By Laura Stevens

Amazon.com Inc. is preparing to launch a delivery service for

businesses, positioning it to compete directly with United Parcel

Service Inc. and FedEx Corp.

Dubbed "Shipping with Amazon," or SWA, the new service will

entail the online retail giant picking up packages from businesses

and shipping them to consumers, according to people familiar with

the matter.

Amazon expects to roll out the delivery service in Los Angeles

in coming weeks with third-party merchants that sell goods via its

website, according to the people. Amazon then aims to expand the

service to more cities as soon as this year, some of the people

say.

While the program is being piloted with the company's

third-party sellers, it is envisioned as eventually accommodating

other businesses as well, according to some of the people. Amazon

is planning to undercut UPS and FedEx on pricing, although the

exact rate structure is still unclear, these people said.

Still, Amazon will face steep hurdles to build out the needed

infrastructure and personnel for a reliable delivery network of any

broader scale, and it could take years for the company to make a

meaningful dent on the industry.

The new service, which stems from a Los Angeles test project

first reported by The Wall Street Journal more than a year ago,

moves Amazon into direct competition for parcel business currently

handled by its delivery partners UPS and FedEx. "Shipping With

Amazon" was previously tested and rolled out in London.

It is the latest move by Amazon to create its own freight and

parcel delivery network. In the last couple of years, Amazon has

expanded into ocean freight, built a network of its own drivers who

can now deliver inside homes and leased up to 40 aircraft while

establishing an air cargo hub.

Amazon already delivers some of its own orders in at least 37

U.S. cities. With the new "Shipping with Amazon" option, Amazon

plans to send its drivers to pick up shipments from warehouses and

businesses itself and deliver the packages when it is able, the

people said. For shipments outside Amazon's delivery reach, the

U.S. Postal Service and other carriers will take care of the

so-called last mile to customers' doorsteps.

"We're always innovating and experimenting on behalf of

customers and the businesses that sell and grow on Amazon to create

faster lower-cost delivery choices," a spokeswoman said in a

statement.

It remains to be seen whether Amazon can successfully deliver

packages for other businesses on a broad scale. UPS and FedEx have

built out massive networks over the course of decades to allow them

to deliver across the U.S. And it is expensive. UPS this year alone

is planning to spend up to $7 billion on upgrading its delivery

network.

Analysts expressed skepticism on Friday about Amazon's ability

to get a transportation network up and running. The company doesn't

have the capacity or equipment yet to handle extra shipments at a

massive scale, and it is unclear whether Amazon is willing to

invest enough to do so, the analysts wrote.

"The trigger we've consistently looked for from the company as a

warning signal has been asset commitment," wrote Citi analyst

Christian Wetherbee in a research note. "To date, the company

hasn't made a meaningful push into the true transportation asset

ownership we believe is necessary to be a competitor."

UPS shares fell 2.6% in Friday trading to $106.39, as the

broader market rose. FedEx shares dipped 1.7% to $235.32.

A spokesman said that UPS continues to support Amazon and other

customers and doesn't comment on customers' business strategies or

decisions regarding using UPS services.

FedEx in a statement Friday pointed to a video on its website

that outlines the size, scope and expertise of its global delivery

network, including its more than 40 years of experience, roughly

650 aircraft, 150,000 trucks, 400,000 employees and 4,800 operating

facilities globally to handle about 12 million shipments a day.

On a FedEx earnings call in December, executives were asked

about what would happen if Amazon started competing for its

shipping business; their reply was that they don't comment on

hypothetical situations. They added that Amazon was a longstanding

customer, but that no one customer represented more than 3% of its

revenue or volume.

Amazon's push into logistics reflects its growing ambitions

across a wide range of businesses beyond online retail. The company

runs a dominant cloud-computing services division, a Hollywood

studio and a massive marketplace and logistics operation for

sellers. Last year, it acquired Whole Foods for roughly $13.5

billion, transforming itself into a brick-and-mortar grocer

overnight.

Last week, Amazon said it was teaming up with JPMorgan Chase

& Co. and Berkshire Hathaway Inc. to form a new company to try

to lower their employees' health costs, an announcement that

rattled health-care firm stocks.

Amazon started building out its logistics network in earnest

after it missed deliveries during the gift-giving season in

December 2013, according to people familiar with Amazon's thinking.

As more shoppers bought products online, Amazon executives

concluded that parcel volume was growing too rapidly for existing

carriers to handle. Amazon also wanted to offer two-day deliveries,

seven days a week.

The company separately has launched a logistics service called

"FBA Onsite," according to the people familiar with the matter.

Currently, most third-party sellers on Amazon's website ship their

goods to an Amazon warehouse for its "Fulfillment by Amazon"

program to qualify for Prime shipping. With FBA Onsite, sellers

automatically qualify for Prime and then can ship directly from

their own warehouse using software provided by Amazon.

While Amazon will decide the method of those shipments, pickups

and deliveries for now still will be handled by various carriers,

including UPS and FedEx, the people said. Bloomberg News earlier

reported on FBA Onsite.

For its "Shipping with Amazon" option, the online retail giant

is expected to be able to offer lower prices than UPS and FedEx

because it already delivers some of its own packages -- any extra

space it can fill in its trucks with additional deliveries is

considered added revenue, according to people familiar with the

company's thinking.

Write to Laura Stevens at laura.stevens@wsj.com

(END) Dow Jones Newswires

February 09, 2018 17:37 ET (22:37 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

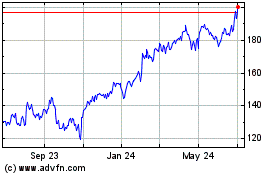

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

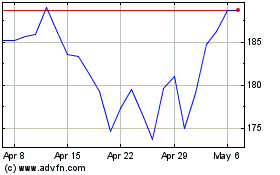

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024