By Yoko Kubota and Dan Strumpf

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 20, 2018).

HONG KONG -- China intensified the tit-for-tat trade battle with

the U.S. on Thursday, with antitrust regulators warning that they

have "hard to resolve" concerns about Qualcomm Inc.'s planned $44

billion purchase of NXP Semiconductors NV, potentially creating a

stumbling block for the deal.

The move follows a decision by the U.S. Commerce Department to

ban sales of American components to Chinese telecommunications

company ZTE Corp., as well as threats from the White House to

impose tariffs on $150 billion worth of Chinese goods to punish

what it says are efforts to steal U.S. technology.

The escalating tensions have put technology firms at the center

of a trade fight between the U.S. and China, placing new

constraints on the companies' strategic plans and threatening their

access to giant markets.

"China wants very much to flex its muscles. It can certainly

inflict pain on one large U.S. company, Qualcomm," said Peter

Fuhrman, chairman and chief executive of investment and advisory

firm China First Capital. He said current tensions make this "the

fraughtest moment in the 30-year history of U.S.-China technology

trade and mutual reliance."

Washington has for years warned about China acquiring U.S.

technology through unfair means, and protested that Beijing is

walling off the world's biggest internet market from American

companies. Beijing has in turn vowed to defend its tech champions,

fueling a multifront battle that is catching many of world's

biggest tech companies in the crossfire. During a visit to China

last month, Apple Inc. Chief Executive Tim Cook urged President

Donald Trump to support free-trade policies.

Qualcomm's supposed strategic value to the U.S. saved the

company from a possible hostile $117 billion takeover last month by

Broadcom Ltd., which was based in Singapore but has since changed

its domicile to the U.S.

Mr. Trump quashed Broadcom's pursuit of Qualcomm, citing

national-security concerns raised by China's growing strength in

advanced technologies. These include the fifth-generation wireless

technology, known as 5G, that will usher in faster, more powerful

connections.

The block put the mobile-chip company firmly at the center of a

growing tech rivalry between its home country and its biggest

market: China, which accounts for almost two-thirds of Qualcomm's

revenue.

China's Commerce Ministry spokesman, Gao Feng, said Thursday a

preliminary review of Qualcomm's NXP deal turned up issues that

make "it difficult to eliminate the negative impact," but he didn't

rule out the possibility of an eventual approval.

Qualcomm said Thursday that it refiled its application with

Chinese regulators, and agreed with NXP to extend the deal's

deadline by three months to July 25.

Qualcomm has been waiting for Beijing's approval to proceed with

the purchase of the Dutch company, having secured permission from

the eight other major antitrust regulators around the world. The

deal is seen as crucial to San Diego-based Qualcomm, which needs to

look for growth beyond its dominance in the smartphone sector. NXP

specializes in making chips for automobiles, a rapidly growing

market.

On Wednesday, Qualcomm said it began laying off an unspecified

number of employees to fulfill a promise to boost profit by

shedding $1 billion in expenses. The layoffs are part of a

cost-reduction program unveiled in January intended to persuade

investors of the company's prospects as it fended off Broadcom

Mr. Gao also took aim at the seven-year U.S. ban on selling

technology to ZTE -- punishment for ZTE breaching a pact reached

last year to resolve alleged sanctions violations over the sale of

gear to Iran. The ban is seen as potentially crippling for ZTE,

which is one of two Chinese companies seeking to take a global lead

in establishing 5G mobile internet networks.

"The action targets China," Mr. Gao said. "However, it will

ultimately undermine the U.S. itself." He said the U.S. is risking

"tens of thousands of jobs and shaking international confidence in

the U.S. business environment."

The interdependence of technology companies across the Pacific

means that a tech war isn't a zero-sum game. Qualcomm is one of

several U.S. suppliers hurt by the ban on sales to ZTE. The ban

potentially covers software such as the Android operating system,

developed by Google parent Alphabet Inc., that powers ZTE

smartphones. ZTE is working to find ways to preserve its access to

Android, according to a person familiar with the matter.

A Google spokesman declined to comment Thursday. ZTE also

declined to comment. It is delaying the release of its quarterly

earnings report as it wrestles with the implications of the

ban.

U.S. punishment of a company seen as a national champion touched

off rallying cries for support on Chinese social media, with photos

circulating of restaurants and stores displaying signs saying "We

are all ZTE people."

Hu Xijin, the editor of nationalistic tabloid Global Times, who

has a large social-media following, wrote in a post Wednesday that

the ban was an attempt to edge out China in the race to dominate 5G

technology.

"Chinese society absolutely needs to support ZTE and back

Huawei," Mr. Hu wrote, referring to China's other major

telecom-gear maker.

Huawei Technologies Co., the world's largest provider of telecom

equipment, acknowledged this week that after years of difficulties

in the U.S., it is going to refocus on other markets.

The U.S. Federal Communications Commission approved a measure

this week that would bar wireless carriers from using government

subsidies to buy telecom gear from Chinese manufacturers. The U.S.

Trade Representative's office also said this week it is considering

retaliation for China's restrictions on U.S. providers of

cloud-computing and other services.

"Everything here is about leverage and China understands its

position in that respect very well," said Mark Natkin, managing

director of Marbridge Consulting, a Beijing-based telecom, media

and technology consulting company. "With tech companies playing an

increasingly pivotal role in economic and geopolitical policy, it

will be difficult for them not to be drawn into the tensions

between the two countries."

--Lin Zhu and Josh Chin in Beijing, Natasha Khan in Hong Kong,

Ted Greenwald in San Francisco and Liza Lin in Shanghai contributed

to this article.

Write to Yoko Kubota at yoko.kubota@wsj.com and Dan Strumpf at

daniel.strumpf@wsj.com

(END) Dow Jones Newswires

April 20, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

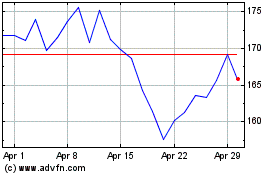

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024