Ackman's Pershing Square Cashes Out of Nike Stake After Roughly 32% Gain --

March 22 2018 - 2:05PM

Dow Jones News

By David Benoit

William Ackman's Pershing Square Capital Management LP cashed

out of its brief holding in Nike Inc. in recent weeks, for a profit

of around $100 million.

The activist had taken the stake in the fourth quarter, it

disclosed in January, but Pershing Square intended to keep it as a

passive bet on a company it believed was undervalued. After the

stock jumped some 32% from Pershing Square's purchasing costs, it

sold the stake, people familiar with the matter said.

Pershing Square had owned about 5.8 million shares at the end of

2017, it had disclosed, which would mean the bet scored about $100

million in profits. The exact size couldn't be determined given the

potential for other trading that wasn't disclosed.

This year is critical for Pershing Square and Mr. Ackman. As a

result of bad bets on companies including Valeant Pharmaceuticals

International Inc. and Herbalife Ltd., the firm has suffered three

straight years of declines that have spurred investor withdrawals

and dragged down assets. It needs wins to convince remaining

investors to hang around. The publicly traded Pershing Square

Holdings Ltd., which closely tracks his private funds, had lost

6.2% this year through Tuesday with bets on Fannie Mae and Freddie

Mac, Mondelez International Inc. and Automatic Data Processing Inc.

all in the red.

Sara Germano contributed to this article.

Write to David Benoit at david.benoit@wsj.com

(END) Dow Jones Newswires

March 22, 2018 13:50 ET (17:50 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

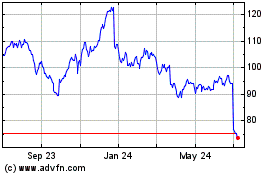

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

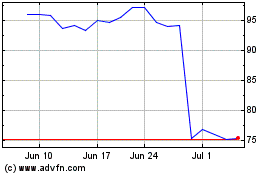

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024