- Significant progress on Asset

Sales:

- Announcing sale of Boston Energy

Trading and Marketing LLC (BETM)

- Announced sale of NRG's interest in

NRG Yield, Renewables platform, ROFO assets and South Central

business for $2.8 billion1 on February 7,

2018

- Exceeded Transformation Plan targets

for cost reductions and working capital improvement in

2017

- Reduced corporate debt by $604

million in 2017 and refinanced senior notes, resulting in

approximately $55 million of recurring interest savings

- Authorized $1 billion in share

repurchases; first $500 million program to be launched

immediately

- Recorded $1.8 billion non-cash asset

and goodwill impairment charge

NRG Energy, Inc. (NYSE: NRG) today reported a full year 2017 net

loss of $1,548 million, or $6.79 per diluted common share. Adjusted

EBITDA for the full year 2017 was $2.4 billion, cash from

operations was $1.4 billion and FCFbG was $1.3 billion. The net

loss and loss per share were driven by a $1.8 billion impairment of

fixed assets, goodwill, and investments of which $1.2 billion was

related to the South Texas Project (STP) nuclear generation

facility, primarily due to the revised outlook of future commodity

prices.

“Our business continued its strong performance in a year when we

announced our Transformation Plan aimed at simplifying and

enhancing the business to deliver increased shareholder value,”

said Mauricio Gutierrez, NRG President and Chief Executive Officer.

“With this announcement, we are demonstrating measurable success

towards achieving the goals of cost excellence, portfolio

optimization and capital structure enhancements. I’m also proud to

report that we did this while realizing our second best safety year

in company history.”

Consolidated Financial Results

Three Months Ended

Twelve Months Ended ($ in millions)

12/31/17

12/31/16 12/31/17

12/31/16 Income/(Loss) from Continuing Operations $

(1,667 ) $ (891 ) $ (1,548 ) $ (983 ) Cash

From Continuing Operations $ 581 $ 533 $ 1,425 $ 2,207 Adjusted

EBITDA $ 497 $ 471 $ 2,373 $ 2,706 Free Cash Flow Before Growth

Investments (FCFbG) $ 497 $ 270 $

1,304 $ 1,255

Segment Results

Table 1: Income/(Loss) from Continuing

Operations

($ in millions)

Three Months

Ended Twelve Months Ended Segment

12/31/17

12/31/16 12/31/17

12/31/16 Generation $ (1,700) $ (774) $ (1,498) $ (824)

Retail 506 317

886

1,053 Renewables a. (207) (223) (266) (330) NRG Yield a. (98) (115)

(23) 2 Corporate (168) (96) (647) (884) Income/(Loss) from

Continuing Operations $ (1,667) $ (891) $ (1,548) $ (983)

a. In accordance with GAAP, 2016 and 2017 results have been

restated to include full impact of the assets in the NRG Yield Drop

Down transactions which closed on September 1, 2016, March 27,

2017, and August 1, 2017

The net loss from continuing operations for the 12 months of

2017 was driven by a $1.8 billion impairment of fixed assets,

goodwill, and investments of which $1.2 billion was related to the

South Texas Project (STP) nuclear generation facility, primarily

due to the revised outlook of future commodity prices. The net loss

from continuing operations for the 12 months of 2016 includes a

$970 million impairment of fixed assets and goodwill.

Table 2: Adjusted EBITDA

($ in millions)

Three Months

Ended Twelve Months Ended Segment

12/31/17

12/31/16 12/31/17 12/31/16

Generation $ 104 $ 117 $ 535 $ 869 Retail 214 134 825 811

Renewables a. 14 19 153 151 NRG Yield a. 204 214 933 932 Corporate

(39) (13) (73) (57) Adjusted EBITDA b. $ 497 $ 471 $ 2,373 $ 2,706

a. 2016 and 2017 results have been restated to include full

impact of the assets in the NRG Yield Drop Down transactions, which

closed on September 1, 2016, March 27, 2017, and August 1, 2017

b. See Appendices A-1 through A-4 for Operating Segment Reg G

reconciliations

Generation: Full year 2017 Adjusted EBITDA was $535

million, $334 million lower than 2016 driven by:

- Gulf Coast: $276 million decrease due

to lower realized energy prices despite slightly higher generation,

partially offset by lower operating expenses, net of outages due to

flooding

- East/West2: $58 million decrease due to

lower dispatch, realized energy prices and capacity revenues,

partially offset by lower operating costs, property tax and

overhead expenses

Fourth quarter Adjusted EBITDA was $104 million, $13 million

lower than the fourth quarter 2016 driven by:

- Gulf Coast: $51 million decrease due to

lower realized energy prices, partially offset by lower operating

expenses

- East/West2: $38 million increase due to

higher capacity revenues, higher trading results at BETM and lower

operating expenses

Retail: Full year 2017 Adjusted EBITDA was $825 million,

$14 million higher than 2016 due to lower operating costs,

partially offset by lower unit margins due to customer mix, milder

weather and the impact of Hurricane Harvey.

Fourth quarter Adjusted EBITDA was $214 million, $80 million

higher than the fourth quarter 2016 due to improved performance,

customer growth and lower operating costs.

Renewables: Full year 2017 Adjusted EBITDA was $153

million, $2 million higher than 2016 due to increased generation

and insurance recovery at Ivanpah, partially offset by lost margin

from the sale of assets, a transmission outage at Agua Caliente,

and increased development expenditures.

Fourth quarter Adjusted EBITDA was $14 million, $5 million lower

than the fourth quarter 2016 due to lost margin from certain asset

sales and plant outages, partially offset by lower operating and

overhead expenses.

NRG Yield: Full year 2017 Adjusted EBITDA was $933

million, $1 million higher than 2016 due to contribution from Utah

Solar assets acquired by NRG in the fourth quarter of 2016 and

growth in distributed generation partnerships, partially offset by

lower renewable production in 2017 driven by lower wind

resources.

Fourth quarter Adjusted EBITDA was $204 million, $10 million

lower than the fourth quarter 2016 due to lower wind production

driven by lower wind resources, partially offset by growth in

distributed generation partnerships.

Corporate: Full year 2017 Adjusted EBITDA was $(73)

million, $16 million lower than 2016 due to the reduction in shared

services income from GenOn, higher advisory fees, partially offset

by lower corporate marketing expenses and the elimination of

operating losses at Residential Solar and eVgo following their wind

down of operations.

Fourth quarter Adjusted EBITDA was $(39) million, $26 million

lower than the fourth quarter 2016 due to the reduction in shared

services income from GenOn, partially offset by lower corporate

marketing expenses and the elimination of operating losses at

Residential Solar following its wind down of operations.

Liquidity and Capital Resources

Table 3: Corporate Liquidity

($ in millions)

12/31/17

12/31/16 Cash at NRG-Level a. $ 769 $ 570 Revolver 1,711 989

NRG-Level Liquidity $ 2,480 $

1,559 Restricted cash 508 446 Cash at Non-Guarantor

Subsidiaries 222 368

Total Liquidity $

3,210 $ 2,373

a. December 31, 2017 balance includes unrestricted cash held at

Midwest Generation (a non-guarantor subsidiary) which can be

distributed to NRG without limitation

NRG-Level cash as of December 31, 2017, was $769 million, an

increase of $199 million from the end of 2016, and $1.7 billion was

available under the Company’s credit facilities at the end of 2017.

Total liquidity was $3.2 billion, including restricted cash and

cash at non-guarantor subsidiaries (primarily NRG Yield).

NRG Transformation Plan Update

Cost Reductions

As of the end of the fourth quarter of 2017, NRG realized $150

million, or 231%, of its 2017 cost savings target as part of the

previously announced Transformation Plan.

Asset Sales Program

To date, NRG has announced or closed approximately $3 billion in

asset sales towards its revised Transformation Plan target of $3.2

billion.

Sale of BETM

Announced today, a subsidiary of NRG has

entered into a purchase and sale agreement with a subsidiary of

Diamond Generating Corporation, a subsidiary of Mitsubishi

Corporation, to sell Boston Energy Trading and Marketing LLC

(BETM). The transaction is expected to close in the second half of

2018 and is subject to closing conditions, approvals and consents

including Federal Energy Regulatory Commission (FERC) and the

Committee on Foreign Investment in the United States (CFIUS).

Sale of NRG Yield and Renewables

Platform

On February 6, 2018, NRG and Global

Infrastructure Partners, or GIP, entered into a purchase and sale

agreement to sell NRG's ownership in NRG Yield, Inc. and NRG's

renewable energy development and operations platform for cash of

$1.375 billion, subject to certain adjustments, and upon closing,

removal of approximately $6.7 billion of consolidated debt as of

12/31/2017. The transaction is expected to close in the second half

of 2018 and is subject to various customary closing conditions,

approvals and consents.

Sale of South Central Business

On February 7, 2018, NRG and Cleco Corporate

Holdings LLC, or Cleco, entered into a purchase and sale agreement

to sell NRG's South Central business for a total cash purchase

price of $1.0 billion, subject to certain adjustments. The

transaction is expected to close in the second half of 2018 and is

subject to various customary closing conditions, approvals and

consents. Also, as part of the transaction, NRG will enter into a

sale leaseback agreement for the Cottonwood plant through May of

2025.

Accelerated Drop Down Agreements

On January 24, 2018, the Company entered into

an agreement with NRG Yield, Inc. to sell 100% of its ownership

interest in Buckthorn Solar for cash consideration of $42 million,

subject to other adjustments.

On February 6, 2018, the Company entered into

an agreement with NRG Yield, Inc. to sell 100% of the membership

interests in Carlsbad Energy Holdings LLC, which indirectly owns

the Carlsbad project, a 527 MW natural gas fired project in

Carlsbad, CA, pursuant to the ROFO Agreement. The purchase price

for the transaction is $365 million in cash consideration, subject

to customary working capital and other adjustments.

2018 Guidance

NRG is reaffirming its guidance range for 2018 with respect to

Consolidated Adjusted EBITDA, Cash From Operations and FCFbG as set

forth below.

Table 4: 2018 Adjusted EBITDA and FCF before

Growth Guidance

2018 ($ in millions)

Guidance Adjusted EBITDA a. $2,800 - $3,000 Cash From

Operations $2,015 - $2,215 Free Cash Flow before Growth $1,550 -

$1,750

a. Non-GAAP financial measure; see Appendix Tables A-1 through

A-5 for GAAP Reconciliation to Net Income that excludes fair value

adjustments related to derivatives. The Company is unable to

provide guidance for Net Income due to the impact of such fair

value adjustments related to derivatives in a given year

Capital Allocation Update

In 2017, NRG reduced corporate debt by $604 million3 and

refinanced and extended its 2023 senior notes realizing annual

interest savings of approximately $55 million. Following the

announced sale of NRG Yield and Renewables and the South Central

businesses, NRG is also announcing corporate debt reduction of $640

million in 2018 and is temporarily reserving $1,200 million of

additional cash to achieve it's 3.0x corporate net debt to Adjusted

EBITDA ratio as part of the previously announced capital allocation

guidance under the Transformation Plan.

The NRG Board of Directors has authorized $1 billion for share

repurchases, with the first $500 million program to begin

immediately. Following the completion of the initial program, and

as NRG progress towards the closing of the announced asset sales,

NRG expects to execute the remaining $500 million of the $1 billion

share repurchase program.

On January 18, 2018, NRG declared a quarterly dividend on the

Company's common stock of $0.03 per share, payable February 15,

2018, to stockholders of record as of February 1, 2018,

representing $0.12 on an annualized basis.

The Company’s common stock dividend, corporate level debt

reduction and share repurchases are subject to available capital,

market conditions and compliance with associated laws and

regulations.

Earnings Conference Call

On March 1, 2018, NRG will host a conference call at 8:00 a.m.

Eastern to discuss these results. Investors, the news media and

others may access the live webcast of the conference call and

accompanying presentation materials by logging on to NRG’s website

at http://www.nrg.com and clicking on

“Investors.” The webcast will be archived on the site for those

unable to listen in real time.

About NRG

NRG is a leading integrated power company built on the strength

of a diverse competitive electric generation portfolio and leading

retail electricity platform. NRG aims to create a sustainable

energy future by producing, selling and delivering electricity and

related products and services in major competitive power markets in

the U.S. in a manner that delivers value to all of NRG's

stakeholders. The Company owns and operates approximately 30,000 MW

of generation; engages in the trading of wholesale energy, capacity

and related products; transacts in and trades fuel and

transportation services; and directly sells energy, services, and

innovative, sustainable products and services to retail customers

under the names “NRG”, "Reliant" and other retail brand names owned

by NRG. More information is available at www.nrg.com. Connect with

NRG Energy on Facebook and follow us on Twitter @nrgenergy.

Safe Harbor Disclosure

In addition to historical information, the information presented

in this communication includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Exchange Act. These statements involve

estimates, expectations, projections, goals, assumptions, known and

unknown risks and uncertainties and can typically be identified by

terminology such as “may,” “should,” “could,” “objective,”

“projection,” “forecast,” “goal,” “guidance,” “outlook,” “expect,”

“intend,” “seek,” “plan,” “think,” “anticipate,” “estimate,”

“predict,” “target,” “potential” or “continue,” or the negative of

these terms or other comparable terminology. Such forward-looking

statements include, but are not limited to, statements about the

Company’s future revenues, income, indebtedness, capital structure,

plans, expectations, objectives, projected financial performance

and/or business results and other future events, and views of

economic and market conditions.

Although NRG believes that its expectations are reasonable, it

can give no assurance that these expectations will prove to be

correct, and actual results may vary materially. Factors that could

cause actual results to differ materially from those contemplated

herein include, among others, general economic conditions, hazards

customary in the power industry, weather conditions, competition in

wholesale power markets, the volatility of energy and fuel prices,

failure of customers to perform under contracts, changes in the

wholesale power markets, changes in government regulations, the

condition of capital markets generally, our ability to access

capital markets, unanticipated outages at our generation

facilities, adverse results in current and future litigation,

failure to identify, execute or successfully implement

acquisitions, repowerings or asset sales, our ability to implement

value enhancing improvements to plant operations and companywide

processes, our ability to implement and execute on our publicly

announced transformation plan, including any cost savings, margin

enhancement, asset sale, and net debt targets, our ability to

proceed with projects under development or the inability to

complete the construction of such projects on schedule or within

budget, risks related to project siting, financing, construction,

permitting, government approvals and the negotiation of project

development agreements, our ability to progress development

pipeline projects, the timing or completion of GenOn's emergence

from bankruptcy, the inability to maintain or create successful

partnering relationships, our ability to operate our businesses

efficiently, our ability to retain retail customers, our ability to

realize value through our commercial operations strategy, the

ability to successfully integrate businesses of acquired companies,

our ability to realize anticipated benefits of transactions

(including expected cost savings and other synergies) or the risk

that anticipated benefits may take longer to realize than expected,

our ability to close the Drop Down transactions with NRG Yield, and

our ability to execute our Capital Allocation Plan. Debt and share

repurchases may be made from time to time subject to market

conditions and other factors, including as permitted by United

States securities laws. Furthermore, any common stock dividend is

subject to available capital and market conditions.

NRG undertakes no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law. The adjusted

EBITDA and free cash flow guidance are estimates as of

March 1, 2018. These estimates are based on assumptions the

company believed to be reasonable as of that date. NRG disclaims

any current intention to update such guidance, except as required

by law. The foregoing review of factors that could cause NRG’s

actual results to differ materially from those contemplated in the

forward-looking statements included in this Earnings press release

should be considered in connection with information regarding risks

and uncertainties that may affect NRG’s future results included in

NRG’s filings with the Securities and Exchange Commission at

www.sec.gov.

NRG ENERGY, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF OPERATIONS

For the Year Ended December 31,

(In millions,

except per share amounts)

2017 2016 2015

Operating Revenues Total operating revenues $ 10,629

$ 10,512 $ 12,328

Operating Costs and Expenses

Cost of operations 7,536 7,301 9,000 Depreciation and amortization

1,056 1,172 1,351 Impairment losses 1,709 702 4,860 Selling,

general and administrative 907 1,095 1,228 Reorganization costs 44

— — Development costs 67 89 154 Total

operating costs and expenses 11,319 10,359 16,593

Other income - affiliate 87 193 193 Gain/(loss) on sale of

assets 16 (80 ) — Gain on postretirement benefits curtailment —

— 21

Operating (Loss)/Income (587 ) 266

(4,051 )

Other Income/(Expense) Equity in earnings of

unconsolidated affiliates 31 27 36 Impairment losses on investments

(79 ) (268 ) (56 ) Other income, net 38 34 26 Loss on sale of

equity method investment — — (14 ) Net (loss)/gain on debt

extinguishment (53 ) (142 ) 10 Interest expense (890 ) (895 ) (937

) Total other expense (953 ) (1,244 ) (935 )

Loss from

Continuing Operations Before Income Taxes (1,540 ) (978 )

(4,986 ) Income tax expense 8 5 1,345

Net Loss from Continuing Operations (1,548 ) (983 )

(6,331 ) (Loss)/income from discontinued operations, net of income

tax (789 ) 92 (105 )

Net Loss (2,337 ) (891 ) (6,436

) Less: Net loss attributable to noncontrolling interests and

redeemable noncontrolling interests (184 ) (117 ) (54 )

Net Loss

Attributable to NRG Energy, Inc. (2,153 ) (774 ) (6,382 )

Dividends for preferred shares — 5 20 Gain on redemption of

preferred shares — (78 ) —

Loss Available for

Common Stockholders $ (2,153 ) $ (701 ) $ (6,402 )

Loss Per

Share Attributable to NRG Energy, Inc. Common Stockholders

Weighted average number of common shares outstanding — basic and

diluted 317 316 329 Loss from continuing operations per weighted

average common share — basic and diluted $ (4.30 ) $ (2.51 ) $

(19.14 ) (Loss)/Income from discontinued operations per weighted

average common share — basic and diluted $ (2.49 ) $ 0.29 $

(0.32 )

Net Loss per Weighted Average Common Share — Basic and

Diluted $ (6.79 ) $ (2.22 ) $ (19.46 )

Dividends Per Common

Share $ 0.12 $ 0.24 $ 0.58

NRG ENERGY, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF COMPREHENSIVE

(LOSS)/INCOME

For the Year Ended December 31,

2017 2016 2015

(In millions) Net Loss $ (2,337 ) $ (891 ) $ (6,436 )

Other Comprehensive Income, net of tax Unrealized

gain/(loss) on derivatives, net of income tax expense of $1, $1,

and $19 13 35 (15 ) Foreign currency translation adjustments, net

of income tax benefit of $(2), $0, and $0 12 (1 ) (11 )

Available-for-sale securities, net of income tax expense/(benefit)

of $10, $0, and $(3) (8 ) 1 17 Defined benefit plan, net of income

tax (benefit)/expense of $(21), $0 and $69 46 3 10

Other comprehensive income 63 38 1

Comprehensive Loss (2,274 ) (853 ) (6,435 ) Less:

Comprehensive loss attributable to noncontrolling interests and

redeemable noncontrolling interests (179 ) (117 ) (73 )

Comprehensive Loss Attributable to NRG Energy, Inc. (2,095 )

(736 ) (6,362 ) Dividends for preferred shares — 5 20 Gain on

redemption of preferred shares — (78 ) —

Comprehensive Loss Available for Common Stockholders $

(2,095 ) $ (663 ) $ (6,382 )

NRG ENERGY, INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE SHEETS

As of December 31, 2017

2016 (In millions) ASSETS Current

Assets Cash and cash equivalents $ 991 $ 938 Funds deposited by

counterparties 37 2 Restricted cash 508 446 Accounts receivable —

trade 1,079 1,058 Inventory 532 721 Derivative instruments 626

1,067 Cash collateral posted in support of energy risk management

activities 171 150 Accounts receivable — affiliate 95 — Current

assets held-for-sale 115 9 Prepayments and other current assets 261

404 Current assets - discontinued operations — 1,919 Total

current assets 4,415 6,714

Property, plant and equipment,

net 13,908 15,369

Other Assets Equity investments

in affiliates 1,038 1,120 Notes receivable, less current portion 2

16 Goodwill 539 662 Intangible assets, net 1,746 1,973 Nuclear

decommissioning trust fund 692 610 Derivative instruments 172 181

Deferred income taxes 134 225 Non-current assets held-for-sale 43

10 Other non-current assets 629 841 Non-current assets -

discontinued operations — 2,961 Total other assets 4,995

8,599

Total Assets $ 23,318 $ 30,682

NRG ENERGY, INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE SHEETS (Continued)

As of December 31, 2017

2016 (In millions, except share data)

LIABILITIES AND STOCKHOLDERS' EQUITY Current

Liabilities Current portion of long-term debt and capital

leases $ 688 $ 516 Accounts payable 881 782 Accounts payable -

affiliate 33 31 Derivative instruments 555 1,092 Cash collateral

received in support of energy risk management activities 37 81

Accrued interest expense 156 180 Current liabilities - held for

sale 72 — Other accrued expenses and other current liabilities 734

810 Other accrued expenses and other current liabilities -

affiliate 161 — Current liabilities - discontinued operations —

1,210 Total current liabilities 3,317 4,702

Other Liabilities Long-term debt and capital leases

15,716 15,957 Nuclear decommissioning reserve 269 287 Nuclear

decommissioning trust liability 415 339 Postretirement and other

benefit obligations 458 510 Deferred income taxes 21 20 Derivative

instruments 197 284 Out-of-market contracts, net 207 230

Non-current liabilities held-for-sale 8 11 Other non-current

liabilities 664 666 Non-current liabilities - discontinued

operations — 3,184 Total non-current liabilities

17,955 21,488

Total Liabilities 21,272

26,190 Redeemable noncontrolling interest in subsidiaries 78

46

Commitments and Contingencies Stockholders' Equity

Common stock; $0.01 par value; 500,000,000 shares authorized;

418,323,134 and 417,583,825 shares issued; and 316,743,089 and

315,443,011 shares outstanding at December 31, 2017 and 2016 4 4

Additional paid-in capital 8,376 8,358 Accumulated deficit (6,268 )

(3,787 ) Treasury stock, at cost; 101,580,045 and 102,140,814

shares at December 31, 2017 and 2016 (2,386 ) (2,399 ) Accumulated

other comprehensive loss (72 ) (135 ) Noncontrolling interest 2,314

2,405

Total Stockholders' Equity

1,968 4,446

Total Liabilities and Stockholders'

Equity $ 23,318 $ 30,682

NRG ENERGY, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF CASH FLOW

For the Year Ended December 31, 2017

2016 2015 (In

millions) Cash Flows from Operating Activities Net loss

(2,337 ) (891 ) (6,436 ) (Loss)/income from discontinued

operations, net of income tax (789 ) 92 (105 ) Loss from continuing

operations $ (1,548 ) $ (983 ) $ (6,331 ) Adjustments to reconcile

net income/(loss) to net cash provided by operating activities:

Equity in earnings and distribution of unconsolidated affiliates 55

54 37 Depreciation and amortization 1,056 1,172 1,351 Provision for

bad debts 68 48 64 Amortization of nuclear fuel 51 49 45

Amortization of financing costs and debt discount/premiums 60 55 47

Adjustment for debt extinguishment 53 142 (10 ) Amortization of

intangibles and out-of-market contracts 108 167 151 Amortization of

unearned equity compensation 35 10 39 Net (gain)/loss on sale of

assets and equity method investments (34 ) 70 14 Gain on post

retirement benefits curtailment — — (21 ) Impairment losses 1,788

972 4,916 Changes in derivative instruments (171 ) 32 235 Changes

in deferred income taxes and liability for uncertain tax benefits

91 (43 ) 1,326 Changes in collateral deposits in support of risk

management activities (80 ) 398 (334 ) Proceeds from sale of

emission allowances 25 34 (24 ) Changes in nuclear decommissioning

trust liability 11 41 (2 ) Cash provided/(used) by changes in other

working capital, net of acquisition and disposition effects:

Accounts receivable - trade (99 ) (7 ) 113 Inventory 143 71 (59 )

Prepayments and other current assets 12 (44 ) (21 ) Accounts

payable 77 (39 ) (180 ) Accrued expenses and other current

liabilities (60 ) (35 ) (29 ) Other assets and liabilities (216 )

43 (40 )

Cash provided by continuing operations 1,425

2,207 1,287

Cash (used)/provided by discontinued operations

(38 ) (119 ) 62

Net Cash Provided by Operating

Activities 1,387 2,088 1,349

Cash Flows

from Investing Activities Acquisition of businesses, net of

cash acquired (41 ) (209 ) (31 ) Capital expenditures (1,111 ) (976

) (1,029 ) Net cash proceeds from notes receivable 17 17 18

Proceeds from renewable energy grants 8 36 82 Proceeds

from/(purchases) of emission allowances, net of purchases 66 (1 )

41 Investments in nuclear decommissioning trust fund securities

(512 ) (551 ) (629 ) Proceeds from sales of nuclear decommissioning

trust fund securities 501 510 631 Proceeds from sale of assets, net

87 73 27 Investments in unconsolidated affiliates (40 ) (23 ) (395

) Other 12 35 16

Cash used by continuing

operations (1,013 ) (1,089 ) (1,269 )

Cash (used)/provided

by discontinued operations (53 ) 297 (259 )

Net Cash

Used by Investing Activities (1,066 ) (792 ) (1,528 )

Cash

Flows from Financing Activities Payments of dividends to

preferred and common stockholders (38 ) (76 ) (201 ) Net receipts

from settlement of acquired derivatives that include financing

elements 2 6 14 Payments for treasury stock — — (437 ) Payments for

preferred shares — (226 ) — Payments for debt extinguishment costs

(42 ) (121 ) — Distributions to, net of contributions from,

noncontrolling interests in subsidiaries 95 (156 ) 47 Proceeds from

sale of noncontrolling interests in subsidiaries — — 600

(Payments)/Proceeds from issuance of common stock (2 ) 1 1 Proceeds

from issuance of long-term debt 2,270 5,527 1,004 Payments of debt

issuance and hedging costs (63 ) (89 ) (21 ) Payments for short and

long-term debt (2,348 ) (5,908 ) (1,362 ) Receivable from affiliate

(125 ) — — Other (10 ) (13 ) (22 )

Cash used by continuing

operations (261 ) (1,055 ) (377 )

Cash (used)/provided by

discontinued operations (224 ) 140 (55 )

Net Cash

Used by Financing Activities (485 ) (915 ) (432 ) Effect of

exchange rate changes on cash and cash equivalents (1 ) 1 10

Change in Cash from discontinued operations (315 )

318 (252 )

Net Increase/(Decrease) in Cash and Cash

Equivalents, Funds Deposited by Counterparties and Restricted

Cash 150 64 (349 )

Cash and Cash Equivalents, Funds

Deposited by Counterparties and Restricted Cash at Beginning of

Period 1,386 1,322 1,671

Cash and Cash

Equivalents, Funds Deposited by Counterparties and Restricted Cash

at End of Period $ 1,536 $ 1,386 $ 1,322

Appendix Table A-1: Fourth Quarter 2017

Adjusted EBITDA Reconciliation by Operating Segment

The following table summarizes the calculation

of Adj. EBITDA and provides a reconciliation to income/(loss) from

continuing operations:

($ in

millions) Gulf Coast East/

West 1

Generation Retail

Renewables NRG Yield Corp/

Elim

Total

Income/(Loss) from Continuing Operations

(1,486 )

(214 ) (1,700 )

506 (207 )

(98 ) (168 )

(1,667 ) Plus: Interest expense, net —

5 5 2 22 68 96 193 Income tax — — — — (7 ) 57 (47 ) 3 Loss on debt

extinguishment — — — — — 1 49 50 Depreciation and amortization 63

27 90 31 51 88 7 267 ARO expense 11 13 24 — 1 1 — 26 Contract

amortization 6 1 7 — — 17 1 25 Lease amortization

— (2 ) (2 )

— — —

— (2 )

EBITDA (1,406

) (170 ) (1,576 ) 539

(140 ) 134 (62 ) (1,105

) Adjustment to reflect NRG share of adjusted EBITDA in

unconsolidated affiliates 2 6 8 (7 ) 2 27 2 32 Acquisition-related

transaction & integration costs — — — — — 1 1 2 Reorganization

costs 6 1 7 6 1 — 12 26 Legal Settlement — — — (1 ) — — — (1 )

Deactivation costs 3 6 9 — — — 2 11 Gain on sale of business — (13

) (13 ) — 5 — (8 ) (16 ) Other non recurring charges 4 (7 ) (3 ) —

(4 ) 10 10 13 Impairments 1,267 196 1,463 8 130 32 (1 ) 1,632

Impairment losses on investments 69 5 74 — 1 — 4 79 Mark to market

(MtM) (gains)/losses on economic hedges 100

35 135

(331 ) 19 —

1 (176 )

Adjusted EBITDA

45 59

104 214

14 204

(39 ) 497

1 Includes International, BETM and generation eliminations

Fourth Quarter 2017 condensed financial

information by Operating Segment:

($ in

millions) Gulf Coast East/

West 1

Generation Retail

Renewables NRG Yield Corp/

Elim

Total Operating revenues 506 333 839 1,508 90 248

(227 ) 2,458 Cost of sales 289

139 428 1,099

4 17

(212 ) 1,336

Economic gross margin

217 194 411 409 86 231

(15 ) 1,122 Operations & maintenance and

other cost of operations 2 143 115 258 77 36 57 21 449 Selling,

marketing, general and administrative 3 27 22 49 114 13 5 30 211

Other expense/(income) 4 2

(2 ) — 4

23 (35 ) (27 )

(35 )

Adjusted EBITDA 45

59 104

214 14

204 (39

) 497

1 Includes International, BETM and generation eliminations

2 Excludes deactivation costs of $11 million

3 Excludes a legal settlement of $(1) million

4 Excludes impairments of $1,711 million, gain on sale of

business of $16 million, acquisition-related transaction &

integration costs of $2 million, reorganization costs of $26

million and loss on debt extinguishment of $50 million

The following table reconciles the condensed

financial information to Adjusted EBITDA:

($ in millions)

Condensedfinancialinformation

Interest, tax,depr., amort.

MtM Deactivation Other

adj. Adjusted EBITDA Operating revenues 2,497 15 (54

) — — 2,458 Cost of operations 1,224

(10 ) 122 —

— 1,336

Gross

margin 1,273 25 (176 ) — —

1,122 Operations & maintenance and other cost of

operations 460 — — (11 ) — 449 Selling, marketing, general &

administrative 1 210 — — — 1 211 Other expense/(income) 2

2,270 (487 ) —

— (1,818 )

(35 )

Income/(Loss) from Continuing Operations

(1,667 ) 512

(176 ) 11

1,817 497

1 Other adj. includes a legal settlement of $(1) million

2 Other adj, includes impairments of $1,711 million, gain on

sale of business of $16 million, acquisition-related transaction

& integration costs of $2 million, reorganization costs of $26

million and loss on debt extinguishment of $50 million

Appendix Table A-2: Fourth Quarter 2016 Adjusted EBITDA

Reconciliation by Operating Segment

The following table summarizes the calculation

of Adjusted EBITDA and provides a reconciliation to income/(loss)

from continuing operations:

($ in millions) Gulf

Coast East/

West 1

Generation Retail Renewables NRG Yield Corp/

Elim

Total

Income/(Loss) from Continuing Operations

(671 ) (103 ) (774

) 317 (223 ) (115

) (96 ) (891 ) Plus: Interest

expense, net — 1 1 — 17 67 91 176 Income tax — 1 1 — (6 ) (26 ) (39

) (70 ) Loss on debt extinguishment — — — — — — 23 23 Depreciation

and amortization 155 29 184 28 45 75 14 346 ARO Expense 3 2 5 — 1 1

1 8 Contract amortization 4 — 4 1 — 17 2 24 Lease amortization

— (2 ) (2 ) — — —

— (2 )

EBITDA (509 ) (72

) (581 ) 346 (166 )

19 (4 ) (386 ) Adjustment to

reflect NRG share of adjusted EBITDA in unconsolidated affiliates

(2 ) 8 6 — 44 7 (43 ) 14 Acquisition-related transaction &

integration costs — — — — — 1 — 1 Deactivation costs — 2 2 — — — 1

3 Gain on sale of business — — — — — — 1 1 Other non recurring

charges — 3 3 1 1 2 (2 ) 5 Impairments 368 36 404 1 28 185 19 637

Impairment loss on investment — — — — 106 — 15 121 Mark to market

(MtM) (gains)/losses on economic hedges 239

44 283 (214 ) 6 — — 75

Adjusted EBITDA 96

21 117 134 19

214 (13 ) 471

1 Includes International, BETM and generation eliminations

Fourth Quarter 2016 condensed financial

information by Operating Segment:

($ in millions) Gulf

Coast East/

West 1

Generation Retail Renewables NRG Yield Corp/

Elim

Total Operating revenues 607 336 943 1,418 86 252 (218 ) 2,481 Cost

of sales 299 151 450

1,053 3 13 (218 ) 1,301

Economic

gross margin 308 185 493 365

83 239 —

1,180 Operations & maintenance

and other cost of operations 2 174 132 306 91 31 52 4 484 Selling,

marketing, general and administrative 36 34 70 136 17 6 65 294

Other expense/(income) 3 2 (2 ) —

4 16 (33 ) (56 ) (69 )

Adjusted EBITDA

96 21 117

134 19 214

(13 ) 471

1 Includes International, BETM and generation eliminations

2 Excludes deactivation costs of $3 million

3 Excludes impairments of $758 million, acquisition-related

transaction & integration costs of $1 million and loss on debt

extinguishment of $23 million

The following table reconciles the condensed

financial information to Adjusted EBITDA:

($ in millions) Condensed

financial information Interest, tax, depr., amort. MtM Deactivation

Other adj. Adjusted EBITDA Operating revenues 2,184 15 282 — —

2,481 Cost of operations 1,103 (9 ) 207

— — 1,301

Gross margin

1,081 24 75 — — 1,180

Operations & maintenance and other cost of operations 487 — —

(3 ) — 484 Selling, marketing, general & administrative 294 — —

— — 294 Other expense/(income) 1 1,191

(458 ) — — (802 ) (69 )

Income/(Loss) from

Continuing Operations (891 )

482 75 3 802

471

1 Other adj. includes impairments of $758 million,

acquisition-related transaction & integration costs of $1

million and loss on debt extinguishment of $23 million

Appendix Table A-3: Full Year 2017 Adjusted EBITDA

Reconciliation by Operating Segment

The following table summarizes the calculation

of Adj. EBITDA and provides a reconciliation to income/(loss) from

continuing operations:

($ in millions) Gulf Coast East/

West 1

Generation Retail Renewables NRG Yield Corp/

Elim

Total

Income/(Loss) from Continuing Operations

(1,427 ) (71 ) (1,498

) 886 (266 ) (23 )

(647 ) (1,548 ) Plus:

Interest expense, net 1 26 27 5 97 303 445 877 Income tax —

2 2 (9 ) (20 ) 72 (37 ) 8 Loss on debt extinguishment — — — — 1 3

49 53 Depreciation and amortization 270 107 377 117 196 334 32

1,056 ARO expense 22 22 44 1 2 4 (1 ) 50 Contract amortization 16 4

20 1 — 69 — 90 Lease amortization — (8

) (8 ) — — — — (8 )

EBITDA

(1,118 ) 82 (1,036 )

1,001 10 762 (159 ) 578

Adjustment to reflect NRG share of adjusted EBITDA in

unconsolidated affiliates 17 25 42 (17 ) (12 ) 106 6 125

Acquisition-related transaction & integration costs — — — — — 3

1 4 Reorganization costs 9 1 10 11 1 — 22 44 Legal Settlement — — —

(1 ) — — — (1 ) Deactivation costs 4 8 12 — — — 9 21 Gain on sale

of assets — (20 ) (20 ) — 5 — (1 ) (16 ) Other non recurring

charges (21 ) (2 ) (23 ) 1 (17 ) 18 44 23 Impairments 1,309 195

1,504 7 154 44 — 1,709 Impairment losses on investments 69 5 74 — —

— 5 79 Mark to market (MtM) (gains)/losses on economic hedges

(52 ) 24 (28 ) (177 ) 12 —

— (193 )

Adjusted EBITDA

217 318 535 825

153 933 (73 )

2,373

1 Includes International, BETM and generation eliminations

Full Year 2017 condensed financial information

by Operating Segment:

($ in millions) Gulf Coast East/

West 1

Generation Retail Renewables NRG Yield Corp/

Elim

Total Operating revenues 2,258 1,464 3,722 6,385 436 1,078 (1,175 )

10,446 Cost of sales 1,338 639 1,977 4,768

15 63 (1,125 ) 5,698

Economic gross

margin 920 825 1,745 1,617

421 1,015 (50 ) 4,748 Operations

& maintenance and other cost of operations 2 612 439 1,051 322

139 263 (38 ) 1,737 Selling, marketing, general and administrative

3 123 84 207 453 56 22 170 908 Other expense/(income) 4 (32 ) (16 )

(48 ) 17 73 (203 ) (109 ) (270 )

Adjusted

EBITDA 217 318 535

825 153 933 (73

) 2,373

1 Includes International, BETM and generation eliminations

2 Excludes deactivation costs of $21 million

3 Excludes a legal settlement of $(1) million

4 Excludes impairments of $1,788 million, gain on sale of assets

of $16 million, reorganization costs of $44 million,

acquisition-related transaction & integration costs of $4

million, and loss on debt extinguishment of $53 million

The following table reconciles the condensed

financial information to Adjusted EBITDA:

($ in millions) Condensed

financial information Interest, tax, depr., amort. MtM Deactivation

Other adj. Adjusted EBITDA Operating revenues 10,629 56 (239 ) — —

10,446 Cost of operations 5,778 (34 )

(46 ) — — 5,698

Gross margin

4,851 90 (193 ) — —

4,748

Operations & maintenance and other cost of operations 1,758 — —

(21 ) — 1,737 Selling, marketing, general & administrative 1

907 — — — 1 908 Other expense/(income) 2 3,734

(1,983 ) — — (2,021 ) (270 )

Income/(Loss)

from Continuing Operations (1,548

) 2,073 (193 ) 21

2,020 2,373

1 Other adj. includes a legal settlement of $(1) million

2 Other adj. includes impairments of $1,788 million, gain on

sale of assets of $16 million, reorganization costs of $44 million,

acquisition-related transaction & integration costs of $4

million, and loss on debt extinguishment of $53 million

Appendix Table A-4: Full Year 2016 Adjusted EBITDA

Reconciliation by Operating Segment

The following table summarizes the calculation

of Adjusted EBITDA and provides a reconciliation to income/(loss)

from continuing operations:

($ in millions) Gulf Coast East/

West 1

Generation Retail Renewables NRG Yield

Corp/

Elim

Total

Income/(Loss) from Continuing Operations

(920 ) 96 (824 )

1,053 (330 ) 2

(884 ) (983 ) Plus: Interest expense,

net 1 24 25 — 97 283 481 886 Income tax (2 ) 1 (1 ) 1 (20 ) (1 ) 26

5 Loss on debt extinguishment — — — — — — 142 142 Depreciation and

amortization 406 110 516 111 185 303 57 1,172 ARO Expense 11 4 15 —

2 3 1 21 Contract amortization 14 5 19 7 1 75 (3 ) 99 Lease

amortization — (8 )

(8 ) — — —

— (8 )

EBITDA (490

) 232 (258 ) 1,172 (65

) 665 (180 ) 1,334 Adjustment to

reflect NRG share of adjusted EBITDA in unconsolidated affiliates 3

27 30 — 42 75 (41 ) 106 Acquisition-related transaction &

integration costs — — — — — 1 7 8 Deactivation costs — 15 15 — — —

2 17 Loss on sale of assets — — — 1 — — 79 80 Other non recurring

charges 19 (2 ) 17 2 9 6 23 57 Impairments 377 53 430 1 54 185 32

702 Impairment losses on investments 137 5 142 — 105 — 21 268 Mark

to market (MtM) (gains)/losses on economic hedges

447 46 493

(365 ) 6 — —

134

Adjusted EBITDA

493 376

869 811 151

932 (57 )

2,706

1 Includes International, BETM and generation eliminations

Full Year 2016 condensed financial information

by Operating Segment:

($ in millions) Gulf

Coast East/

West 1

Generation Retail Renewables NRG Yield Corp/

Elim

Total Operating revenues 2,603 1,781 4,384 6,336 413 1,104 (1,027 )

11,210 Cost of sales 1,325 768

2,093 4,687 14 61 (1,028 ) 5,827

Economic gross margin 1,278 1,013 2,291

1,649 399 1,043 1 5,383

Operations & maintenance and other cost of operations 2 672 539

1,211 338 142 241 (10 ) 1,922 Selling, marketing, general and

administrative 132 133 265 498 61 17 254 1,095 Other

expense/(income) 3 (19 ) (35 ) (54 ) 2

45 (147 ) (186 ) (340 )

Adjusted EBITDA

493 376 869

811 151 932 (57

) 2,706

1 Includes International, BETM and generation eliminations

2 Excludes deactivation costs of $17 million

3 Excludes impairments of $970 million, loss on sale of assets

of $80 million, acquisition-related transaction & integration

costs of $8 million, and loss on debt extinguishment of $142

million

The following table reconciles the condensed

financial information to Adjusted EBITDA:

($ in millions) Condensed

financial information Interest, tax, depr., amort. MtM Deactivation

Other adj. Adjusted EBITDA Operating revenues 10,512 56 642 — —

11,210 Cost of operations 5,362 (43 )

508 — — 5,827

Gross margin

5,150 99 134 — —

5,383 Operations &

maintenance and other cost of operations 1,939 — — (17 ) — 1,922

Selling, marketing, general & administrative 1,095 — — — —

1,095 Other expense/(income) 1 3,099

(2,076 ) — — (1,363 ) (340 )

Income/(Loss) from

Continuing Operations (983 )

2,175 134 17 1,363

2,706

1 Other adj. includes impairments of $970 million, loss on sale

of assets of $80 million, acquisition-related transaction &

integration costs of $8 million, and loss on debt extinguishment of

$142 million

Appendix Table A-5: 2017 and 2016 Three Months Ended December

31 and Full Year Adjusted Cash Flow from Operations

Reconciliations

The following table summarizes the calculation

of adjusted cash flow operating activities providing a

reconciliation to net cash provided by operating activities:

Three Months Ended ($ in millions)

December 31, 2017

December 31, 2016 Net Cash Provided by Operating

Activities 581 533 Sale of Land and

other assets (3) — Merger, integration and cost-to-achieve expenses

1 23 (7) Return of capital from equity investments 4 11 Adjustment

for change in collateral 2 (23)

(137)

Adjusted Cash Flow from Operating Activities

582 400 Maintenance

CapEx, net 3 (39) (41) Environmental CapEx, net 1 (42)

Distributions to non-controlling interests

(47) (47)

Free Cash Flow - before Growth

497 270

1. 2017 includes cost-to-achieve expenses associated with the

Transformation Plan announced on July 2017 call; 2016 includes

cost-to achieve expenses associated with the $150 million savings

announced on September 2015 call.

2. Reflects change in NRG’s cash collateral balance as of 4Q2017

including $79 million of collateral postings from our

deconsolidated affiliate (GenOn)

3. Includes insurance proceeds of $7 million

and $4 million in 2017 and 2016, respectively

Twelve Months Ended ($ in millions)

December 31, 2017

December 31, 2016 Net Cash Provided by Operating

Activities 1,425 2,207

Reclassifying of net receipts for settlement of acquired

derivatives that include financing elements 2 6 Sale of Land and

other assets 5 — Merger, integration and cost-to-achieve expenses 1

37 40 Cash Contribution to GenOn pension plan 2 13 — Return of

capital from equity investments 26 17 Adjustment for change in

collateral 3 159 (398)

Adjusted Cash Flow from Operating Activities

1,667 1,872 Maintenance CapEx,

net 4 (164) (212) Environmental CapEx, net (24) (240) Preferred

dividends — (2) Distributions to non-controlling interests

(175) (163)

Free Cash Flow - before

Growth 1,304

1,255

1. 2017 includes cost-to-achieve expenses associated with the

Transformation Plan announced on July 2017 call; 2016 includes

cost-to achieve expenses associated with the $150 million savings

announced on September 2015 call.

2. Reflects cash contribution related to Legacy GenOn pension

liability retained by NRG

3. Reflects change in NRG’s cash collateral balance as of 4Q2017

including $79 million of collateral postings from our

deconsolidated affiliate (GenOn)

4. Includes insurance proceeds of $29 million and $35 million in

2017 and 2016, respectively

Appendix Table A-6: Full Year 2017 Sources and Uses of

Liquidity

The following table summarizes the sources and

uses of liquidity for the full year 2017:

($ in millions)

Twelve Months

Ended

December 31, 2017

Sources: Adjusted cash flow from operations 1,667 Increase

in credit facility 722 Issuance of Agua Caliente HoldCo debt 130

Divestitures 81 NYLD Equity Issuance 34

Uses:

Debt repayments, net of proceeds (1,207) Collateral 1 (159)

Maintenance and environmental capex, net 2 (188) Distributions to

non-controlling interests (175) Common Stock Dividends (38)

Cost-to-achieve3 (43) Growth investments and acquisitions, net (9)

Other Investing and Financing 22

Change in Total

Liquidity 837

1. Reflects change in NRG’s cash collateral balance as of 4Q2017

including $79MM of collateral postings from our deconsolidated

affiliate (GenOn)

2. Includes insurance proceeds of $29 million

3. 2017 includes cost-to-achieve expenses associated with the

Transformation Plan announced on July 2017 call

Appendix Table A-7: 2018 Adjusted EBITDA

Guidance Reconciliation

The following table summarizes the calculation

of Adjusted EBITDA providing reconciliation to net income:

2018 Adjusted EBITDA ($ in millions)

Low High Income from Continuing

Operations 1 410 610 Income Tax 20 20 Interest Expense

785 785 Depreciation, Amortization, Contract Amortization and ARO

Expense 1,180 1,180 Adjustment to reflect NRG share of adjusted

EBITDA in unconsolidated affiliates 135 135 Other Costs 2 270 270

Adjusted EBITDA 2,800 3,000

1. For purposes of guidance, discontinued operations are

excluded and fair value adjustments related to derivatives are

assumed to be zero.

2. Includes deactivation costs and cost-to-achieve expenses

Appendix Table A-8: 2018 FCFbG Guidance

Reconciliation

The following table summarizes the calculation

of Free Cash Flow before Growth providing reconciliation to Cash

from Operations:

2018 ($ in millions)

Guidance Adjusted EBITDA $2,800

- $3,000 Cash Interest payments (785 ) Cash Income tax (40 )

Collateral / working capital / other 40 Cash From Operations

$2,015 - $2,215 Adjustments: Acquired Derivatives, Cost-to-Achieve,

Return of Capital Dividends, Collateral and Other — Adjusted

Cash flow from operations $2,015 - $2,215 Maintenance capital

expenditures, net (210) - (240) Environmental capital expenditures,

net (0) - (5) Distributions to non-controlling interests (220) -

(250) Free Cash Flow - before Growth $1,550 - $1,750

EBITDA and Adjusted EBITDA are non-GAAP financial measures.

These measurements are not recognized in accordance with GAAP and

should not be viewed as an alternative to GAAP measures of

performance. The presentation of Adjusted EBITDA should not be

construed as an inference that NRG’s future results will be

unaffected by unusual or non-recurring items.

EBITDA represents net income before interest (including loss on

debt extinguishment), taxes, depreciation and amortization. EBITDA

is presented because NRG considers it an important supplemental

measure of its performance and believes debt-holders frequently use

EBITDA to analyze operating performance and debt service capacity.

EBITDA has limitations as an analytical tool, and you should not

consider it in isolation, or as a substitute for analysis of our

operating results as reported under GAAP. Some of these limitations

are:

- EBITDA does not reflect cash

expenditures, or future requirements for capital expenditures, or

contractual commitments;

- EBITDA does not reflect changes in, or

cash requirements for, working capital needs;

- EBITDA does not reflect the significant

interest expense, or the cash requirements necessary to service

interest or principal payments, on debt or cash income tax

payments;

- Although depreciation and amortization

are non-cash charges, the assets being depreciated and amortized

will often have to be replaced in the future, and EBITDA does not

reflect any cash requirements for such replacements; and

- Other companies in this industry may

calculate EBITDA differently than NRG does, limiting its usefulness

as a comparative measure.

Because of these limitations, EBITDA should not be considered as

a measure of discretionary cash available to use to invest in the

growth of NRG’s business. NRG compensates for these limitations by

relying primarily on our GAAP results and using EBITDA and Adjusted

EBITDA only supplementally. See the statements of cash flow

included in the financial statements that are a part of this news

release.

Adjusted EBITDA is presented as a further supplemental measure

of operating performance. As NRG defines it, Adjusted EBITDA

represents EBITDA excluding impairment losses, gains or losses on

sales, dispositions or retirements of assets, any mark-to-market

gains or losses from accounting for derivatives, adjustments to

exclude the Adjusted EBITDA related to the non-controlling

interest, gains or losses on the repurchase, modification or

extinguishment of debt, the impact of restructuring and any

extraordinary, unusual or non-recurring items plus adjustments to

reflect the Adjusted EBITDA from our unconsolidated investments.

The reader is encouraged to evaluate each adjustment and the

reasons NRG considers it appropriate for supplemental analysis. As

an analytical tool, Adjusted EBITDA is subject to all of the

limitations applicable to EBITDA. In addition, in evaluating

Adjusted EBITDA, the reader should be aware that in the future NRG

may incur expenses similar to the adjustments in this news

release.

Management believes Adjusted EBITDA is useful to investors and

other users of NRG's financial statements in evaluating its

operating performance because it provides an additional tool to

compare business performance across companies and across periods

and adjusts for items that we do not consider indicative of NRG’s

future operating performance. This measure is widely used by

debt-holders to analyze operating performance and debt service

capacity and by equity investors to measure our operating

performance without regard to items such as interest expense,

taxes, depreciation and amortization, which can vary substantially

from company to company depending upon accounting methods and book

value of assets, capital structure and the method by which assets

were acquired. Management uses Adjusted EBITDA as a measure of

operating performance to assist in comparing performance from

period to period on a consistent basis and to readily view

operating trends, as a measure for planning and forecasting overall

expectations, and for evaluating actual results against such

expectations, and in communications with NRG's Board of Directors,

shareholders, creditors, analysts and investors concerning its

financial performance.

Adjusted cash flow from operating activities is a non-GAAP

measure NRG provides to show cash from operations with the

reclassification of net payments of derivative contracts acquired

in business combinations from financing to operating cash flow, as

well as the add back of merger, integration and related

restructuring costs. The Company provides the reader with this

alternative view of operating cash flow because the cash settlement

of these derivative contracts materially impact operating revenues

and cost of sales, while GAAP requires NRG to treat them as if

there was a financing activity associated with the contracts as of

the acquisition dates. The Company adds back merger, integration

related restructuring costs as they are one time and unique in

nature and do not reflect ongoing cash from operations and they are

fully disclosed to investors.

Free cash flow (before Growth) is adjusted cash flow from

operations less maintenance and environmental capital expenditures,

net of funding, preferred stock dividends and distributions to

non-controlling interests and is used by NRG predominantly as a

forecasting tool to estimate cash available for debt reduction and

other capital allocation alternatives. The reader is encouraged to

evaluate each of these adjustments and the reasons NRG considers

them appropriate for supplemental analysis. Because we have

mandatory debt service requirements (and other non-discretionary

expenditures) investors should not rely on free cash flow before

Growth as a measure of cash available for discretionary

expenditures.

Free Cash Flow before Growth is utilized by Management in making

decisions regarding the allocation of capital. Free Cash Flow

before Growth is presented because the Company believes it is a

useful tool for assessing the financial performance in the current

period. In addition, NRG’s peers evaluate cash available for

allocation in a similar manner and accordingly, it is a meaningful

indicator for investors to benchmark NRG's performance against its

peers. Free Cash Flow before Growth is a performance measure and is

not intended to represent net income (loss), cash from operations

(the most directly comparable U.S. GAAP measure), or liquidity and

is not necessarily comparable to similarly titled measures reported

by other companies.

1 Excluding transaction costs, working capital, and other

purchase price adjustments

2 Includes International and BETM

3 Cash cost of $646 million, including $42 million of debt

extinguishment fees

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180301005719/en/

Media:Marijke Shugrue,

609-524-5262orInvestors:Kevin L. Cole, CFA,

609-524-4526orLindsey Puchyr, 609-524-4527

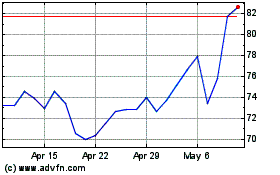

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Apr 2023 to Apr 2024