Current Report Filing (8-k)

November 15 2017 - 5:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

November

15,

2017

Date of Report (Date of earliest event reported)

Canbiola, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Florida

|

|

____333-208293_______

|

|

20-3624118

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.

|

|

|

|

|

960 South Broadway, Suite 120, Hicksville, NY

|

|

11801

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code

516-205-4751

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

|

¨

|

Written communications pursuant to Rule 425 under Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company X

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

On November 1, 2017, Canbiola, Inc. (the “Company”) entered into a consulting agreement (“Consulting Agreement”) with Robert A. Kornfeld (“Kornfeld”) whereby Kornfeld will provide the Company with product development and marketing consulting services from a medical standpoint and sit on the Company’s medical advisory board. In consideration for such services, the Company has agreed to pay Kornfeld 1,000,000 restricted shares of the Company’s common stock according to the following vesting schedule:

250,000 Upon execution of the Consulting Agreement

250,000 On January 31, 2018

250,000 On April 31, 2018

250,000 On July 31, 2018

The Consulting Agreement is for a term of one year, but may be terminated by either party with five (5) days’ notice or immediately upon breach by the other party.

On or around November 9, 2017, the Company’s Board of Directors ratified a loan from the Company to Pure Health Products, LLC (“PH”) in the amount of $60,000. The loan was a purchase loan to enable PH to acquire certain assets for the manufacture of products containing CBD. The loan is secured by PH’s assets and will accrue interest at 12% per year. The loan matures in one year from the effective date of the relating promissory note from PH to the Company.

As a condition to the loan, PH granted the Company an option to purchase the assets acquired through the loan proceeds pursuant to the terms of an agreed upon Agreement for Sale and Purchase of Business Assets (the “Purchase Agreement”). The option is for a period of 10 years and the purchase price for the assets is set at $60,000.

Pursuant to the Purchase Agreement, the PH is required to sell the assets to the Company upon exercise of its option, with the closing scheduled 14 days following the exercise date. Also pursuant to the Purchase Agreement, PH has agreed to various restrictive covenants relating to its use of the assets, designed towards preservation in the event the Company exercises its option. The Company may pay the purchase price in cash or through extinguishment of the debt owed by PH. The Company has not yet decided to exercise its purchase option.

Item 3.02 Unregistered Sales of Equity Securities.

The disclosures in Item 1.01 relating to issuance of shares to Kornfeld, who has been issued the first tranche of 250,000 shares pursuant to Section 4(a)(2) of the Securities Act of 1933, is incorporated herein by reference.

Item 8.01 Other Events

On October 25, 2017, the Company changed its registered agent from Rolv E. Heggenhougen to Carl Dilley, located at 15500 Roosevelt Boulevard, Suite 301, Clearwater, FL 33760. The Company has also changed its principal address to 960 South Broadway, Suite 120, Hicksville, NY 11801.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On November 15, 2017, the Company filed an amendment to its Articles of Incorporation with state of Florida to increase its authorized common stock to 750,000,000 shares and its preferred stock to 5,000,000 shares. The Company also designated a new series of preferred stock, Series B Convertible Preferred Stock, with the rights, privileges and preferences as detailed in the attached Certificate of Designations.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed herewith:

99.1

Amendment to Articles of Incorporation and Certificate of Designations for Series B Preferred Stock

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Canbiola, Inc.

|

|

|

|

|

|

|

|

Date: November 15, 2017

|

By:

|

___/s/ Marco Alfonsi

________

Marco Alfonsi, CEO

|

|

|

|

|

|

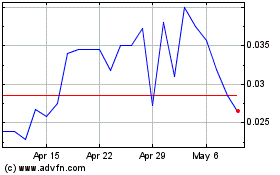

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Mar 2024 to Apr 2024

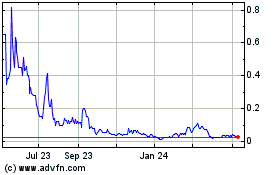

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Apr 2023 to Apr 2024