Hecla Mining Company (NYSE:HL) today provided an update on its

exploration programs during the fourth quarter.

Exploration Highlights

- San Sebastian continues to expand

high-grade, polymetallic zones similar to the Hugh Zone on the

Middle and Francine veins.

- Casa Berardi has expanded and refined

resources that could increase the size of the proposed Principal

and current East Mine Crown Pillar (EMCP) open pits and discovered

mineralization that could lead to new pits in the west part of the

mine at the West Mine Pillar and NW-SW zones.

- Drilling of the 118 and 123 zones at

Casa Berardi has discovered high-grade mineralization at depth and

to the west.

- Greens Creek exploration continues to

expand the resource by drilling on known mineralized trends.

“Our strategy of investing in exploration continues to add

value, with considerable exploration success this year, including

the record silver, gold and lead reserves announced last week,”

said Phillips S. Baker, Jr., President and CEO. “This past quarter

was no different than the full year. We continue to expand the

polymetallic mineralization at San Sebastian, so much so that we

expect to take a bulk sample this year. At Casa Berardi, our

exploration continues to confirm the high expectations we had when

we acquired it, with expansions of planned pits and discovery of

new open pitable material as well as new high-grade lenses

underground. Finally, drilling at Greens Creek discovered

high-grade mineralization in the central part of the mine that

could enhance Greens Creek’s already exceptional mine economics and

mine life.”

San Sebastian - Mexico

During the quarter, exploration with three core drills that were

directed towards polymetallic mineralization successfully

discovered new high-grade zones along the Middle and

Francine veins.

Drilling of the 97 Zone along the West Middle Vein

was directed toward a new zone of high-grade, polymetallic

mineralization with similar mineral characteristics as the

previously discovered Hugh Zone on the Francine Vein. The 97 Zone

extends 1,000 feet along strike and 750 feet down-dip and is open

to the east and at depth. This mineralization is located about 100

to 300 feet below the new Middle Vein underground mine ramp and a

development drift has begun that will facilitate the collection of

a bulk sample of the polymetallic mineralization this year. Recent

assay results from step-out drilling include 10.2 oz/ton silver, 3%

copper, 10% lead, and 18% zinc over 4.4 feet and 12.0 oz/ton

silver, 4% copper, 6% lead, and 9% zinc over 5.4 feet. Drilling is

planned to the east and at 1,000 feet of depth to evaluate the

potential of polymetallic mineralization to extend below the 3,000

feet of strike length of the oxide reserves.

On the Francine Vein, drilling continues to intersect

high-grade, polymetallic mineralization extending 600 feet to the

west and 800 feet east of the current Hugh Zone resource for

a total of over 5,000 feet of strike length. Recent vein intercepts

suggest this polymetallic mineralization is closer to surface to

the west. Recent assay results from drilling on the Francine Vein

include 9.2 oz/ton silver, 2% copper, 5% lead, and 5% zinc

over 6.3 feet to the east and 12.8 oz/ton silver, 2% copper,

4% lead and 6% zinc over 3.6 feet to the west.

As noted in the last quarter, a drill hole located 2,500 feet to

the west of the Hugh Zone resource intersected a polymetallic vein

with over six feet of true thickness. Results of step-out drilling

in this area include 9.1 oz/ton silver, 3% copper, 3% lead,

and 4% zinc over 2.6 feet. The vein is one of the most western

intersections along the Francine Vein and is largely open between

the most recent drilling west of the Hugh Zone.

Drilling continues to expand resources and evaluate polymetallic

targets along the Middle and Francine veins and the plan is to also

evaluate near-surface, oxide mineralization at the Provessor, North

and Esperanza veins.

More complete drill assay highlights from San Sebastian can be

found in Table A at the end of this release and a presentation

showing drill intersection locations is available at the following:

http://ir.hecla-mining.com/interactive/newlookandfeel/4130678/Hecla-Q4-2017ExplorationUpdate.pdf

Casa Berardi – Quebec

During the fourth quarter, six underground drills were used to

refine stope designs, expand reserves and resources in the 118,

123, and 124 zones and confirm further potential at depth, to the

west and in some cases to the east. Up to four drills on surface

completed in-fill and exploration drilling that could expand the

proposed Principal Pit and the current EMCP pit and discover new

mineralization that could lead to pits in the west part of the

mine.

At the Lower 118 Zone, drilling has confirmed the

continuity of multiple mineralized lenses that extend over 1,600

feet down-plunge and remain open to depth and to the east and west

of the current resources. Drilling near the bottom of the mine

returned 0.90 oz/ton gold over 21.9 feet and 0.38 oz/ton gold

over 37.8 feet and suggests there is good potential to extent

high-grade resources to the west and to depth near the Casa Berardi

Fault and below the current mine infrastructure.

Drilling of stacked, high-grade lenses of the 123 Zone is

defining the connection of multiple mineralized lenses for over

1,600 feet of strike length and over 3,000 feet down-dip below the

1010 level. Drilling on the western extreme of the lower 123 Zone

intersected 0.32 oz/ton gold over 37.1 feet, confirming the

continuation of multiple lenses. Also, to the east there was an

intersection grading 0.22 oz/ton gold over 24.0 feet. Drilling

below the mine infrastructure intersected 0.41 oz/ton gold over

10.7 feet and 0.35 oz/ton gold over 11.5 feet. Drilling of the

lower 123 Zone at the bottom of the mine confirmed vein continuity

and shows that it is open at depth and to the east and west of the

current resources.

Intersections from drilling on the upper part of the 124

Zone include 0.91 oz/ton gold over 4.6 feet and 0.42 oz/ton

gold over 17.7 feet, suggesting mineralization continues down from

surface and is open at depth and to the west. Drilling in this area

has also confirmed the high-grade nature of the crown pillar below

the proposed Principal Pit.

Surface and shallow underground drilling have identified

extensions of potential pits that are being evaluated for

production. Drilling along the northeast extension of the proposed

Principal Pit area confirmed 1,200 feet of continuity to the

northeast and includes an intersection of 0.11 oz/ton gold over 7.2

feet. Drilling targeting the shallow eastern extension of the 124

Zone intersected strong mineralization including 0.14 oz/ton gold

over 9.7 feet. Underground drilling of this target is planned to

evaluate deeper extensions of the high-grade shoots. Drilling on

the west extension of the current EMCP pit has returned 0.09

oz/ton gold over 27.8 feet and 0.07 oz/ton gold over 50.7 feet

to define an extension over 700 feet to the west of the current pit

outline.

Drilling of the West Mine Surface Pillar within 800 feet

of surface to the west of the west shaft intersected a broad

mineralized zone of 0.04 oz/ton gold over 78.7 feet that contains

an interval of 0.12 oz/ton gold over 13.8 feet. In-fill drilling in

2018 may convert a large portion of those resources to indicated

category with the eventual incorporation into the life of mine

plan.

Aggressive surface drilling programs are planned through 2018 at

the 124 Zone (Principal area), 146/EMCP, West Mine Surface

Pillar and South West zones to define a possible series of open

pits along the Casa Berardi Fault. Underground drilling is expected

to continue to expand and refine the lower 118, 121 and 123 zones

lower in the mine.

More complete drill assay highlights from Casa Berardi can be

found in Table A at the end of the release and a presentation

showing drill intersection locations is available at the following:

http://ir.hecla-mining.com/interactive/newlookandfeel/4130678/Hecla-Q4-2017ExplorationUpdate.pdf

Greens Creek – Alaska

At Greens Creek, drilling in the fourth quarter, targeting the

East Ore, Deep 200 South, Gallagher, Deep Southwest and West zones,

upgraded and expanded the known resources. Strong assay results

were also received from previous drilling on the East Ore,

Gallagher and Deep 200 South zones.

In the East Ore Zone intersections from definition

drilling, including 32.3 oz/ton silver, 0.18 oz/ton gold,

9.0% zinc and 4.8% lead over 19.8 feet, compare favorably to

previously modeled resource estimates, particularly at higher

elevations. Step-out drilling, including an intersection of 54.2

oz/ton silver, 0.43 oz/ton gold, 4.25% zinc and 1.34% lead over

19.0 feet, suggest strong mineralization continues beyond the

resource to the south and at depth. Aggressive drilling of the East

Ore Zone is planned to continue well into 2018 with the goal of

confirming reserves and expanding the known resource.

Definition drilling of the southern portion of the Deep 200

South Zone, including 40.1 oz/ton silver, 0.03 oz/ton

gold, 6.0% zinc and 4.2% lead over 18.9 feet, improved the

high-grades and upgraded it to indicated resource. Exploration

drilling south of the current resource has extended 200 South Bench

mineralization another 300 feet with an intersection of

23.6 oz/ton silver, 0.06 oz/ton gold, 2.5% zinc and 1.3% lead

over 19.5 feet. Recent exploration drilling further south suggests

the bench mineralization remains robust.

Drilling of the Gallagher Zone confirmed modeled

thicknesses and may have increased the resource by defining

mineralization further to the west and east beyond the current

resource. Intersections from this program include 25.3 oz/ton

silver, 0.01 oz/ton gold, 0.7% zinc and 0.3% lead over 9.4 feet and

8.4 oz/ton silver, 0.03 oz/ton gold, 11.8% zinc and 6.4% lead over

11.2 feet.

Underground drilling for the remainder of the year is planned to

focus on the East Ore, Upper Plate, Deep 200 South, and Gallagher

zones.

More complete drill assay highlights from Greens Creek can be

found in Table A at the end of this release and a presentation

showing drill intersection locations is available at the following:

http://ir.hecla-mining.com/interactive/newlookandfeel/4130678/Hecla-Q4-2017ExplorationUpdate.pdf.

ABOUT HECLA

Founded in 1891, Hecla Mining Company (NYSE:HL) is a leading

low-cost U.S. silver producer with operating mines in Alaska, Idaho

and Mexico, and is a growing gold producer with an operating mine

in Quebec, Canada. The Company also has exploration and

pre-development properties in seven world-class silver and gold

mining districts in the U.S., Canada, and Mexico, and an

exploration office and investments in early-stage silver

exploration projects in Canada.

Cautionary Statements Regarding Forward Looking

Statements

Statements made or information provided in this news release

that are not historical facts are "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995 and "forward-looking information" within the meaning of

Canadian securities laws. Words such as “may”, “will”, “should”,

“expects”, “intends”, “projects”, “believes”, “estimates”,

“targets”, “anticipates” and similar expressions are used to

identify these forward-looking statements. The material factors or

assumptions used to develop such forward-looking statements or

forward-looking information include that the Company’s plans for

development and production will proceed as expected and will not

require revision as a result of risks or uncertainties, whether

known, unknown or unanticipated, to which the Company’s operations

are subject.

Forward-looking statements involve a number of risks and

uncertainties that could cause actual results to differ materially

from those projected, anticipated, expected or implied. These risks

and uncertainties include, but are not limited to, metals price

volatility, volatility of metals production and costs, litigation,

regulatory and environmental risks, operating risks, project

development risks, political risks, labor issues, ability to raise

financing and exploration risks and results. Refer to the Company's

Form 10K and 10-Q reports for a more detailed discussion of

factors that may impact expected future results. The Company

undertakes no obligation and has no intention of updating

forward-looking statements other than as may be required by

law.

Cautionary Statements to Investors on Reserves and

Resources

Reporting requirements in the United States for disclosure of

mineral properties are governed by the SEC and included in the

SEC's Securities Act Industry Guide 7, entitled “Description of

Property by Issuers Engaged or to be Engaged in Significant Mining

Operations” (Guide 7). However, the Company is also a “reporting

issuer” under Canadian securities laws, which require estimates of

mineral resources and reserves to be prepared in accordance with

Canadian National Instrument 43-101 (NI 43-101). NI 43-101 requires

all disclosure of estimates of potential mineral resources and

reserves to be disclosed in accordance with its requirements. Such

Canadian information is being included here to satisfy the

Company's “public disclosure” obligations under Regulation FD of

the SEC and to provide U.S. holders with ready access to

information publicly available in Canada.

Reporting requirements in the United States for disclosure of

mineral properties under Guide 7 and the requirements in Canada

under NI 43-101 standards are substantially different. This

document contains a summary of certain estimates of the Company,

not only of proven and probable reserves within the meaning of

Guide 7, but also of mineral resource and mineral reserve estimates

estimated in accordance with the definitional standards of the

Canadian Institute of Mining, Metallurgy and Petroleum referred to

in NI 43-101. Under Guide 7, the term “reserve” means that part of

a mineral deposit that can be economically and legally extracted or

produced at the time of the reserve determination. The term

“economically,” as used in the definition of reserve, means that

profitable extraction or production has been established or

analytically demonstrated to be viable and justifiable under

reasonable investment and market assumptions. The term “legally,”

as used in the definition of reserve, does not imply that all

permits needed for mining and processing have been obtained or that

other legal issues have been completely resolved. However, for a

reserve to exist, Hecla must have a justifiable expectation, based

on applicable laws and regulations, that issuance of permits or

resolution of legal issues necessary for mining and processing at a

particular deposit will be accomplished in the ordinary course and

in a timeframe consistent with Hecla’s current mine plans. The

terms “measured resources”, “indicated resources,” and “inferred

resources” are Canadian mining terms as defined in accordance with

NI 43-101. These terms are not defined under Guide 7 and are not

normally permitted to be used in reports and registration

statements filed with the SEC in the United States, except where

required to be disclosed by foreign law. The term “resource” does

not equate to the term “reserve”. Under Guide 7, the material

described herein as “indicated resources” and “measured resources”

would be characterized as “mineralized material” and is permitted

to be disclosed in tonnage and grade only, not ounces. The category

of “inferred resources” is not recognized by Guide 7. Investors are

cautioned not to assume that any part or all of the mineral

deposits in such categories will ever be converted into proven or

probable reserves. “Resources” have a great amount of uncertainty

as to their existence, and great uncertainty as to their economic

and legal feasibility. It cannot be assumed that all or any part of

such a “resource” will ever be upgraded to a higher category or

will ever be economically extracted. Investors are cautioned not to

assume that all or any part of a “resource” exists or is

economically or legally mineable. Investors are also especially

cautioned that the mere fact that such resources may be referred to

in ounces of silver and/or gold, rather than in tons of

mineralization and grades of silver and/or gold estimated per ton,

is not an indication that such material will ever result in mined

ore which is processed into commercial silver or gold.

Qualified Person (QP) Pursuant to Canadian National

Instrument 43-101

Dean McDonald, PhD. P.Geo., Senior Vice President - Exploration

of Hecla Mining Company, who serves as a Qualified Person under

National Instrument 43-101, supervised the preparation of the

scientific and technical information concerning Hecla’s mineral

projects in this news release. Information regarding data

verification, surveys and investigations, quality assurance program

and quality control measures and a summary of sample, analytical or

testing procedures for the Greens Creek Mine are contained in a

technical report prepared for Hecla titled “Technical Report for

the Greens Creek Mine, Juneau, Alaska, USA” effective date March

28, 2013, and for the Lucky Friday Mine are contained in a

technical report prepared for Hecla titled “Technical Report on the

Lucky Friday Mine Shoshone County, Idaho, USA” effective date April

2, 2014, for the Casa Berardi Mine are contained in a technical

report prepared for Hecla titled "Technical Report on the Mineral

Resource and Mineral Reserve Estimate for the Casa Berardi Mine,

Northwestern Quebec, Canada" effective date March 31, 2014 (the

"Casa Berardi Technical Report"), and for the San Sebastian Mine

are contained in a technical report prepared for Hecla titled

"Technical Report for the San Sebastian Ag-Au Property, Durango,

Mexico" effective date September 8, 2015. Also included in these

three technical reports is a description of the key assumptions,

parameters and methods used to estimate mineral reserves and

resources and a general discussion of the extent to which the

estimates may be affected by any known environmental, permitting,

legal, title, taxation, socio-political, marketing or other

relevant factors. Copies of these technical reports are available

under Hecla's profile on SEDAR at www.sedar.com.

Table A - Assay Results – Q4 2017

San Sebastian (Mexico)

Zone Drill Hole Number Sample From

(ft) Sample To (ft) Width (feet)

True Width (feet) Gold (oz/ton)

Silver (oz/ton) Zinc (%) Lead

(%) Copper (%) Middle Vein

SS-1450 818.3 821.5

3.2 2.0 0.00 2.6

1.4 1.08 0.35 Middle

Vein SS-1454 987.4

996.3 9.0 5.4 0.07

12.0 8.5 5.46

4.36 Middle Vein SS-1458

1095.2 1099.7 3.2

3.6 0.00 3.5 3.1

2.78 0.99 Middle Vein

SS-1460 1298.4 1304.3

3.5 4.4 0.00 10.2

17.5 10.30 2.55 East

Francine SS-1437 859.3

881.2 21.9 18.4

0.00 0.2 0.1 0.03

0.06 East Francine SS-1438

1368.5 1376.0 7.5

6.3 0.00 9.2 5.2

5.42 1.73 East Francine

SS-1444 1613.1 1624.6

11.5 9.6 0.00 4.6

4.0 1.48 1.47 East

Francine SS-1448 1708.6

1712.4 3.8 3.2

0.01 6.4 5.6 2.99

0.67 East Francine SS-1453

1370.8 1379.5 8.8

7.4 0.00 3.0 3.6

2.13 0.43 East Francine

SS-1465 1696.4 1702.5

6.1 5.1 0.00 4.1

2.4 1.47 1.16

Francine SS-1471 982.6

996.6 14.0 11.8

0.04 4.7 2.1 2.41

0.69 West Francine SS-1474

663.5 667.8 4.3

3.6 0.00 12.8 5.9

3.86 2.17 West Francine

SS-1475 1504.0 1505.3

1.3 1.1 0.00 11.6

10.0 4.93 3.07 West

Francine SS-1478 1173.4

1175.7 2.3 1.9

0.06 15.1 0.5 0.30

1.06 West Francine SS-1459

991.9 995.0 3.1

2.6 0.00 9.1 3.6

2.85 3.22

Casa Berardi (Quebec)

Zone Drill Hole Number Drill Hole

Section Drill Hole Azm/Dip Sample

From Sample To True Width (feet)

Gold (oz/ton) Depth From Mine Surface

(feet) Lower 118 - 990 Area CBP-0990-033

12137 341/-14 187.0

229.7 37.8 0.38

-3286.6 118 CBP-0990-034

12136 341/22 203.4

213.3 10.5 0.39

-3148.6 118 CBP-0990-035

12151 354/-20 206.7

223.1 15.1 0.31

-3308.7 118 CBP-0990-042

12152 354/-38 196.9

210.0 10.7 0.35

-3358.1 118 CBP-0990-042

12152 354/-38 239.5

265.7 21.9 0.90

-3387.3 118 CBP-0990-045

12139 341/-34 213.3

266.7 42.1 0.41

-3358.5 Lower 123 - 870-990 Area

CBP-0870-123 12212 193/-4

152.9 190.3 37.1

0.32 -2822.1 123

CBP-0870-124 12222 179/-17

199.1 210.0 10.2

0.15 -2865.7 123

CBP-0870-125 12241 168/-24

482.3 495.4 12.1

0.20 -2955.1 123

CBP-0870-127 12198 242/35

72.2 137.1 62.0

0.11 -2744.9 123

CBP-0870-127 12152 242/35

312.0 321.5 8.5

0.17 -2623.7 123

CBP-0870-127 12138 242/35

367.1 400.9 24.0

0.22 -2584.8 123

CBP-0870-130 12201 242/26

75.8 84.3 7.5 0.26

-2770.9 123 CBP-0950-055

12365 180/23 68.9

141.1 71.6 0.32

-3073.4 123 CBP-0950-056

12366 180/0 75.5

167.3 90.5 0.26

-3116.6 123 CBP-0950-057

12365 180/-13 90.2

173.2 73.7 0.25

-3146.6 123 CBP-0950-060

12345 178/36 71.5

113.5 40.0 0.25

-3060.4 123 CBP-0950-061

12345 181/4 75.5

104.3 26.9 0.52

-3112.6 123 CBP-0950-062

12345 181/-16 113.2

149.6 32.5 0.73

-3156.3 123 CBP-0950-063

12345 180/-28 117.1

169.9 54.9 0.33

-3187.0 123 CBP-0950-065

12329 180/1 92.2

119.8 26.1 0.40

-3114.0 123 CBP-0950-069

12346 180/20 59.7

102.4 42.6 0.47

-3087.9 123 CBP-0950-076

12390 177/29 51.5

62.3 10.2 0.55

-3083.3 123 CBP-0950-078

12390 180/-27 9.2

26.6 11.3 0.65

-3124.1 123 CBP-0950-079

12390 180/-40 12.5

49.2 19.0 0.54

-3136.4 123 CBP-0950-080

12387 180/28 39.4

61.7 19.8 0.59

-3086.5 123 CBP-0675

11985 360/-36 200.1

219.8 19.5 0.31

-3341.0 123 CBP-0675

11989 360/-36 465.9

476.0 10.1 0.25

-3491.0 123 CBP-0678

12025 360/-23 649.6

661.4 10.7 0.41

-3475.8 123 CBP-0681

12078 360/-24 587.3

600.1 11.7 0.35

-3459.8 123 CBP-0648

12329 190/-46 39.4

54.1 11.5 0.35

-3165.2 123 CBP-0648

12280 190/-46 853.0

866.1 7.5 0.25

-3690.0 Upper Principal 124 - 210 area

CBP-0210-032 12420 359/28

150.3 170.6 17.7

0.42 -606.9 124

CBP-0210-036 12432 4/46

137.8 157.5 10.5

0.21 -576.0 124

CBP-0210-038 12445 27/32

106.0 113.8 4.6

0.91 -625.8 124

CBP-0210-039 12466 26/42

125.0 134.5 6.5

0.33 -595.3 Explo Surface Principal

Area CBS-17-803 13075

360/-45 721.8 755.6

26.2 0.02 -519.6 124

CBS-17-804 13286 360/-45

319.9 329.7 7.2

0.11 -226.3 124

CBS-17-811 12802 15/-65

543.3 748.0 139.8

0.06 -565.5 124

CBS-17-812 12850 0/-46

190.3 205.1 9.7

0.14 -140.2 124

CBS-17-812 12862 0/-46

1184.4 1186.0 1.0

1.09 -789.9 Surface EMCP pit

CBF-148-049 14621 360/-60

426.5 465.9 27.8

0.09 -389.8 148

CBF-148-049 14618 360/-60

547.9 613.5 50.7

0.07 -500.2 148

CBF-148-050 14599 345/-45

446.2 493.8 40.1

0.04 -340.9 148

CBF-148-051 14653 15/-45

518.4 590.6 64.8

0.03 -392.5 148

CBF-148-052 14628 360/-60

239.5 334.6 72.4

0.06 -262.2 148

CBF-148-052 14626 360/-60

364.2 423.2 41.0

0.05 -354.8 Surface - NW-SW Area

CBS-17-777 10561 1/-44

472.4 502.0 23.0

0.05 -358.2 NW-SW

CBS-17-806 10411 360/-55

1082.0 1107.3 14.4

0.02 -897.3 NW-SW

CBS-17-807 10371 360/-50

816.9 933.1 78.7

0.04 -685.8 NW-SW

CBS-17-808 10381 360/-45

531.5 551.2 18.3

0.02 -405.3 NW-SW

CBS-17-808 10372.19 360/-45

900.6 915.4 13.8

0.12 -649.7 NW-SW

CBS-17-815 9585 360/-60

477.4 492.1 11.2

0.06 -444.0

Greens Creek (Alaska)

Zone Drill Hole Number Drillhole

Azm/Dip Sample From Sample To

True Width (feet) Silver (oz/ton)

Gold (oz/ton) Zinc (%) Lead

(%) Depth From Mine Portal (feet) East Ore

Definition GC4672 63/30

466.50 476.50 9.0

12.33 0.09 18.28

4.02 772 GC4676

63/25 566.00 567.50

1.2 24.42 0.17

5.77 3.45 945

571.50 576.00

3.5 36.59 0.13

5.07 2.63 949

580.00 585.00

3.9 20.94 0.16

14.99 4.98 952

GC4688 63/-20 362.00

381.00 19.0 54.24

0.43 4.25 1.34 569

GC4692 63/30

643.00 646.00 1.5

14.31 0.00 5.16

0.82 1019 GC4704

63/-5 384.50 386.00

1.3 14.25 0.04

7.87 2.42 655

GC4706 63/-19 368.00

373.80 5.8 15.72

0.06 6.37 4.20 566

GC4707 63/-46

356.10 359.20 3.1

28.14 0.02 4.79

2.76 440 GC4708

63/-61 362.20 366.60

4.3 34.25 0.05

4.70 2.89 378

GC4709 63/-85 453.80

455.00 1.1 23.16

0.24 7.47 1.67 249

GC4715 63/-84

446.00 452.80 5.8

40.96 0.00 4.92

3.10 245 GC4719

63/20 519.50 524.00

4.4 16.99 0.04

1.85 0.82 797

GC4720 63/11 491.50

495.00 3.2 314.49

0.98 6.05 0.49 887

GC4723 63/-13

366.00 369.00 2.9

15.34 0.11 10.35

4.60 625 GC4726

63/-74 301.50 346.00

42.1 12.54 0.16

11.97 4.59 415

377.00 397.50

19.8 15.41 0.10

12.20 5.59 371

GC4743 63/-63 242.00

264.00 19.8 32.30

0.18 8.97 4.82 483

302.70

304.50 1.7 58.31

0.25 4.84 2.33 470

GC4746 63/-84

316.00 318.00 1.4

15.97 0.12 1.97

0.08 388

413.00 416.20 2.5

10.32 0.05 13.22

2.67 378 GC4764

63/-62 229.20 238.00

8.5 29.09 0.10

8.75 3.88 502

247.50 248.50

1.0 13.67 0.00

4.28 2.28 487

GC4769 108/-73 236.50

252.00 13.7 11.51

0.07 5.76 2.23 476

Deep 200 South Definition GC4727

63/-87 236.00 248.50

12.1 15.25 0.00

7.83 4.30 -1513

318.00 330.00

12.0 13.38 0.19

2.17 1.55 -1596

GC4730 63/-77 355.00

361.70 5.8 12.20

0.26 2.37 1.43

-1641 GC4731 243/-76

647.00 665.00 14.0

15.83 0.14 1.12

0.59 -1658 GC4732

243/-51 163.00 168.00

3.4 27.44 0.03

0.52 0.24 -1410

327.50 330.60

2.2 13.42 0.00

2.34 1.02 -1533

587.00 592.10

3.0 18.98 0.03

0.38 0.21 -1726 Deep 200

South Exploration GC4671 63/-87

409.00 411.00 2.0

34.06 0.06 1.03

0.47 -1691 GC4679

63/-78 482.00 490.00

2.7 16.26 0.08

0.75 0.51 -1756

GC4683 243/-85 183.00

187.00 4.0 32.51

0.02 6.98 3.34

-1464

216.00 237.00 18.9

40.07 0.03 6.02

4.17 -1493

389.50 391.00 1.5

27.67 0.10 0.99

0.55 -1667 GC4691

243/-54 596.40 598.00

1.3 22.08 0.00

2.69 1.02 -1764

GC4695 243/-65 206.30

208.00 1.5 16.54

0.00 2.45 2.03

-1468 GC4736 63/-73

688.20 690.00 1.4

10.98 0.04 6.81

3.02 -1936 GC4741

243/-83 64.00 71.00

6.9 37.70 0.03

11.76 6.07 -1349

97.20 103.00

3.7 30.20 0.20

7.74 3.88 -1381

124.20 230.00

22.4 24.09 0.08

3.37 1.60 -1405

543.80 548.00

4.0 46.62 0.15

1.18 0.58 -1798

688.00 694.70

6.2 52.67 0.23

4.84 2.44 -1822

GC4748 243/-76 67.00

68.00 0.9 24.08

0.00 15.01 8.40

-1351

176.10 201.60 19.5

23.61 0.06 2.51

1.31 -1457

503.00 513.00 9.7

13.30 0.08 6.78

3.30 -1767

565.80 569.50 3.6

12.12 0.03 2.60

1.22 -1829

693.60 711.00 14.8

28.72 0.15 1.69

0.94 -1955 GC4751

243/-65 61.00 65.50

4.3 17.51 0.00

11.92 5.51 -1345

597.00 599.00

2.0 21.39 0.00

0.38 0.22 -1828

GC4754 243/-53 57.00

66.00 9.0 17.81

0.01 14.56 8.67

-1333

257.00 263.50 6.4

178.47 0.01 8.33

4.33 -1496 Gallagher Definition

GC4677 27/56 22.00

25.50 3.3 14.56

0.00 9.77 5.50

-687 49.00

65.00 14.5 6.91

0.01 10.10 5.43

-658 GC4681 261/40

49.00 51.00 1.3

13.67 0.00 11.08

4.90 -675

162.70 173.40 9.1

5.33 0.41 7.87

4.13 -617 GC4686

252/9 344.00 349.50

2.5 26.93 0.08

8.00 4.41 -653

GC4693 243/30 29.80

32.00 1.9 8.80

0.00 10.53 5.20

-618 GC4696 63/-85

475.00 484.50 9.4

25.34 0.00 0.73

0.34 -1184 GC4703

243/10 578.50 593.80

11.2 8.39 0.03

11.79 6.44 -591

606.50 611.00

3.3 5.73 0.03

9.24 4.61 -587

GC4705 243/6 342.60

344.00 1.0 8.61

0.01 9.97 4.80

-632

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180212005508/en/

Hecla Mining CompanyMike Westerlund, 800-HECLA91

(800-432-5291)Vice President, Investor

Relationshmc-info@hecla-mining.comwww.hecla-mining.com

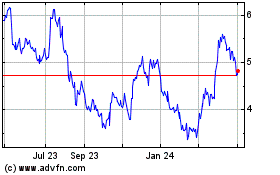

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Aug 2024 to Sep 2024

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Sep 2023 to Sep 2024