Qualcomm Raises Bid for NXP to $44 Billion -- 2nd Update

February 20 2018 - 11:48AM

Dow Jones News

By Ben Dummett and Ted Greenwald

Qualcomm Inc. raised its bid for NXP Semiconductors NV to about

$44 billion and locked up support from key investors, as the chip

maker seeks to fend off a $121 billion hostile takeover approach by

Broadcom Ltd.

Qualcomm, based in San Diego, increased its bid for NXP to

$127.50 a share. It also lowered the threshold for NXP shareholder

support to 70% from 80%, making it easier to complete the deal.

The move, announced Tuesday, sets up a March 6 showdown after

months of sniping between Qualcomm and Broadcom, which has put

forth its own slate of directors for Qualcomm investors to vote on

at the company's annual shareholder meeting.

The elevated NXP offer came nearly a week after Broadcom and

Qualcomm executives sat down together for the first time since

Broadcom launched its takeover effort. The meeting seemingly

resulted in no progress toward an agreement. Qualcomm has said

Broadcom's $121 billion bid undervalues it, and that it likely

would run into trouble gaining regulatory approvals.

In a statement Tuesday, Broadcom said Qualcomm's higher NXP bid

"demonstrates the Qualcomm board's disregard for its fiduciary

duty" to its shareholders. The statement didn't address whether

Broadcom would continue its pursuit.

Broadcom Chief Executive Hock Tan has said his offer for

Qualcomm stands regardless of the NXP purchase, though he has

threatened to withdraw if Qualcomm increased the price above the

original $110 a share. Mr. Tan appeared to soften that stance last

week in an appearance on CNBC, saying in that event he would

preserve his options.

Qualcomm's new NXP bid appeased Elliott Management Corp. and

several other hedge funds that had argued the $110-a-share offer

was too low. New York-based Elliott, which owns a 7.2% stake in

NXP, had been among the most vocal advocates for a higher price,

arguing NXP, the world's largest developer of chips for

automobiles, was worth at least $135 a share. It cited NXP's

better-than-expected fourth-quarter earnings among other

factors.

Elliott on Tuesday said it agreed to tender its shares in NXP in

response to Qualcomm's higher offer. Qualcomm said it obtained

binding agreements from other shareholders as well, for a total of

28% of outstanding NXP shares.

The higher NXP bid was seen as a necessary step for Qualcomm to

win support from shareholders. Since the summer, shares of the

Dutch automotive chip specialist have been trading above Qualcomm's

original offer of $110 a share, or $39 billion.

On Tuesday, Qualcomm shares sank 4.2% to $62.11, while shares of

NXP jumped 6.2% to $125.78. Broadcom shares were up 2.3% to

$254.72.

The Wall Street Journal reported earlier Tuesday that Qualcomm

was set to sweeten its offer.

Qualcomm's offer "reduces the chances that a Broadcom deal would

go through at $82 a share," weighing on Qualcomm's stock, said

Chris Caso, an analyst with Raymond James Financial Inc.

The NXP deal has been wending its way through international

regulatory approvals for more than a year. It awaits approval by

Chinese antitrust authorities -- its last regulatory hurdle. During

that time, NXP investors bid up the stock, and some shareholders

withdrew their shares, putting pressure on Qualcomm to raise its

offer.

Qualcomm is looking to NXP to broaden its product line beyond

its smartphone stronghold to automobiles, security and

internet-connected devices, combined markets the company says will

be worth $77 billion by 2020.

On its recent earnings call, Qualcomm estimated it would take

three weeks to wrap up the acquisition once China approves the

deal.

"We are working hard to complete this transaction

expeditiously," Chief Executive Steve Mollenkopf said Tuesday.

Write to Ben Dummett at ben.dummett@wsj.com and Ted Greenwald at

Ted.Greenwald@wsj.com

(END) Dow Jones Newswires

February 20, 2018 11:33 ET (16:33 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

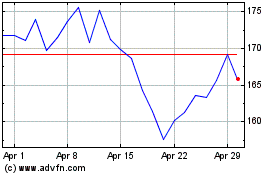

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Aug 2024 to Sep 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Sep 2023 to Sep 2024