- Total revenues increased 5% to $10.4

billion in the third quarter

- Shareholders’ net income for the

third quarter was $560 million, or $2.21 per share

- Adjusted income from

operations1 in the third quarter was $716 million, or

$2.83 per share

- Global medical customer2

growth projection increased to approximately 650,000 lives in

2017

- Adjusted income from

operations1,3 is now projected to be in the range of

$2.60 billion to $2.65 billion in 2017, or $10.20 to $10.40 per

share4, which represents per share growth of 26% to

28% over 2016

Cigna Corporation (NYSE: CI) today reported third quarter 2017

results with strong performance across the company’s Global Health

Care, Global Supplemental Benefits and Group Disability & Life

segments.

“Cigna’s third quarter results are driven by consistent, strong

execution of our strategy to provide affordable and personalized

solutions for our customers and clients around the globe,” said

David M. Cordani, President and Chief Executive Officer. “As we

look ahead to 2018, we expect to drive continued innovation and

growth as we deliver sustained value in a rapidly changing and

dynamic environment.”

Total revenues in the quarter were $10.4 billion, an increase of

5% over third quarter 2016, driven by continued growth in Cigna's

targeted customer segments.

For the third quarter of 2017, shareholders’ net income was $560

million, or $2.21 per share, compared with $456 million, or $1.76

per share, for the third quarter of 2016.

Cigna's adjusted income from operations1 for the third quarter

of 2017 was $716 million, or $2.83 per share, compared with $503

million, or $1.94 per share, for the third quarter of 2016. This

reflects significantly increased earnings contributions from each

of our business segments.

Reconciliations of shareholders’ net income to adjusted income

from operations1 are provided on the following page, and on Exhibit

2 of this earnings release.

CONSOLIDATED HIGHLIGHTS

The following table includes highlights of results and

reconciliations of consolidated operating revenues5 to total

revenues and adjusted income from operations1 to shareholders’ net

income:

Consolidated Financial Results (dollars in millions, customers

in thousands): Nine Months

Three Months Ended Ended September 30, June

30, September 30, 2017

2016 2017 2017

Total Revenues $ 10,382 $ 9,880 $ 10,318 $ 31,085 Net

Realized Investment (Gains) (117) (75)

(51) (214) Consolidated Operating Revenues5 $

10,265 $ 9,805 $ 10,267 $ 30,871

Consolidated Earnings,

net of taxes Shareholders’ Net Income $ 560 $ 456 $ 813 $ 1,971

Net Realized Investment (Gains) (75) (48) (34) (140) Amortization

of Other Acquired Intangible Assets 16 24 18 54 Special Items1

215 71 (47) 300

Adjusted Income from Operations1 $ 716 $ 503 $ 750

$ 2,185 Shareholders’ Net Income, per share $ 2.21

$ 1.76 $ 3.15 $ 7.67 Adjusted Income from

Operations1, per share $ 2.83 $ 1.94 $ 2.91 $

8.50

- Third quarter 2017 shareholders’ net

income included special item1 charges of $215 million after-tax, or

$0.85 per share, predominantly associated with the previously

disclosed early extinguishment of debt, compared with special item1

charges in third quarter 2016 of $71 million after-tax, or $0.28

per share, for merger-related transaction costs and a litigation

matter.

- Cash and marketable investments at the

parent company were $1.7 billion at September 30, 2017 and $2.8

billion at December 31, 2016.

- Year to date, as of November 1, 2017,

the Company repurchased 13.2 million shares of common stock for

approximately $2.3 billion.

HIGHLIGHTS OF SEGMENT RESULTS

See Exhibit 2 for a reconciliation of adjusted income (loss)

from operations1 to shareholders’ net income.

Global Health

Care

This segment includes Cigna’s Commercial and Government

businesses that deliver medical and specialty health care products

and services to domestic and multi-national clients and customers

using guaranteed cost, retrospectively experience-rated and

administrative services only (“ASO”) funding arrangements.

Specialty health care includes behavioral, dental, disease and

medical management, stop loss and pharmacy-related products and

services.

Financial Results (dollars in millions, customers in

thousands): Nine Months

Three Months Ended Ended September 30,

June 30,

September 30, 2017 2016

2017

2017 Premiums and Fees $ 7,197 $ 6,807

$ 7,179 $ 21,715 Adjusted Income from Operations1 $ 575 $ 416 $ 591

$ 1,776 Adjusted Margin, After-Tax6 7.1% 5.4% 7.3% 7.3%

As of the Periods Ended September 30,

June 30,

December 31,

Customers:

2017 2016

2017 2016 Commercial 15,332 14,594

15,163 14,631 Government 484 583

491 566 Medical2 15,816 15,177 15,654 15,197

Behavioral Care7 26,636 25,643 26,014 25,790 Dental 15,776 14,960

15,760 14,981 Pharmacy 8,959 8,370 8,902 8,461 Medicare Part D 812

999 823 972

- Global Health Care results in the third

quarter reflect strong performance led by our Commercial

business.

- Third quarter 2017 premiums and fees

increased 6% relative to third quarter 2016, driven by customer

growth and specialty contributions in our Commercial business,

partially offset by lower enrollment in our Government business, as

expected.

- The medical customer base2 at the end

of the third quarter 2017 totaled 15.8 million, an increase of

619,000 customers year to date, driven by organic growth across our

Commercial market segments.

- Third quarter 2017 adjusted income from

operations1 and adjusted margin, after-tax6 reflect strong medical

and specialty results, continued effective medical cost management

and operating expense discipline.

- Adjusted income from operations1 for

third quarter 2017 and second quarter 2017 included favorable prior

year reserve development on an after-tax basis of $19 million and

$36 million, respectively. Third quarter of 2016 did not have a

meaningful amount of net prior year reserve development.

Year-to-date 2017 adjusted income from operations1 includes

favorable prior year reserve development on an after-tax basis of

$116 million.

- The Total Commercial medical care

ratio8 (“MCR”) of 78.6% for third quarter 2017 reflects strong

performance and effective medical cost management in both our

Employer and Individual books of business, as well as the impact of

the health insurance tax moratorium.

- The Total Government MCR8 of 84.0% for

third quarter 2017 reflects solid performance in our Medicare

Advantage and Medicare Part D businesses.

- The third quarter 2017 Global Health

Care operating expense ratio8 of 21.1% reflects the impact of the

health insurance tax moratorium, business mix changes and continued

effective expense management.

- Global Health Care net medical costs

payable9 was approximately $2.52 billion at September 30, 2017 and

$2.26 billion at December 31, 2016.

Global Supplemental

Benefits

This segment includes Cigna’s global individual supplemental

health, life and accident insurance business, primarily in Asia,

and Medicare supplement coverage in the United States.

Financial Results (dollars in millions, policies in

thousands):

Nine Months Three Months Ended

Ended September 30,

June 30,

September 30, 2017 2016

2017

2017 Premiums and Fees10 $ 937 $ 833 $

914 $ 2,720 Adjusted Income from Operations1 $ 109 $ 81 $ 105 $ 288

Adjusted Margin, After-Tax6 11.1% 9.4% 11.0% 10.1%

As of

the Periods Ended September 30,

June 30,

December 31, 2017 2016

2017 2016

Policies10 13,087 12,069 13,058 12,151

- Global Supplemental Benefits results

continue to reflect the value created by affordable and

personalized solutions delivered directly to individual consumers

through a diversified set of distribution channels.

- Third quarter 2017 premiums and fees10

grew 12% over third quarter 2016, reflecting continued business

growth.

- Third quarter 2017 adjusted income from

operations1 and adjusted margin, after-tax6 reflect business

growth, favorable claims experience, particularly in South Korea,

and effective operating expense management.

Group Disability and

Life

This segment includes Cigna’s group disability, life and

accident insurance operations.

Financial Results (dollars in millions):

Nine Months Three Months

Ended Ended September 30,

June 30,

September 30, 2017 2016

2017 2017 Premiums

and Fees $ 1,015 $ 1,024 $ 1,022 $ 3,068 Adjusted Income (Loss)

from Operations1 $ 73 $ 53 $ 83 $ 224 Adjusted Margin, After-Tax6

6.6% 4.8% 7.5% 6.7%

- Group Disability and Life results

reflect the value created for our customers and clients through

differentiated solutions that enhance health, productivity and

sense of security.

- Third quarter 2017 adjusted income from

operations1 and adjusted margin, after-tax6 reflect favorable

claims experience in our life business, and disability results

consistent with our expectations.

Corporate & Other

Operations

Adjusted loss from operations1 for Cigna's remaining operations

is presented below:

Financial Results (dollars in

millions):

Nine Months Three Months Ended

Ended September 30,

June 30,

September 30, 2017 2016

2017 2017

Corporate & Other Operations $ (41) $ (47) $ (29) $ (103)

2017 OUTLOOK

Cigna's outlook for full year 2017 consolidated adjusted income

from operations1,3 is in the range of $2.60 billion to $2.65

billion, or $10.20 to $10.40 per share. Cigna’s outlook excludes

the impact of additional prior year reserve development and

potential effects of any future capital deployment.4

(dollars in millions, except where noted

and per share amounts)

Projection for Full-Year Ending December 31,

2017 Adjusted Income (Loss) from

Operations1,3 Global Health Care $ 2,140 to 2,170 Global

Supplemental Benefits $ 345 to 355 Group Disability and Life $ 275

to 285 Ongoing Businesses $ 2,760 to 2,810 Corporate &

Other Operations $ (160) Consolidated Adjusted Income from

Operations1,3 $ 2,600 to 2,650 Consolidated Adjusted Income

from Operations, per share1,3,4 $ 10.20 to 10.40

2017 Operating

Metrics and Ratios Outlook

Total Revenue Growth

Approximately 4%

Full Year Total Commercial Medical Care Ratio8 80% to

81%

Full Year Total Government Medical Care

Ratio8

84.5% to 85.5%

Full Year Global Health Care Operating

Expense Ratio8

Approximately 21%

Global Medical Customer Growth2

Approximately 650,000 customers

The foregoing statements represent the Company’s current

estimates of Cigna's 2017 consolidated and segment adjusted income

from operations1,3 and other key metrics as of the date of this

release. Actual results may differ materially depending on a number

of factors. Investors are urged to read the Cautionary Note

Regarding Forward-Looking Statements included in this release.

Management does not assume any obligation to update these

estimates.

This quarterly earnings release and the Quarterly Financial

Supplement are available on Cigna’s website in the Investor

Relations section (http://www.cigna.com/aboutcigna/investors).

Management will be hosting a conference call to review third

quarter 2017 results and discuss full year 2017 outlook beginning

today at 8:30 a.m. EDT. A link to the conference call is available

in the Investor Relations section of Cigna's website located at

http://www.cigna.com/cignadotcom/aboutcigna/investors/events/index.page.

The call-in numbers for the conference call are as follows:

Live Call(800) 369-1781

(Domestic)(210) 234-0090 (International)Passcode:

11022017

Replay(800) 945-7247 (Domestic)(203) 369-3951

(International)

It is strongly suggested you dial in to the conference call by

8:15 a.m. EDT.

Notes:

1.

Adjusted income (loss) from operations

is defined as shareholders’ net income (loss) excluding the

following after-tax adjustments: net realized investment results,

net amortization of other acquired intangible assets and special

items. Special items are identified in Exhibit 2 of this earnings

release.

Adjusted income (loss) from operations

is a measure of profitability used by Cigna’s management because it

presents the underlying results of operations of Cigna’s businesses

and permits analysis of trends in underlying revenue, expenses and

shareholders’ net income. This consolidated measure is not

determined in accordance with accounting principles generally

accepted in the United States (GAAP) and should not be viewed as a

substitute for the most directly comparable GAAP measure,

shareholders’ net income. See Exhibits 1 and 2 for a reconciliation

of adjusted income from operations to shareholders’ net

income.

2.

Global medical customers include

individuals who meet any one of the following criteria: are covered

under a medical insurance policy, managed care arrangement, or

service agreement issued by Cigna; have access to Cigna's provider

network for covered services under their medical plan; or have

medical claims and services that are administered by Cigna.

3.

Management is not able to provide a

reconciliation to shareholders’ net income (loss) on a

forward-looking basis because we are unable to predict, without

unreasonable effort, certain components thereof including (i)

future net realized investment results and (ii) future special

items. These items are inherently uncertain and depend on various

factors, many of which are beyond our control. As such, any

associated estimate and its impact on shareholders’ net income

could vary materially.

4.

The Company’s outlook excludes the

potential effects of any share repurchases or business combinations

that may occur after the date of this earnings release.

5.

The measure “consolidated operating

revenues” is not determined in accordance with GAAP and should not

be viewed as a substitute for the most directly comparable GAAP

measure, “total revenues.” We define consolidated operating

revenues as total revenues excluding realized investment results.

We exclude realized investment results from this measure because

our portfolio managers may sell investments based on factors

largely unrelated to the underlying business purposes of each

segment. As a result, gains or losses created in this process may

not be indicative of past or future underlying performance of the

business. See Exhibit 1 for a reconciliation of consolidated

operating revenues to total revenues.

6.

Adjusted margin, after-tax, is

calculated by dividing adjusted income (loss) from operations by

operating revenues for each segment.

7.

Prior period behavioral care customers

have been revised to conform to current presentation.

8.

Operating ratios are defined as

follows:

•

Total Commercial medical care ratio

represents medical costs as a percentage of premiums for all

commercial risk products, including medical, pharmacy, dental, stop

loss and behavioral products provided through guaranteed cost or

experience-rated funding arrangements in both the United States and

internationally.

•

Total Government medical care ratio

represents medical costs as a percentage of premiums for Medicare

Advantage, Medicare Part D, and Medicaid products.

•

Global Health Care operating expense

ratio represents operating expenses excluding acquisition related

amortization expense as a percentage of operating revenue in the

Global Health Care segment.

9.

Global Health Care medical costs

payable are presented net of reinsurance and other recoverables.

The gross Global Health Care medical costs payable balance was

$2.78 billion as of September 30, 2017 and $2.53 billion as of

December 31, 2016.

10.

Cigna owns a 50% noncontrolling

interest in its China joint venture. Cigna's 50% share of the joint

venture’s earnings is reported in Other Revenues using the equity

method of accounting under GAAP. As such, the premiums and fees and

policy counts for the Global Supplemental Benefits segment do not

include the China joint venture.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This press release, and oral statements made with respect to

information contained in this release, may contain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are based on Cigna's

current expectations and projections about future trends, events

and uncertainties. These statements are not historical facts.

Forward-looking statements may include, among others, statements

concerning our projected adjusted income (loss) from operations

outlook for 2017, on both a consolidated and segment basis;

projected total revenue growth and global medical customer growth,

each over year end 2016; projected growth in 2018 and beyond;

projected medical care and operating expense ratios and medical

cost trends; future financial or operating performance, including

our ability to deliver personalized and innovative solutions for

our customers and clients; future growth, business strategy,

strategic or operational initiatives; economic, regulatory or

competitive environments, particularly with respect to the pace and

extent of change in these areas; financing or capital deployment

plans and amounts available for future deployment; our prospects

for growth in the coming years; and other statements regarding

Cigna's future beliefs, expectations, plans, intentions, financial

condition or performance. You may identify forward-looking

statements by the use of words such as “believe,” “expect,” “plan,”

“intend,” “anticipate,” “estimate,” “predict,” “potential,” “may,”

“should,” “will” or other words or expressions of similar meaning,

although not all forward-looking statements contain such terms.

Forward-looking statements are subject to risks and

uncertainties, both known and unknown, that could cause actual

results to differ materially from those expressed or implied in

forward-looking statements. Such risks and uncertainties include,

but are not limited to: our ability to achieve our financial,

strategic and operational plans or initiatives; our ability to

predict and manage medical costs and price effectively and develop

and maintain good relationships with physicians, hospitals and

other health care providers; the impact of modifications to our

operations and processes, including those in our disability

business; our ability to identify potential strategic acquisitions

or transactions and realize the expected benefits of such

transactions; the substantial level of government regulation over

our business and the potential effects of new laws or regulations

or changes in existing laws or regulations; the outcome of

litigation, regulatory audits, investigations, actions and/or

guaranty fund assessments; uncertainties surrounding participation

in government-sponsored programs such as Medicare; the

effectiveness and security of our information technology and other

business systems; unfavorable industry, economic or political

conditions including foreign currency movements; acts of war,

terrorism, natural disasters or pandemics; uncertainty as to the

outcome of the litigation between Cigna and Anthem, Inc. with

respect to the termination of the merger agreement, the reverse

termination fee and/or contract and non-contract damages for claims

each party has filed against the other, including the risk that a

court finds that Cigna has not complied with its obligations under

the merger agreement, is not entitled to receive the reverse

termination fee or is liable for breach of the merger agreement;,

as well as more specific risks and uncertainties discussed in our

most recent report on Form 10-K and subsequent reports on Forms

10-Q and 8-K available on the Investor Relations section of

www.cigna.com. You should not place undue reliance on

forward-looking statements, which speak only as of the date they

are made, are not guarantees of future performance or results, and

are subject to risks, uncertainties and assumptions that are

difficult to predict or quantify. Cigna undertakes no obligation to

update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise, except as may be

required by law.

CIGNA CORPORATION

COMPARATIVE SUMMARY OF FINANCIAL RESULTS (unaudited)

Exhibit 1 (Dollars in millions, except per share amounts)

Three Months Ended Nine

Months Ended September 30, September 30,

2017 2016

2017 2016 REVENUES

Premiums $ 8,030 $ 7,605 $ 24,143 $ 23,005 Fees 1,137 1,086 3,417

3,346 Net investment income 298 282 909 848 Mail order pharmacy

revenues 733 762 2,200 2,207 Other revenues 67 70

202 208 Consolidated operating revenues 10,265 9,805

30,871 29,614 Net realized investment gains 117 75 214 110

Total revenues $ 10,382 $ 9,880

$ 31,085 $ 29,724

SHAREHOLDERS' NET INCOME

(LOSS) Shareholders' net income $ 560 $ 456 $

1,971 $ 1,485 After-tax adjustments to reconcile to adjusted income

from operations: Realized investment (gains) (75) (48) (140) (71)

Amortization of other acquired intangible assets, net 16 24 54 72

Special items 215 71 300 133

Adjusted income from

operations (1) $ 716 $ 503 $

2,185 $ 1,619

Adjusted income

(loss) from operations by segment

Global Health Care $ 575 $ 416 $ 1,776 $ 1,446 Global Supplemental

Benefits 109 81 288 231 Group Disability and Life 73

53 224 56 Ongoing Operations 757 550 2,288 1,733

Corporate and Other (41) (47) (103) (114)

Total

adjusted income from operations $ 716 $ 503

$ 2,185 $ 1,619

DILUTED EARNINGS PER

SHARE Shareholders' net income $ 2.21 $ 1.76 $ 7.67 $

5.72 After-tax adjustments to reconcile to adjusted income from

operations: Realized investment (gains) (0.29) (0.19) (0.54) (0.27)

Amortization of other acquired intangible assets, net 0.06 0.09

0.21 0.28 Special items 0.85 0.28

1.16 0.51 Adjusted income

from operations (1) $ 2.83 $ 1.94

$ 8.50 $ 6.24 Weighted average shares (in thousands)

253,410 259,754

257,058 259,568 Common shares outstanding (in

thousands)

247,573 256,720

SHAREHOLDERS' EQUITY at

September 30 $

14,145 $ 13,974

SHAREHOLDERS' EQUITY PER

SHARE at September 30

$ 57.13 $ 54.43

(1) Adjusted income (loss) from operations is defined as

shareholders' net income (loss) excluding the following after-tax

adjustments: realized investment results; net amortization of other

acquired intangible assets; and special items (identified and

quantified on Exhibit 2).

CIGNA CORPORATION

RECONCILIATION OF SHAREHOLDERS' NET INCOME

(LOSS) TO ADJUSTED INCOME FROM OPERATIONS

Exhibit 2

(Dollars in millions, except per share

amounts)

Diluted Global Group Corporate

Earnings Global Supplemental Disability

and Per Share Consolidated Health Care

Benefits and Life Other Three Months

Ended, 3Q17 3Q16 2Q17

3Q17 3Q16 2Q17

3Q17 3Q16 2Q17

3Q17 3Q16 2Q17

3Q17 3Q16 2Q17

3Q17 3Q16 2Q17

Shareholders' net income (loss) $ 2.21 $ 1.76 $ 3.15 $ 560 $ 456 $

813 $ 610 $ 413 $ 599 $ 105 $ 77 $ 101 $ 97 $ 65 $ 97 $ (252) $

(99) $ 16 After-tax adjustments to reconcile to adjusted income

(loss) from operations: Realized investment (gains) losses (0.29)

(0.19) (0.13) (75) (48) (34) (47) (42) (22) - - - (24) (12) (14)

(4) 6 2 Amortization of other acquired intangible assets, net 0.06

0.09 0.07 16 24 18 12 20 14 4 4 4 - - - - - - Special items: Debt

extinguishment costs 0.82 - - 209 - - - - - - - - - - - 209 - -

Merger-related transaction costs 0.03 0.18 (0.18) 6 46 (47) - - - -

- - - - - 6 46 (47) Charges associated with litigation matters

- 0.10 - -

25 - - 25

- - - -

- - - -

- - Adjusted income (loss) from operations $

2.83 $ 1.94 $ 2.91 $ 716 $ 503 $

750 $ 575 $ 416 $ 591 $ 109 $ 81

$ 105 $ 73 $ 53 $ 83 $ (41)

$ (47) $ (29) Weighted average shares (in thousands)

253,410 259,754 258,061 Special items, pre-tax: Debt

extinguishment costs $ 321 $ - $ - $ - $ - $ - $ - $ - $ - $ - $ -

$ - $ 321 $ - $ - Merger-related transaction costs 9 49 16 - - - -

- - - - - 9 49 16 Charges associated with litigation matters

- 40 - - 40

- - - -

- - - -

- - Total $ 330 $ 89 $ 16

$ - $ 40 $ - $ - $ - $ -

$ - $ - $ - $ 330 $ 49 $

16 (Dollars in millions, except per share

amounts)

Diluted Global Group

Corporate

Earnings Global Supplemental Disability

and Per Share Consolidated Health Care

Benefits and Life Other Nine Months Ended

September 30, 3Q17 3Q16

3Q17 3Q16

3Q17 3Q16 3Q17

3Q16 3Q17

3Q16

3Q17

3Q16

Shareholders' net income (loss) $ 7.67 $ 5.72 $ 1,971 $

1,485 $ 1,753 $ 1,414 $ 283 $ 214 $ 253 $ 81 $ (318) $ (224)

After-tax adjustments to reconcile to adjusted income (loss) from

operations: Realized investment (gains) losses (0.54) (0.27) (140)

(71) (85) (49) (9) 1 (44) (25) (2) 2 Amortization of other acquired

intangible assets, net 0.21 0.28 54 72 40 56 14 16 - - - - Special

items: Debt extinguishment costs 0.81 - 209 - - - - - - - 209 -

Merger-related transaction costs (1) 0.03 0.41 8 108 - - - - - - 8

108 Long-term care guaranty fund assessment 0.32 - 83 - 68 - - - 15

- - - Charges associated with litigation matters -

0.10 -

25 - 25

- - -

- -

- Adjusted income (loss) from operations $ 8.50

$ 6.24 $ 2,185 $ 1,619 $

1,776 $ 1,446 $ 288

$ 231 $ 224 $ 56 $ (103)

$ (114) Weighted average shares (in thousands)

257,058 259,568 Common shares outstanding as of September 30, (in

thousands) 247,573 256,720 Special items, pre-tax: Debt

extinguishment costs $ 321 $ - $ - $ - $ - $ - $ - $ - $ 321 $ -

Merger-related transaction costs (1) 88 123 - - - - - - 88 123

Long-term care guaranty fund assessment 129 - 106 - - - 23 - - -

Charges associated with litigation matters -

40 - 40

- - -

- -

- Total $ 538 $ 163 $ 106

$ 40 $ - $ - $ 23

$ - $ 409 $ 123

(1) For additional information related to a one-time tax benefit

of approximately $60 million recorded in the second quarter of

2017, please refer to Note 3 to the Consolidated Financial

Statements in Cigna's Form 10-Q for the period ended September 30,

2017 expected to be filed on November 2, 2017.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171102005313/en/

Cigna CorporationWill McDowell, Investor Relations –

215-761-4198Matt Asensio, Media Relations –

860-226-2599

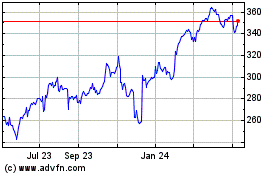

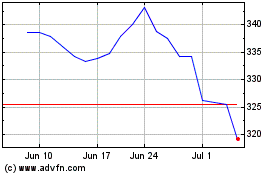

Cigna (NYSE:CI)

Historical Stock Chart

From Aug 2024 to Sep 2024

Cigna (NYSE:CI)

Historical Stock Chart

From Sep 2023 to Sep 2024