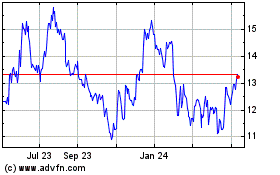

Lakeland Bancorp, Inc. (NASDAQ:LBAI) (the “Company”), the parent

company of Lakeland Bank (“Lakeland”), reported net income of $13.7

million for the three months ended September 30, 2017 compared to

$11.3 million for the same period in 2016. For the three

months ended September 30, 2017, diluted earnings per share (“EPS”)

of $0.29 increased 16% from $0.25 for the same period in 2016.

For the third quarter of 2017, return on average assets was

1.03%, return on average common equity was 9.48%, and return on

average tangible common equity was 12.51%.

For the nine months ended September 30, 2017,

the Company reported net income of $39.4 million, compared to $29.6

million for the same period in 2016. Over the same period,

the Company reported diluted EPS of $0.82 in 2017 compared to $0.69

in 2016. Year-to-date 2017, return on average assets was

1.01%, return on average common equity was 9.33%, and return on

average tangible common equity was 12.38%.

Thomas Shara, Lakeland Bancorp’s President and

CEO, commented on the Company’s quarterly results, “We are pleased

with our continued strong quarterly financial metrics as

demonstrated by our enhancements in net income, earnings per share,

return on assets, return on equity, efficiency ratio and asset

quality. We continue to grow our Bank by generating new

customers with our relationship banking philosophy and providing

best in class customer service.”

The following represents performance highlights

and significant events as of or for the third quarter of 2017:

- Net income of $13.7 million increased from $13.4 million in the

second quarter of 2017 and $11.3 million in the third quarter of

2016.

- Return on average assets of 1.03% grew from 1.02% in the second

quarter of 2017 and 0.94% in the third quarter of 2016.

- The efficiency ratio of 51.72% improved from 52.64% in the

second quarter of 2017 and 53.35% in the third quarter of

2016.

- Tangible book value per share rose to $9.25 at September 30,

2017, a 14.6% increase from $8.07 at September 30, 2016.

- Net interest margin of 3.39% fell slightly from 3.41% in the

second quarter of 2017 and 3.45% in the third quarter of 2016.

- Total deposits grew $129.8 million, or 3.1%, during the third

quarter of 2017 and $415.3 million, or 10.5%, since September 30,

2016.

- Total loans and leases grew $38.6 million, or 1.0%, during the

third quarter of 2017 and $298.4 million, or 7.9%, since September

30, 2016.

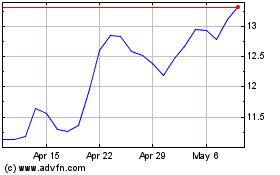

- On October 24, 2017, the Company declared a cash dividend of

$0.10 per share to be paid on November 15, 2017 to stockholders of

record as of November 6, 2017.

EarningsNet

income for the third quarter of 2017 was $13.7 million, a 21%

increase compared to $11.3 million for the same period in

2016. Excluding merger related expenses incurred in the third

quarter of 2016, this increase was 11%.

Year-to-date net income for 2017 was $39.4

million, a 33% increase compared to $29.6 million for the same

period in 2016. After excluding merger related expenses

incurred in 2016, this increase was 22%.

Net Interest

Income Net interest income for the third

quarter of 2017 was $42.1 million, compared to $38.5 million for

the same period in 2016 due to the organic growth of earning

assets. Year-to-date net interest income for 2017 was $122.9

million, as compared to $107.5 million for the same period in

2016. For 2017, year-to-date total interest income increased

due to higher interest earning assets from organic growth and the

merger with Harmony Bank in July 2016 (the “merger”). For

2017, year-to-date total interest expense increased primarily due

to increased deposits related to the merger, continued organic

deposit growth coupled with higher CD rates in the third quarter of

2017 due to market competition and the impact of the additional

interest expense from the subordinated debt offering in September

2016.

Noninterest

Income Noninterest income totaled $5.5

million for the third quarter of 2017 compared to $6.4 million for

the same period in 2016. This decrease was primarily due to

$0.9 million in death benefits received on bank owned life

insurance in 2016.

Year-to-date 2017 noninterest income totaled

$19.7 million compared to $16.2 million for the same period in

2016. This increase was primarily due to $2.2 million in

gains on sales of investment securities in the first quarter of

2017, $0.9 million in gains on sales of three former branches

during 2017, $0.3 million gain on the payoff of an acquired loan in

2017 and a $0.2 million increase on the sales of other real estate

owned in 2017, partially offset by $0.9 million in death benefits

received on bank owned life insurance in 2016 and a $0.3 million

decline in gains on sales of loans during 2017.

Noninterest

Expense Noninterest expense totaled $24.8

million for the third quarter of 2017 compared to $26.0 million for

the same period in 2016. Excluding $1.7 million in merger

related expenses incurred in 2016, noninterest expense would have

increased $0.5 million due to additional salary and employee

benefit expense, partially offset by a $0.3 million reduction in

the cost of FDIC insurance.

Year-to-date 2017 noninterest expense totaled

$78.7 million compared to $75.1 million for the same period in

2016. During 2017, the Company incurred long-term debt

prepayment penalties of $2.8 million, and during 2016, the Company

incurred $4.1 million in merger related expenses. Excluding

these one-time items, the resulting $4.8 million net increase in

noninterest expense was primarily due to $3.8 million in increased

salary and employee benefit expense related to additional headcount

from the merger as well as supplementing the operating

infrastructure of the Company. In addition, other expenses

increased by $0.7 million primarily due to higher legal,

correspondent, audit and consulting fees.

Financial

ConditionFor the nine months ended September 30,

2017, total assets increased $306.4 million, or 6%, to $5.40

billion as total loans and leases grew $219.0 million, or 6%, to

$4.09 billion, investment in bank owned life insurance grew $34.4

million, or 48%, to $106.8 million and investment securities

increased $25.7 million, or 3%, to $795.1 million. On the

funding side, total deposits grew $264.2 million, or 6%, to $4.36

billion while borrowings increased $13.4 million, or 3%, to $435.4

million. As of September 30, 2017, total loans and leases to

total deposits was 93.9%.

Asset

QualityAt September 30, 2017, non-performing

assets totaled $14.7 million (0.27% of total assets) compared to

$21.5 million (0.42% of total assets) at December 31, 2016.

Non-accrual loans and leases as a percent of total loans and

leases decreased to 0.33% at September 30, 2017 from 0.53% at

December 31, 2016. The allowance for loan and lease losses

increased to $33.9 million at September 30, 2017, and represented

0.83% of total loans and leases. For the nine months ended

September 30, 2017, the Company had net charge-offs of $2.2 million

(annualized 0.07% of average loans and leases) compared to $3.4

million (annualized 0.13% of average loans and leases) for the same

period in 2016. The year-to-date provision for loan and lease

losses was $4.9 million compared to $3.8 million for the same

period in 2016.

CapitalAt

September 30, 2017, stockholders' equity was $577.1 million

compared to $550.0 million at December 31, 2016. At

September 30, 2017, the book value per common share and tangible

book value per common share were $12.19 and $9.25 compared to

$11.65 and $8.70, respectively, at December 31, 2016.

Forward-Looking

StatementsThe information disclosed in this

document includes various forward-looking statements (with respect

to corporate objectives, trends, and other financial and business

matters) that are made in reliance upon the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995. The

words “anticipates”, “projects”, “intends”, “estimates”, “expects”,

“believes”, “plans”, “may”, “will”, “should”, “could”, and other

similar expressions are intended to identify such forward-looking

statements. The Company cautions that these forward-looking

statements are necessarily speculative and speak only as of the

date made, and are subject to numerous assumptions, risks and

uncertainties, all of which may change over time. Actual

results could differ materially from such forward-looking

statements. The following factors, among others, could cause

actual results to differ materially and adversely from such

forward-looking statements: changes in the financial services

industry and the U.S. and global capital markets, changes in

economic conditions nationally, regionally and in the Company’s

markets, the nature and timing of actions of the Federal Reserve

Board and other regulators, the nature and timing of legislation

affecting the financial services industry, government intervention

in the U.S. financial system, changes in levels of market interest

rates, pricing pressures on loan and deposit products, credit risks

of the Company’s lending and leasing activities, successful

implementation, deployment and upgrades of new and existing

technology, systems, services and products, customers’ acceptance

of the Company’s products and services, and competition. Any

statements made by the Company that are not historical facts should

be considered to be forward-looking statements. The Company

is not obligated to update and does not undertake to update any of

its forward-looking statements made herein.

Explanation of Non-GAAP

Financial MeasuresReported amounts are presented

in accordance with accounting principles generally accepted in the

United States of America ("GAAP"). This press release

also contains certain supplemental non-GAAP information that the

Company’s management uses in its analysis of the Company’s

financial results. Specifically, the Company provides

measures based on what it believes are its operating earnings on a

consistent basis, and excludes material non-routine operating items

which affect the GAAP reporting of results of operations. The

Company’s management believes that providing this information to

analysts and investors allows them to better understand and

evaluate the Company’s core financial results for the periods in

question.

The Company also provides measurements and

ratios based on tangible equity and tangible assets. These

measures are utilized by regulators and market analysts to evaluate

a company’s financial condition and, therefore, the Company’s

management believes that such information is useful to

investors.

The Company also uses an efficiency ratio that

is a non-GAAP financial measure. The ratio that the Company

uses excludes amortization of core deposit intangibles, provision

for unfunded lending commitments and, where applicable, long-term

debt prepayment fees and merger related expenses. Income for

the non-GAAP ratio is increased by the favorable effect of

tax-exempt income and excludes gains and losses from the sale of

investment securities and gain on debt extinguishment, which can

vary from period to period. The Company uses this ratio

because it believes the ratio provides a relevant measure to

compare the operating performance period to period.

These disclosures should not be viewed as a

substitute for financial results determined in accordance with

GAAP, nor are they necessarily comparable to non-GAAP performance

measures which may be presented by other companies. See

accompanying non-GAAP tables.

About Lakeland BankLakeland

Bank is the wholly-owned subsidiary of Lakeland Bancorp, Inc.

(NASDAQ:LBAI), which has $5.4 billion in total assets. The Bank

operates 53 branch offices throughout Bergen, Essex, Morris, Ocean,

Passaic, Somerset, Sussex, and Union counties in New Jersey

including one branch in Highland Mills, New York; six New Jersey

regional commercial lending centers in Bernardsville, Jackson,

Montville, Newton, Teaneck and Waldwick; and one in New York to

serve the Hudson Valley region. Lakeland also has a commercial loan

production office serving Middlesex and Monmouth counties in New

Jersey. Lakeland Bank offers an extensive suite of financial

products and services for businesses and consumers. Visit

LakelandBank.com for more information.

Thomas J. SharaPresident & CEO

Thomas F. SplaineEVP & CFO973-697-2000

| |

| Lakeland Bancorp, Inc. |

| Financial Highlights |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| (Dollars in thousands, except per share amounts) |

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

INCOME STATEMENT |

|

|

|

|

|

|

|

|

| Net

interest income |

|

|

$ |

42,115 |

|

|

$ |

38,518 |

|

|

$ |

122,859 |

|

|

$ |

107,470 |

|

| Provision

for loan and lease losses |

|

|

(1,827 |

) |

|

|

(1,763 |

) |

|

|

(4,872 |

) |

|

|

(3,848 |

) |

| Other

noninterest income |

|

|

|

4,976 |

|

|

|

5,664 |

|

|

|

15,788 |

|

|

|

14,201 |

|

| Gains

(losses) on sales of investment securities |

|

- |

|

|

|

- |

|

|

|

2,524 |

|

|

|

370 |

|

| Gains on

sales of loans |

|

|

|

478 |

|

|

|

753 |

|

|

|

1,347 |

|

|

|

1,598 |

|

| Long-term

debt prepayment fee |

|

|

- |

|

|

|

- |

|

|

|

(2,828 |

) |

|

|

- |

|

| Merger

related expenses |

|

|

|

- |

|

|

|

(1,697 |

) |

|

|

- |

|

|

|

(4,103 |

) |

| Other

noninterest expense |

|

|

(24,849 |

) |

|

|

(24,309 |

) |

|

|

(75,857 |

) |

|

|

(71,042 |

) |

|

Pretax income |

|

|

|

20,893 |

|

|

|

17,166 |

|

|

|

58,961 |

|

|

|

44,646 |

|

| Provision

for income taxes |

|

|

(7,170 |

) |

|

|

(5,839 |

) |

|

|

(19,556 |

) |

|

|

(15,081 |

) |

| Net

income |

|

|

$ |

13,723 |

|

|

$ |

11,327 |

|

|

$ |

39,405 |

|

|

$ |

29,565 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Basic

earnings per common share |

|

$ |

0.29 |

|

|

$ |

0.25 |

|

|

$ |

0.82 |

|

|

$ |

0.69 |

|

| Diluted

earnings per common share |

|

$ |

0.29 |

|

|

$ |

0.25 |

|

|

$ |

0.82 |

|

|

$ |

0.69 |

|

| Dividends

per common share |

|

$ |

0.10 |

|

|

$ |

0.095 |

|

|

$ |

0.295 |

|

|

$ |

0.275 |

|

| Weighted

average shares - basic |

|

|

47,466 |

|

|

|

44,439 |

|

|

|

47,429 |

|

|

|

42,211 |

|

| Weighted

average shares - diluted |

|

|

47,692 |

|

|

|

44,659 |

|

|

|

47,660 |

|

|

|

42,390 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

SELECTED OPERATING RATIOS |

|

|

|

|

|

|

|

|

| Annualized

return on average assets |

|

|

1.03 |

% |

|

|

0.94 |

% |

|

|

1.01 |

% |

|

|

0.88 |

% |

| Annualized

return on average common equity |

|

9.48 |

% |

|

|

9.10 |

% |

|

|

9.33 |

% |

|

|

8.54 |

% |

| Annualized

return on average tangible common equity (1) |

|

12.51 |

% |

|

|

12.68 |

% |

|

|

12.38 |

% |

|

|

11.95 |

% |

| Annualized

return on interest-earning assets |

|

3.93 |

% |

|

|

3.85 |

% |

|

|

3.86 |

% |

|

|

3.86 |

% |

| Annualized

cost of interest-bearing liabilities |

|

0.71 |

% |

|

|

0.53 |

% |

|

|

0.65 |

% |

|

|

0.51 |

% |

| Annualized

net interest spread |

|

|

3.22 |

% |

|

|

3.32 |

% |

|

|

3.22 |

% |

|

|

3.35 |

% |

| Annualized

net interest margin |

|

|

3.39 |

% |

|

|

3.45 |

% |

|

|

3.38 |

% |

|

|

3.47 |

% |

| Efficiency

ratio (1) |

|

|

|

51.72 |

% |

|

|

53.35 |

% |

|

|

53.52 |

% |

|

|

56.52 |

% |

|

Stockholders' equity to total assets |

|

|

|

|

|

|

10.69 |

% |

|

|

10.17 |

% |

| Book value

per common share |

|

|

|

|

|

$ |

12.19 |

|

|

$ |

11.22 |

|

| Tangible

book value per common share (1) |

|

|

|

|

$ |

9.25 |

|

|

$ |

8.07 |

|

| Tangible

common equity to tangible assets (1) |

|

|

|

|

|

8.33 |

% |

|

|

7.53 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

ASSET QUALITY RATIOS |

|

|

|

|

|

9/30/2017 |

|

9/30/2016 |

| Ratio of allowance for loan and lease losses to total loans and

leases |

|

|

|

|

0.83 |

% |

|

|

0.83 |

% |

| Non-performing loans and leases to total loans and leases |

|

|

|

|

|

0.33 |

% |

|

|

0.60 |

% |

| Non-performing assets to total assets |

|

|

|

|

|

|

0.27 |

% |

|

|

0.50 |

% |

| Annualized net charge-offs to average loans and leases |

|

|

|

|

|

0.07 |

% |

|

|

0.13 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

SELECTED BALANCE SHEET DATA AT PERIOD-END |

|

|

|

9/30/2017 |

|

9/30/2016 |

| Loans and

leases |

|

|

|

|

|

|

$ |

4,092,893 |

|

|

$ |

3,794,519 |

|

| Allowance

for loan and lease losses |

|

|

|

|

|

(33,925 |

) |

|

|

(31,369 |

) |

| Investment

securities |

|

|

|

|

|

|

|

795,096 |

|

|

|

638,091 |

|

| Total assets |

|

|

|

|

|

|

|

|

5,399,481 |

|

|

|

4,904,291 |

|

| Total

deposits |

|

|

|

|

|

|

4,356,996 |

|

|

|

3,941,742 |

|

| Short-term

borrowings |

|

|

|

|

|

|

|

133,960 |

|

|

|

29,699 |

|

| Other

borrowings |

|

|

|

|

|

|

|

301,411 |

|

|

|

398,671 |

|

|

Stockholders' equity |

|

|

|

|

|

|

577,081 |

|

|

|

498,722 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

SELECTED AVERAGE BALANCE SHEET DATA |

For the Three Months Ended |

|

For the Nine Months Ended |

|

|

|

|

|

9/30/2017 |

|

9/30/2016 |

|

9/30/2017 |

|

9/30/2016 |

| Loans and

leases |

|

|

$ |

4,060,838 |

|

|

$ |

3,743,434 |

|

|

$ |

3,993,030 |

|

|

$ |

3,481,053 |

|

| Investment

securities |

|

|

|

815,773 |

|

|

|

606,779 |

|

|

|

814,392 |

|

|

|

584,271 |

|

|

Interest-earning assets |

|

|

4,957,856 |

|

|

|

4,467,524 |

|

|

|

4,897,550 |

|

|

|

4,166,190 |

|

| Total

assets |

|

|

5,300,191 |

|

|

|

4,805,381 |

|

|

|

5,232,283 |

|

|

|

4,486,979 |

|

|

Noninterest-bearing demand deposits |

|

|

971,143 |

|

|

|

895,851 |

|

|

|

949,474 |

|

|

|

819,459 |

|

| Savings

deposits |

|

|

|

484,982 |

|

|

|

487,918 |

|

|

|

489,562 |

|

|

|

483,140 |

|

|

Interest-bearing transaction accounts |

|

|

2,206,206 |

|

|

|

1,988,405 |

|

|

|

2,247,674 |

|

|

|

1,816,003 |

|

| Time

deposits |

|

|

|

645,333 |

|

|

|

533,224 |

|

|

|

587,086 |

|

|

|

495,278 |

|

| Total

deposits |

|

|

4,307,664 |

|

|

|

3,905,398 |

|

|

|

4,273,796 |

|

|

|

3,613,880 |

|

| Short-term

borrowings |

|

|

|

42,172 |

|

|

|

35,608 |

|

|

|

41,211 |

|

|

|

39,165 |

|

| Other

borrowings |

|

|

|

344,775 |

|

|

|

339,204 |

|

|

|

323,180 |

|

|

|

344,859 |

|

| Total

interest-bearing liabilities |

|

|

3,723,468 |

|

|

|

3,384,359 |

|

|

|

3,688,713 |

|

|

|

3,178,445 |

|

|

Stockholders' equity |

|

|

|

574,113 |

|

|

|

495,343 |

|

|

|

564,443 |

|

|

|

462,445 |

|

| |

|

|

|

|

|

|

|

|

|

|

| (1) See

Supplemental Information - Non-GAAP Financial Measures |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Lakeland Bancorp,

Inc. |

|

| Consolidated Statements of

Operations |

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

| (Dollars in thousands, except per share amounts) |

|

|

|

2017 |

|

2016 |

|

|

|

2017 |

|

2016 |

|

| |

|

|

|

|

|

|

|

|

|

| INTEREST INCOME |

|

|

|

|

|

|

|

|

| Loans, leases and fees |

|

|

$ |

44,302 |

$ |

39,766 |

|

|

$ |

127,453 |

$ |

109,687 |

|

| Federal funds sold and interest-bearing deposits with

banks |

|

210 |

|

142 |

|

|

|

618 |

|

341 |

|

| Taxable investment securities and other |

|

3,720 |

|

2,627 |

|

|

|

11,137 |

|

8,285 |

|

| Tax exempt investment securities |

|

|

503 |

|

470 |

|

|

|

1,535 |

|

1,300 |

|

| |

TOTAL INTEREST INCOME |

|

|

48,735 |

|

43,005 |

|

|

|

140,743 |

|

119,613 |

|

| INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

Deposits |

|

|

|

|

4,443 |

|

2,886 |

|

|

|

11,561 |

|

7,495 |

|

| Federal funds purchased and securities sold under agreements to

repurchase |

|

52 |

|

19 |

|

|

|

160 |

|

66 |

|

| Other borrowings |

|

|

|

2,125 |

|

1,582 |

|

|

|

6,163 |

|

4,582 |

|

|

|

TOTAL INTEREST EXPENSE |

|

6,620 |

|

4,487 |

|

|

|

17,884 |

|

12,143 |

|

| NET INTEREST INCOME |

|

|

42,115 |

|

38,518 |

|

|

|

122,859 |

|

107,470 |

|

| Provision for loan and lease losses |

|

|

1,827 |

|

1,763 |

|

|

|

4,872 |

|

3,848 |

|

|

|

NET INTEREST INCOME AFTER PROVISION FOR LOAN AND LEASE

LOSSES |

|

40,288 |

|

36,755 |

|

|

|

117,987 |

|

103,622 |

|

| NONINTEREST INCOME |

|

|

|

|

|

|

|

| Service charges on deposit accounts |

|

|

2,797 |

|

2,615 |

|

|

|

7,926 |

|

7,580 |

|

| Commissions and fees |

|

|

|

1,258 |

|

1,182 |

|

|

|

3,549 |

|

3,260 |

|

| Gains on sales of investment securities |

|

|

- |

|

- |

|

|

|

2,524 |

|

370 |

|

| Gains on sales of loans |

|

|

|

478 |

|

753 |

|

|

|

1,347 |

|

1,598 |

|

| Income on bank owned life insurance |

|

|

624 |

|

1,303 |

|

|

|

1,550 |

|

2,125 |

|

| Other

income |

|

|

|

|

297 |

|

564 |

|

|

|

2,763 |

|

1,236 |

|

|

|

TOTAL

NONINTEREST INCOME |

|

|

|

5,454 |

|

6,417 |

|

|

|

19,659 |

|

16,169 |

|

| NONINTEREST EXPENSE |

|

|

|

|

|

|

|

| Salaries and employee benefit expense |

|

|

15,100 |

|

14,626 |

|

|

|

45,613 |

|

41,802 |

|

| Net occupancy expense |

|

|

|

2,327 |

|

2,372 |

|

|

|

7,670 |

|

7,401 |

|

| Furniture and equipment expense |

|

|

2,073 |

|

1,876 |

|

|

|

6,166 |

|

5,904 |

|

| Stationary, supplies and postage expense |

|

404 |

|

412 |

|

|

|

1,419 |

|

1,271 |

|

| Marketing expense |

|

|

|

442 |

|

429 |

|

|

|

1,351 |

|

1,123 |

|

| FDIC insurance expense |

|

|

|

430 |

|

715 |

|

|

|

1,173 |

|

1,986 |

|

| ATM and debit card expense |

|

|

546 |

|

420 |

|

|

|

1,504 |

|

1,149 |

|

| Telecommunications expense |

|

|

380 |

|

479 |

|

|

|

1,156 |

|

1,289 |

|

| Data processing expense |

|

|

|

441 |

|

518 |

|

|

|

1,496 |

|

1,497 |

|

| Other real estate owned and other repossessed assets

expense |

|

67 |

|

(32 |

) |

|

|

108 |

|

33 |

|

| Long-term debt prepayment fee |

|

|

- |

|

- |

|

|

|

2,828 |

|

- |

|

| Merger related expenses |

|

|

|

- |

|

1,697 |

|

|

|

- |

|

4,103 |

|

| Core deposit intangible amortization |

|

|

104 |

|

201 |

|

|

|

489 |

|

532 |

|

|

Other expenses |

|

|

|

|

2,535 |

|

2,293 |

|

|

|

7,712 |

|

7,055 |

|

|

|

TOTAL NONINTEREST EXPENSE |

|

24,849 |

|

26,006 |

|

|

|

78,685 |

|

75,145 |

|

|

INCOME BEFORE PROVISION FOR INCOME

TAXES |

|

|

|

|

20,893 |

|

17,166 |

|

|

|

58,961 |

|

44,646 |

|

|

Provision for income taxes |

|

|

|

|

7,170 |

|

5,839 |

|

|

|

19,556 |

|

15,081 |

|

|

NET INCOME |

|

|

|

$ |

13,723 |

$ |

11,327 |

|

|

$ |

39,405 |

$ |

29,565 |

|

| EARNINGS PER COMMON SHARE |

|

|

|

|

|

|

|

Basic |

|

|

|

$ |

0.29 |

$ |

0.25 |

|

|

$ |

0.82 |

$ |

0.69 |

|

|

Diluted |

|

|

|

$ |

0.29 |

$ |

0.25 |

|

|

$ |

0.82 |

$ |

0.69 |

|

|

DIVIDENDS PER COMMON SHARE |

|

|

|

$ |

0.100 |

$ |

0.095 |

|

|

$ |

0.295 |

$ |

0.275 |

|

| |

| Lakeland Bancorp, Inc. |

| Consolidated Balance Sheets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

| (Dollars in thousands) |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

Cash |

|

|

|

|

$ |

178,905 |

|

|

$ |

169,149 |

|

|

Interest-bearing deposits due from banks |

|

|

|

|

|

24,012 |

|

|

|

6,652 |

|

|

Total cash and cash equivalents |

|

|

|

|

|

202,917 |

|

|

|

175,801 |

|

|

|

|

|

|

|

|

|

|

| Investment securities available for sale, at fair value |

|

|

647,292 |

|

|

|

606,704 |

|

| Investment securities held to maturity; fair value of $135,085

at September 30, 2017 |

|

|

|

| and $146,990 at December 31, 2016 |

|

|

|

135,021 |

|

|

|

147,614 |

|

| Federal Home Loan Bank and other membership stocks, at

cost |

|

12,783 |

|

|

|

15,099 |

|

| Loans held

for sale |

|

|

|

|

2,221 |

|

|

|

1,742 |

|

| Loans and

leases: |

|

|

|

|

|

|

|

Commercial, real estate |

|

|

|

|

3,018,106 |

|

|

|

2,767,710 |

|

|

Commercial, industrial and other |

|

|

|

342,775 |

|

|

|

350,228 |

|

| Leases |

|

|

|

|

|

71,698 |

|

|

|

67,016 |

|

|

Residential mortgages |

|

|

|

|

329,625 |

|

|

|

349,581 |

|

| Consumer and home equity |

|

|

|

330,689 |

|

|

|

339,360 |

|

|

Total loans and leases |

|

|

|

4,092,893 |

|

|

|

3,873,895 |

|

| Net

deferred costs (fees) |

|

|

|

|

(3,720 |

) |

|

|

(3,297 |

) |

| Allowance for loan and lease losses |

|

|

|

(33,925 |

) |

|

|

(31,245 |

) |

| Net loans

and leases |

|

|

|

|

|

4,055,248 |

|

|

|

3,839,353 |

|

| Premises and equipment, net |

|

|

|

49,699 |

|

|

|

52,236 |

|

| Accrued interest receivable |

|

|

|

13,592 |

|

|

|

12,557 |

|

|

Goodwill |

|

|

|

|

|

136,433 |

|

|

|

135,747 |

|

| Other identifiable intangible assets |

|

|

|

2,526 |

|

|

|

3,344 |

|

| Bank owned life insurance |

|

|

|

|

106,831 |

|

|

|

72,384 |

|

| Other

assets |

|

|

|

|

|

34,918 |

|

|

|

30,550 |

|

|

TOTAL

ASSETS |

|

|

|

|

$ |

5,399,481 |

|

|

$ |

5,093,131 |

|

| |

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

| Noninterest-bearing |

|

|

|

$ |

955,444 |

|

|

$ |

927,270 |

|

|

Savings and interest-bearing transaction accounts |

|

|

2,681,512 |

|

|

|

2,620,657 |

|

| Time deposits

$250 thousand and under |

|

|

|

|

|

549,893 |

|

|

|

404,680 |

|

|

Time deposits over $250 thousand |

|

|

|

|

|

170,147 |

|

|

|

140,228 |

|

|

Total deposits |

|

|

|

|

|

4,356,996 |

|

|

|

4,092,835 |

|

| Federal funds purchased and securities sold under agreements to

repurchase |

|

133,960 |

|

|

|

56,354 |

|

| Other borrowings |

|

|

|

|

196,539 |

|

|

|

260,866 |

|

| Subordinated debentures |

|

|

|

|

104,872 |

|

|

|

104,784 |

|

| Other

liabilities |

|

|

|

|

|

30,033 |

|

|

|

28,248 |

|

| TOTAL LIABILITIES |

|

|

|

|

4,822,400 |

|

|

|

4,543,087 |

|

| |

|

|

|

|

|

|

|

| STOCKHOLDERS' EQUITY |

|

|

|

|

|

| Common stock, no par value; authorized 70,000,000

shares; |

|

|

|

| issued

47,352,714 shares at September 30, 2017 |

|

|

|

|

|

|

|

| and 47,222,914

shares at December 31, 2016 |

|

|

|

|

|

512,383 |

|

|

|

510,861 |

|

| Retained earnings |

|

|

|

|

63,917 |

|

|

|

38,590 |

|

| Accumulated other comprehensive gain |

|

|

|

|

781 |

|

|

|

593 |

|

|

TOTAL STOCKHOLDERS' EQUITY |

|

|

|

|

|

577,081 |

|

|

|

550,044 |

|

|

TOTAL

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

$ |

5,399,481 |

|

|

$ |

5,093,131 |

|

| |

|

|

|

|

|

|

|

| Lakeland Bancorp, Inc. |

| Financial Highlights |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

| |

|

|

Sept 30, |

June 30, |

Mar 31, |

Dec 31, |

Sept 30, |

| (Dollars in thousands, except per share data) |

|

|

2017 |

|

|

2017 |

|

|

2017 |

|

|

2016 |

|

|

2016 |

|

| |

|

|

|

|

|

|

|

|

INCOME STATEMENT |

|

|

|

|

|

|

| Net

interest income |

|

$ |

42,115 |

|

$ |

41,421 |

|

$ |

39,323 |

|

$ |

38,179 |

|

$ |

38,518 |

|

| Provision

for loan and lease losses |

|

|

(1,827 |

) |

|

(1,827 |

) |

|

(1,218 |

) |

|

(375 |

) |

|

(1,763 |

) |

| Other

noninterest income |

|

|

4,976 |

|

|

5,655 |

|

|

5,157 |

|

|

4,636 |

|

|

5,664 |

|

| Gains

(losses) on sales of investment securities |

|

|

- |

|

|

(15 |

) |

|

2,539 |

|

|

- |

|

|

- |

|

| Gains on

sales of loans |

|

|

478 |

|

|

471 |

|

|

398 |

|

|

525 |

|

|

753 |

|

| Long-term

debt prepayment fee |

|

|

- |

|

|

- |

|

|

(2,828 |

) |

|

- |

|

|

- |

|

| Merger

related expenses |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(1,697 |

) |

| Other

noninterest expense |

|

|

(24,849 |

) |

|

(25,366 |

) |

|

(25,642 |

) |

|

(24,772 |

) |

|

(24,309 |

) |

|

Pretax income |

|

|

20,893 |

|

|

20,339 |

|

|

17,729 |

|

|

18,193 |

|

|

17,166 |

|

| Provision

for income taxes |

|

|

(7,170 |

) |

|

(6,969 |

) |

|

(5,417 |

) |

|

(6,240 |

) |

|

(5,839 |

) |

| Net

income |

|

$ |

13,723 |

|

$ |

13,370 |

|

$ |

12,312 |

|

$ |

11,953 |

|

$ |

11,327 |

|

| |

|

|

|

|

|

|

|

| Basic

earnings per common share |

|

$ |

0.29 |

|

$ |

0.28 |

|

$ |

0.26 |

|

$ |

0.26 |

|

$ |

0.25 |

|

| Diluted

earnings per common share |

|

$ |

0.29 |

|

$ |

0.28 |

|

$ |

0.26 |

|

$ |

0.26 |

|

$ |

0.25 |

|

| Dividends

per common share |

|

$ |

0.10 |

|

$ |

0.100 |

|

$ |

0.095 |

|

$ |

0.095 |

|

$ |

0.095 |

|

| Dividends

paid |

|

$ |

4,775 |

|

$ |

4,775 |

|

$ |

4,527 |

|

$ |

4,265 |

|

$ |

4,261 |

|

| Weighted

average shares - basic |

|

|

47,466 |

|

|

47,465 |

|

|

47,354 |

|

|

45,002 |

|

|

44,439 |

|

| Weighted

average shares - diluted |

|

|

47,692 |

|

|

47,674 |

|

|

47,623 |

|

|

45,257 |

|

|

44,659 |

|

| |

|

|

|

|

|

|

|

|

SELECTED OPERATING RATIOS |

|

|

|

|

|

|

| Annualized

return on average assets |

|

|

1.03 |

% |

|

1.02 |

% |

|

0.97 |

% |

|

0.95 |

% |

|

0.94 |

% |

| Annualized

return on average common equity |

|

|

9.48 |

% |

|

9.49 |

% |

|

9.02 |

% |

|

9.31 |

% |

|

9.10 |

% |

| Annualized

return on average tangible common equity (1) |

|

12.51 |

% |

|

12.58 |

% |

|

12.04 |

% |

|

12.83 |

% |

|

12.68 |

% |

| Annualized

net interest margin |

|

|

3.39 |

% |

|

3.41 |

% |

|

3.33 |

% |

|

3.27 |

% |

|

3.45 |

% |

| Efficiency

ratio (1) |

|

|

51.72 |

% |

|

52.64 |

% |

|

56.36 |

% |

|

56.35 |

% |

|

53.35 |

% |

| Common

stockholders' equity to total assets |

|

|

10.69 |

% |

|

10.58 |

% |

|

10.63 |

% |

|

10.80 |

% |

|

10.17 |

% |

| Tangible

common equity to tangible assets (1) |

|

|

8.33 |

% |

|

8.20 |

% |

|

8.20 |

% |

|

8.30 |

% |

|

7.53 |

% |

| Tier 1

risk-based ratio |

|

|

10.82 |

% |

|

10.77 |

% |

|

10.73 |

% |

|

10.85 |

% |

|

9.70 |

% |

| Total

risk-based ratio |

|

|

13.37 |

% |

|

13.32 |

% |

|

13.29 |

% |

|

13.48 |

% |

|

12.40 |

% |

| Tier 1

leverage ratio |

|

|

9.07 |

% |

|

8.99 |

% |

|

8.97 |

% |

|

9.07 |

% |

|

8.26 |

% |

| Common

equity tier 1 capital ratio |

|

|

10.13 |

% |

|

10.06 |

% |

|

10.01 |

% |

|

10.11 |

% |

|

8.94 |

% |

| Book value

per common share |

|

$ |

12.19 |

|

$ |

11.99 |

|

$ |

11.78 |

|

$ |

11.65 |

|

$ |

11.22 |

|

| Tangible

book value per common share (1) |

|

$ |

9.25 |

|

$ |

9.05 |

|

$ |

8.84 |

|

$ |

8.70 |

|

$ |

8.07 |

|

| |

|

|

|

|

|

|

|

| (1) See

Supplemental Information - Non-GAAP Financial Measures |

|

|

|

|

|

|

| Lakeland Bancorp, Inc. |

| Financial Highlights |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

| |

|

|

|

Sept 30, |

June 30, |

Mar 31, |

Dec 31, |

Sept 30, |

| (Dollars in thousands) |

|

|

|

2017 |

|

|

2017 |

|

|

2017 |

|

|

2016 |

|

|

2016 |

|

| |

|

|

|

|

|

|

|

SELECTED BALANCE SHEET DATA AT

PERIOD-END |

|

|

|

|

| Loans and

leases |

|

|

$ |

4,092,893 |

|

$ |

4,054,276 |

|

$ |

3,974,718 |

|

$ |

3,873,895 |

|

$ |

3,794,519 |

|

| Allowance

for loan and lease losses |

|

(33,925 |

) |

|

(32,823 |

) |

|

(31,590 |

) |

|

(31,245 |

) |

|

(31,369 |

) |

| Investment

securities |

|

|

|

795,096 |

|

|

830,531 |

|

|

847,833 |

|

|

769,417 |

|

|

638,091 |

|

| Total assets |

|

|

|

|

5,399,481 |

|

|

5,362,187 |

|

|

5,247,815 |

|

|

5,093,131 |

|

|

4,904,291 |

|

| Total

deposits |

|

|

|

4,356,996 |

|

|

4,227,204 |

|

|

4,293,393 |

|

|

4,092,835 |

|

|

3,941,742 |

|

| Short-term

borrowings |

|

|

|

133,960 |

|

|

118,487 |

|

|

84,850 |

|

|

56,354 |

|

|

29,699 |

|

| Other

borrowings |

|

|

|

301,411 |

|

|

417,093 |

|

|

278,238 |

|

|

365,650 |

|

|

398,671 |

|

|

Stockholders' equity |

|

|

|

577,081 |

|

|

567,545 |

|

|

557,642 |

|

|

550,044 |

|

|

498,722 |

|

| |

|

|

|

|

|

|

|

|

| LOANS AND

LEASES |

|

|

|

|

|

|

|

| Commercial,

real estate |

|

|

$ |

3,018,106 |

|

$ |

2,955,596 |

|

$ |

2,881,972 |

|

$ |

2,767,710 |

|

$ |

2,675,154 |

|

| Commercial,

industrial and other |

|

|

342,775 |

|

|

352,977 |

|

|

342,264 |

|

|

350,228 |

|

|

339,291 |

|

| Leases |

|

|

|

|

71,698 |

|

|

70,295 |

|

|

67,488 |

|

|

67,016 |

|

|

65,659 |

|

| Residential

mortgages |

|

|

|

329,625 |

|

|

337,765 |

|

|

344,890 |

|

|

349,581 |

|

|

370,766 |

|

| Consumer

and home equity |

|

|

|

330,689 |

|

|

337,643 |

|

|

338,104 |

|

|

339,360 |

|

|

343,649 |

|

|

Total loans and leases |

|

|

$ |

4,092,893 |

|

$ |

4,054,276 |

|

$ |

3,974,718 |

|

$ |

3,873,895 |

|

$ |

3,794,519 |

|

| |

|

|

|

|

|

|

|

|

| DEPOSITS |

|

|

|

|

|

|

|

|

|

Noninterest-bearing |

|

|

$ |

955,444 |

|

$ |

978,668 |

|

$ |

924,581 |

|

$ |

927,270 |

|

$ |

931,385 |

|

| Savings and

interest-bearing transaction accounts

|

|

2,681,512 |

|

|

2,682,291 |

|

|

2,809,705 |

|

|

2,620,657 |

|

|

2,471,097 |

|

| Time

deposits |

|

|

|

720,040 |

|

|

566,245 |

|

|

559,107 |

|

|

544,908 |

|

|

539,260 |

|

|

Total deposits |

|

|

$ |

4,356,996 |

|

$ |

4,227,204 |

|

$ |

4,293,393 |

|

$ |

4,092,835 |

|

$ |

3,941,742 |

|

| |

|

|

|

|

|

|

|

|

| Total loans

and leases to total deposits |

|

|

93.9 |

% |

|

95.9 |

% |

|

92.6 |

% |

|

94.7 |

% |

|

96.3 |

% |

| |

|

|

|

|

|

|

|

|

|

SELECTED AVERAGE BALANCE SHEET DATA |

|

|

|

|

|

| Loans and

leases |

|

|

$ |

4,060,838 |

|

$ |

4,011,325 |

|

$ |

3,905,216 |

|

$ |

3,806,588 |

|

$ |

3,743,434 |

|

| Investment

securities |

|

|

|

815,773 |

|

|

837,075 |

|

|

790,046 |

|

|

683,986 |

|

|

606,779 |

|

|

Interest-earning assets |

|

|

|

4,957,856 |

|

|

4,907,488 |

|

|

4,825,855 |

|

|

4,680,156 |

|

|

4,467,524 |

|

| Total

assets |

|

|

|

5,300,191 |

|

|

5,241,155 |

|

|

5,153,893 |

|

|

5,015,439 |

|

|

4,805,381 |

|

|

Noninterest-bearing demand deposits |

|

|

971,143 |

|

|

954,966 |

|

|

921,770 |

|

|

951,418 |

|

|

895,851 |

|

| Savings

deposits |

|

|

|

484,982 |

|

|

492,991 |

|

|

490,777 |

|

|

490,556 |

|

|

487,918 |

|

|

Interest-bearing transaction accounts |

|

|

2,206,206 |

|

|

2,295,256 |

|

|

2,241,954 |

|

|

2,072,154 |

|

|

1,988,405 |

|

| Time

deposits |

|

|

|

645,333 |

|

|

559,665 |

|

|

555,270 |

|

|

539,870 |

|

|

533,224 |

|

| Total

deposits |

|

|

4,307,664 |

|

|

4,302,878 |

|

|

4,209,771 |

|

|

4,053,998 |

|

|

3,905,398 |

|

| Short-term

borrowings |

|

|

|

42,172 |

|

|

52,951 |

|

|

28,358 |

|

|

27,538 |

|

|

35,608 |

|

| Other

borrowings |

|

|

|

344,775 |

|

|

291,882 |

|

|

332,750 |

|

|

392,789 |

|

|

339,204 |

|

| Total

interest-bearing liabilities |

|

|

3,723,468 |

|

|

3,692,745 |

|

|

3,649,109 |

|

|

3,522,907 |

|

|

3,384,359 |

|

|

Stockholders' equity |

|

|

|

574,113 |

|

|

565,211 |

|

|

553,782 |

|

|

510,562 |

|

|

495,343 |

|

| |

|

|

|

|

|

| Lakeland Bancorp, Inc. |

|

| Financial Highlights |

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

|

|

|

|

|

Sept 30, |

June 30, |

Mar 31, |

Dec 31, |

Sept 30, |

|

| (Dollars in thousands) |

|

|

|

2017 |

|

|

2017 |

|

|

2017 |

|

|

2016 |

|

|

2016 |

|

|

| |

|

|

|

|

|

|

|

AVERAGE ANNUALIZED YIELDS (TAXABLE EQUIVALENT

BASIS) |

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

|

| Loans and

leases |

|

|

|

4.33 |

% |

|

4.27 |

% |

|

4.20 |

% |

|

4.19 |

% |

|

4.23 |

% |

|

| Taxable

investment securities and other |

|

|

2.09 |

% |

|

2.11 |

% |

|

2.13 |

% |

|

2.00 |

% |

|

2.06 |

% |

|

| Tax-exempt

securities |

|

|

|

2.98 |

% |

|

2.86 |

% |

|

2.78 |

% |

|

2.75 |

% |

|

3.01 |

% |

|

| Federal

funds sold and interest-bearing cash accounts |

|

1.03 |

% |

|

0.89 |

% |

|

0.85 |

% |

|

0.48 |

% |

|

0.48 |

% |

|

|

Total interest-earning assets |

|

|

3.93 |

% |

|

3.88 |

% |

|

3.78 |

% |

|

3.74 |

% |

|

3.85 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

| Savings

accounts |

|

|

|

0.06 |

% |

|

0.06 |

% |

|

0.06 |

% |

|

0.06 |

% |

|

0.06 |

% |

|

|

Interest-bearing transaction accounts |

|

|

0.49 |

% |

|

0.44 |

% |

|

0.38 |

% |

|

0.35 |

% |

|

0.34 |

% |

|

| Time

deposits |

|

|

|

1.03 |

% |

|

0.86 |

% |

|

0.83 |

% |

|

0.84 |

% |

|

0.81 |

% |

|

| Borrowings |

|

|

|

|

2.20 |

% |

|

2.30 |

% |

|

2.37 |

% |

|

2.37 |

% |

|

1.71 |

% |

|

|

Total interest-bearing liabilities |

|

|

0.71 |

% |

|

0.63 |

% |

|

0.60 |

% |

|

0.62 |

% |

|

0.53 |

% |

|

| Net

interest spread (taxable equivalent basis) |

|

3.22 |

% |

|

3.25 |

% |

|

3.18 |

% |

|

3.12 |

% |

|

3.32 |

% |

|

| |

|

|

|

|

|

|

|

|

|

| Annualized

net interest margin (taxable equivalent basis) |

|

3.39 |

% |

|

3.41 |

% |

|

3.33 |

% |

|

3.27 |

% |

|

3.45 |

% |

|

| Annualized

cost of deposits |

|

|

0.41 |

% |

|

0.35 |

% |

|

0.32 |

% |

|

0.30 |

% |

|

0.29 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

ASSET QUALITY DATA |

|

|

|

|

|

|

|

| ALLOWANCE

FOR LOAN AND LEASE LOSSES |

|

|

|

|

|

|

| Balance at

beginning of period |

|

$ |

32,823 |

|

$ |

31,590 |

|

$ |

31,245 |

|

$ |

31,369 |

|

$ |

30,667 |

|

|

| Provision

for loan and lease losses |

|

|

1,827 |

|

|

1,827 |

|

|

1,218 |

|

|

375 |

|

|

1,763 |

|

|

| Charge-offs |

|

|

|

|

(869 |

) |

|

(870 |

) |

|

(1,360 |

) |

|

(795 |

) |

|

(1,273 |

) |

|

| Recoveries |

|

|

|

|

144 |

|

|

276 |

|

|

487 |

|

|

296 |

|

|

212 |

|

|

|

Balance at end of period |

|

|

$ |

33,925 |

|

$ |

32,823 |

|

$ |

31,590 |

|

$ |

31,245 |

|

$ |

31,369 |

|

|

| |

|

|

|

|

|

|

|

|

|

| NET LOAN

AND LEASE CHARGE-OFFS (RECOVERIES) |

|

|

|

|

|

|

| Commercial,

real estate |

|

|

$ |

285 |

|

$ |

(67 |

) |

$ |

595 |

|

$ |

(87 |

) |

$ |

(11 |

) |

|

| Commercial,

industrial and other |

|

|

168 |

|

|

44 |

|

|

68 |

|

|

(96 |

) |

|

(30 |

) |

|

| Leases |

|

|

|

|

80 |

|

|

92 |

|

|

39 |

|

|

42 |

|

|

40 |

|

|

| Residential

mortgages |

|

|

|

95 |

|

|

169 |

|

|

141 |

|

|

231 |

|

|

385 |

|

|

| Consumer

and home equity |

|

|

97 |

|

|

356 |

|

|

30 |

|

|

409 |

|

|

677 |

|

|

| Net

charge-offs (recoveries) |

|

$ |

725 |

|

$ |

594 |

|

$ |

873 |

|

$ |

499 |

|

$ |

1,061 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

NON-PERFORMING ASSETS |

|

|

|

|

|

|

|

| Commercial,

real estate |

|

|

$ |

6,820 |

|

$ |

10,240 |

|

$ |

10,443 |

|

$ |

11,885 |

|

$ |

13,068 |

|

|

| Commercial,

industrial and other |

|

|

172 |

|

|

378 |

|

|

136 |

|

|

167 |

|

|

39 |

|

|

| Leases |

|

|

|

|

110 |

|

|

81 |

|

|

179 |

|

|

153 |

|

|

78 |

|

|

| Residential

mortgages |

|

|

|

4,410 |

|

|

3,857 |

|

|

4,715 |

|

|

6,048 |

|

|

7,264 |

|

|

| Consumer

and home equity |

|

|

2,033 |

|

|

1,689 |

|

|

2,270 |

|

|

2,151 |

|

|

2,210 |

|

|

|

Total non-accrual loans and leases |

|

|

13,545 |

|

|

16,245 |

|

|

17,743 |

|

|

20,404 |

|

|

22,659 |

|

|

| Property

acquired through foreclosure or repossession |

|

1,168 |

|

|

1,415 |

|

|

710 |

|

|

1,072 |

|

|

1,918 |

|

|

|

Total non-performing assets |

|

$ |

14,713 |

|

$ |

17,660 |

|

$ |

18,453 |

|

$ |

21,476 |

|

$ |

24,577 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Loans past

due 90 days or more and still accruing |

$ |

9 |

|

$ |

20 |

|

$ |

- |

|

$ |

10 |

|

$ |

10 |

|

|

| Loans

restructured and still accruing |

|

$ |

11,279 |

|

$ |

11,697 |

|

$ |

11,553 |

|

$ |

8,802 |

|

$ |

9,251 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Ratio of

allowance for loan and lease losses to total loans and leases |

|

|

|

|

0.83 |

% |

|

0.81 |

% |

|

0.79 |

% |

|

0.81 |

% |

|

0.83 |

% |

|

| Total

non-accrual loans and leases to total loans and leases |

|

|

|

|

0.33 |

% |

|

0.40 |

% |

|

0.45 |

% |

|

0.53 |

% |

|

0.60 |

% |

|

| Total

non-performing assets to total assets |

|

|

|

|

0.27 |

% |

|

0.33 |

% |

|

0.35 |

% |

|

0.42 |

% |

|

0.50 |

% |

|

|

Annualized net charge-offs (recoveries) to average loans and

leases |

|

|

|

|

0.07 |

% |

|

0.06 |

% |

|

0.09 |

% |

|

0.05 |

% |

|

0.11 |

% |

|

| |

|

|

|

|

|

| Lakeland Bancorp, Inc. |

| Supplemental Information - Non-GAAP Financial

Measures |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At or for the Quarter Ended |

|

|

|

|

|

Sept 30, |

June 30, |

Mar 31, |

Dec 31, |

Sept 30, |

| (Dollars in thousands, except per share amounts) |

|

2017 |

|

|

2017 |

|

|

2017 |

|

|

2016 |

|

|

2016 |

|

| |

|

|

|

|

|

|

|

|

|

CALCULATION OF TANGIBLE BOOK VALUE PER COMMON

SHARE |

|

|

|

|

|

| Total

common stockholders' equity at end of period - GAAP |

$ |

577,081 |

|

$ |

567,545 |

|

$ |

557,642 |

|

$ |

550,044 |

|

$ |

498,722 |

|

| Less:

Goodwill |

|

|

|

|

136,433 |

|

|

136,433 |

|

|

135,747 |

|

|

135,747 |

|

|

136,392 |

|

| Less:

Other identifiable intangible assets |

|

|

2,526 |

|

|

2,631 |

|

|

3,149 |

|

|

3,344 |

|

|

3,545 |

|

| Total tangible common stockholders' equity at

end of period - Non-GAAP |

$ |

438,122 |

|

$ |

428,481 |

|

$ |

418,746 |

|

$ |

410,953 |

|

$ |

358,785 |

|

| |

|

|

|

|

|

|

|

|

| Shares outstanding at end of period |

|

|

47,353 |

|

|

47,353 |

|

|

47,350 |

|

|

47,223 |

|

|

44,443 |

|

| |

|

|

|

|

|

|

|

|

| Book value per share - GAAP |

|

|

$ |

12.19 |

|

$ |

11.99 |

|

$ |

11.78 |

|

$ |

11.65 |

|

$ |

11.22 |

|

| |

|

|

|

|

|

|

|

|

| Tangible book value per share - Non-GAAP |

|

$ |

9.25 |

|

$ |

9.05 |

|

$ |

8.84 |

|

$ |

8.70 |

|

$ |

8.07 |

|

| |

|

|

|

|

|

|

|

|

|

CALCULATION OF TANGIBLE COMMON EQUITY TO TANGIBLE

ASSETS |

|

|

|

|

|

| Total tangible common stockholders' equity at end of

period - Non-GAAP |

$ |

438,122 |

|

$ |

428,481 |

|

$ |

418,746 |

|

$ |

410,953 |

|

$ |

358,785 |

|

| |

|

|

|

|

|

|

|

|

| Total

assets at end of period - GAAP |

|

$ |

5,399,481 |

|

$ |

5,362,187 |

|

$ |

5,247,815 |

|

$ |

5,093,131 |

|

$ |

4,904,291 |

|

| Less:

Goodwill |

|

|

|

|

136,433 |

|

|

136,433 |

|

|

135,747 |

|

|

135,747 |

|

|

136,392 |

|

| Less:

Other identifiable intangible assets |

|

|

2,526 |

|

|

2,631 |

|

|

3,149 |

|

|

3,344 |

|

|

3,545 |

|

| Total tangible assets at end of period -

Non-GAAP |

$ |

5,260,522 |

|

$ |

5,223,123 |

|

$ |

5,108,919 |

|

$ |

4,954,040 |

|

$ |

4,764,354 |

|

| |

|

|

|

|

|

|

|

|

| Common equity to assets - GAAP |

|

|

|

10.69 |

% |

|

10.58 |

% |

|

10.63 |

% |

|

10.80 |

% |

|

10.17 |

% |

| |

|

|

|

|

|

|

|

|

| Tangible common equity to tangible assets - Non-GAAP |

|

8.33 |

% |

|

8.20 |

% |

|

8.20 |

% |

|

8.30 |

% |

|

7.53 |

% |

| |

|

|

|

|

|

|

|

|

|

CALCULATION OF RETURN ON AVERAGE TANGIBLE COMMON

EQUITY |

|

|

|

|

|

| Net

income - GAAP |

|

|

|

$ |

13,723 |

|

$ |

13,370 |

|

$ |

12,312 |

|

$ |

11,953 |

|

$ |

11,327 |

|

| |

|

|

|

|

|

|

|

|

| Total

average common stockholders' equity - GAAP |

$ |

574,113 |

|

$ |

565,211 |

|

$ |

553,782 |

|

$ |

510,562 |

|

$ |

495,343 |

|

| Less:

Average goodwill |

|

|

|

136,433 |

|

|

135,755 |

|

|

135,747 |

|

|

136,385 |

|

|

136,392 |

|

| Less:

Average other identifiable intangible assets |

|

2,606 |

|

|

3,069 |

|

|

3,276 |

|

|

3,459 |

|

|

3,685 |

|

| Total average tangible common stockholders'

equity - Non-GAAP |

$ |

435,074 |

|

$ |

426,387 |

|

$ |

414,759 |

|

$ |

370,718 |

|

$ |

355,266 |

|

| |

|

|

|

|

|

|

|

|

| Return on average common stockholders' equity - GAAP |

|

9.48 |

% |

|

9.49 |

% |

|

9.02 |

% |

|

9.31 |

% |

|

9.10 |

% |

| |

|

|

|

|

|

|

|

|

| Return on average tangible common stockholders' equity -

Non-GAAP |

|

12.51 |

% |

|

12.58 |

% |

|

12.04 |

% |

|

12.83 |

% |

|

12.68 |

% |

| |

|

|

|

|

|

|

|

|

|

CALCULATION OF EFFICIENCY RATIO |

|

|

|

|

|

|

| Total

noninterest expense |

|

|

$ |

24,849 |

|

$ |

25,366 |

|

$ |

28,470 |

|

$ |

24,772 |

|

$ |

26,006 |

|

|

Amortization of core deposit intangibles |

|

|

(104 |

) |

|

(190 |

) |

|

(195 |

) |

|

(202 |

) |

|

(201 |

) |

| Long-term

debt prepayment fee |

|

|

|

- |

|

|

- |

|

|

(2,828 |

) |

|

- |

|

|

- |

|

| Merger

related expenses |

|

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(1,697 |

) |

| Noninterest expense, as adjusted |

|

|

$ |

24,745 |

|

$ |

25,176 |

|

$ |

25,447 |

|

$ |

24,570 |

|

$ |

24,108 |

|

| |

|

|

|

|

|

|

|

|

| Net interest

income |

|

|

|

$ |

42,115 |

|

$ |

41,421 |

|

$ |

39,323 |

|

$ |

38,179 |

|

$ |

38,518 |

|

| Total noninterest income |

|

|

|

5,454 |

|

|

6,111 |

|

|

8,094 |

|

|

5,161 |

|

|

6,417 |

|

| Total

revenue |

|

|

|

|

47,569 |

|

|

47,532 |

|

|

47,417 |

|

|

43,340 |

|

|

44,935 |

|

|

Tax-equivalent adjustment on municipal securities |

|

271 |

|

|

281 |

|

|

275 |

|

|

262 |

|

|

253 |

|

| (Gains) losses on sales of investment securities |

|

- |

|

|

15 |

|

|

(2,539 |

) |

|

- |

|

|

- |

|

| Total revenue, as adjusted |

|

|

$ |

47,840 |