By Bradley Olson and Sarah Kent

The world's biggest oil companies are awash in cash, thanks to

rising crude prices. But few, if any, are going on spending sprees,

even as the prospect of a global oil shortage looms.

Western energy giants including Exxon Mobil Corp., Chevron Corp.

and Royal Dutch Shell PLC just posted their best first-quarter

profits in years, with most besting a time when crude sold for more

than $100 a barrel.

Combined, profits at Exxon, Chevron, Shell and Total were $16.8

billion, the highest since 2014.

Yet despite a 50% surge in prices since last year, drilling

budgets at the largest oil-and-gas companies are up only about 7%,

according to consultancy Wood Mackenzie.

Large publicly traded oil companies are moving carefully because

they are under pressure from investors after spending heavily over

the past decade, when prices were higher, only to generate

underwhelming returns.

"The newfound religion and confidence in the sector is, to say

the least, fragile," said Shell Chief Executive Ben van Beurden.

"We'll need to show a little longer that we actually mean what we

say in terms of capital discipline."

By contrast, smaller U.S. shale producers -- especially those

backed by private equity -- have seized on the opportunity to ramp

up drilling and gain market share.

Two years ago, the top 30 U.S. companies accounted for almost

64% of production in the contiguous U.S. That percentage has fallen

to 60% this year, according to consultancy Rystad Energy.

"Big companies are still cutting coupons to show that they can

live within their means," said Adam Flikerski, managing partner at

BlackGold Capital Management LP, an asset manager that specializes

in oil and gas lending. "Like technology companies, the smaller

players are still rewarded for growth."

The wary response from the world's biggest producers comes as a

global oil glut that has hung over the industry for the past four

years finally appears to be withering away. Without stepped-up

spending on new oil production, the International Energy Agency

warns, the world could flip from abundance to supply crunch by

2020.

Still, many investors in publicly traded oil and gas producers

are pressing executives not to sow the seeds of another price crash

with excessive growth. Their apathy about oil's rally has

shown.

While the price of Brent crude, the international oil benchmark,

is up around 11% this year, a leading barometer of energy stocks,

the MSCI World Energy Index, is only up around 4%. A number of

companies have performed even worse. Exxon is down 3.9%.

The pace of share buybacks has been a key factor for performance

so far. ConocoPhillips shares rose 3% Thursday after the company

disclosed it had repurchased about $500 million in stock, as it

reported that quarterly profits jumped 52% to $888 million.

Exxon fell 3.4% Friday after announcing that it hasn't yet

reinstated its longstanding program for buying back shares.

Exxon's net income rose 16% to $4.7 billion, but production fell

6% to below 4 million barrels a day after an earthquake in Papua

New Guinea knocked out natural gas production in the country.

Revenue rose 16% to $68 billion.

Although the company posted its highest cash flow since 2014, it

still fell short of analyst expectations for the second straight

quarter and shares fell 3.4% Friday.

Chevron's profit rose 36% to $3.6 billion, while output rose

6.5% to the equivalent of about 2.9 million barrels a day. Its

shares rose 1.8% Friday after it reported revenue surged 13% to

about $38 billion.

Executives at Exxon and Chevron said they continue to weigh

whether to reinstate share buybacks, a longstanding practice they

discontinued after the 2014 price collapse, but said paying

dividends and reinvesting in attractive prospects are higher

priorities.

"Buybacks remain on the table," said Jeff Woodbury, Exxon's vice

president of investor relations. "We are intensely focused on

value."

Shell's U.K. shares fell 0.7% on Thursday after the company

missed cash flow expectations and failed to give more clarity on

when it would begin buying back $25 billion in stock, as it

reported quarterly profits rose by two-thirds to nearly $6

billion.

One reason for caution among larger companies is that some

analysts, investors and executives still lack faith that crude

prices will remain elevated through the end of the year.

"There's potential weakness on the horizon in oil prices," said

Tom Ellacott, senior vice president for corporate research at Wood

Mackenzie. "It's still quite an uncertain environment."

Smaller U.S. producers are exercising less caution, as many of

them still have business models akin to startups. They must invest

in new wells to prove the viability of new prospects.

Those companies are a major reason why forecasters say U.S. oil

output may reach 11 million barrels a day by the end of the year,

surpassing the output of Saudi Arabia.

In February, companies that aren't among the top U.S. crude

producers made up almost half the permits approved for new

drilling, according to data and analytics firm DrillingInfo. In the

past six months, those operators accounted for about 42% of

permits. Permits are generally a useful barometer for future

drilling activity.

Many such companies will be affected by shortages in labor and

trucking, as well as pipeline bottlenecks in the Permian basin in

West Texas and New Mexico, the heart of U.S. drilling activity.

Those challenges could curtail production by about 400,000 barrels

a day, but output will continue surging as many companies have

secured the supplies and contracts needed to meet their goals, said

Artem Abramov, vice president of analysis at Rystad.

"We've got a completely new generation of small, private players

with very ambitious growth plans in the Permian basin," he said.

"Those plans will continue."

Write to Bradley Olson at Bradley.Olson@wsj.com and Sarah Kent

at sarah.kent@wsj.com

(END) Dow Jones Newswires

April 27, 2018 14:29 ET (18:29 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

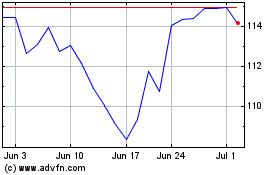

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

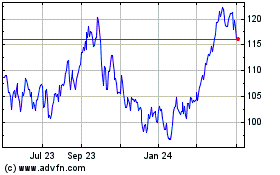

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024