Global Payments Inc. (NYSE: GPN) today announced results for the

third quarter ended September 30, 2017.

“We delivered another quarter of double digit organic adjusted

net revenue growth, underscoring the ongoing successful execution

of our technology enabled, software driven

strategy,” said Jeff Sloan, Chief Executive Officer. “Our

integrated and vertical markets and ecommerce and omnichannel

solutions businesses, which now comprise 40% of our adjusted net

revenue, provide further opportunities for sustained share

gains. Additionally, we are delighted with the pace of revenue

cross-sell efforts around the world from our recent acquisitions,

which positions us well for future growth.”

Third Quarter 2017 Summary

- GAAP revenues were $1,038.9 million,

compared to $951.9 million in the third quarter of 2016; diluted

earnings per share were $0.71 compared to $0.36 in the prior year;

and operating margin was 16.6% compared to 12.6% in the third

quarter of 2016.

- Adjusted net revenue grew 12% to $930.4

million, compared to $828.4 million in the third quarter of

2016.

- Adjusted earnings per share grew 29% to

$1.15, compared to $0.89 in the third quarter of 2016.

- Adjusted operating margin expanded 110

basis points to 31.3%.

2017 Outlook

“We are very pleased with our performance in the third quarter

and year-to-date period, again delivering results in excess of our

targets for the business,” stated Cameron Bready, Senior Executive

Vice President and Chief Financial Officer. “As a result of this

strong performance and to reflect the impacts of the ACTIVE Network

transaction, we are increasing our outlook for 2017. We now expect

adjusted net revenue to range from $3.505 billion to $3.53 billion,

or growth of 23% to 24% over 2016 and adjusted earnings per share

to be in a range of $3.94 to $4.02, reflecting growth of 24% to 26%

over 2016. We continue to expect adjusted operating margin to

expand by as much as 120 basis points.”

Capital Allocation

Global Payments’ Board of Directors approved a dividend of $0.01

per share payable December 29, 2017 to shareholders of record as of

December 15, 2017.

Conference Call

Global Payments’ management will host a conference call today,

November 8, 2017 at 8:00 a.m. ET to discuss financial results and

business highlights. Callers may access the conference call via the

investor relations page of the company’s website at

www.globalpaymentsinc.com; or callers in North America may dial

877-674-6428 and callers outside North America may dial

970-315-0457. A replay of the call will be archived on the

company’s website within two hours of the live call.

Non-GAAP Financial Measures

Global Payments supplemented revenues, income and earnings per

share information determined in accordance with GAAP by providing

those measures on an adjusted basis in this earnings release to

assist with evaluating performance. In addition to GAAP measures,

management uses these non-GAAP measures to focus on the factors the

company believes are pertinent to the daily management of our

operations.

Reconciliations of the non-GAAP measures to the most directly

comparable GAAP measure are included in the schedules to this

release.

About Global Payments

Global Payments Inc. (NYSE: GPN) is a leading worldwide provider

of payment technology services that delivers innovative solutions

driven by customer needs globally. Our technologies, partnerships

and employee expertise enable us to provide a broad range of

products and services that allow our customers to accept all

payment types across a variety of distribution channels in many

markets around the world.

Headquartered in Atlanta, Georgia with more than 10,000

employees worldwide, Global Payments is a member of the S&P 500

with customers and partners in 30 countries throughout North

America, Europe, the Asia-Pacific region and Brazil. For more

information about Global Payments, our Service. Driven. Commerce

brand and our technologies, please visit www.globalpaymentsinc.com.

Forward-Looking Statements

This announcement and comments made by Global Payments’

management during the conference call may contain certain

forward-looking statements within the meaning of the “safe-harbor”

provisions of the Private Securities Litigation Reform Act of 1995.

Statements that are not historical facts, including revenue,

earnings estimates and management’s expectations regarding future

events and developments, are forward-looking statements and are

subject to significant risks and uncertainties.

Important factors that may cause actual events or results to

differ materially from those anticipated by such forward-looking

statements include our ability to safeguard our data; increased

competition from larger companies and non-traditional competitors,

our ability to update our services in a timely manner; our ability

to maintain Visa and MasterCard registration and financial

institution sponsorship; our reliance on financial institutions to

provide clearing services in connection with our settlement

activities; our potential failure to comply with card network

requirements; potential systems interruptions or failures; software

defects or undetected errors; increased attrition of merchants,

referral partners or independent sales organizations; our ability

to increase our share of existing markets and expand into new

markets; a decline in the use of cards for payment generally;

unanticipated increases in chargeback liability; increases in

credit card network fees; change in laws, regulations or network

rules or interpretations thereof; foreign currency exchange and

interest rate risks; political, economic and regulatory changes in

the foreign countries in which we operate; future performance,

integration and conversion of acquired operations; including

without limitation difficulties and delays in integrating the

Heartland or ACTIVE Network businesses or fully realizing cost

savings and other benefits of the acquisitions at all or within the

expected time period; fully realizing anticipated annual interest

expense savings from refinancing our corporate debt facilities; our

loss of key personnel and other risk factors presented in Item 1-

Risk Factors of our Transition Report on Form 10-K for the seven

months ended December 31, 2016 and any subsequent SEC filings,

which we advise you to review. Our forward-looking statements speak

only as of the date they are made and should not be relied upon as

representing our plans and expectations as of any subsequent date.

We undertake no obligation to revise any of these statements to

reflect future circumstances or the occurrence of unanticipated

events.

SCHEDULE 1UNAUDITED GAAP

CONSOLIDATED STATEMENTS OF INCOMEGLOBAL PAYMENTS INC. AND

SUBSIDIARIES(In thousands, except per share data)

Three Months Ended Nine

Months Ended September 30 September 30 2017 2016

% Change 2017 2016 %

Change Revenues $ 1,038,907 $ 951,885 9.1 % $ 2,920,910 $

2,420,789 20.7 % Operating expenses: Cost of service 493,883

469,980 5.1 % 1,418,969 1,125,041 26.1 % Selling, general and

administrative 372,553 361,516 3.1 % 1,092,648

1,019,626 7.2 % 866,436 831,496 4.2 %

2,511,617 2,144,667 17.1 % Operating income

172,471 120,389 43.3 % 409,293 276,122

48.2 % Interest and other income 2,347 1,465 60.2 % 5,787

45,312 (87.2 )% Interest and other expense (40,764 ) (45,609 )

(10.6 )% (130,422 ) (95,280 ) 36.9 % (38,417 ) (44,144 ) (13.0 )%

(124,635 ) (49,968 ) 149.4 % Income before income taxes

134,054 76,245 75.8 % 284,658 226,154 25.9 % Provision for income

taxes (15,692 ) (14,021 ) 11.9 % (40,893 ) (33,350 ) 22.6 % Net

income 118,362 62,224 90.2 % 243,765 192,804 26.4 % Less: Net

income attributable to noncontrolling interests, net of income tax

(7,622 ) (6,714 ) 13.5 % (17,302 ) (15,150 ) 14.2 % Net income

attributable to Global Payments $ 110,740 $ 55,510

99.5 % $ 226,463 $ 177,654 27.5 % Earnings per

share attributable to Global Payments: Basic $ 0.72 $ 0.36 100.0 %

$ 1.48 $ 1.24 19.4 % Diluted $ 0.71 $ 0.36 97.2 % $ 1.47 $ 1.23

19.5 % Weighted-average number of shares outstanding: Basic

154,560 153,668 153,138 143,794 Diluted 155,402 154,530 154,079

144,731

SCHEDULE 2NON-GAAP FINANCIAL

MEASURES (UNAUDITED)GLOBAL PAYMENTS INC. AND SUBSIDIARIES(In

thousands, except per share data)

Three Months Ended Nine

Months Ended September 30 September 30 2017 2016 %

Change 2017 2016 % Change Adjusted net revenue

$ 930,411 $ 828,436 12.3 % $ 2,582,231 $ 2,024,346 27.6 %

Adjusted operating income $ 290,773 $ 249,943 16.3 % $ 767,260 $

581,749 31.9 % Adjusted net income $ 178,313 $ 137,925 29.3

% $ 452,714 $ 335,736 34.8 % Adjusted EPS $ 1.15 $ 0.89 29.2

% $ 2.94 $ 2.32 26.7 %

See Schedules 6 and 7 for a reconciliation

of each non-GAAP financial measure to the most comparable GAAP

measure and Schedule 10 for a discussion of non-GAAP financial

measures.

SCHEDULE 3SEGMENT INFORMATION

(UNAUDITED)GLOBAL PAYMENTS INC. AND SUBSIDIARIES(In

thousands)

Three Months Ended

September 30, 2017

September 30, 2016

% Change

GAAP

Non-GAAP1

GAAP

Non-GAAP1 GAAP Non-GAAP1 Revenues: North

America $ 764,902 $ 685,776 $ 718,977 $ 618,712 6.4 % 10.8 % Europe

205,203 175,833 173,246 150,062 18.4 % 17.2 % Asia-Pacific

68,802 68,802 59,662

59,662 15.3 % 15.3 % $ 1,038,907 $ 930,411 $

951,885 $ 828,436 9.1 % 12.3 % Operating

income: North America $ 138,345 $ 216,870 $ 110,983 $ 188,197 24.7

% 15.2 % Europe 76,214 83,130 63,727 71,017 19.6 % 17.1 %

Asia-Pacific 20,032 22,197 14,657 17,291 36.7 % 28.4 % Corporate

(62,120

)

(31,424

)

(68,978

)

(26,562 ) (9.9 )% 18.3 % $ 172,471 $ 290,773 $

120,389 $ 249,943 43.3 % 16.3 % Nine

Months Ended September 30, 2017 September 30, 2016 % Change GAAP

Non-GAAP1 GAAP Non-GAAP1 GAAP Non-GAAP1 Revenues: North

America $ 2,162,911 $ 1,907,670 $ 1,770,957 $ 1,435,680 22.1 % 32.9

% Europe 557,258 473,820 479,620 418,454 16.2 % 13.2 % Asia-Pacific

200,741 200,741 170,212

170,212 17.9 % 17.9 % $ 2,920,910 $ 2,582,231

$ 2,420,789 $ 2,024,346 20.7 % 27.6 %

Operating income: North America $ 344,604 $ 574,391 $ 258,648 $

409,302 33.2 % 40.3 % Europe 196,394 219,305 172,293 199,612 14.0 %

9.9 % Asia-Pacific 57,321 62,756 40,266 49,021 42.4 % 28.0 %

Corporate (189,026 ) (89,192 ) (195,085 )

(76,186 ) (3.1 )% 17.1 % $ 409,293 $ 767,260 $

276,122 $ 581,749 48.2 % 31.9 %

1 See Schedules 8 and 9 for a

reconciliation of adjusted net revenue and adjusted operating

income by segment to the most comparable GAAP measures and Schedule

10 for a discussion of non-GAAP financial measures.

SCHEDULE 4UNAUDITED CONSOLIDATED

BALANCE SHEETSGLOBAL PAYMENTS INC. AND SUBSIDIARIES(In

thousands, except share data)

September 30,

2017

December 31,

2016

ASSETS Current assets: Cash and cash equivalents $

1,186,050 $ 1,162,779 Accounts receivable, net of allowances for

doubtful accounts of $1,423 and $1,092, respectively 296,366

275,032 Settlement processing assets 1,847,232 1,546,854 Prepaid

expenses and other current assets 220,649 131,341

Total current assets 3,550,297 3,116,006 Goodwill 5,616,414

4,807,594 Other intangible assets, net 2,328,709 2,085,292 Property

and equipment, net 577,188 526,370 Deferred income taxes 16,736

15,789 Other noncurrent assets 192,205 113,299 Total

assets $ 12,281,549 $ 10,664,350

LIABILITIES AND EQUITY Current liabilities: Settlement lines

of credit $ 487,513 $ 392,072 Current portion of long-term debt

93,408 177,785 Accounts payable and accrued liabilities 992,363

804,887 Settlement processing obligations 1,550,627

1,477,212 Total current liabilities 3,123,911 2,851,956

Long-term debt 4,677,910 4,260,827 Deferred income taxes 632,648

676,472 Other noncurrent liabilities 152,127 95,753

Total liabilities 8,586,596 7,885,008 Commitments and

contingencies Equity: Preferred stock, no par value; 5,000,000

shares authorized and none issued — — Common stock, no par value;

200,000,000 shares authorized; 158,762,894 issued and outstanding

at September 30, 2017 and 152,185,616 issued and outstanding at

December 31, 2016 — — Paid-in capital 2,376,331 1,816,278 Retained

earnings 1,357,526 1,137,230 Accumulated other comprehensive loss

(202,508 ) (322,717 ) Total Global Payments shareholders’ equity

3,531,349 2,630,791 Noncontrolling interests 163,604 148,551

Total equity 3,694,953 2,779,342 Total

liabilities and equity $ 12,281,549 $ 10,664,350

SCHEDULE 5UNAUDITED CONSOLIDATED

STATEMENTS OF CASH FLOWSGLOBAL PAYMENTS INC. AND

SUBSIDIARIES(In thousands)

Nine Months Ended

September 30,

2017

September 30,

2016

Cash flows from operating activities: Net income $ 243,765 $

192,804 Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization of property and

equipment 80,868 62,964 Amortization of acquired intangibles

249,095 173,345 Share-based compensation expense 30,771 26,060

Provision for operating losses and bad debts 37,203 26,069

Amortization of capitalized customer acquisition costs 32,863 9,337

Deferred income taxes (51,093 ) (30,504 ) Gain on sale of

investments — (41,150 ) Other, net 34,190 26,790 Changes in

operating assets and liabilities, net of the effects of

acquisitions: Accounts receivable (6,070 ) 14,216 Settlement

processing assets and obligations, net (232,713 ) (109 ) Prepaid

expenses and other assets (12,605 ) (27,474 ) Capitalized customer

acquisition costs (65,697 ) (45,425 ) Accounts payable and other

liabilities 19,546 (19,491 ) Net cash provided by operating

activities 360,123 367,432 Cash flows from investing

activities: Business acquisitions, net of cash acquired (563,009 )

(1,825,975 ) Capital expenditures (136,612 ) (102,442 ) Proceeds

from sale of investments — 37,783 Proceeds from sales of property

and equipment 37,520 — Other, net (48,056 ) (1,409 ) Net cash used

in investing activities (710,157 ) (1,892,043 ) Cash flows from

financing activities: Net proceeds from (repayments of) settlement

lines of credit 77,397 (952 ) Proceeds from long-term debt

1,713,324 3,263,045 Repayments of long-term debt (1,386,721 )

(1,110,258 ) Payment of debt issuance costs (9,520 ) (58,448 )

Repurchase of common stock (32,811 ) (130,314 ) Proceeds from stock

issued under share-based compensation plans 7,068 5,614 Common

stock repurchased - share-based compensation plans (21,171 )

(15,622 ) Proceeds from sale of subsidiary shares to noncontrolling

interest — 16,374 Distributions to noncontrolling interests (9,301

) (10,216 ) Dividends paid (5,141 ) (4,376 ) Net cash provided by

financing activities 333,124 1,954,847 Effect of

exchange rate changes on cash 40,181 (7,142 ) Increase in

cash and cash equivalents 23,271 423,094 Cash and cash equivalents,

beginning of the period 1,162,779 587,751 Cash and

cash equivalents, end of the period $ 1,186,050 $ 1,010,845

SCHEDULE 6RECONCILIATION OF

NON-GAAP FINANCIAL MEASURES TO GAAP MEASURES (UNAUDITED)THREE

MONTHS ENDED SEPTEMBER 30, 2017 AND 2016GLOBAL PAYMENTS INC. AND

SUBSIDIARIES(In thousands, except per share data)

Three Months Ended September 30, 2017 GAAP

Net Revenue

Adjustments1

Earnings

Adjustments2

Income

Taxes on

Adjustments3

Non-GAAP Revenues $ 1,038,907 $ (108,496 ) $ — $ — $ 930,411

Operating income $ 172,471 $ 2,008 $ 116,294 $ — $ 290,773

Net income attributable to Global Payments $ 110,740 $ 2,008

$ 114,496 $ (48,931 ) $ 178,313 Diluted earnings per share

attributable to Global Payments4 $ 0.71 $ 1.15 Three

Months Ended September 30, 2016 GAAP

Net Revenue

Adjustments1

Earnings

Adjustments2

Income

Taxes on

Adjustments3

Non-GAAP Revenues $ 951,885 $ (123,449 ) $ — $ — $ 828,436

Operating income $ 120,389 $ — $ 129,554 $ — $ 249,943 Net

income attributable to Global Payments $ 55,510 $ — $ 127,723 $

(45,308 ) $ 137,925 Diluted earnings per share attributable

to Global Payments4 $ 0.36 $ 0.89

1 Represents adjustments to revenues for

gross-up related payments (included in operating expenses)

associated with certain lines of business to reflect economic

benefits to the company. For the three months ended September 30,

2017, includes $2.0 million to eliminate the effect of acquisition

accounting fair value adjustments for software deferred revenue

associated with the ACTIVE Network transaction.

2 Earnings adjustments to operating income

for the three months ended September 30, 2017 include $84.9 million

in cost of service and $31.4 million in selling, general and

administrative expenses. Adjustments to cost of service include

amortization of acquired intangibles of $84.5 million, $0.3

million of acquisition and integration costs and employee

termination costs of $0.1 million. Adjustments to selling,

general and administrative expenses include share-based

compensation expense of $9.9 million, acquisition and integration

costs of $21.2 million and employee termination costs of $0.3

million.

Earnings adjustments to operating income

for the three months ended September 30, 2016 include $87.0 million

in cost of service and $42.6 million in selling, general and

administrative expenses. Adjustments to cost of service include

amortization of acquired intangibles of $86.2 million and employee

termination costs and other adjustments of $0.8 million.

Adjustments to selling, general and administrative expenses include

share-based compensation expense of $8.4 million, acquisition and

integration costs of $34.0 million and employee termination costs

and other adjustments of $0.2 million.

3 Income taxes on adjustments reflect the

tax effect of earnings adjustments to income before income taxes.

The tax rate used in determining the tax impact of earnings

adjustments is either the jurisdictional statutory rate in effect

at the time of the adjustment or the jurisdictional expected annual

effective tax rate for the period, depending on the nature and

timing of the adjustment. In addition, income taxes on adjustments

for the three months ended September 30, 2017 reflect the removal

of a $7.7 million tax benefit associated with the vesting of

share-based awards.

4 Adjusted EPS is calculated by dividing

adjusted net income attributable to Global Payments by the diluted

weighted-average number of shares outstanding.

See “Non-GAAP Financial Measures”

discussion on Schedule 10.

SCHEDULE 7RECONCILIATION OF

NON-GAAP FINANCIAL MEASURES TO GAAP MEASURES (UNAUDITED)NINE

MONTHS ENDED SEPTEMBER 30, 2017 AND 2016GLOBAL PAYMENTS INC. AND

SUBSIDIARIES(In thousands, except per share data)

Nine Months Ended September 30, 2017 GAAP

Net Revenue

Adjustments1

Earnings

Adjustments2

Income

Taxes on

Adjustments3

Non-GAAP Revenues $ 2,920,910 $ (338,679 ) $ — $ — $

2,582,231 Operating income $ 409,293 $ 2,008 $ 355,959 $ — $

767,260 Net income attributable to Global Payments $ 226,463

$ 2,008 $ 357,372 $ (133,129 ) $ 452,714 Diluted earnings

per share attributable to Global Payments4 $ 1.47 $ 2.94

Nine Months Ended September 30, 2016 GAAP

Net Revenue

Adjustments1

Earnings

Adjustments2

Income

Taxes on

Adjustments3

Non-GAAP Revenues $ 2,420,789 $ (396,443 ) $ — $ — $ 2,024,346

Operating income $ 276,122 $ — $ 305,627 $ — $ 581,749

Net income attributable to Global Payments $ 177,654 $ — $

260,596 $ (102,514 ) $ 335,736 Diluted earnings per share

attributable to Global Payments4 $ 1.23 $ 2.32

1 Represents adjustments to revenues for

gross-up related payments (included in operating expenses)

associated with certain lines of business to reflect economic

benefits to the company. For the nine months ended September 30,

2017, includes $2.0 million to eliminate the effect of acquisition

accounting fair value adjustments for software deferred revenue

associated with the ACTIVE Network transaction.

2 Earnings adjustments to operating income

for the nine months ended September 30, 2017 include $252.8 million

in cost of service and $103.2 million in selling, general and

administrative expenses. Adjustments to cost of service include

amortization of acquired intangibles of $250.7 million, employee

termination costs of $1.8 million and acquisition and integration

costs of $0.3 million. Adjustments to selling, general and

administrative expenses include share-based compensation expense of

$31.1 million, acquisition and integration costs of $69.2 million

and employee termination costs of $2.9 million. Net income

attributable to Global Payments also reflects an adjustment to

remove a non-cash charge of $6.8 million associated with the

refinancing of our corporate credit facility.

Earnings adjustments to operating income

for the nine months ended September 30, 2016 include $176.1 million

in cost of service and $129.5 million in selling, general and

administrative expenses. Adjustments to cost of service represent

amortization of acquired intangibles of $175.0 million and employee

termination costs and other adjustments of $1.1 million.

Adjustments to selling, general and administrative expenses include

share-based compensation expense of $25.0 million, acquisition and

integration costs of $94.0 million, litigation related costs of

$7.6 million and employee termination costs and other adjustments

of $2.9 million. Net income attributable to Global

Payments also reflects an adjustment to remove a gain on the

sale of membership interests in Visa Europe of $41.2

million.

3 Income taxes on adjustments reflect the

tax effect of earnings adjustments to income before income taxes.

The tax rate used in determining the tax impact of earnings

adjustments is either the jurisdictional statutory rate in effect

at the time of the adjustment or the jurisdictional expected annual

effective tax rate for the period, depending on the nature and

timing of the adjustment. In addition, income taxes on adjustments

for the nine months ended September 30, 2017 reflect the removal of

a $2.4 million tax benefit associated with the elimination of a

deferred tax liability and the removal of a $4.0 million tax

benefit associated with the vesting of share-based awards. For the

nine months ended September 30, 2016, income taxes on adjustments

reflect the removal of a $10.9 million tax benefit associated with

our decision to indefinitely reinvest earnings in Canada.

4 Adjusted EPS is calculated by dividing

adjusted net income attributable to Global Payments by the diluted

weighted-average number of shares outstanding.

See “Non-GAAP Financial Measures”

discussion on Schedule 10.

SCHEDULE 8RECONCILIATION OF

SEGMENT NON-GAAP FINANCIAL MEASURES TO GAAP MEASURES

(UNAUDITED)THREE MONTHS ENDED SEPTEMBER 30, 2017 AND 2016GLOBAL

PAYMENTS INC. AND SUBSIDIARIES(In thousands)

Three Months Ended September 30, 2017

Three Months Ended September 30, 2016 GAAP

Net Revenue

Adjustments1

Earnings

Adjustments2

Non-GAAP GAAP

Net Revenue

Adjustments1

Earnings

Adjustments2

Non-GAAP

Revenues: North America $ 764,902 $ (79,126

) $ — $ 685,776 $ 718,977 $ (100,265 ) $ — $ 618,712 Europe 205,203

(29,370 ) — 175,833 173,246 (23,184 ) — 150,062 Asia-Pacific 68,802

— — 68,802 59,662 — —

59,662 $ 1,038,907 $ (108,496 ) $ — $

930,411 $ 951,885 $ (123,449 ) $ — $ 828,436

Operating income: North America $ 138,345 $

2,008 $ 76,517 $ 216,870 $ 110,983 $ — $ 77,214 $ 188,197 Europe

76,214 — 6,916 83,130 63,727 — 7,290 71,017 Asia-Pacific 20,032 —

2,165 22,197 14,657 — 2,634 17,291 Corporate (62,120 ) —

30,696 (31,424 ) (68,978 ) — 42,416 (26,562 )

$ 172,471 $ 2,008 $ 116,294 $ 290,773 $

120,389 $ — $ 129,554 $ 249,943

1 Represents adjustments to revenues for

gross-up related payments (included in operating expenses)

associated with certain lines of business to reflect economic

benefits to the company. For the three months ended September 30,

2017, includes $2.0 million to eliminate the effect of acquisition

accounting fair value adjustments for software deferred revenue

associated with the ACTIVE Network transaction.

2 Earnings adjustments to operating income

for the three months ended September 30, 2017 include $84.9 million

in cost of service and $31.4 million in selling, general and

administrative expenses. Adjustments to cost of service include

amortization of acquired intangibles of $84.5 million, $0.3

million of acquisition and integration costs and employee

termination costs of $0.1 million. Adjustments to selling,

general and administrative expenses include share-based

compensation expense of $9.9 million, acquisition and integration

costs of $21.2 million and employee termination costs of $0.3

million.

Earnings adjustments to operating income

for the three months ended September 30, 2016 include $87.0 million

in cost of service and $42.6 million in selling, general and

administrative expenses. Adjustments to cost of service include

amortization of acquired intangibles of $86.2 million and employee

termination costs and other adjustments of $0.8 million.

Adjustments to selling, general and administrative expenses include

share-based compensation expense of $8.4 million, acquisition and

integration costs of $34.0 million and employee termination costs

and other adjustments of $0.2 million.

See “Non-GAAP Financial Measures”

discussion on Schedule 10.

SCHEDULE 9RECONCILIATION OF

SEGMENT NON-GAAP FINANCIAL MEASURES TO GAAP MEASURES

(UNAUDITED)NINE MONTHS ENDED SEPTEMBER 30, 2017 AND 2016GLOBAL

PAYMENTS INC. AND SUBSIDIARIES(In thousands)

Nine Months Ended September 30, 2017

Nine Months Ended September 30, 2016 GAAP

Net Revenue

Adjustments1

Earnings

Adjustments2

Non-GAAP GAAP

Net Revenue

Adjustments1

Earnings

Adjustments2

Non-GAAP

Revenues: North America $ 2,162,911 $

(255,241 ) $ — $ 1,907,670 $ 1,770,957 $ (335,277 ) $ — $ 1,435,680

Europe 557,258 (83,438 ) — 473,820 479,620 (61,166 ) — 418,454

Asia-Pacific 200,741 — — 200,741

170,212 — — 170,212 $ 2,920,910

$ (338,679 ) $ — $ 2,582,231 $ 2,420,789 $

(396,443 ) $ — $ 2,024,346

Operating

income: North America $ 344,604 $ 2,008 $ 227,779 $ 574,391 $

258,648 $ — $ 150,654 $ 409,302 Europe 196,394 — 22,911 219,305

172,293 — 27,319 199,612 Asia-Pacific 57,321 — 5,435 62,756 40,266

— 8,755 49,021 Corporate (189,026 ) — 99,834 (89,192

) (195,085 ) — 118,899 (76,186 ) $ 409,293 $

2,008 $ 355,959 $ 767,260 $ 276,122 $ —

$ 305,627 $ 581,749

1 Represents adjustments to revenues for

gross-up related payments (included in operating expenses)

associated with certain lines of business to reflect economic

benefits to the company. For the nine months ended September 30,

2017, includes $2.0 million to eliminate the effect of acquisition

accounting fair value adjustments for software deferred revenue

associated with the ACTIVE Network transaction.

2 Earnings adjustments to operating income

for the nine months ended September 30, 2017 include $252.8 million

in cost of service and $103.2 million in selling, general and

administrative expenses. Adjustments to cost of service include

amortization of acquired intangibles of $250.7 million, employee

termination costs of $1.8 million and acquisition and integration

costs of $0.3 million. Adjustments to selling, general and

administrative expenses include share-based compensation expense of

$31.1 million, acquisition and integration costs of $69.2 million

and employee termination costs of $2.9 million.

Earnings adjustments to operating income

for the nine months ended September 30, 2016 include $176.1 million

in cost of service and $129.5 million in selling, general and

administrative expenses. Adjustments to cost of service represent

amortization of acquired intangibles of $175.0 million and employee

termination costs and other adjustments of $1.1 million.

Adjustments to selling, general and administrative expenses include

share-based compensation expense of $25.0 million, acquisition and

integration costs of $94.0 million, litigation related costs of

$7.6 million and employee termination costs and other adjustments

of $2.9 million.

See “Non-GAAP Financial Measures”

discussion on Schedule 10.

SCHEDULE 10OUTLOOK SUMMARY

(UNAUDITED)GLOBAL PAYMENTS INC. AND SUBSIDIARIES(In billions,

except per share data)

2016 Actual 2017 Outlook

% Change Revenues: GAAP revenue $ 3.37 $3.945 to $3.97 17% to 18%

Adjustments1 (0.53 ) (0.44 ) Adjusted net revenue $

2.84 $3.505 to $3.53 23% to 24% Earnings Per Share

("EPS"): GAAP diluted EPS $ 1.37 $1.97 to $2.05 44% to 50%

Acquisition-related amortization expense, share-based compensation

expense and other items2 1.82 1.97

Adjusted EPS $ 3.19 $3.94 to $4.02 24% to 26%

1 Represents adjustments to revenues for

gross-up related payments (included in operating expenses)

associated with certain lines of business to reflect economic

benefits to the company. For 2017, includes adjustments to

eliminate the effect of acquisition accounting fair value

adjustments for software deferred revenue associated with the

ACTIVE Network transaction.

2 Adjustments to Calendar 2016 GAAP

diluted EPS include acquisition related amortization expense of

$1.17, share-based compensation expense of $0.14 and net other

items of $0.51, including merger-related costs of $0.62, a $0.16

adjustment to remove a gain on the sale of membership interests in

Visa Europe and a $0.07 adjustment to remove a tax benefit

associated with our decision to indefinitely reinvest earnings in

Canada. Adjustments to 2016 GAAP diluted EPS also includes the

effect of these adjustments on noncontrolling interests and income

taxes, as applicable. For 2017, includes the revenue adjustment

described above and adjustments for acquisition-related

amortization expense, share-based compensation expense, acquisition

and integration costs, employee termination costs and certain

income tax benefits.

NON-GAAP FINANCIAL MEASURES

Global Payments supplements revenues, income and EPS information

determined in accordance with U.S. GAAP by providing these measures

with certain adjustments (such measures being non-GAAP financial

measures) in this document to assist with evaluating our

performance. In addition to GAAP measures, management uses these

non-GAAP financial measures to focus on the factors the company

believes are pertinent to the daily management of our operations.

Management believes adjusted net revenue more closely reflects the

economic benefits to the company’s core business and allows for

better comparisons with industry peers. Management uses these

non-GAAP financial measures, together with other metrics, to set

goals for and measure the performance of the business and to

determine incentive compensation. Adjusted net revenue, adjusted

operating income, adjusted net income and adjusted EPS should be

considered in addition to, and not as substitutes for, revenues,

operating income, net income and EPS determined in accordance with

GAAP. The non-GAAP financial measures reflect management’s judgment

of particular items, and may not be comparable to similarly titled

measures reported by other companies.

Adjusted net revenue excludes gross-up related payments

associated with certain lines of business to reflect economic

benefits to the company. On a GAAP basis, these payments are

presented gross in both revenues and operating expenses.

Adjusted operating income, adjusted net income and adjusted EPS

exclude acquisition-related amortization expense, share-based

compensation and certain other items specific to each reporting

period as more fully described in the accompanying reconciliations

in Schedules 6, 7, 8 and 9. The tax rate used in determining the

net income impact of earnings adjustments is either the

jurisdictional statutory rate in effect at the time of the

adjustment or the jurisdictional expected annual effective tax rate

for the period, depending on the nature and timing of the

adjustment.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171108005375/en/

Global Payments Inc.Investor contact:Isabel Janci,

770-829-8478investor.relations@globalpay.comorMedia

contact:Amy Corn,

770-829-8755media.relations@globalpay.com

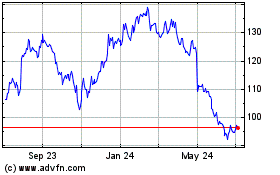

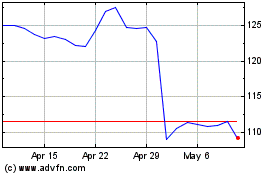

Global Payments (NYSE:GPN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Global Payments (NYSE:GPN)

Historical Stock Chart

From Sep 2023 to Sep 2024