Worthington Industries, Inc. (NYSE:WOR) today reported net sales of

$871.3 million and net earnings of $39.4 million, or $0.62 per

diluted share, for its fiscal 2018 second quarter ended November

30, 2017. Net earnings in the quarter included pre-tax

impairment charges of $8.3 million and a net pre-tax restructuring

gain of $9.7 million, which combined to increase earnings per

diluted share by $0.01. Results for the current quarter also

included a charge of $3.6 million within equity income to reflect a

new cost-sharing agreement at the Worthington Armstrong Venture

(WAVE) joint venture, which required an adjustment for the period

covering January 1, 2017 to August 31, 2017. The after-tax

impact of this item reduced earnings per diluted share by $0.04 in

the quarter. In the second quarter of fiscal 2017, the

Company reported net sales of $727.8 million and net earnings of

$46.6 million, or $0.72 per diluted share. Net earnings in

the second quarter of fiscal 2017 included pre-tax restructuring

charges totaling $3.3 million, which reduced earnings per diluted

share by $0.03.

Financial highlights for the current and comparative periods are

as follows:

| (U.S. dollars in millions, except per share amounts) |

|

|

| |

2Q 2018 |

|

1Q 2018 |

|

2Q 2017 |

|

6M 2018 |

|

6M 2017 |

| Net sales |

$ |

871.3 |

|

$ |

848.2 |

|

$ |

727.8 |

|

$ |

1,719.5 |

|

$ |

1,465.3 |

| Operating income |

|

52.1 |

|

|

42.2 |

|

|

43.0 |

|

|

94.3 |

|

|

107.9 |

| Equity income |

|

16.4 |

|

|

27.3 |

|

|

27.1 |

|

|

43.8 |

|

|

61.7 |

| Net earnings |

|

39.4 |

|

|

45.5 |

|

|

46.6 |

|

|

84.9 |

|

|

112.1 |

| Earnings per diluted

share |

$ |

0.62 |

|

$ |

0.70 |

|

$ |

0.72 |

|

$ |

1.33 |

|

$ |

1.74 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

“We had the second best, second quarter results in our history,”

said John McConnell, Chairman and CEO of Worthington

Industries. “We saw improvement in our Pressure Cylinders

segment, with especially strong results in consumer product volumes

driven by our 14 and 16 oz. camping cylinders and solid earnings

from our Amtrol acquisition. Lower toll volumes in Steel

Processing and lower equity income from our joint ventures led to a

decline from the year ago quarter. We also had a charge at

WAVE for parent company allocations.” McConnell added, “All

in all, most of the markets we serve were steady.”

Consolidated Quarterly Results

Net sales for the second quarter of fiscal 2018

were $871.3 million, up 20% over the comparable quarter in the

prior year, when net sales were $727.8 million. The increase was

driven by contributions from the June 2, 2017 acquisition of

Amtrol, higher overall volumes in Pressure Cylinders, and higher

average direct selling prices in Steel

Processing.

Gross margin increased $17.3 million over the prior year quarter to

$140.1 million on contributions from the Amtrol acquisition and

higher overall volumes in Pressure Cylinders, partially offset by

lower direct spreads in Steel Processing.

Operating income for the current quarter was

$52.1 million, an increase of $9.0 million over the prior year

quarter. The increase was driven by higher gross margin and

lower combined impairment and restructuring charges, partially

offset by higher SG&A expense, up $12.9 million, due primarily

to the Amtrol acquisition.

Interest expense was $10.0 million for the

current quarter, compared to $7.7 million in the prior year

quarter. The increase was due primarily to the July 2017

issuance of $200.0 million of 4.3% senior unsecured notes due

August 1, 2032.

Equity income from unconsolidated joint ventures

decreased $10.7 million from the prior year quarter to $16.4

million on lower contributions from WAVE, ClarkDietrich and

ArtiFlex. WAVE’s contribution to equity income was $5.0

million lower than the prior year quarter due primarily to an

increase in allocated costs resulting from a new cost-sharing

agreement between the joint venture and its partners, which

required an adjustment of $3.6 million to equity income for the

period covering January 1, 2017 to August 31, 2017. The

Company’s portion of allocated costs for the period covering the

current quarter were approximately $1.3 million, but this run rate

is expected to decline 40 to 50% once the sale of the international

business closes in 2018. The majority of the increase in

allocated costs were from the joint venture partner and therefore

are not offset elsewhere in the Company’s results.

ClarkDietrich’s contribution to equity income was $3.9 million

lower than the prior year quarter as higher steel prices compressed

margins. ArtiFlex’s equity income was $1.3 million below the prior

year quarter, primarily due to a decline in its offload business.

The Company received cash distributions of $19.4 million from

unconsolidated joint ventures during the quarter for a total of

$38.9 million year-to-date for fiscal 2018, a cash conversion rate

of 89% on equity income.

Income tax expense was $18.2 million in the

current quarter compared to $13.5 million in the prior year

quarter. The increase was due primarily to favorable discrete

tax adjustments booked in the prior year quarter. Tax expense in

the current quarter reflects an estimated annual effective rate of

30.0% compared to 28.5% for the prior year quarter.

Balance Sheet

At quarter-end, total debt was $780.7 million,

up $0.1 million from August 31, 2017. The Company had $122.2

million of cash at quarter-end.

Quarterly Segment Results

Steel Processing’s net sales totaled $538.4

million, up 6%, or $29.6 million, over the comparable prior year

quarter driven by higher average direct selling prices, partially

offset by lower tolling volume due primarily to declines at certain

consolidated joint ventures. Operating income of $41.1

million was $5.7 million higher than the prior year quarter driven

by a net gain of $10.6 million related to the sale of the legacy

real estate of the Company’s former stainless steel business, PSM,

partially offset by lower direct spreads and lower tolling

volume. Inventory holding gains were negligible in both the

current and prior year quarters. The mix of direct versus

toll tons processed was 57% to 43% in the current quarter, compared

to 49% to 51% in the prior year quarter.

Pressure Cylinders’ net sales totaled $300.9

million, up 55%, or $106.2 million, over the comparable prior year

quarter due to contributions from the Amtrol acquisition and higher

volumes across the legacy consumer and industrial products

businesses and in the oil & gas equipment business.

Operating income of $24.7 million was $13.4 million higher than the

prior year quarter driven by improvements in the legacy consumer

and industrial products businesses and contributions from the

Amtrol acquisition. Improvements in the oil & gas

equipment business were largely offset by a decline in the

alternative fuels business.

Engineered Cabs’ net sales totaled $30.4

million, up $7.9 million, or 35%, over the prior year quarter on

higher volume. The operating loss of $1.6 million was $1.8

million less than the prior year quarter due to the favorable

impact of higher volume.

The “Other” category includes the energy

innovations business, as well as non-allocated corporate

expenses. Net sales in the “Other” category were $1.6

million, a decrease of $0.2 million from the prior year quarter on

lower volume in the energy innovations business. The

operating loss of $12.2 million for the quarter was driven by an

impairment charge of $7.3 million in the energy innovations

business related to its goodwill and intangible assets, and an

increase in non-allocated corporate expenses.

Recent Business

Developments

- On June 2, 2017, the Company acquired Amtrol, a leading

manufacturer of pressure cylinders and water system tanks with

operations in the U.S. and Europe. The total purchase price

was $291.9 million after adjusting for final working capital.

The acquisition was funded primarily with cash on hand. The

net assets became part of the Company’s Pressure Cylinders

operating segment at closing, with the well water and expansion

tank operations aligning under the consumer product business and

the refrigerant, liquid propane, and industrial and specialty gas

operations aligning under the industrial products business.

- On July 28, 2017, the Company completed a public offering of

$200.0 million aggregate principal amount of senior unsecured

notes. The notes bear interest at a rate of 4.3% and mature

on August 1, 2032.

- On November 20, 2017, the Company announced that its WAVE joint

venture, had agreed to sell its business and operations in Europe,

the Middle East, Africa and Asia, to Knauf Group, a family-owned

manufacturer of building materials headquartered in Germany.

Worthington expects to realize proceeds of approximately $45

million for its 50% share of the WAVE operations being sold.

The transaction is subject to regulatory approvals and other

customary closing conditions and is anticipated to close in the

middle of calendar 2018.

- During the second fiscal quarter, the Company repurchased a

total of 1,500,000 common shares for $67.4 million at an

average price of $44.97.

Outlook

“The Company is performing well with strong

volumes from the heavy truck and agriculture markets, and

improvements in Pressure Cylinders, where we are seeing strong

consumer product volumes and increasing demand in the oil and gas

business,” McConnell said. “The repositioning of Engineered

Cabs to attract new customers is resulting in increasing sales and

we anticipate WAVE to continue to deliver excellent results as it

focuses on its North America growth strategy with the pending sale

of the international business.”

Conference Call

Worthington will review fiscal 2018 second

quarter results during its quarterly conference call on December

19, 2017 at 2:30 p.m., Eastern Time. Details regarding the

conference call can be found on the Company website at

www.WorthingtonIndustries.com.

About Worthington

Industries

Worthington Industries is a leading global

diversified metals manufacturing company with 2017 fiscal year

sales of $3.0 billion. Headquartered in Columbus, Ohio,

Worthington is North America’s premier value-added steel processor

providing customers with wide ranging capabilities, products and

services for a variety of markets including automotive,

construction and agriculture; a global leader in manufacturing

pressure cylinders for propane, refrigerant and industrial gases

and for cryogenic applications, water well tanks for commercial and

residential uses, CNG and LNG storage, transportation and

alternative fuel tanks, oil & gas equipment, and consumer

products for camping, grilling, hand torch solutions and helium

balloon kits; and a manufacturer of operator cabs for heavy mobile

industrial equipment; laser welded blanks for light weighting

applications; automotive racking solutions; and through

unconsolidated joint ventures, complete ceiling grid solutions;

automotive tooling and stampings; and steel framing for commercial

construction. Worthington employs approximately 11,000

people and operates 85 facilities in 11 countries.

Founded in 1955, the Company operates under a

long-standing corporate philosophy rooted in the golden rule.

Earning money for its shareholders is the first corporate goal.

This philosophy serves as the basis for an unwavering commitment to

the customer, supplier, and shareholder, and as the Company’s

foundation for one of the strongest employee-employer partnerships

in American industry.

Safe Harbor Statement

The Company wishes to take advantage of the Safe

Harbor provisions included in the Private Securities Litigation

Reform Act of 1995 (the “Act”). Statements by the Company relating

to outlook, strategy or business plans; future or expected growth,

growth potential, forward momentum, performance, competitive

position, sales, volumes, cash flows, earnings, balance sheet

strengths, debt, financial condition or other financial measures;

pricing trends for raw materials and finished goods and the impact

of pricing changes; demand trends for the Company or its markets;

additions to product lines and opportunities to participate in new

markets; expected benefits from Transformation and innovation

efforts and the ability to improve performance and competitive

position at our operations; anticipated working capital needs,

capital expenditures and asset sales; anticipated improvements and

efficiencies in costs, operations, sales, inventory management,

sourcing and the supply chain and the results thereof; projected

profitability potential; the ability to successfully integrate

AMTROL and the expected benefits, costs and results from the

acquisition of AMTROL; the ability to make acquisitions and the

projected timing, results, benefits, costs, charges and

expenditures related to acquisitions, newly-created joint ventures,

headcount reductions and facility dispositions, shutdowns and

consolidations; the anticipated impact of the pending sale of WAVE

international; projected capacity and the alignment of operations

with demand; the ability to operate profitably and generate cash in

down markets; the ability to maintain margins and capture and

maintain market share and to develop or take advantage of future

opportunities, customer initiatives, new businesses, new products

and new markets; expectations for Company and customer inventories,

jobs and orders; expectations for the economy and markets or

improvements therein; expectations for generating improving and

sustainable earnings, earnings potential, margins or shareholder

value; effects of judicial rulings; and other non-historical

matters constitute “forward-looking statements” within the meaning

of the Act. Because they are based on beliefs, estimates and

assumptions, forward-looking statements are inherently subject to

risks and uncertainties that could cause actual results to differ

materially from those projected. Any number of factors could affect

actual results, including, without limitation, the effect of

national, regional and global economic conditions generally and

within major product markets, including a recurrent slowing

economy; the effect of conditions in national and worldwide

financial markets; lower oil prices as a factor in demand for

products; product demand and pricing; changes in product mix,

product substitution and market acceptance of our products;

fluctuations in the pricing, quality or availability of raw

materials (particularly steel), supplies, transportation, utilities

and other items required by operations; effects of facility

closures and the consolidation of operations; the effect of

financial difficulties, consolidation and other changes within the

steel, automotive, construction, oil and gas, and other industries

in which we participate; failure to maintain appropriate levels of

inventories; financial difficulties (including bankruptcy filings)

of original equipment manufacturers, end-users and customers,

suppliers, joint venture partners and others with whom we do

business; the ability to realize targeted expense reductions from

headcount reductions, facility closures and other cost reduction

efforts; the ability to realize cost savings and operational, sales

and sourcing improvements and efficiencies, and other expected

benefits from Transformation initiatives, on a timely basis; the

overall success of, and the ability to integrate, newly-acquired

businesses and joint ventures, maintain and develop their

customers, and achieve synergies and other expected benefits and

cost savings therefrom; the successful completion of the single,

integrated sale of the Armstrong World Industries international

business and WAVE international; capacity levels and efficiencies,

within facilities, within major product markets and within the

industries as a whole; the effect of disruption in the business of

suppliers, customers, facilities and shipping operations due to

adverse weather, casualty events, equipment breakdowns, civil

unrest, international conflicts, terrorist activities or other

causes; changes in customer demand, inventories, spending patterns,

product choices, and supplier choices; risks associated with doing

business internationally, including economic, political and social

instability, foreign currency exchange rate exposure and the

acceptance of our products in global markets; the ability to

improve and maintain processes and business practices to keep pace

with the economic, competitive and technological environment; the

outcome of adverse claims experience with respect to workers’

compensation, product recalls or product liability, casualty events

or other matters; deviation of actual results from estimates and/or

assumptions used by us in the application of our significant

accounting policies; level of imports and import prices in our

markets; the impact of judicial rulings and governmental

regulations, both in the United States and abroad, including those

adopted by the United States Securities and Exchange Commission and

other governmental agencies as contemplated by the Dodd-Frank Wall

Street Reform and Consumer Protection Act of 2010; the effect of

healthcare laws in the United States and potential changes for such

laws which may increase our healthcare and other costs and

negatively impact our operations and financial results; the impact

of U.S. tax reform legislation; cyber security risks; and

other risks described from time to time in the Company’s filings

with the United States Securities and Exchange Commission,

including those described in “Part I – Item 1A. – Risk Factors” of

our Annual Report on Form 10-K for the fiscal year ended May 31,

2017.

| WORTHINGTON INDUSTRIES, INC. |

| CONSOLIDATED STATEMENTS OF

EARNINGS |

| (In thousands, except per share

amounts) |

|

|

| |

Three Months Ended November

30, |

|

Six Months Ended November

30, |

| |

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| Net sales |

$ |

871,266 |

|

|

$ |

727,780 |

|

|

$ |

1,719,503 |

|

|

$ |

1,465,329 |

|

| Cost of goods sold |

|

731,187 |

|

|

|

604,977 |

|

|

|

1,446,646 |

|

|

|

1,195,244 |

|

| Gross

margin |

|

140,079 |

|

|

|

122,803 |

|

|

|

272,857 |

|

|

|

270,085 |

|

| Selling, general and

administrative expense |

|

89,425 |

|

|

|

76,487 |

|

|

|

177,674 |

|

|

|

157,543 |

|

| Impairment of goodwill

and long-lived assets |

|

8,289 |

|

|

|

- |

|

|

|

8,289 |

|

|

|

- |

|

| Restructuring and other

expense (income), net |

|

(9,694 |

) |

|

|

3,272 |

|

|

|

(7,390 |

) |

|

|

4,600 |

|

| Operating

income |

|

52,059 |

|

|

|

43,044 |

|

|

|

94,284 |

|

|

|

107,942 |

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

Miscellaneous income, net |

|

1,321 |

|

|

|

872 |

|

|

|

1,669 |

|

|

|

1,735 |

|

| Interest

expense |

|

(10,038 |

) |

|

|

(7,658 |

) |

|

|

(18,845 |

) |

|

|

(15,528 |

) |

| Equity in

net income of unconsolidated affiliates |

|

16,445 |

|

|

|

27,124 |

|

|

|

43,751 |

|

|

|

61,668 |

|

| Earnings

before income taxes |

|

59,787 |

|

|

|

63,382 |

|

|

|

120,859 |

|

|

|

155,817 |

|

| Income tax expense |

|

18,165 |

|

|

|

13,515 |

|

|

|

31,163 |

|

|

|

37,414 |

|

| Net earnings |

|

41,622 |

|

|

|

49,867 |

|

|

|

89,696 |

|

|

|

118,403 |

|

| Net earnings

attributable to noncontrolling interests |

|

2,219 |

|

|

|

3,302 |

|

|

|

4,759 |

|

|

|

6,271 |

|

| Net earnings

attributable to controlling interest |

$ |

39,403 |

|

|

$ |

46,565 |

|

|

$ |

84,937 |

|

|

$ |

112,132 |

|

| |

|

|

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

|

| Average common shares

outstanding |

|

61,503 |

|

|

|

62,348 |

|

|

|

61,976 |

|

|

|

62,115 |

|

| Earnings per

share attributable to controlling interest |

$ |

0.64 |

|

|

$ |

0.75 |

|

|

$ |

1.37 |

|

|

$ |

1.81 |

|

| |

|

|

|

|

|

|

|

|

Diluted |

|

|

|

|

|

|

|

| Average common shares

outstanding |

|

63,468 |

|

|

|

64,725 |

|

|

|

64,044 |

|

|

|

64,599 |

|

| Earnings per

share attributable to controlling interest |

$ |

0.62 |

|

|

$ |

0.72 |

|

|

$ |

1.33 |

|

|

$ |

1.74 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Common shares

outstanding at end of period |

|

60,755 |

|

|

|

62,562 |

|

|

|

60,755 |

|

|

|

62,562 |

|

| |

|

|

|

|

|

|

|

| Cash dividends declared

per share |

$ |

0.21 |

|

|

$ |

0.20 |

|

|

$ |

0.42 |

|

|

$ |

0.40 |

|

| WORTHINGTON INDUSTRIES, INC. |

| CONSOLIDATED BALANCE SHEETS |

| (In thousands) |

| |

| |

November 30, |

|

May 31, |

| |

2017 |

|

2017 |

|

Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and

cash equivalents |

$ |

122,214 |

|

$ |

278,081 |

|

Receivables, less allowances of $3,127 and $3,444 at November 30,

2017 |

|

|

|

| and May

31, 2017, respectively |

|

507,704 |

|

|

486,730 |

|

Inventories: |

|

|

|

| Raw

materials |

|

228,568 |

|

|

185,001 |

| Work in

process |

|

108,260 |

|

|

95,630 |

| Finished

products |

|

79,180 |

|

|

73,303 |

| Total

inventories |

|

416,008 |

|

|

353,934 |

| Income

taxes receivable |

|

10,858 |

|

|

7,164 |

| Assets

held for sale |

|

3,740 |

|

|

9,654 |

| Prepaid

expenses and other current assets |

|

51,204 |

|

|

55,406 |

| Total

current assets |

|

1,111,728 |

|

|

1,190,969 |

| Investments in

unconsolidated affiliates |

|

213,814 |

|

|

208,591 |

| Goodwill |

|

350,117 |

|

|

247,673 |

| Other intangible

assets, net of accumulated amortization of $71,580 and |

|

|

|

| $63,134

at November 30, 2017 and May 31, 2017, respectively |

|

239,934 |

|

|

82,781 |

| Other assets |

|

28,369 |

|

|

24,841 |

| Property, plant and

equipment: |

|

|

|

| Land |

|

27,381 |

|

|

22,077 |

| Buildings

and improvements |

|

311,685 |

|

|

297,951 |

| Machinery

and equipment |

|

1,035,787 |

|

|

961,542 |

|

Construction in progress |

|

34,015 |

|

|

27,616 |

| Total

property, plant and equipment |

|

1,408,868 |

|

|

1,309,186 |

| Less:

accumulated depreciation |

|

781,117 |

|

|

738,697 |

| Total

property, plant and equipment, net |

|

627,751 |

|

|

570,489 |

| Total

assets |

$ |

2,571,713 |

|

$ |

2,325,344 |

| |

|

|

|

| Liabilities and

equity |

|

|

|

| Current

liabilities: |

|

|

|

| Accounts

payable |

$ |

363,032 |

|

$ |

368,071 |

|

Short-term borrowings |

|

723 |

|

|

123 |

| Accrued

compensation, contributions to employee benefit plans and |

|

|

|

| related

taxes |

|

74,404 |

|

|

86,201 |

| Dividends

payable |

|

13,815 |

|

|

13,698 |

| Other

accrued items |

|

59,255 |

|

|

41,551 |

| Income

taxes payable |

|

2,027 |

|

|

4,448 |

| Current

maturities of long-term debt |

|

13,193 |

|

|

6,691 |

| Total

current liabilities |

|

526,449 |

|

|

520,783 |

| Other liabilities |

|

68,672 |

|

|

61,498 |

| Distributions in excess

of investment in unconsolidated affiliate |

|

61,085 |

|

|

63,038 |

| Long-term debt |

|

766,737 |

|

|

571,796 |

| Deferred income taxes,

net |

|

105,987 |

|

|

34,300 |

| Total

liabilities |

|

1,528,930 |

|

|

1,251,415 |

| Shareholders' equity -

controlling interest |

|

919,287 |

|

|

951,635 |

| Noncontrolling

interests |

|

123,496 |

|

|

122,294 |

| Total

equity |

|

1,042,783 |

|

|

1,073,929 |

| Total

liabilities and equity |

$ |

2,571,713 |

|

$ |

2,325,344 |

| WORTHINGTON INDUSTRIES, INC. |

| CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| (In thousands) |

|

|

| |

Three Months Ended November

30, |

|

Six Months Ended November

30, |

| |

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| Operating

activities: |

|

|

|

|

|

|

|

| Net earnings |

$ |

41,622 |

|

|

$ |

49,867 |

|

|

$ |

89,696 |

|

|

$ |

118,403 |

|

| Adjustments to

reconcile net earnings to net cash provided by operating

activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

26,283 |

|

|

|

21,645 |

|

|

|

51,648 |

|

|

|

43,476 |

|

|

Impairment of goodwill and long-lived assets |

|

8,289 |

|

|

|

- |

|

|

|

8,289 |

|

|

|

- |

|

| Provision

for (benefit from) deferred income taxes |

|

(583 |

) |

|

|

2,316 |

|

|

|

7,351 |

|

|

|

2,336 |

|

| Bad debt

(income) expense |

|

41 |

|

|

|

232 |

|

|

|

(21 |

) |

|

|

151 |

|

| Equity in

net income of unconsolidated affiliates, net of distributions |

|

2,952 |

|

|

|

(2,824 |

) |

|

|

(4,803 |

) |

|

|

1,074 |

|

| Net

(gain) loss on assets |

|

(10,680 |

) |

|

|

(2,912 |

) |

|

|

(9,255 |

) |

|

|

1,484 |

|

|

Stock-based compensation |

|

3,787 |

|

|

|

3,824 |

|

|

|

7,194 |

|

|

|

6,960 |

|

| Changes in assets and

liabilities, net of impact of acquisitions: |

|

|

|

|

|

|

|

|

Receivables |

|

(46,097 |

) |

|

|

(7,156 |

) |

|

|

16,581 |

|

|

|

9,798 |

|

|

Inventories |

|

9,871 |

|

|

|

31,875 |

|

|

|

(24,825 |

) |

|

|

(18,523 |

) |

| Prepaid

expenses and other current assets |

|

3,622 |

|

|

|

(1,737 |

) |

|

|

4,765 |

|

|

|

5,425 |

|

| Other

assets |

|

(626 |

) |

|

|

1,165 |

|

|

|

(976 |

) |

|

|

2,411 |

|

| Accounts

payable and accrued expenses |

|

(21,577 |

) |

|

|

(65,946 |

) |

|

|

(48,368 |

) |

|

|

(22,885 |

) |

| Other

liabilities |

|

2,478 |

|

|

|

950 |

|

|

|

5,461 |

|

|

|

2,094 |

|

| Net cash

provided by operating activities |

|

19,382 |

|

|

|

31,299 |

|

|

|

102,737 |

|

|

|

152,204 |

|

| |

|

|

|

|

|

|

|

| Investing

activities: |

|

|

|

|

|

|

|

|

Investment in property, plant and equipment |

|

(23,678 |

) |

|

|

(14,730 |

) |

|

|

(41,691 |

) |

|

|

(31,046 |

) |

|

Acquisitions, net of cash acquired |

|

(523 |

) |

|

|

- |

|

|

|

(285,028 |

) |

|

|

- |

|

| Proceeds

from sale of assets |

|

16,312 |

|

|

|

799 |

|

|

|

16,739 |

|

|

|

956 |

|

| Net cash used

by investing activities |

|

(7,889 |

) |

|

|

(13,931 |

) |

|

|

(309,980 |

) |

|

|

(30,090 |

) |

| |

|

|

|

|

|

|

|

| Financing

activities: |

|

|

|

|

|

|

|

| Net

proceeds from (repayments of) short-term borrowings |

|

302 |

|

|

|

(1,037 |

) |

|

|

600 |

|

|

|

(2,154 |

) |

| Proceeds

from long-term debt, net of issuance costs |

|

(594 |

) |

|

|

- |

|

|

|

197,685 |

|

|

|

- |

|

| Principal

payments on long-term debt |

|

(220 |

) |

|

|

(218 |

) |

|

|

(439 |

) |

|

|

(437 |

) |

| Proceeds

from issuance of common shares, net of tax withholdings |

|

(722 |

) |

|

|

(2,849 |

) |

|

|

(3,996 |

) |

|

|

2,972 |

|

| Payments

to noncontrolling interests |

|

(3,196 |

) |

|

|

(6,781 |

) |

|

|

(3,916 |

) |

|

|

(6,781 |

) |

|

Repurchase of common shares |

|

(67,448 |

) |

|

|

- |

|

|

|

(112,524 |

) |

|

|

- |

|

| Dividends

paid |

|

(13,256 |

) |

|

|

(12,828 |

) |

|

|

(26,034 |

) |

|

|

(24,722 |

) |

| Net cash

provided (used) by financing activities |

|

(85,134 |

) |

|

|

(23,713 |

) |

|

|

51,376 |

|

|

|

(31,122 |

) |

| |

|

|

|

|

|

|

|

| Increase (decrease) in

cash and cash equivalents |

|

(73,641 |

) |

|

|

(6,345 |

) |

|

|

(155,867 |

) |

|

|

90,992 |

|

| Cash and cash

equivalents at beginning of period |

|

195,855 |

|

|

|

181,525 |

|

|

|

278,081 |

|

|

|

84,188 |

|

| Cash and cash

equivalents at end of period |

$ |

122,214 |

|

|

$ |

175,180 |

|

|

$ |

122,214 |

|

|

$ |

175,180 |

|

| WORTHINGTON INDUSTRIES, INC. |

| SUPPLEMENTAL DATA |

| (In thousands, except volume) |

|

|

| This

supplemental information is provided to assist in the analysis of

the results of operations. |

|

|

|

|

| |

Three Months Ended November

30, |

|

Six Months Ended November

30, |

| |

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| Volume: |

|

|

|

|

|

|

|

| Steel

Processing (tons) |

|

921,961 |

|

|

|

1,020,147 |

|

|

|

1,890,291 |

|

|

|

2,051,645 |

|

| Pressure

Cylinders (units) |

|

23,321,823 |

|

|

|

16,308,448 |

|

|

|

43,763,099 |

|

|

|

35,224,326 |

|

| |

|

|

|

|

|

|

|

| Net sales: |

|

|

|

|

|

|

|

| Steel

Processing |

$ |

538,390 |

|

|

$ |

508,806 |

|

|

$ |

1,081,881 |

|

|

$ |

1,014,480 |

|

| Pressure

Cylinders |

|

300,862 |

|

|

|

194,661 |

|

|

|

570,673 |

|

|

|

399,870 |

|

|

Engineered Cabs |

|

30,404 |

|

|

|

22,463 |

|

|

|

62,350 |

|

|

|

48,044 |

|

|

Other |

|

1,610 |

|

|

|

1,850 |

|

|

|

4,599 |

|

|

|

2,935 |

|

| Total net

sales |

$ |

871,266 |

|

|

$ |

727,780 |

|

|

$ |

1,719,503 |

|

|

$ |

1,465,329 |

|

| |

|

|

|

|

|

|

|

| Material cost: |

|

|

|

|

|

|

|

| Steel

Processing |

$ |

380,328 |

|

|

$ |

338,988 |

|

|

$ |

759,548 |

|

|

$ |

651,703 |

|

| Pressure

Cylinders |

|

129,981 |

|

|

|

76,302 |

|

|

|

250,612 |

|

|

|

159,230 |

|

|

Engineered Cabs |

|

14,934 |

|

|

|

10,173 |

|

|

|

29,151 |

|

|

|

21,420 |

|

| |

|

|

|

|

|

|

|

| Selling, general and

administrative expense: |

|

|

|

|

|

|

|

| Steel

Processing |

$ |

33,543 |

|

|

$ |

35,806 |

|

|

$ |

70,071 |

|

|

$ |

72,688 |

|

| Pressure

Cylinders |

|

46,312 |

|

|

|

35,530 |

|

|

|

91,780 |

|

|

|

72,520 |

|

|

Engineered Cabs |

|

4,233 |

|

|

|

3,669 |

|

|

|

8,502 |

|

|

|

7,620 |

|

|

Other |

|

5,337 |

|

|

|

1,482 |

|

|

|

7,321 |

|

|

|

4,715 |

|

| Total

selling, general and administrative expense |

$ |

89,425 |

|

|

$ |

76,487 |

|

|

$ |

177,674 |

|

|

$ |

157,543 |

|

| |

|

|

|

|

|

|

|

| Operating income

(loss): |

|

|

|

|

|

|

|

| Steel

Processing |

$ |

41,130 |

|

|

$ |

35,448 |

|

|

$ |

74,002 |

|

|

$ |

90,230 |

|

| Pressure

Cylinders |

|

24,675 |

|

|

|

11,304 |

|

|

|

35,133 |

|

|

|

25,409 |

|

|

Engineered Cabs |

|

(1,587 |

) |

|

|

(3,381 |

) |

|

|

(1,948 |

) |

|

|

(5,224 |

) |

|

Other |

|

(12,159 |

) |

|

|

(327 |

) |

|

|

(12,903 |

) |

|

|

(2,473 |

) |

| Total

operating income |

$ |

52,059 |

|

|

$ |

43,044 |

|

|

$ |

94,284 |

|

|

$ |

107,942 |

|

| |

|

|

|

|

|

|

|

| Equity income (loss) by

unconsolidated affiliate: |

|

|

|

|

|

|

|

| WAVE |

$ |

13,729 |

|

|

$ |

18,720 |

|

|

$ |

35,957 |

|

|

$ |

39,466 |

|

|

ClarkDietrich |

|

374 |

|

|

|

4,262 |

|

|

|

1,081 |

|

|

|

12,929 |

|

|

Serviacero |

|

1,514 |

|

|

|

2,039 |

|

|

|

4,488 |

|

|

|

3,991 |

|

|

ArtiFlex |

|

865 |

|

|

|

2,134 |

|

|

|

2,348 |

|

|

|

5,027 |

|

|

Other |

|

(37 |

) |

|

|

(31 |

) |

|

|

(123 |

) |

|

|

255 |

|

| Total

equity income |

$ |

16,445 |

|

|

$ |

27,124 |

|

|

$ |

43,751 |

|

|

$ |

61,668 |

|

| WORTHINGTON INDUSTRIES, INC. |

| SUPPLEMENTAL DATA |

| (In thousands, except volume) |

|

|

| The

following provides detail of Pressure Cylinders volume and net

sales by principal class of products. |

|

|

| |

Three Months Ended November

30, |

|

Six Months Ended November

30, |

| |

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| Volume (units): |

|

|

|

|

|

|

|

| Consumer

products |

|

19,498,496 |

|

|

|

14,330,955 |

|

|

|

35,852,923 |

|

|

|

30,477,672 |

|

|

Industrial products |

|

3,707,829 |

|

|

|

1,842,869 |

|

|

|

7,684,119 |

|

|

|

4,475,212 |

|

|

Alternative fuels |

|

114,779 |

|

|

|

134,190 |

|

|

|

224,635 |

|

|

|

270,252 |

|

| Oil &

gas equipment |

|

719 |

|

|

|

434 |

|

|

|

1,422 |

|

|

|

1,190 |

|

| Total

Pressure Cylinders |

|

23,321,823 |

|

|

|

16,308,448 |

|

|

|

43,763,099 |

|

|

|

35,224,326 |

|

| |

|

|

|

|

|

|

|

| Net sales: |

|

|

|

|

|

|

|

| Consumer

products |

$ |

123,236 |

|

|

$ |

75,130 |

|

|

$ |

231,917 |

|

|

$ |

156,931 |

|

|

Industrial products |

|

126,421 |

|

|

|

79,173 |

|

|

|

239,435 |

|

|

|

158,358 |

|

|

Alternative fuels |

|

25,986 |

|

|

|

29,170 |

|

|

|

49,665 |

|

|

|

58,932 |

|

| Oil &

gas equipment |

|

25,219 |

|

|

|

11,188 |

|

|

|

49,656 |

|

|

|

25,649 |

|

| Total

Pressure Cylinders |

$ |

300,862 |

|

|

$ |

194,661 |

|

|

$ |

570,673 |

|

|

$ |

399,870 |

|

|

|

|

|

| The

following provides detail of impairment of goodwill and long-lived

assets and restructuring and other expense (income), net included

in operating income by segment. |

|

|

| |

Three Months Ended November

30, |

|

Six Months Ended November

30, |

| |

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| Impairment of goodwill

and long-lived assets: |

|

|

|

|

|

|

|

| Steel

Processing |

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

| Pressure

Cylinders |

|

964 |

|

|

|

- |

|

|

|

964 |

|

|

|

- |

|

|

Engineered Cabs |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Other |

|

7,325 |

|

|

|

- |

|

|

|

7,325 |

|

|

|

- |

|

| Total

impairment of goodwill and long-lived assets |

$ |

8,289 |

|

|

$ |

- |

|

|

$ |

8,289 |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

| Restructuring and other

expense (income), net: |

|

|

|

|

|

|

|

| Steel

Processing |

$ |

(10,335 |

) |

|

$ |

318 |

|

|

$ |

(10,056 |

) |

|

$ |

1,284 |

|

| Pressure

Cylinders |

|

488 |

|

|

|

1,963 |

|

|

|

2,365 |

|

|

|

2,109 |

|

|

Engineered Cabs |

|

(82 |

) |

|

|

1,004 |

|

|

|

(78 |

) |

|

|

1,210 |

|

|

Other |

|

235 |

|

|

|

(13 |

) |

|

|

379 |

|

|

|

(3 |

) |

| Total

restructuring and other expense (income), net |

$ |

(9,694 |

) |

|

$ |

3,272 |

|

|

$ |

(7,390 |

) |

|

$ |

4,600 |

|

Contacts:CATHY M. LYTTLEVP, CORPORATE COMMUNICATIONSAND INVESTOR RELATIONS614.438.3077 | cathy.lyttle@WorthingtonIndustries.comSONYA L. HIGGINBOTHAMDIRECTOR, CORPORATE COMMUNICATIONS614.438.7391 | sonya.higginbotham@worthingtonindustries.com

200 Old Wilson Bridge Rd. | Columbus, Ohio 43085WorthingtonIndustries.com

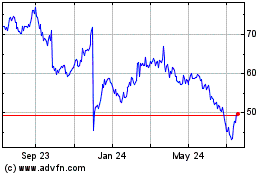

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

From Aug 2024 to Sep 2024

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

From Sep 2023 to Sep 2024