Crown Castle Profit Falls, Revenue Rises in Latest Quarter

April 18 2018 - 5:41PM

Dow Jones News

By Aisha Al-Muslim

Crown Castle International Corp. reported its first-quarter

earnings fell as the real-estate investment trust was affected by

about $71 million of losses on the retirement of long-term

obligations.

The Houston-based company, which runs a nationwide portfolio of

communications infrastructure, reported a profit of $114 million,

or 21 cents a share, down from $119 million, or 33 cents a share, a

year earlier.

Net revenue jumped 28% to $1.3 billion.

Analysts polled by Thomson Reuters had forecast earnings of 26

cents a share on $1.3 billion in revenue.

For 2018, the company raised its profit guidance to a range of

$589 million to $669 million, compared with the previously issued

outlook of $511 million to $591 million. The company also forecast

funds from operations of $2 billion to $2.05 billion, compared with

the previously issued outlook of $1.97 million to $2.01

billion.

The stock has remained unchanged at $106.59 in after-hours

trading Wednesday. Shares are up 10% in the last year.

Crown Castle owns, operates and leases more than 40,000 cell

towers and about 60,000 route miles of fiber supporting small cells

and fiber solutions across the U.S.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

April 18, 2018 17:26 ET (21:26 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

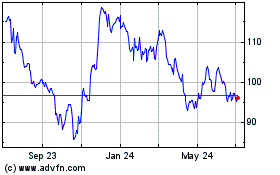

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

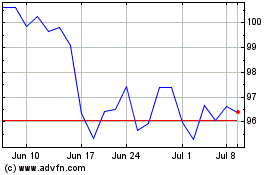

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Apr 2023 to Apr 2024