By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

New safety technology is bringing fresh headaches to Union

Pacific Corp. and its shipping customers. Railroad Chief Executive

Lance Fritz says the troublesome implementation of braking

technology known as positive train control is causing congestion in

its networks, the WSJ's Paul Ziobro reports, triggering slowdowns

and terminal delays at key points in the UP system. The problems at

the largest American railroad mark a new concern for U.S. shippers,

with freight networks increasingly jammed in a resurgent economy

marked by strong shipping demand. Many shippers have turned to rail

service with trucking capacity tight and over-the-road rates

soaring, and that's helped boost intermodal railroad traffic at a

typically weak seasonal period. UP competes for that business, and

for commodities like lumber and refrigerated transports. But the

company's 5% gain in fourth-quarter revenue was relatively slim,

and delays in spots including Chicago, Kansas City and Houston make

it harder to lure away frustrated truck shippers.

One piece of the White House infrastructure plan coming into

clearer focus is that the Trump administration wants projects to

move faster. The administration plans to roll back regulations to

reduce the period between project approval and construction, the

WSJ's Ted Mann reports, limiting environmental reviews and

litigation in favor of getting big things built. That would be

welcome news to bridge builders, port planners and others focused

on transportation spending. Yet it could make passing an

infrastructure package more difficult, with Democrats and

environmental groups likely to raise alarms that the

fast-permitting plan is focused less on efficiency than on

sidestepping basic air and water quality reviews. The White House

expects to have allies, however, among mayors and governors who are

eager to see local projects move ahead quickly but then see them

hobbled by a gauntlet of federal agency reviews.

The biggest tax overhaul in three decades is already starting to

ripple across U.S. supply chains just weeks after it was adopted.

Companies are dusting off once-shelved plans, re-evaluating

existing projects and exploring new investment in factories and

equipment, the WSJ's Theo Francis, Peter Loftus and Heather Haddon

report, signaling a growing impact the tax law is likely to have on

production and distribution. Specialty drugmaker Amicus

Therapeutics Inc. will spend as much as $200 million on a new

production facility in the Eastern U.S. rather than look at

European sites to supply an experimental drug. Grocery distributor

United Natural Foods Inc., a supplier to Whole Foods, says the

return on investment improved by four percentage points on a

planned warehousing project, largely because of the new lower tax

rate. Economist Joseph LaVorgna says the law may trigger a kind of

virtuous cycle, with spending by some companies feeding still more

revenue to other firms.

ECONOMY & TRADE

Growing world-wide demand has U.S. industrial manufacturing

engines humming. Caterpillar Inc. and 3M Co. are both reporting

stronger revenue and profit growth, and the WSJ's Andrew Tangel and

Bob Tita write that expanding trade in goods from construction

equipment to industrial electronics has the companies heading into

2018 with brighter outlooks. Caterpillar's expansion is especially

significant for industrial markets: the 18% revenue growth last

year breaks a four-year streak of declining sales, and the 35%

surge in fourth-quarter revenue may drive the construction and

mining industry bellwether to boost investment after restoring

4,800 jobs in the U.S. last year. 3M is investing in supplying

electronics and energy business, including makers of

semiconductors, automotive electrification and energy grids. Its

revenue in that industrial arena rose 12.5% last quarter, largely

driven by overseas demand. The sales figures suggest more

production is coming from those companies, and likely even more

from their customers.

QUOTABLE

IN OTHER NEWS

The Conference Board's Leading Economic Index rose 0.6% in

December, slightly more than in November. (WSJ)

The U.K. economy grew 0.5% in 2017, the slowest pace in five

years. (WSJ)

Natural gas prices are at the highest level in more than a year.

(WSJ)

Japan's exports jumped 11.8% last year but imports grew even

faster at 14%. (WSJ)

Canada hopes to break a logjam in North American Free Trade

Agreement talks with a proposal for more regional content in

automobiles. (WSJ)

Congo is moving to double taxes on cobalt, a key metal in high

demand for use in smartphones and electric vehicles. (WSJ)

Big global mergers-and-acquisitions are coming at a blistering

pace to start 2018. (WSJ)

United Continental Holdings Inc. fourth-quarter cargo revenue

soared 21.6% on a 15.2% gain in traffic. (WSJ)

President Trump says he would rejoin the Trans-Pacific

Partnership if "we made a much better deal than we had." (Nikkei

Asian Review)

CSX Corp. is considering selling up to 8,000 miles of its

21,000-mile freight rail network. (Albany Times-Union)

Nine West Holdings Inc. is near entering bankruptcy as part of a

deal to restructure debt and sell off parts of the clothing

retailer. (Bloomberg)

U.S. soybean growers are losing market share in China to

Brazilian exporters as their push for higher yields has dimmed

protein levels in American crops. (Reuters)

Dicks Sporting Goods opened the first phase of a Binghamton,

N.Y., distribution center expected to grow to 923,000 square feet.

(Press Connects)

Norfolk Southern Corp.'s revenue rose 7% in the fourth quarter

on 5% more freight volume. (Roanoke Times)

Euronav will consider more acquisitions in the troubled tanker

market once its purchase of Gener8 Maritime closes. (Lloyd's

List)

The Transpacific Stabilization Agreement container shipping

price discussion group shut down. (Seatrade Maritime)

Bangladeshi lawmakers enacted tougher penalties aimed at

cleaning up the country's notorious ship recycling sector. (Splash

24/7)

Container imports at California's Port of Long Beach soared

27.3% year-over-year in December and advanced sharply from

November. (American Shipper)

Las Vegas Railway Express Inc. acquired United Rail in its

growing effort to buy freight and passenger short lines.

(Progressive Railroading)

Fourth-quarter net profit at trucker Marten Transport Ltd. rose

3.7% to $8.6 million excluding special tax gains on a 5.9% gain in

revenue. (Heavy Duty Trucking)

A poll shows 94% of U.S. workers doubt they will lose jobs to

automation despite rapid growth in robotics in warehouses.

(NPR)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

January 26, 2018 06:46 ET (11:46 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

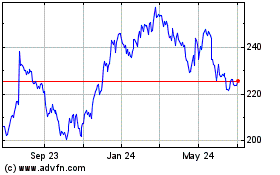

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

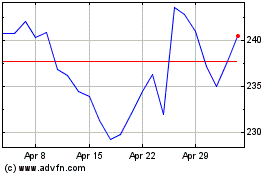

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Apr 2023 to Apr 2024