, such amount being reported in the statement

of income for the fiscal year ended December 31, 2017, and (ii) to delegate to the Board of Directors the allocation of the approved

remunerations to each member of the Supervisory Committee.

ITEM # 8

:

For a majority

of 633,717,920 votes for, 24,377,930 abstentions and 5,254,540 votes against this motion, the Shareholders resolved to approve

the Auditor’s remuneration of AR$ 16,740,128, payable for such Auditor’s work related to the audit of the Company’s

financial statements for the fiscal year ended December 31, 2017.

ITEM # 9

:

For a majority

of 644,396,990 votes for, 4,229,430 abstentions and 14,723,970 votes against this motion, the Shareholders’ Meeting resolved

to appoint Mr. Delfín Jorge Ezequiel Carballo as regular director to hold office for three fiscal years, as per the nomination

of the shareholders Jorge Horacio Brito and Delfín Jorge Ezequiel Carballo.

For a majority of 654,500,020 votes for,

1,398,220 abstentions and 7,452,150 votes against this motion, the Shareholders’ Meeting resolved to appoint Ms. Constanza

Brito as regular director to hold office for three fiscal years, as per the nomination of the shareholders Jorge Horacio Brito

and Delfín Jorge Ezequiel Carballo.

For a majority of 661,235,930 votes for,

1,404,520 abstentions and 709,940 votes against this motion, the Shareholders’ Meeting resolved to appoint Mr. Mario Luis

Vicens as regular director to hold office for three fiscal years, as per the nomination of the shareholders Jorge Horacio Brito

and Delfín Jorge Ezequiel Carballo.

For a majority of 661,272,840 votes for,

1,404,510 abstentions and 673,040 votes against this motion, the Shareholders’ Meeting resolved to appoint Mr. Guillermo

Eduardo Stanley as regular director to hold office for three fiscal years, as per the nomination of the shareholders Jorge Horacio

Brito and Delfín Jorge Ezequiel Carballo.

For a majority of 655,150,240 votes for,

1,405,620 abstentions and 6,794,530 votes against this motion, the Shareholders’ Meeting resolved to appoint Mr. Juan Martín

Monge Varela as regular director to hold office for three fiscal years, as per the nomination of the shareholder ANSES-FGS.

For a majority of 660,824,610 votes for,

2,475,940 abstentions and 49,840 votes against this motion, the Shareholders’ Meeting resolved to appoint Mr. Santiago Horacio

Seeber as alternate director to hold office for one fiscal year, as per the nomination of the shareholders Jorge Horacio Brito

and Delfín Jorge Ezequiel Carballo.

For a majority of 660,201,580 votes for,

2,477,010 abstentions and 671,800 votes against this motion, the Shareholders’ Meeting resolved to appoint Mr. Alberto Guillermo

Chiti as alternate director to hold office for one fiscal year, as per the nomination of the shareholder ANSES-FGS.

The shareholders present expressly state

that Messrs. Delfín Jorge Ezequiel Carballo and Santiago Horacio Seeber and Ms. Constanza Brito shall act as non-independent

directors and Messrs. Mario Luis Vicens, Juan Martín Monge Varela and Alberto Guillermo Chiti shall act as independent directors,

the latter pursuant to the provisions of Article III, Chapter III, Title II of the Rules of the Argentine Securities Exchange Commission

(“CNV”).

The shareholders present were advised that

Mr. Guillermo Eduardo Stanley meets the requirements of independency provided for in General Resolution No. 622/2013 as published

in the Official Gazette on September 9

th

2013. On April 16

th

2018 the CNV published General Resolution No.

730/2018 by which it: (i) modified the criteria for a director to be considered independent, among other changes qualifying as

non-independent those directors who, as in the case of Mr. Stanley, had acted in the company as independent directors for a period

of 10 years; and (ii) established that any company required by the applicable rules to have among the members of its Board independent

directors, must comply with the provisions of the General Resolution mentioned in last place as of the first general shareholders’

meeting discussing the items included in subsection 1, section 234 of the General Companies Act, to be held after December 31

st

2018.

ITEM # 10

:

For a majority

of 616,489,040 votes for, 28,288,000 abstentions and 18,573,350 votes against this motion, the Shareholders’ Meeting resolved

that the Supervisory Committee shall be composed of three regular members and three alternate members and designated the Accountants

Alejandro Almarza, Carlos Javier Piazza and Silvana María Gentile as regular syndics and the Accountants Alejandro Carlos

Piazza, Leonardo Pablo Cortigiani and Jorge Roberto Pardo as alternate syndics, to hold office for one fiscal year. All the members

of the Supervisory Committee shall act as independent members.

The Certified Public Accountants Alejandro

Almarza, Carlos Javier Piazza, Alejandro Carlos Piazza and Leonardo Pablo Cortigiani were appointed as per the nomination submitted

by the shareholders Jorge Horacio Brito and Delfín Jorge Ezequiel Carballo, and the Certified Public Accountants Silvana

María Gentile and Jorge Roberto Pardo were appointed as per the nomination submitted by the shareholder ANSES-FGS.

ITEM # 11

:

For a majority

of 639,529,310 votes for, 18,566,710 abstentions and 5,254,370 votes against this motion, the Shareholders’ Meeting resolved

to designate as Independent Auditors for the fiscal year ending December 31, 2018, the Certified Public Accountant Norberto Marcelo

Nacuzzi, who shall act as regular auditor and the Certified Public Accountant José Gerardo Riportella as alternate auditor,

all of them partners at the accounting and auditing firm Pistrelli, Henry Martin y Asociados S.R.L.

ITEM # 12

:

For a majority

of 436,980,440 votes for, 34,769,520 abstentions and 191,600,430 votes against this motion, the Shareholders’ Meeting resolved

to establish the budget for the Audit Committee in AR$ 1,384,000.

ITEM # 13

:

For a majority

of 663,206,070 votes for, 135,840 abstentions and 8,480 votes against this motion, the Shareholders’ Meeting resolved: (i)

to extend of the maximum amount of the Bank’s Global Program of Negotiable Obligations (hereinafter referred to as the “Program”)

of USD 1,500,000,000 to USD 2,500,000,000 or its equivalent in any other currency or to any lesser amount, as the Board of Directors

shall determine in due time; and (ii) to delegate to the Board of Directors the necessary powers to perform before the CNV,

Bolsas

y Mercados Argentinos S.A.

(“BYMA”),

Mercado Abierto Electrónico S.A.

(“MAE”) and any

other market of the Republic of Argentina and/or foreign market, all necessary acts and proceedings to obtain the authorization

for the Program’s extension and to perform all the acts the Board shall deem convenient to carry out such extension, authorizing

the Board to sub-delegate to one or more of its members, or to whom they shall deem appropriate, the above described powers.

ITEM # 14

:

For a majority

of 663,208,470 votes for, 135,730 abstentions and 6,190 votes against this motion, the Shareholders’ Meeting resolved to

renew the delegation to the Board, under the terms of section 9 of Law 23576, of all the necessary powers to: (i) determine and

establish all the terms and conditions of the Program, of each of the series to be issued from time to time and of the negotiable

obligations to be issued thereunder, which have not been expressly established by the General Shareholders Meeting, including,

without limitation, the amount (subject to the maximum authorized amount or a lesser amount, as the Board shall determine), the

degree of subordination (being, if applicable, able to adjust it to the rules of the Central Bank of the Republic of Argentina

and any supplementary rules or any other rules that may replace them in the future), time of issuance, term, price, currency (including

the possibility of deciding the issuance in Purchasing Power Units/ Housing Units (UVAs/ UVIs for its acronyms in Spanish language),

placement method and terms of payment, the interest rate, the possibility that the negotiable obligations be issued as certificate

or book-entry instrument, or as a global certificate, on a registered or bearer form, to be issued in one or several classes and/or

series, to be listed or negotiated in stock exchanges and/or over-the-counter markets within the country and/or abroad, and any

other term or condition that the Board may deem convenient to establish; (ii) perform, before the CNV and/or any other similar

foreign entity the Board may consider appropriate, any and all the necessary acts in connection with the authorization of the Program

or of the public offering of the negotiable obligations to be issued thereunder; (iii) perform, before the BYMA, MAE and/or any

other stock exchange or authorized market in Argentina and/or abroad, any and all the necessary acts to get the negotiable obligations

to be issued under the Program eventually listed and/or negotiated; (iv) if applicable, negotiate with the entity established in

the relevant Pricing Supplement, the terms and conditions (including the determination of service fees) for it to act as payment

agent and/or registrar and, eventually, as depositary of the global note; and (v) hire one or more independent risk rating agencies

to rate the Program and/or series to be issued thereunder.

For a majority of 663,208,470 votes for,

135,730 abstentions and 6,190 votes against this motion, the Shareholders’ Meeting resolved to authorize the Board to subdelegate

to one or more of its members, or to whom the latter may deem appropriate, the powers described in the preceding paragraph.

ITEM # 15

:

For a majority

of 663,212,970 votes for, 129,820 abstentions and 7,600 votes against this motion, the Shareholders’ Meeting resolved: (i)

to approve the registration with the Frequent Issuer Registry for the Bank to be subject to such regime (both for the issuance

of debt instruments and shares), based on the benefits it would derive for the Bank. Pursuant to the rule of the CNV, this would

allow the simplification of the authorization processes to make public offering in order to be able to take advantage of the opportunities

and benefits arising in the most favorable moments of the market; and (ii) to authorize the Board to subdelegate to one or more

of its members, or to whom the latter may deem appropriate, the powers described above in connection with the registration as frequent

issuer.

ITEM # 16

:

For a majority

of 479,087,080 votes for, 184,255,960 abstentions and 7,350 votes against this motion, the Shareholders’ Meeting resolved

to authorize the Attorneys Carolina Paola Leonhart, Carla Valeria Lorenzo, Ana Cristina Rodríguez, Hugo Nicolás Luis

Bruzone, José María Bazán and María Lucila Winschel, and the Notaries Public Alejandro Senillosa and

Gabriela Eliana Blanco, so that the above mentioned persons, acting jointly, severally or individually, may obtain the administrative

approval and registration of the resolutions adopted at the present shareholders’ meeting, if applicable, with powers to

execute all the necessary instruments to such effect, publish official notices, answer requests and separate and withdraw documents.

Signed: Delfín Jorge Ezequiel Carballo

(Vice Chairman acting as Chairman); Ernesto López (representing the shareholder Jorge Horacio Brito); Fernando Ledesma Padilla

(representing The Bank of New York Mellon); Silvana María Gentile (member of the Supervisory Committee).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: May 2, 2018

|

|

MACRO BANK INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jorge Francisco Scarinci

|

|

|

|

Name: Jorge Francisco Scarinci

|

|

|

|

Title: Chief Financial Officer

|

|

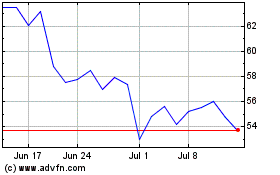

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

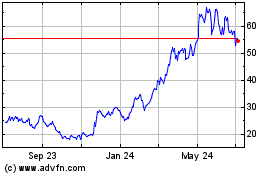

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Apr 2023 to Apr 2024