By Dana Mattioli, Keach Hagey and Ryan Knutson

New suitors are circling 21st Century Fox Inc., affirming that

the media empire built by Rupert Murdoch is now in play.

Comcast Corp. has approached the media company to express

interest in buying a substantial piece of it, according to people

familiar with the situation. Verizon Communications Inc. is also

kicking the tires on Fox assets, though a person familiar with its

thinking cautioned the exploration was in the early stages. And

Sony Corp's entertainment unit has also informally approached Fox,

the people familiar with the situation said.

The takeover interest in 21st Century Fox gained steam after

news last week that Walt Disney Co. recently held talks with the

company but failed to reach a deal.

The assets Fox is discussing with potential suitors include the

Twentieth Century Fox studio, some U.S. cable networks and the

international business. Fox News, the Fox broadcast network and the

company's sports channels haven't been part of the talks, the

people familiar with the situation said.

Any deal would be sizable. 21st Century Fox has a market

capitalization of about $54 billion. Fox's shares rose 8.1% after

hours on Thursday, after The Wall Street Journal reported the

interest from Comcast and Verizon.

21st Century Fox and the Journal's parent, News Corp, share

common ownership.

It is uncertain how regulators would receive a combination

involving a large player like Comcast or Verizon with 21st Century

Fox. AT&T Inc.'s pending takeover of Time Warner Inc., which

would result in a behemoth spanning distribution and content, has

run into resistance in Washington, and could be headed for a court

battle.

The interest in Fox is part of a broader wave of consolidation

sweeping through the media industry as the pace of cable-TV

cord-cutting accelerates and new players like Netflix Inc. and

Amazon.com Inc. have quickly ascended to dominant positions.

At the same time, a series of mergers has bulked up distributors

like Charter Communications, AT&T and Comcast, weakening the

leverage that media companies have to get their channels

distributed at a good price.

Fox may be more receptive to offers after its shares

underperformed some media competitors in recent years. While

content creators and distributors have been consolidating, some of

Fox's pursuits have been thwarted. Fox saw the need for greater

scale three years ago and attempted to buy Time Warner Inc., but

was ultimately rebuffed and backed off after its stock price sank.

Last year, in yet another bid for greater scale, it announced its

intention to buy the rest of Sky beyond the 39% it already

owns.

Comcast has weathered the storms in pay TV better than peers in

recent years, but has begun to feel the pinch. In its most recent

quarter, it suffered its largest quarterly loss of cable

subscribers in three years. Comcast is particularly interested in

Fox's international assets, one of the people familiar with the

situation said. As the U.S. pay-TV market saturates, other

countries where penetration of cable services is lower can offer

more growth.

The notion that Comcast would make a large bet on more media

content in this environment is especially surprising. The cable

company acquired NBCUniversal in 2011, integrating a host of cable

TV networks, the NBC broadcast network and the Universal studio.

And one reason antitrust enforcers are skeptical about the AT&T

deal is that they believe Comcast hasn't lived up to the spirit of

the conditions regulators put on that 2011 deal, people familiar

with the matter have said.

For Verizon, a deal with Fox would help it expand its

digital-media business, which as of now is driven by the

combination of AOL and Yahoo, both of which it acquired. Verizon is

looking to build a cache of websites and online video services it

can sell advertising against.

The wireless carrier has frequently expressed skepticism about

the legacy television business model, but has aggressively sought

to build new video businesses based around mobile video.

Verizon may face slightly less antitrust scrutiny than some of

its rivals. Unlike Comcast and AT&T, which have millions of

pay-TV subscribers, Verizon only has 4.6 million TV customers, who

are all concentrated in the northeastern U.S. Verizon Wireless is

the nation's largest cell carrier, with more than 115 million

subscribers, but there is no established model for bundling

television and cellular services like there is in the cable

industry.

Reports last week of Fox's discussions with Disney signaled a

new willingness from the Murdoch family to consider a restructuring

of its media empire, a move that shocked the industry and

effectively put Fox on the block.

Entertainment assets like those owned by Fox are rarely

available for purchase, and are expensive and time-consuming to

create from the ground up. Mr. Murdoch invested heavily to build

and piece together his company over the course of decades.

Over the past week, Fox has hosted both its quarterly earnings

call and its annual shareholder meeting. While executives have

declined to address acquisition-related questions, they have taken

the opportunity to emphasize Fox's ability to compete with its

current set of assets.

"There's a lot of talk about the growing importance of scale in

the media industry," 21st Century Fox Executive Co-Chairman Lachlan

Murdoch said at the annual meeting Wednesday. "Subscale players are

finding it difficult to leverage their position into new and

emerging video platforms, but let me be very clear: We are not in

that category."

One of Fox's international assets that has drawn particular

interest is U.K. pay-TV company Sky. Fox already owns a 39% stake

in Sky, but its bid to acquire the rest of the company has faced

significant delays in the U.K. since the approximately $15 billion

bid was announced a year ago. Fox has continued to express

confidence that the deal will close by mid-2018.

Fox has said its international holdings help it reach more than

one billion subscribers in roughly 50 languages in more than 170

countries.

Fox's movie and television studio has been a mixed bag. Fox is

one of the most prolific producers of scripted shows, providing

programming for its own channels as well as selling shows like

"Modern Family" and "This Is Us" to other networks and digital

platforms. The Twentieth Century Fox film studio's performance has

been more erratic, ranking everywhere from first to sixth in

domestic box-office sales since 2011, according to Box Office

Mojo.

Some of Fox's entertainment networks have also been eyed by the

potential acquirers. The cable network FX is a critical darling and

some of its shows command top dollar in rerun rights from Netflix.

National Geographic Channel has been spending heavily on original

content but so far the effort hasn't paid off in higher

ratings.

Selling off some assets could slim the Fox global conglomerate

down to a leaner media company focused on broadcast TV, cable news

and sports programming, which theoretically could command a higher

valuation. The thinking at Fox, according to a person familiar with

the matter, is that the company could be successful with a makeup

similar to CBS Corp., which has a higher valuation even though it

isn't one of the largest U.S. media conglomerates.

Joe Flint and Lukas I. Alpert contributed to this article.

Write to Dana Mattioli at dana.mattioli@wsj.com, Keach Hagey at

keach.hagey@wsj.com and Ryan Knutson at ryan.knutson@wsj.com

(END) Dow Jones Newswires

November 16, 2017 21:53 ET (02:53 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

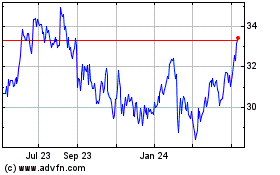

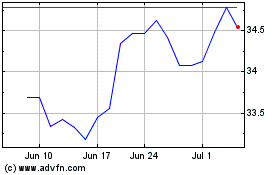

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Apr 2023 to Apr 2024