CVS, Walgreens Say Drug Prices Are Easing After Years of Ballooning -- Update

January 04 2018 - 2:53PM

Dow Jones News

By Sharon Terlep

After years of surging U.S. drug prices, the two largest

drugstore companies said some pricey prescription medicines are

becoming more affordable.

CVS Health Corp. and Walgreens Boots Alliance Inc. said Thursday

that their pharmacy revenues are taking a hit from an increase in

generic alternatives, particularly for some expensive specialty

drugs, along with slowing price inflation for name-brand

medications.

"You're going to see continued dampening going forward as you

think about the pipeline of generics coming into the markets," said

CVS finance chief Dave Denton, who didn't discuss specific

products.

Lower prices will dent the company's revenue, but ultimately

could lead to increased profits because generics generally have a

higher margin than name-brand drugs. "The introduction of generics

can really dampen the top line but affect the bottom line in a

positive way," Mr. Denton said.

Prices for generic medicines fell sharply last year as

wholesalers competed for business by discounting them. Meanwhile,

some pharmaceutical firms raised branded prices at a slower rate

than previous years to avoid sparking further scrutiny from

lawmakers in Washington.

Some of the most eye-popping prices are for cancer treatments

and genetics-based therapies that aren't sold through

drugstores.

Just this week, Spark Therapeutics Inc. said it would charge

$850,000 per patient for a pioneering new treatment for a

hereditary form of vision loss.

CVS, which also owns Caremark, a large pharmacy benefit manager,

forecast low single-digit revenue growth in 2018 and

operating-profit growth of 1% to 4%. The figures don't factor in

CVS's planned acquisition of health insurer Aetna Inc. The company

aims to close the $69 billion deal in the second half of this

year.

CVS said it expects claims volume in its pharmacy-services

segment to grow by 8% in 2018, with revenue rising a slimmer 1.5%

to 3.5% due largely to cheaper drugs. Walgreens, meantime, said

U.S. pharmacy sales rose nearly 9% by volume in the most recent

quarter, while revenue increased 7.4%.

Alex Gourlay, Walgreens co-chief operating officer, in a call

with analysts, said the company has been seeing drug-price

deflation due to in introduction of generics.

Walgreens, which also has operations in Europe, said the

increase in prescription volumes helped lift U.S. pharmacy sales in

its latest quarter. Comparable retail sales, which includes general

merchandise and personal-care items, fell 0.9%.

Regulators recently approved Walgreens's $4.38 billion deal with

Rite Aid Corp. to buy 1,932 of Rite Aid's stores, but the deal was

smaller than originally anticipated because of regulatory concerns.

The company had initially offered $9.4 billion to buy Rite Aid,

which would have expanded its store count by 4,600 stores.

Walgreens shares initially jumped Thursday on its latest results

but then fell after Rite Aid reported quarterly results that

included a decline in store sales and a decrease in the number of

prescription sales. Walgreens shares were down nearly 5% to $71.82

in afternoon trading, while CVS rose 3% to $75.43.

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

January 04, 2018 14:38 ET (19:38 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

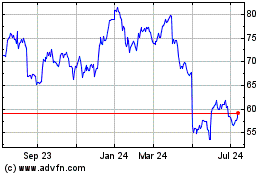

CVS Health (NYSE:CVS)

Historical Stock Chart

From Aug 2024 to Sep 2024

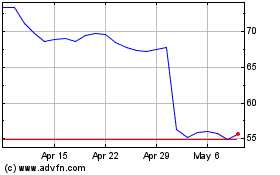

CVS Health (NYSE:CVS)

Historical Stock Chart

From Sep 2023 to Sep 2024