Qualcomm Raises Bid for NXP to $44 Billion -- Update

February 20 2018 - 7:39AM

Dow Jones News

By Ben Dummett

Chip giant Qualcomm Inc. raised its bid for NXP Semiconductors

NV to about $44 billion on Tuesday in an effort to win shareholder

support for the acquisition.

The move could also help Qualcomm as it tries to fend off a $121

billion takeover approach from Broadcom Ltd., which has threatened

to withdraw its offer if Qualcomm makes a higher offer for NXP.

San Diego-based Qualcomm increased its bid for rival chip maker

NXP to $127.50 a share, up from its initial offer of $110, or $39

billion.

The Wall Street Journal reported earlier Tuesday that Qualcomm

was set to sweeten its offer.

The move is meant to appease Elliott Management Corp. and

several other hedge funds that had argued the original bid was too

low. New York-based Elliott, which owns a 7.2% stake, had been

among the most vocal advocates for a higher price, arguing that

NXP, the world's largest developer of chips for automobiles, was

worth at least $135 a share. It cited NXP's better-than-expected

fourth-quarter earnings among other factors.

Elliott said Tuesday it had agreed to tender its shares in NXP

in response to the higher offer.

NXP, headquartered in the Netherlands but listed in New York,

last traded at $118.50 a share, a strong signal of investor

expectations of a higher offer. NXP shares rose 6.5% premarket

Tuesday.

Under the initial deal terms, first announced October 2016,

Qualcomm at a minimum needs support from NXP shareholders holding

80% of the company's shares. The updated offer lowers the minimum

tender condition to 70% of shares outstanding.

That threshold gave NXP shareholders considerable leverage to

block the deal, putting pressure on Qualcomm to raise its bid.

Qualcomm is expected to receive substantial support for the revised

offer, helping to ensure it can complete the acquisition, according

to the people familiar with the matter.

In addition to shareholder support, Qualcomm is still seeking

approval from Chinese antitrust authorities. It has already secured

competition approval in the U.S., the European Union, and other

jurisdictions.

Write to Ben Dummett at ben.dummett@wsj.com

(END) Dow Jones Newswires

February 20, 2018 07:24 ET (12:24 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

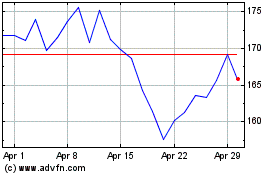

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024