Filed by Twenty-First Century Fox, Inc.

Pursuant to Rule 425 under the Securities Act of 1933,

as amended, and deemed filed pursuant to Rule

14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Twenty-First Century Fox, Inc.

Commission File No.:

001-32352

12/14/2017 09:00 AM GMT, Twenty-First Century Fox Inc. to Spin off Businesses and Create New

“Fox”; a Growth Company Centered on Live News and Sports Brands and the Iconic Fox Brand Conference Call—Final Transcript

CORPORATE PARTICIPANTS

James Rupert Murdoch

Twenty-First Century Fox, Inc. - CEO & Director

John P. Nallen

Twenty-First Century Fox, Inc. - Senior EVP & CFO

Keith Rupert Murdoch

Twenty-First Century Fox, Inc. - Founder & Executive Chairman

Lachlan Keith Murdoch

Twenty-First Century Fox, Inc. - Executive Chairman

Reed Nolte

Twenty-First Century Fox, Inc. - EVP of IR

CONFERENCE CALL PARTICIPANTS

Benjamin Daniel

Swinburne

Morgan Stanley, Research Division - MD

Douglas David Mitchelson

UBS Investment Bank, Research Division - MD and

Equity Research Analyst, Media

Douglas Mitchelson

-

Jessica Reif Cohen

BofA Merrill Lynch, Research Division - MD in Equity Research

Michael Brian Nathanson

MoffettNathanson LLC - Founding Partner & Senior Research Analyst

Steven Lee Cahall

RBC Capital Markets, LLC, Research Division - Analyst -

PRESENTATION

Operator

Ladies and gentlemen, thank you for standing by. Welcome to the Twenty-First Century Fox Announces Creation of New Fox and Intention to Merge Certain Assets

with Disney Conference Call. (Operator Instructions) As a reminder, this conference is being recorded. I would now like to turn the conference over to your host, Mr. Reed Nolte, Executive Vice President, Investor Relations. Please go ahead.

Reed Nolte

Twenty-First Century Fox, Inc. - EVP of IR

Thank you very much, operator. Hello, everyone, and welcome to today’s conference call. On the call today are Executive Chairman, Rupert Murdoch and

Lachlan Murdoch; Chief Executive Officer, James Murdoch; and Chief Financial Officer, John Nallen.

First, we’ll give some prepared remarks on the

announced transactions, and then we’ll be happy to take a few questions from the investment community.

Before we start, I’d like to remind you

that comments made today regarding the benefits of the transactions, the anticipated timing of the transactions and intended spinoff of certain of the company’s businesses to create New Fox and the future business plans and prospects of the

companies are forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current knowledge and assumptions about future events,

involve risks and uncertainties that could cause actual results to differ materially from our expectations.

For additional information on the most important factors that could affect these expectations, please see the

company’s most recent annual report on Form 10-K or the filings made with the Securities and Exchange Commission, including the Form 8-K filed this morning.

Please note that the following communication is not an offer to sell or a solicitation of any offer to buy any securities or a solicitation of any votes for

approval. We urge investors to read the registration statement on Form S-4, containing the joint proxy statement prospectus, and all other relevant documents filed with the SEC or were sent to stockholders as they become available, including the

registration statement for the New Fox when it becomes available. And with that, I’m pleased to turn it over to Rupert.

Keith Rupert Murdoch

Twenty-First Century Fox, Inc. - Founder & Executive Chairman

Thank you, Reed. Good morning, and thank you all for joining us.

Today is a momentous occasion for me, our investors and thousands of colleagues who have joined us over the years in building and nurturing what has become Twenty-First Century Fox. I have a special appreciation of the team at Twenty-First Century

Fox, and I’m grateful for their hardwork, their creativity and their dedication to Fox.

Our journey started decades ago, with a single newspaper in

Adelaide, Australia. Through the efforts and energy of many, we have grown to be one of the most dynamic media companies in the world.

4 years ago, we

separated our publishing and digital real estate businesses to unlock value and to focus on the opportunities for and potential of News Corp. and Twenty-First Century Fox. With today’s announcement, we launch the next great leg of our journey.

The world of media has obviously been undergoing rapid change. New technologies, competitors and shifting consumer preferences have redrawn the whole

media map. As a result of the transformative transactions proposed today, we are paving the way for the New Fox and a transformed Disney to chart a course across a broad frontier of opportunity.

As Bob and his team explained earlier this morning, the combined Fox and Walt Disney Company will be an impressive global operation, enabling us to deliver

what consumers want: quality, storytelling breadth and extraordinary products.

At Fox, we have long admired what Disney has built. Like Fox, Disney boast

content assets that engage audiences around the world. The parks and resorts businesses of Disney is a leader as is their Consumer Products business, forming a broad array of touch points with the consumers.

The scope of new Disney’s combined storytelling, customer interactions, consolidated Hulu ownership and the international direct-to-consumer businesses

at Sky and Star will yield a customer-driven company poised for success in the future.

Fox businesses, IP and brands will continue to flourish together with Disney, and our investors are expected to

earn 25% of the opportunity that the new Disney presents. We are grateful to Bob that he has committed as part of this transaction to stay on a few years and see through the powerful vision that we share. I know he will cherish the great talent

he’s inheriting and appreciate the quality of the individuals who will certainly play a crucial role in fashioning a future for Disney.

Now to the

New Fox. This will be a growth company, centered on live news and sports brands and the strength of the Fox Network. Those of you who know me know I am a news man with a competitive spirit.

When we launched Fox News, the consensus was that America had no appetite for another cable news network. Well they were wrong. When we launched the Fox

Broadcast network, we were written off by the conventional wisdom and told there was no need for a fourth major network. The story — the same story holds true of Fox Sports 1.

The New Fox is going to have an important lesson I’ve learned in my career in media, namely content and news relevant to viewers will always be valuable.

So there’s no wonder, we’re excited for the possibilities of the New Fox.

Housing our news and sports and broadcast franchises, this company is

already a leader many times over. Fox News is a long-time leading cable news network and, more recently, the #1 cable network and probably the strongest brand in all of television. FOX Business is now the most-watched business news channel. Fans

look to Fox and Fox Sports as the long-term home of important sports leagues, like the NFL, the MLB and NASCAR, and college conferences like the Big Ten. And the Fox Broadcast Network and stations group are present in tens of millions of homes

across the country, providing Americans with live local news and sports.

New Fox’s unique strategic advantages are reflected in some remarkable

financial profile. We’ll be the leader in top and bottom line growth and generate robust cash flow, further enhanced by tax attributes you will learn more about from John in just a few moments.

Finally, now I know a lot of you are wondering, “Why did the Murdochs come to such a momentous decision?” Are we retreating? Absolutely not. We are

pivoting at a pivotal moment. We have always made a commitment to deliver more choices for customers, provide great storytelling, objective news, challenging opinion and compelling sports.

Through today’s announcements, we are proud to recommit to that promise and enable our shareholders to benefit for years to come through ownership of 2

of the world’s most iconic, relevant and dynamic media companies. They will each continue to be leaders in creating the very best experiences for consumers.

And now I would like to turn it over to John to give you some specifics on the overall transaction for our shareholders. Thank you, John.

John P. Nallen

Twenty-First Century Fox, Inc. - Senior EVP & CFO

Thanks, Rupert, and good morning, everyone. I’d like to echo Rupert’s comments on how excited we are to announce this value-enhancing transaction for

our shareholders. So let me provide a brief overview of the integrated transactions that we’re announcing today.

First, Twenty-First Century Fox

will split a group of related core businesses into a separately-traded public company which, for now we’ll call New Fox and which will be a leading provider of live content most relevant to viewers.

The businesses that will comprise New Fox include: Fox News; Fox Business; The Fox Broadcast Network, both entertainment and sports; the owned and operated

Fox television stations; FS1 and FS2; and the Big Ten Network. In addition, New Fox will own the Los Angeles studio lot and some other small investments.

Now at a high level and using fiscal 2017 financials as a pro forma reference, New Fox would have approximately $10 billion of annual revenue and $2.8 billion

of EBITDA, which includes an estimate of incremental public company corporate and shared costs. New Fox will also have a strong investment-grade balance sheet, conservatively levered with a maximum of $9 billion of new gross debt, $7.5 billion of

net debt and under 3x net leverage out of the box.

New Fox will be positioned to continue to deliver consistent growth, driven by affiliate and retrans

revenue growth and strong advertising demand for its news, sports and entertainment product. We also expect robust free cash flow generation at New Fox from the strong conversion of earnings into free cash flow, enhanced by the substantial tax

benefits New Fox will have at the date of closing.

This strong cash flow profile will also provide New Fox with financial flexibility to pursue a

balanced capital allocation framework, allowing it to be opportunistic in its approach, to maximize both near-term and long-term shareholder value.

We

expect that New Fox will initially pay a dividend at least at the yield of 21 CF today and that it should grow at least in line with overall earnings growth of the business over time.

The separation of New Fox from Twenty-First Century Fox will be a taxable spin transaction at the corporate level of 21 CF, and the tax incurred will be

payable by Disney. But to offset this tax liability, on the date of the separation, New Fox will pay a cash dividend to MergeCo Fox equivalent to the value of the tax liability up to $8.5 billion and subject to a downward adjustment based on the

actual tax liability at the time of closing.

New Fox will then benefit from a step up in its deductible tax basis, allowing it to appropriately exempt a

significant portion of its income from taxes for the next 15 years. In the second part of the integrated transaction, all of the remaining FOX businesses inside of the Twenty-First Century Fox entity, which we’ll refer to as MergeCo Fox, will

merge with Disney.

Under the terms of the agreement, upon the closing, Twenty-First Century Fox shareholders will receive 0.2745

Disney shares for each Fox share they hold, regardless of class. The exchange ratio is subject to adjustment for certain tax liabilities from the spin transaction.

The transaction values MergeCo FOX businesses at a total enterprise value of approximately $69 billion using yesterday’s Disney closing price and

including the assumption of all of 21 CF’s net debt. After the transaction closes, Fox shareholders will own approximately 25% of the outstanding shares of Disney and the Fox shareholders will also own all of the outstanding shares in New Fox

in the same class proportion as they do now.

The integrated transactions will complete together and are subject to a number of conditions, including

regulatory tax and shareholder approval, among others. And we’ll keep you informed along the way as we make progress toward the closing.

Now let me

turn it over to Lachlan for some additional comments.

Lachlan Keith Murdoch

Twenty-First Century Fox, Inc. - Executive Chairman

Thanks, John. To start, I would like to say that this transaction would never have been possible without the incredible work of our 22,000 employees and

creative partners. It is, frankly, a huge recognition of their talent and of their accomplishments that we are able to transform this company into these 2 new entities, the merged business with Disney and the New Fox.

I would like to thank each and every one of our colleagues for their work. Everyone should be very proud of what they have created.

The logic behind the transaction is really simple. The assets we are merging into Disney will bring that company new creative opportunities, established

intellectual properties and global reach. Fox Film and Fox Searchlight, with a combined 27 Golden Globes nominations this year, our credible TV studio with hits on 5 separate networks, the inspiring National Geographic partnership and the inventive

originality of FX, our local sports networks and our thriving international channels and platforms like Hulu and Sky and the burgeoning Star.

Managed

correctly, these assets should flourish under Disney ownership and drive shareholder return into the future. There is no doubt that the combined business will be a clear leader in entertainment content across all corners of the world.

But while the merged business is about scale, the New Fox is about returning to our roots as a lean, aggressive challenger brand, focused at the beginning on

must-watch news and live sports. The business is positioned to explore potentially disruptive distribution and monetization strategies.

This strategic strength, when coupled with its strong balance sheet, robust cash flow profile and entrepreneurial DNA, makes the potential for New Fox extraordinarily exciting. Over the next few

months, we will be working through the leadership and management structure of the New Fox, something we will announce close to the closing. In the meantime, our motivation and focus from now until then is in getting the best outcome for our

shareholders, for our creative partners and for our employees, many of whom have found this to be a very difficult time.

Sometimes, the right decisions

are the hardest ones, and this is no exception. In the end, the combined Disney and Fox assets and the creation of New Fox will best position our businesses to thrive over the coming years. I’ll now hand over to James for additional comments.

James Rupert Murdoch

Twenty-First Century Fox, Inc. - CEO & Director

Thanks, Lachlan, and thanks, everyone, for joining us this morning. I just want to take just a minute to talk to little bit of the logic of why we’re

moving forward with this transaction.

So first of all, my father, the team he’s built, all of us, we’ve always been interested in game-changers

and we’re a business of change and of challenge and have never been complacent. In this transaction, this creation of 2 new ventures for our shareholders is a game-changer like no other.

We committed some years ago to simplifying our operating model and our portfolio. I want to be clear with you that this integrated transaction reinforces

that. This is all about reinvesting in brands, in storytelling and in our capabilities. These investments are demonstrated in the birth of the Fox Network and Fox News and the extraordinarily important mission driven work of National Geographic

partners and in our unparalleled investment in media in the world’s largest democracy, India.

This commitment is also witnessed in our decades-long

project to provide choice and innovation to customers of Sky across our European markets and in our genuine zeal for investing in and developing the most challenging and innovative storytellers in the U.S. This transaction amplifies and enhances

everything that we’ve been up to and accelerates our mission as a plurality in competition machine everywhere we operate.

The new Disney, with

deeper, better and more extensive direct-to-consumer services around the world, extraordinarily creative talent and a zeal for innovation is well positioned to be the pacesetter in a dramatically competitive global marketplace. It benefits customers

and shareholders alike.

The New Fox, with a unique focus on live and a brand that matters for consumers across the United States, is set to be the

premier American television brand for decades to come. Unlocking this opportunity is truly special. And as John mentioned from a financial perspective, we expect New Fox to have industry-leading growth and very robust free cash flow generation with

an attractive dividend and significant financial flexibility going forward.

I need to mention one more thing for the avoidance of doubt. We’re totally committed to closing the proposed

transaction to acquire the balance of Sky shares that we do not already own. We expect that transaction to pass regulatory muster before the end of this financial year, as we’ve said in the past.

We believe that today’s announcement of these value-creating transactions sets each of these enterprises, the new Disney and New Fox, to be in a superior

position strategically, operationally and financially versus the status quo. And no doubt, it delivers on our unrelenting focus on shareholder value. As a result, the integrated transactions have the unanimous support of our board, and we look

forward to closing these transactions in due course.

I’ll hand it back to my father to close.

Keith Rupert Murdoch

Twenty-First Century Fox, Inc. - Founder & Executive Chairman

Thank you John, Lachlan and James. So as you can see, we are energized with the prospects of the 2 new companies we’re introducing today and firmly

believe that these transactions will unlock real value for consumers and for the future customers of both entities, especially during the time of change.

For all of our colleagues and wonderful creative talent with whom we partnered, we believe these transactions provide for you unprecedented opportunity to do

the very best work of your lives. And importantly, to 21 CF and Disney shareholders, the value we’re unlocking is plain to see. We have now established 2 dynamic companies, each of which is better positioned to deliver distinctive experiences

to consumers and succeed well into the future.

Thank you very much. With that, we’re very happy to take some questions.

Reed Nolte

Twenty-First Century Fox, Inc. - EVP of IR

Operator, we’ll be happy to take a few questions from the investment community.

QUESTIONS AND ANSWERS

Operator

(Operator Instructions) And first is the line of

Jessica Reif with Bank of America Merrill Lynch.

Jessica Reif Cohen

BofA Merrill Lynch, Research Division - MD in Equity Research

Here’s my one long question. You know it’s coming. So the first question is there’s been a lot of speculation that Fox and News Corp. will

recombine. If yes, can you discuss if that’s what you are thinking? Can you discuss the rationale? On the Sky deal, how will — how do you expect the regulators to take into account the pending Disney deal? And then finally, on FBC, how do

you think the strategy will change without a production company as part of the business?

Keith Rupert Murdoch

Twenty-First Century Fox, Inc. - Founder & Executive Chairman

I can just answer that. We haven’t thought about combining with News Corp. And if we do, it’s way ahead of the future. Regulatorily, we think this is

the best option. We see really no problems. And I think it should be fine. You never know what justice comes up with. And as for FBC, we can make our own programs, we’ll be buying from TCFTV. And we were just talking about this morning, as the

network tend to make more and more of their own programs, people like Warner Bros. and Sony will be looking to us to buy our programs. So I think we’re in a strong position for buying — for getting all the programs we need.

James Rupert Murdoch

Twenty-First Century Fox, Inc. - CEO & Director

And Jessica, it’s James here. Just to clarify on the Sky deal, the regulatory question there. We expect the Sky transaction to close on a timetable that

we’ve already laid out for everyone and that the U.K. authorities there will continue on their path as they are today. And that should close prior to the close of this transaction with Disney.

Keith Rupert Murdoch

Twenty-First Century Fox, Inc. - Founder & Executive Chairman

And Jessica, if anything goes wrong, this present — the existing shares in Sky will still go to Disney. It will be up to them what to do.

Operator

We’ll go to Ben Swinburne with Morgan

Stanley.

Benjamin Daniel Swinburne

Morgan Stanley, Research Division - MD

How does — how do you view the growth rate and pricing power for your cable network portfolio now that you’re removing FX and Nat Geo. Does it

enhance it? Does it work against it as you deal with existing distributors? And then, John, can you help us with the basis step up? Is there any way for you to help us quantify that or if you valued it on an NPV basis? It sounds significant, but any

help for us to think about citing that would be great.

Keith Rupert Murdoch

Twenty-First Century Fox, Inc. - Founder & Executive Chairman

I would say there’s no — we’re in a very stronger position, if anything, with the FBC, with this NFL and particularly Fox News. Fox News is

something that just no one can afford to drop. [Inaudible] tried it for six weeks and lost 150,000 customers. I think it’s — we’ve shown we’ve lost some of our stars and lost none of our audience, so it’s extraordinary. So

that’s fine. John, you talk about it.

John P. Nallen

Twenty-First Century Fox, Inc. - Senior EVP & CFO

Yes. Ben, just on the tax side, well, it’s all subject to final calculations and everything. I think it’s safe to assume that somewhere around $1.5

billion of each year’s taxable income will be sheltered through the deductible basis for 15 years.

Operator

We’ll go to Michael Nathanson with MoffettNathanson.

Michael Brian Nathanson

MoffettNathanson LLC - Founding Partner & Senior Research Analyst

I have — 2 is on sports for all 3 of you guys. Firstly, I guess, can you walk me through why the RSNs were sold given the focus you have on sports and

the remaining assets? So what was the thinking of divesting the RSNs? And then two, you have an NFL deal coming due down the road and baseball deal coming due, how do you think about the scale of your businesses when those negotiations start? I

mean, if they are major increases in sports rights, it could be a problem on profitably. So talk me through how you see the future sports rights, too.

Keith Rupert Murdoch

Twenty-First Century Fox, Inc. - Founder & Executive Chairman

Well, I think that the sports rights will dictate what we have to

ask for subscriptions. I think we’re in good shape there. There’s several years to go on the NFL. And I think MLB is up next year. Is that right, James?

James Rupert Murdoch

Twenty-First Century Fox, Inc. - CEO & Director

It’s a little bit longer than that.

Keith Rupert Murdoch

Twenty-First Century Fox, Inc. - Founder & Executive Chairman

Okay. Sorry.

James Rupert Murdoch

Twenty-First Century Fox, Inc. - CEO & Director

Quite a bit, yes. So I think, Michael, if I may, on the RSNs and the inclusions

in this, I think when we looked at the mix of businesses and structuring this transaction, we’re really mindful of what the fit was for each business. Obviously, both the new Disney and the New Fox are in the sports business, and it was really

a question of where the best fit was and also what was really going to generate the most value for shareholders and how that works. So that was really a lot of our thinking there. And with respect to those contracts with the NFL and MLB rights, have

a little ways to go into the — both into ‘21 and then ‘23, I think. So we have pretty good visibility of that. And I think when you look at the New Fox, it’s a business that has really substantial scale and concentrated scale in

its core market of the United States. And we’ll be competing for rights on an ongoing basis in what has always been a competitive market for rights.

Keith Rupert Murdoch

Twenty-First Century Fox, Inc. - Founder & Executive Chairman

I would just say that if we kept RSNs, it would have added a huge

tax burden to the spin. And meanwhile, we’ve got a take at a premium of 12.5x their earnings. So it was — I think it’s a good deal.

Operator

And we’ll go to Steven Cahall with RBC.

Steven Lee Cahall

RBC

Capital Markets, LLC, Research Division - Analyst

Yes, just one for me. It sounds like you’ll have a lot of free cash flow to allocate back

to the business or to shareholders. I was wondering if you could talk maybe a little bit about how you think about any potential inorganic growth strategy? Do you like the station footprint the way it is? Are there opportunities to add more maybe

digital assets with Fox News? So anything you can talk about, maybe the strategic use of the balance sheet?

Keith Rupert Murdoch

Twenty-First Century Fox, Inc. - Founder & Executive Chairman

Well, yes, as far as the stations, there will be opportunities. It will depend on the price. Certainly, if we had more, it would give us greater strength in

getting clearances. But it’s going to have a free cash flow, we expect, of at least $2 billion a year as a New Fox. And we’ll start modestly the dividend size and then we will see from there, I mean, what comes up. We’ll be in a mood

to expand and do new things and we’ll have the ability. It will be somewhat underleveraged very quickly. I just — go on, John.

John P. Nallen

Twenty-First Century Fox, Inc. - Senior EVP & CFO

No, no. Reed, do you want to move on to the next question?

Reed Nolte

Twenty-First Century Fox, Inc. - EVP of IR

And at this point, I think we have time for one last question.

Operator

That will be from Doug Mitchelson with Crédit Suisse.

Douglas Mitchelson

-

I think it’s going to be important for investors to understand the digital or direct-to-consumer strategy of the New Fox. I mean, for

example, you’ve talked a lot about the need to evolve TV advertising, you’ve considered transactions to increase strategic flexibility for the TV stations. And it seems like you’re going to have a greater exposure on both those

revenue streams. So to the extent Lachlan said you’re going to be positioned to pursue disruptive distribution monetization strategies in the context of the New Fox, can you give us any sense of what those might be and, hopefully, what the

digital strategy is for the New Fox? And then maybe for John, I’m just curious if the Fox broadcast deal with Hulu was extended as part of the negotiations or will be extended as part of the deal?

Keith Rupert Murdoch

Twenty-First Century Fox, Inc. - Founder & Executive Chairman

Lachlan, do you want to take…

Lachlan Keith Murdoch

Twenty-First Century Fox, Inc. - Executive Chairman

Yes. So thanks for the question. The digital strategy for the New Fox is really the

same as the digital strategy for the old Fox. And we’ve been pretty open for some time in saying that we believe that all of our content and channels will ultimately have a direct-to-consumer distribution element as well as a traditional

distribution combined. And so — and that’s very much the same here. So we would expect that the New Fox, the New Fox channels to have a direct-to-consumer platform as actually part of the deal. And moving forward is to take all that

technology that we’ve been developing and we’ve talked to you about that we’ve been developing over the 12 months over into the New Fox to enable that.

Douglas David Mitchelson

UBS Investment Bank, Research Division - MD and Equity Research Analyst, Media

That’s great. And on the Hulu side?

James Rupert Murdoch

Twenty-First Century Fox, Inc. - CEO & Director

Hulu is part of the deal is an element in Hulu. I don’t think any of the parties want to discuss — any of the owners and any of their partners

discuss the details of it.

Douglas David Mitchelson

UBS Investment Bank, Research Division - MD and Equity Research Analyst, Media

And Lachlan, just to be clear, you’re saying the technology that Fox has been building for direct-to-consumer stays with the New Fox? That’s what

you’re saying?

Lachlan Keith Murdoch

Twenty-First Century Fox, Inc. - Executive Chairman

That’s correct.

-

Oh, yes.

Reed Nolte

Twenty-First

Century Fox, Inc. - EVP of IR

Thank you, Doug, and thank you, everyone, for joining today’s call. If you have further questions, please feel

free to give Mike Petrie or me a call.

James Rupert Murdoch

Twenty-First Century Fox, Inc. - CEO & Director

Thanks, everyone.

Operator

Ladies and gentlemen, this conference is available for replay. It starts today at 11:00 a.m. Eastern, will last until December 28 at midnight. You can

access the replay at any time by dialing (800) 475-6701 or (320) 365-3844. The access code is 439113. That does conclude your conference for today. Thank you for your participation. You may now disconnect.

Important Information About the Transaction and Where to Find It

In connection with the proposed transaction between The Walt Disney Company (“Disney”) and Twenty-First Century Fox, Inc. (“21CF”), Disney

and 21CF will file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form

S-4

that will include a joint proxy statement of Disney and 21CF that also constitutes a

prospectus of Disney. 21CF will file with the SEC a registration statement for a newly formed subsidiary (“New Fox”), which is contemplated to own certain assets and businesses of 21CF not being acquired by Disney in connection with the

proposed transaction. 21CF and Disney may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document which

21CF or Disney may file with the SEC.

INVESTORS AND SECURITY HOLDERS OF 21CF AND DISNEY ARE URGED TO READ THE REGISTRATION STATEMENTS, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE

SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS.

Investors and security holders may

obtain free copies of the registration statements and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by 21CF and Disney through the web site maintained by the SEC at

www.sec.gov

or by contacting

the investor relations department of :

|

|

|

|

|

21CF

|

|

Disney

|

|

1211 Avenue of Americas

|

|

c/o Broadridge Corporate Issuer Solutions

|

|

New York, NY 10036

|

|

P.O. Box 1342

|

|

Attention: Investor Relations

|

|

Brentwood, NY 11717

|

|

1 (212) 852 7059

|

|

Attention: Disney Shareholder Services

|

|

Investor@21CF.com

|

|

1 (855) 553 4763

|

Participants in the Solicitation

21CF, Disney and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed

transaction. Information regarding 21CF’s directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is available in 21CF’s Annual Report on Form

10-K

for the year ended June 30, 2017 and its proxy statement filed on September 28, 2017, which are filed with the SEC. Information regarding Disney’s directors and executive officers,

including a description of their direct interests, by security holdings or otherwise, is available in Disney’s Annual Report on Form

10-K

for the year ended September 30, 2017 and its proxy statement

filed on January 13, 2017, which are filed with the SEC. A more complete description will be available in the registration statement on Form

S-4,

the joint proxy statement/prospectus and the registration

statement of New Fox.

No Offer or Solicitation

This communication is for informational purposes only and is not intended to and does not constitute an offer to subscribe for, buy or sell, or the

solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell any securities or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in

any jurisdiction in which such offer, invitation, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Cautionary

Notes on Forward Looking Statements

This communication contains “forward-looking statements” within the meaning of the federal

securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and

financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,”

“would,” “target,” similar expressions, and variations or negatives of these words.

Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as

statements about the consummation of the proposed transaction and the anticipated benefits thereof. These and other forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could

cause actual results to differ materially from those expressed in any forward-looking statements, including the failure to consummate the proposed transaction or to make any filing or take other action required to consummate such transaction in a

timely matter or at all, are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statements. Important risk factors

that may cause such a difference include, but are not limited to: (i) the completion of the proposed transaction may not occur on the anticipated terms and timing or at all, (ii) the required regulatory approvals are not obtained, or that

in order to obtain such regulatory approvals, conditions are imposed that adversely affect the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction, (iii) the risk that a condition to

closing of the transaction may not be satisfied (including, but not limited to, the receipt of legal opinions and rulings with respect to the treatment of the transaction under U.S. and Australian tax laws), including the

tax-free

treatment of the transaction to 21CF’s stockholders of the distribution of shares of New Fox common stock, (iv) the risk that the anticipated tax treatment of the transaction is not obtained,

(v) an increase or decrease in the anticipated transaction taxes (including due to any changes to tax legislation and its impact on tax rates (and the timing of the effectiveness of any such changes)) to be paid in connection with the

separation prior to the closing of the transactions could cause an adjustment to the exchange ratio, (vi) potential litigation relating to the proposed transaction that could be instituted against 21CF, Disney or their respective directors,

(vii) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transactions, (viii) risks associated with third party contracts containing consent and/or other provisions that

may be triggered by the proposed transaction, (ix) negative effects of the announcement or the consummation of the transaction on the market price of 21CF and/or Disney’s common stock, (x) risks relating to the value of the Disney

shares to be issued in the transaction and uncertainty as to the long-term value of Disney’s common stock, (xi) the potential impact of unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic

performance, indebtedness, financial condition and losses on the future prospects, business and management strategies for the management, expansion and growth of Disney’s operations after the consummation of the transaction and on the other

conditions to the completion of the merger, (xii) the risks and costs associated with, and the ability of Disney to, integrate the businesses successfully and to achieve anticipated synergies, (xiii) the risk that disruptions from the

proposed transaction will harm 21CF’s or Disney’s business, including current plans and operations, (xiv) the ability of 21CF or Disney to retain and hire key personnel, (xv) adverse legal and regulatory developments or

determinations or adverse changes in, or interpretations of, U.S., Australian or other foreign laws, rules or regulations, including tax laws, rules and regulations, that could delay or prevent completion of the proposed transactions or cause the

terms of the proposed transactions to be modified, (xvi) the risk that New Fox, as a new company that currently has no credit rating, will not have access to the capital markets on acceptable terms, (xvii) the risk that New Fox may be

unable to achieve some or all of the benefits that 21CF expects New Fox to achieve as an independent, publicly-traded company, (xviii) the risk that New Fox may be more susceptible to market fluctuations and other adverse events than it would

have otherwise been while still a part of 21CF, (xix) the risk that New Fox will incur significant indebtedness in connection with the separation and distribution, and the degree to which it will be leveraged following completion of the

distribution may materially and adversely affect its business, financial condition and results of operations, (xx) the ability to obtain or consummate financing or refinancing related to the transaction upon acceptable terms or at all,

(xxi) as well as management’s response to any of the aforementioned factors. These risks, as well as other risks associated with the proposed transactions, will be more fully discussed in the joint proxy statement/prospectus that will be

included in the registration statement on Form

S-4

that will be filed with the SEC in connection with the proposed transactions, as well as in the registration statement filed with respect to New Fox. While

the list of factors presented here is, and the list of factors to be presented in the registration statement on Form

S-4

and the registration statement of New Fox are, considered representative, no such list

should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward looking statements. Consequences of material differences in results

as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material

adverse effect on 21CF’s or Disney’s consolidated financial condition, results of operations, credit rating or liquidity. Neither 21CF nor Disney assumes any obligation to publicly provide revisions or updates to any forward looking

statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws.

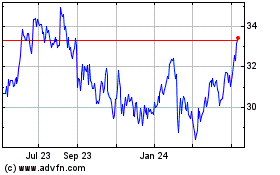

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Mar 2024 to Apr 2024

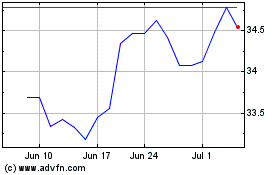

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Apr 2023 to Apr 2024