By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

Logistics and transportation companies are scrambling to match

hiring to growing demand. Employment in the transportation and

warehousing sector rose by 8,400 jobs from September to October,

WSJ Logistics Report's Jennifer Smith writes, with surging

shipments and an expected boom in e-commerce sales fueling the

employment boost. Some companies are reporting that the only thing

holding back their hiring is their ability to bring new workers on

board in a timely manner. Overall trucking payrolls were

essentially flat last month, according to the broad government

figures, even as operators like less-than-truckload market major

Old Dominion Freight Line Inc. said they added hundreds of workers

and raised pay. Freight businesses are facing more competition for

workers from industries like the construction business, which has

added 11,000 jobs in each of the past two months. Warehousing and

parcel carriers showed the biggest gains for logistics last month

even as retailers cut their payrolls at stores, a strong sign of

where business is going in the coming weeks and beyond.

Retail price wars are already underway and the holiday sales

season hasn't even started. Amazon.com Inc. has started lowering

prices on goods offered by independent merchants on its

marketplace, the WSJ's Laura Stevens reports, potentially lining up

a fierce competition with low-cost rivals just as the critical

shopping season is set to begin. It also sets up a potential

conflict in Amazon's relationships with sellers. The e-commerce

giant generally controls pricing only on the goods it sells

directly, but the new lower prices come with a tag that the

"discount is provided by Amazon." The discounts could be a mixed

bag for some merchants, helping drive sales at no extra cost to the

seller while unexpectedly depleting inventory. And they could

violate a merchant's agreement with a brand on pricing of products.

Third-party sales have become more important to Amazon, boosting

revenue without adding inventory, and the company is showing it's

willing to pay for a bigger share of the market.

The largest supermarket chain in the U.S. wants to sell blouses

along with broccoli. Kroger Co. plans to launch an apparel line in

the coming year in a bid to bring more shoppers into its stores,

the WSJ's Heather Haddon reports, and compete more with big

retailers that have expanded into the grocery business. The move

will add new wrinkles to Kroger's supply chain, from purchasing to

distribution, while extending a shift in the retail world that has

seen stores blur traditional boundaries between various lines of

business. That's largely a result of internet-driven changes in

consumer buying patterns, but for Kroger the push toward clothing

could have a big impact on physical stores. The clothing line will

operate under a private-label umbrella, part of a broader move by

the grocer to push its own branded products. The brand strategy is

aimed at lowering costs while Kroger hopes the clothing line will

give it a bigger share of its customers' buying dollars.

ECONOMY & TRADE

Americans may have some competition this year for a staple of

their holiday dinner table. A newfound taste among Chinese

consumers for cranberries is turning the berries into a booming

export business, the WSJ's Jennifer Levitz reports. That's vaulted

China from barely any consumption five years ago to the

second-largest foreign market for U.S.-processed cranberries last

year. That's been a boon to a niche of the agriculture field that

has been looking to boost domestic and international demand to help

manage large supplies. U.S. cranberry production this year is

expected to be the second-largest in history, after 2016's record

crop, but cranberry consumption is up only slightly. The export

surge is the latest example of how changes in buying patterns in

China can cause big waves around the world because of the sheer

scale of the consumer market. And the consumer tastes for those

imports are triggering more investment in supply chains within

China, including the refrigeration needed to get the goods to

market.

QUOTABLE

IN OTHER NEWS

Global oil prices hit a two-year high today after Saudi Arabia

made a string of arrests in a corruption crackdown. (WSJ)

A new U.S. government report draws a direct line between human

activity and the quickening pace of climate change. (WSJ)

U.S. trade rose at a strong pace in September, with imports up

1.2% by value and exports rising 1.1%. (WSJ)

A broad gauge of U.S. services activity ticked up in October to

its highest level in more than 12 years. (WSJ)

Canadian exports fell in September for a fourth straight month.

(WSJ)

Canada's economy added a net 35,000 jobs in October, far ahead

of expectations. (WSJ)

Documents show U.S. Commerce Secretary Wilbur Ross didn't

disclose connections between his interests in a shipping business

and Russian President Vladimir Putin's family and inner circle.

(WSJ)

Sears Holdings Corp. plans to close 63 more stores early next

year. (WSJ)

Qatar Airways Co. is buying a 9.6% stake in Cathay Pacific

Airways Ltd. (WSJ)

Broadcom Ltd. plans an unsolicited takeover approach to rival

chip maker Qualcomm. (WSJ)

Chip maker Marvell Technology Group Ltd. is in talks to combine

with Cavium Inc. (WSJ)

Nestle SA is acquiring Chameleon Cold-Brew, its second recent

buy of a niche American coffee brand. (WSJ)

U.S. federal investigators have contacted General Motors Co. and

Ford Motor Co. in a probe of job-training programs set up with the

top autoworker union. (WSJ)

Amazon is ending its Fresh grocery delivery service in some U.S.

cities. (Reuters)

CSX Corp. is withdrawing from freight projects in Ohio and North

Carolina as the railroad overhauls its intermodal strategy.

(Trains)

Almost two-thirds of European businesses who buy from British

suppliers expect to shift purchasing to within the single market

after Brexit. (The Guardian)

China lifted its ban on imports of Australian beef. (Sydney

Morning Herald)

The chief of South Korea's SM Line wants to expand in part by

buying domestic and overseas shipping companies. (Lloyd's List)

West Africa's container imports from Asia are rising for the

first time since 2014. (IHS Fairplay)

Honda Motor Co. tripled the number of autos shipped through

Georgia's Port of Brunswick in the past 12 months. (Associated

Press)

Brazil exported a record $641.6 million in vehicles in August.

(Automotive Logistics)

Mazda Motor plans to release electric vehicles with

range-extending rotary engines in 2019. (Nikkei Asian Review)

Japanese logistics company SG Holdings Co expects to raise $1.1

billion in an initial public offering. (Reuters)

The U.S. Postal Service awarded a $214 million contract to

Spartan Motors Inc. to build cargo vehicles. (Lansing State

Journal)

Chicago Rockford Airport in Illinois is upgrading capacity after

seeing a 44% gain in cargo volume in the past year. (The

Loadstar)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

November 06, 2017 06:46 ET (11:46 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

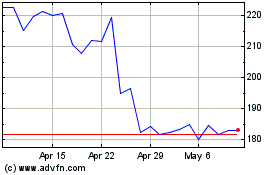

Old Dominion Freight Line (NASDAQ:ODFL)

Historical Stock Chart

From Mar 2024 to Apr 2024

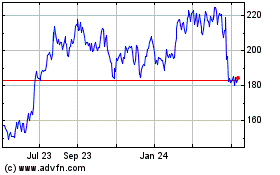

Old Dominion Freight Line (NASDAQ:ODFL)

Historical Stock Chart

From Apr 2023 to Apr 2024