Boston Properties, Inc. (NYSE: BXP), a real estate

investment trust and one of the largest owners, managers and

developers of Class A office properties in the United States,

reported results today for the third quarter ended

September 30, 2017.

- Net income attributable to common

shareholders was $117.3 million compared to $76.8 million for the

quarter ended September 30, 2016.

- Net income attributable to common

shareholders per share (EPS) was $0.76 basic and $0.76 on a diluted

basis, compared to $0.50 basic and $0.50 on a diluted basis for the

quarter ended September 30, 2016.

- Funds from Operations (FFO) were

$243.0 million, or $1.57 per share basic and $1.57 per share

diluted. This compares to FFO of $219.6 million, or $1.43 per

share basic and $1.42 per share diluted, for the quarter ended

September 30, 2016.

- FFO of $1.57 per share diluted was

greater than the mid-point of the Company’s guidance previously

provided of $1.52 - $1.54 per share diluted primarily due to:

- $0.02 per share of additional

development and management services revenue;

- $0.01 per share due to better than

expected portfolio operations; and

- $0.01 per share of less than projected

general and administrative expenses.

- The Company provided its guidance

for full year 2018 EPS and FFO per share as follows:

- Projected EPS (diluted) for 2018 of

$2.55 - $2.71 per share; and

- Projected FFO per share (diluted) for

2018 of $6.20 - $6.36 per share.

- Development Highlights - Signed

leases and commenced development of the new office headquarters for

Marriott International, Inc. and the Transportation Security

Administration ("TSA") aggregating 1.4 million square feet, and

fully placed in-service 888 Boylston Street, a 417,000 square foot

office building development that is 93% leased.

The reported results are unaudited and there can be no assurance

that these reported results will not vary from the final

information for the quarter ended September 30, 2017. In the

opinion of management, the Company has made all adjustments

considered necessary for a fair presentation of these reported

results.

At September 30, 2017, the Company’s portfolio consisted of

177 properties aggregating approximately 49.8 million square feet,

including ten properties under construction/redevelopment totaling

approximately 5.7 million square feet. The overall percentage of

leased space for the 164 properties in service (excluding the

Company’s two residential properties and hotel) as of

September 30, 2017 was 90.2%.

Significant events during the third quarter included:

Development activities

- On August 7, 2017, the Company entered

into a joint venture with The Bernstein Companies to develop an

approximately 722,000 net rentable square foot (subject to

adjustment based on finalized building design) build-to-suit Class

A office building and below-grade parking garage at 7750 Wisconsin

Avenue in Bethesda, Maryland. The joint venture entered into a

lease agreement with an affiliate of Marriott International, Inc.,

under which Marriott will lease 100% of the office building and

garage for a term of 20 years, and the building will serve as

Marriott’s new worldwide headquarters. Marriott has agreed to fund

100% of the related tenant improvement costs and leasing

commissions for the office building. The Company will serve as

co-development manager for the venture and expects to commence

construction in 2018. The Company and The Bernstein Companies each

own a 50% interest in the joint venture.

- On August 24, 2017, the Company entered

into a 15-year lease with the General Services Administration,

under which the Company will develop the new headquarters for the

TSA. The TSA will occupy 100% of the approximately 623,000 net

rentable square feet of Class A office space and a parking garage

at 6595 Springfield Center Drive located in Springfield, Virginia.

Concurrently with the execution of the lease, the Company commenced

development of the project and expects the building to be available

for occupancy by the fourth quarter of 2020.

- On September 16, 2017, the Company

completed and fully placed in-service 888 Boylston Street, a Class

A office and retail project with approximately 417,000 net rentable

square feet located in Boston, Massachusetts. The property is 93%

leased.

Acquisition and disposition activities

- On August 30, 2017, the Company

completed the sale of its Reston Eastgate property located in

Reston, Virginia for a gross sale price of $14.0 million. Net cash

proceeds totaled approximately $13.2 million, resulting in a gain

on sale of real estate totaling approximately $2.8 million. Reston

Eastgate is a parcel of land containing approximately 21.7 acres

located at 11011 Sunset Hills Road.

Capital markets activities

- On July 28, 2017, a joint venture in

which the Company has a 50% interest obtained mortgage financing

collateralized by its Colorado Center property located in Santa

Monica, California totaling $550.0 million. The mortgage financing

bears interest at a fixed rate of 3.56% per annum and matures on

August 9, 2027. The loan requires interest-only payments during the

10-year term of the loan, with the entire principal amount due at

maturity. The joint venture distributed $502.0 million to the

partners, of which the Company's share was $251.0 million. Colorado

Center is a six-building office complex that sits on a 15-acre site

and contains an aggregate of approximately 1,118,000 net rentable

square feet with an underground parking garage for 3,100

vehicles.

- On September 6, 2017, a joint venture

in which the Company has a 50% interest obtained construction

financing with a total commitment of $204.6 million collateralized

by its Hub on Causeway development project. The construction

financing bears interest at a variable rate equal to LIBOR plus

2.25% per annum and matures on September 6, 2021, with two,

one-year extension options, subject to certain conditions. As of

September 30, 2017, the venture had not drawn any funds under the

loan. The Hub on Causeway is an approximately 385,000 net rentable

square foot project containing retail and office space located in

Boston, Massachusetts.

EPS and FFO per Share Guidance:

The Company’s guidance for the fourth quarter 2017, full year

2017 and full year 2018 for EPS (diluted) and FFO per share

(diluted) is set forth and reconciled below. Except as described

below, the estimates reflect management’s view of current and

future market conditions, including assumptions with respect to

rental rates, occupancy levels and the earnings impact of the

events referenced in this release and otherwise referenced during

the conference call referred to below. The estimates do not include

possible future gains or losses or the impact on operating results

from other possible future property acquisitions or dispositions,

other possible capital markets activity or possible future

impairment charges. EPS estimates may be subject to fluctuations as

a result of several factors, including changes in the recognition

of depreciation and amortization expense and any gains or losses

associated with disposition activity. The Company is not able to

assess at this time the potential impact of these factors on

projected EPS. By definition, FFO does not include real

estate-related depreciation and amortization, impairment losses on

depreciable real estate or gains or losses associated with

disposition activities. There can be no assurance that the

Company’s actual results will not differ materially from the

estimates set forth below.

As set forth below, the Company has updated its projected EPS

(diluted) for the full year 2017 to $2.80 - $2.81 per share from

$2.72 - $2.77 per share. This is an increase of approximately $0.06

per share at the mid-point of the Company’s guidance consisting of

$0.02 per share of better than expected portfolio performance and

additional development services revenue, $0.02 per share of lower

depreciation and amortization expense, and $0.02 per share

resulting from an unbudgeted land sale during the third quarter of

2017. In addition, the Company has updated its projected guidance

for FFO per share (diluted) for the full year to $6.24 - $6.25 per

share from $6.20 - $6.25 per share. This is an increase of

approximately $0.02 per share at the mid-point of the Company’s

guidance primarily consisting of better than expected portfolio

performance and additional development services revenue.

Fourth Quarter 2017 Full

Year 2017 Low - High Low

- High Projected EPS (diluted) $ 0.66 - $ 0.67 $ 2.80

- $ 2.81 Add: Projected Company Share of Real Estate Depreciation

and Amortization 0.87 - 0.87 3.48 - 3.48 Less: Projected Company

Share of Gains on Sales of Real Estate — - — 0.04

- 0.04 Projected FFO per Share (diluted) $ 1.53 - $

1.54 $ 6.24 - $ 6.25

The Company's guidance for the full year 2018 for EPS (diluted)

and FFO per share (diluted) is set forth and reconciled below. When

compared to the full year 2017, the estimates for 2018 include,

among other assumptions, (1) an incremental contribution of $0.26

per share at the mid-point from development deliveries and (2) an

increase in the Company’s Share of Same Property net operating

income ("NOI") (excluding termination income) of 0.5% to 2.5%

resulting in an incremental $0.13 per share at the mid-point of the

range. These items are partially offset by (1) an increase in net

interest expense (including the Company's share of unconsolidated

joint venture debt at Colorado Center) of $0.17 per share at the

mid-point, (2) a decrease in lease termination fees of $0.10 per

share at the mid-point, (3) an increase in depreciation expense

primarily due to development deliveries of $0.07 per share, (4) an

increase in noncontrolling interests in property partnerships of

$0.05 per share at the mid-point, (5) an increase in G & A

expense of $0.03 per share at the mid-point and (6) a decrease in

development and management services revenue of $0.01 per share at

the mid-point.

Full Year 2018 Low -

High Projected EPS (diluted) $

2.65

- $

2.81

Add: Projected Company Share of Real Estate Depreciation and

Amortization

3.55

-

3.55

Less: Projected Company Share of Gains on Sales of Real Estate —

- — Projected FFO per Share (diluted) $ 6.20 - $ 6.36

Boston Properties will host a conference call on Thursday,

November 2, 2017 at 10:00 AM Eastern Time, open to the general

public, to discuss the third quarter 2017 results, the fourth

quarter 2017, full fiscal year 2017 and full fiscal year 2018

projections and related assumptions, and other matters that may be

of interest to investors. The number to call for this interactive

teleconference is (877) 796-3880 (Domestic) or (443) 961-9013

(International) and entering the passcode 41547548. A replay of the

conference call will be available through November 16, 2017, by

dialing (855) 859-2056 (Domestic) or (404) 537-3406 (International)

and entering the passcode 41547548. There will also be a live audio

webcast of the call which may be accessed on the Company’s website

at www.bostonproperties.com in the Investor Relations section.

Shortly after the call a replay of the webcast will be available in

the Investor Relations section of the Company’s website and

archived for up to twelve months following the call.

Additionally, a copy of Boston Properties’ third quarter 2017

“Supplemental Operating and Financial Data” and this press release

are available in the Investor Relations section of the Company’s

website at www.bostonproperties.com.

Boston Properties is a fully integrated real estate investment

trust that develops, redevelops, acquires, manages, operates and

owns a diverse portfolio of primarily Class A office space totaling

49.8 million square feet and consisting of 166 office properties

(including seven properties under construction), five retail

properties, five residential properties (including three properties

under construction) and one hotel. The Company is one of the

largest owners and developers of Class A office properties in the

United States, concentrated in five markets - Boston, Los Angeles,

New York, San Francisco and Washington, DC.

This press release contains forward-looking statements within

the meaning of the Federal securities laws. You can identify these

statements by our use of the words “assumes,” “believes,”

“budgeted,” “estimates,” “expects,” “guidance,” “intends,” “plans,”

“projects” and similar expressions that do not relate to historical

matters. You should exercise caution in interpreting and relying on

forward-looking statements because they involve known and unknown

risks, uncertainties and other factors which are, in some cases,

beyond Boston Properties’ control and could materially affect

actual results, performance or achievements. These factors include,

without limitation, the Company’s ability to satisfy the closing

conditions to the pending transactions described above, the

Company’s ability to enter into new leases or renew leases on

favorable terms, dependence on tenants’ financial condition, the

uncertainties of real estate development, acquisition and

disposition activity, the ability to effectively integrate

acquisitions, the uncertainties of investing in new markets, the

costs and availability of financing, the effectiveness of our

interest rate hedging contracts, the ability of our joint venture

partners to satisfy their obligations, the effects of local,

national and international economic and market conditions, the

effects of acquisitions, dispositions and possible impairment

charges on our operating results, the impact of newly adopted

accounting principles on the Company’s accounting policies and on

period-to-period comparisons of financial results, regulatory

changes and other risks and uncertainties detailed from time to

time in the Company’s filings with the Securities and Exchange

Commission. Boston Properties does not undertake a duty to update

or revise any forward-looking statement, including its guidance for

the fourth quarter 2017, full fiscal year 2017 and full fiscal year

2018, whether as a result of new information, future events or

otherwise.

Financial tables follow.

BOSTON PROPERTIES, INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

September 30, 2017

December 31, 2016

(in thousands, except for share and par value amounts)

ASSETS Real estate, at cost $ 19,260,022 $ 18,862,648

Construction in progress 1,386,638 1,037,959 Land held for future

development 212,585 246,656 Less: accumulated depreciation

(4,484,798 ) (4,222,235 ) Total real estate 16,374,447 15,925,028

Cash and cash equivalents 493,055 356,914 Cash held in escrows

83,779 63,174 Investments in securities 27,981 23,814 Tenant and

other receivables, net 79,750 92,548 Accrued rental income, net

835,415 799,138 Deferred charges, net 657,474 686,163 Prepaid

expenses and other assets 144,817 129,666 Investments in

unconsolidated joint ventures 611,800 775,198 Total

assets $ 19,308,518 $ 18,851,643

LIABILITIES AND

EQUITY Liabilities: Mortgage notes payable, net $ 2,982,067 $

2,063,087 Unsecured senior notes, net 7,252,567 7,245,953 Unsecured

line of credit — — Unsecured term loan — — Mezzanine notes payable

— 307,093 Outside members’ notes payable — 180,000 Accounts payable

and accrued expenses 325,440 298,524 Dividends and distributions

payable 130,434 130,308 Accrued interest payable 99,100 243,933

Other liabilities 419,215 450,821 Total liabilities

11,208,823 10,919,719 Commitments and

contingencies — — Equity: Stockholders’ equity

attributable to Boston Properties, Inc.: Excess stock, $0.01 par

value, 150,000,000 shares authorized, none issued or outstanding —

— Preferred stock, $0.01 par value, 50,000,000 shares authorized;

5.25% Series B cumulative redeemable preferred stock, $0.01 par

value, liquidation preference $2,500 per share, 92,000 shares

authorized, 80,000 shares issued and outstanding at September 30,

2017 and December 31, 2016 200,000 200,000 Common stock, $0.01 par

value, 250,000,000 shares authorized, 154,401,166 and 153,869,075

issued and 154,322,266 and 153,790,175 outstanding at September 30,

2017 and December 31, 2016, respectively 1,543 1,538 Additional

paid-in capital 6,370,932 6,333,424 Dividends in excess of earnings

(692,739 ) (693,694 ) Treasury common stock at cost, 78,900 shares

at September 30, 2017 and December 31, 2016 (2,722 ) (2,722 )

Accumulated other comprehensive loss (51,796 ) (52,251 ) Total

stockholders’ equity attributable to Boston Properties, Inc.

5,825,218 5,786,295 Noncontrolling interests: Common units of the

Operating Partnership 605,802 614,982 Property partnerships

1,668,675 1,530,647 Total equity 8,099,695

7,931,924 Total liabilities and equity $ 19,308,518 $

18,851,643

BOSTON PROPERTIES, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

Three months ended September

30,

Nine months ended September

30,

2017 2016 2017

2016 (in thousands, except for per share

amounts) Revenue

Rental

Base rent $ 513,269 $ 489,312 $ 1,537,373 $ 1,518,826 Recoveries

from tenants 94,476 92,560 272,803 267,852 Parking and other 26,092

24,638 78,164 75,576 Total rental

revenue 633,837 606,510 1,888,340 1,862,254 Hotel revenue 13,064

12,354 33,859 33,919 Development and management services 10,811

6,364 24,648 18,586 Total revenue

657,712 625,228 1,946,847 1,914,759

Expenses Operating Rental 237,341 228,560 696,082 665,670 Hotel

8,447 8,118 23,942 23,730 General and administrative 25,792 25,165

84,319 79,936 Transaction costs 239 249 572 1,187 Impairment loss —

1,783 — 1,783 Depreciation and amortization 152,164 203,748

463,288 516,371 Total expenses 423,983

467,623 1,268,203 1,288,677 Operating income

233,729 157,605 678,644 626,082 Other income (expense) Income from

unconsolidated joint ventures 843 1,464 7,035 5,489 Interest and

other income 1,329 3,628 3,447 6,657 Gains from investments in

securities 944 976 2,716 1,713 Gains (losses) from early

extinguishments of debt — (371 ) 14,354 (371 ) Losses from interest

rate contracts — (140 ) — (140 ) Interest expense (92,032 )

(104,641 ) (282,709 ) (314,953 ) Income before gains on sales of

real estate 144,813 58,521 423,487 324,477 Gains on sales of real

estate 2,891 12,983 6,791 80,606 Net

income 147,704 71,504 430,278 405,083 Net income attributable to

noncontrolling interests Noncontrolling interests in property

partnerships (14,340 ) 17,225 (33,967 ) (53 ) Noncontrolling

interest—common units of the Operating Partnership (13,402 ) (9,387

) (40,350 ) (42,120 ) Net income attributable to Boston Properties,

Inc. 119,962 79,342 355,961 362,910 Preferred dividends (2,625 )

(2,589 ) (7,875 ) (7,796 ) Net income attributable to Boston

Properties, Inc. common shareholders $ 117,337 $ 76,753

$ 348,086 $ 355,114 Basic earnings per common

share attributable to Boston Properties, Inc. common shareholders:

Net income $ 0.76 $ 0.50 $ 2.26 $ 2.31

Weighted average number of common shares outstanding 154,355

153,754 154,132 153,681 Diluted earnings per

common share attributable to Boston Properties, Inc. common

shareholders: Net income $ 0.76 $ 0.50 $ 2.26

$ 2.31 Weighted average number of common and common

equivalent shares outstanding 154,483 154,136 154,344

153,971

BOSTON PROPERTIES, INC.

FUNDS FROM OPERATIONS (1)

(Unaudited)

Three months ended September

30,

Nine months ended September

30,

2017 2016 2017

2016 (in thousands, except for per share

amounts) Net income attributable to Boston Properties,

Inc. common shareholders $ 117,337 $ 76,753 $ 348,086 $ 355,114

Add: Preferred dividends 2,625 2,589 7,875 7,796 Noncontrolling

interest - common units of the Operating Partnership 13,402 9,387

40,350 42,120 Noncontrolling interests in property partnerships

14,340 (17,225 ) 33,967 53 Less: Gains on sales of real estate

2,891 12,983 6,791 80,606 Income before

gains on sales of real estate 144,813 58,521 423,487 324,477 Add:

Depreciation and amortization 152,164 203,748 463,288 516,371

Noncontrolling interests in property partnerships' share of

depreciation and amortization (18,552 ) (40,907 ) (59,294 ) (79,831

) Company's share of depreciation and amortization from

unconsolidated joint ventures 9,282 9,128 27,952 18,242

Corporate-related depreciation and amortization (434 ) (393 )

(1,445 ) (1,119 ) Less: Noncontrolling interests in property

partnerships 14,340 (17,225 ) 33,967 53 Preferred dividends 2,625

2,589 7,875 7,796 Funds from operations

(FFO) attributable to the Operating Partnership common unitholders

(including Boston Properties, Inc.) 270,308 244,733 812,146 770,291

Less: Noncontrolling interest - common units of the Operating

Partnership’s share of funds from operations 27,293 25,169

82,881 79,440 Funds from operations

attributable to Boston Properties, Inc. common shareholders $

243,015 $ 219,564 $ 729,265 $ 690,851

Boston Properties, Inc.’s percentage share of funds from operations

- basic 89.90 % 89.72 % 89.79 % 89.69 % Weighted average shares

outstanding - basic 154,355 153,754 154,132

153,861 FFO per share basic $ 1.57 $ 1.43 $

4.73 $ 4.50 Weighted average shares outstanding -

diluted 154,483 154,136 154,344 153,971

FFO per share diluted $ 1.57 $ 1.42 $ 4.73 $

4.49

(1) Pursuant to the revised definition of Funds from Operations

adopted by the Board of Governors of the National Association of

Real Estate Investment Trusts (“NAREIT”), we calculate Funds from

Operations, or “FFO,” by adjusting net income (loss) attributable

to Boston Properties, Inc. common shareholders (computed in

accordance with GAAP) for gains (or losses) from sales of

properties, impairment losses on depreciable real estate

consolidated on our balance sheet, impairment losses on our

investments in unconsolidated joint ventures driven by a measurable

decrease in the fair value of depreciable real estate held by the

unconsolidated joint ventures and real estate-related depreciation

and amortization. FFO is a non-GAAP financial measure, but we

believe the presentation of FFO, combined with the presentation of

required GAAP financial measures, has improved the understanding of

operating results of REITs among the investing public and has

helped make comparisons of REIT operating results more meaningful.

Management generally considers FFO and FFO per share to be useful

measures for understanding and comparing our operating results

because, by excluding gains and losses related to sales of

previously depreciated operating real estate assets, impairment

losses and real estate asset depreciation and amortization (which

can differ across owners of similar assets in similar condition

based on historical cost accounting and useful life estimates), FFO

and FFO per share can help investors compare the operating

performance of a company’s real estate across reporting periods and

to the operating performance of other companies.

Our computation of FFO may not be comparable to FFO reported by

other REITs or real estate companies that do not define the term in

accordance with the current NAREIT definition or that interpret the

current NAREIT definition differently.

In order to facilitate a clear understanding of the Company's

operating results, FFO should be examined in conjunction with net

income attributable to Boston Properties, Inc. common shareholders

as presented in the Company's consolidated financial statements.

FFO should not be considered as a substitute for net income

attributable to Boston Properties, Inc. common shareholders

(determined in accordance with GAAP) or any other GAAP financial

measures and should only be considered together with and as a

supplement to the Company's financial information prepared in

accordance with GAAP.

BOSTON PROPERTIES, INC.

PORTFOLIO LEASING PERCENTAGES

% Leased by

Location September 30, 2017 December 31, 2016

Boston 92.6 % 90.7 % New York 86.1 % 90.2 % San Francisco and Los

Angeles 89.9 % 89.8 % Washington, DC 91.5 % 89.9 % Total Portfolio

90.2 % 90.2 %

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171101006949/en/

Boston Properties, Inc.Michael LaBelle, 617-236-3352Executive

Vice President, Chief Financial Officer and TreasurerorArista

Joyner, 617-236-3343Investor Relations Manager

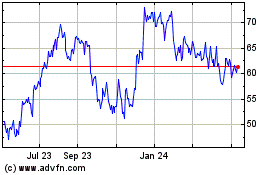

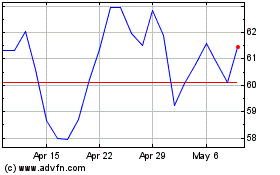

Boston Properties (NYSE:BXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boston Properties (NYSE:BXP)

Historical Stock Chart

From Apr 2023 to Apr 2024