Broadcom Lowers Offer for Qualcomm, Citing 'Value Transfer'

February 21 2018 - 10:08AM

Dow Jones News

By Austen Hufford

Broadcom Ltd. lowered its offer to buy Qualcomm Inc. by about $4

billion in response to Qualcomm raising its offer to buy NXP

Semiconductors NV.

Qualcomm on Tuesday raised its offer to buy NXP Semiconductors

to $44 billion, from about $39 billion, and locked up support from

key stakeholders.

Wednesday, Broadcom, which had opposed the increased offer for

NXP, said in a securities filing Wednesday that it would lower its

own bid for Qualcomm, citing the "value transfer" to NXP

shareholders. Broadcom said its per-share offer of $79 consists of

$57 a share in cash and $22 a share in stock. The proposal would be

worth about $117 billion, compared with the $121 billion offer that

had been on the table.

However Broadcom said it would revert to its previous $121

billion bid if the NXP deal doesn't go through.

Qualcomm didn't immediately respond to a request for

comment.

Qualcomm and Broadcom have been maneuvering for months around

what could be the largest tech deal ever.

Broadcom Chief Executive Hock Tan had previously stressed the

company's offer for Qualcomm was dependent on the target not

raising its price for NXP but recently softened his position, and

the latest move Wednesday showed that he still wants the deal to

succeed.

Broadcom and Qualcomm are headed toward a March 6 showdown in

which Qualcomm shareholders are scheduled to vote on a slate of

directors nominated by Broadcom.

In another recent concession, Mr. Tan reduced his number of

candidates from 11 to six, seeking a majority rather than trying to

unseat the entire Qualcomm board.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

February 21, 2018 09:53 ET (14:53 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

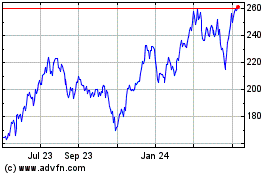

NXP Semiconductors NV (NASDAQ:NXPI)

Historical Stock Chart

From Aug 2024 to Sep 2024

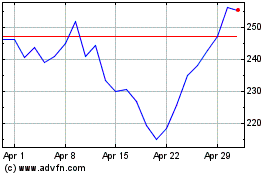

NXP Semiconductors NV (NASDAQ:NXPI)

Historical Stock Chart

From Sep 2023 to Sep 2024