Seagate Technology plc (NASDAQ:STX) (the “Company” or “Seagate”)

today reported financial results for the quarter ended September

29, 2017. For the first quarter, the Company reported revenue of

$2.6 billion, gross margin of 28.0%, net income of $181 million and

diluted earnings per share of $0.62. On a non-GAAP basis, which

excludes the net impact of certain items, Seagate reported gross

margin of 29.0%, net income of $279 million and diluted earnings

per share of $0.96.

During the first quarter, the Company generated $237 million in

cash flow from operations and returned approximately $350 million

to shareholders in the form of dividends and share repurchases.

Cash and cash equivalents totaled approximately $2.3 billion at the

end of the quarter. There were 289 million ordinary shares issued

and outstanding as of the end of the quarter.

“The results of our performance this quarter reflect solid

execution and market demand for our storage product portfolio,”

said Dave Mosley, Seagate’s chief executive officer. “Seagate

delivered record levels of exabyte shipments and generated

sequential growth in revenue and profit. As the demand for storage

continues to benefit from the proliferation of data, Seagate is in

a strong position to grow its businesses, improve profitability and

continue with its shareholder-return objectives.”

For a detailed reconciliation of GAAP to non-GAAP results, see

accompanying financial tables.

Seagate has issued a Supplemental Financial Information

document, which is available on Seagate’s Investors Relations

website at www.seagate.com/investors.

Quarterly Cash Dividend

The Board of Directors of the Company (the “Board”) has approved

a quarterly cash dividend of $0.63 per share, which will be payable

on January 3, 2018 to shareholders of record as of the close of

business on December 20, 2017. The payment of any future quarterly

dividends will be at the discretion of the Board and will be

dependent upon Seagate’s financial position, results of operations,

available cash, cash flow, capital requirements and other factors

deemed relevant by the Board.

Investor Communications

Seagate management will hold a public webcast today at 6:00 a.m.

Pacific Time that can be accessed on its Investor Relations website

at www.seagate.com/investors. During today’s webcast, the Company

will provide an outlook for its second fiscal quarter of 2018,

including key underlying assumptions.

An archived audio webcast of this event will be available on

Seagate’s Investors Relations website at www.seagate.com/investors

shortly following the event conclusion.

About Seagate

To learn more about the Company’s products and services, visit

www.seagate.com and follow us on Twitter, Facebook, LinkedIn,

Spiceworks, YouTube and subscribe to our blog. The contents of our

website and social media channels are not a part of this

release.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, each as

amended, including, in particular, statements about the Company’s

plans, strategies and prospects, financial projections, estimates

of industry growth, market demand, shifts in technology and

dividend issuance plans for the fiscal quarter ending December 29,

2017 and beyond. These statements identify prospective

information and may include words such as “expects,” “intends,”

“plans,” “anticipates,” “believes,” “estimates,” “predicts,”

“projects,” “should,” “may,” “will,” or the negative of these

words, variations of these words and comparable terminology. These

forward-looking statements are based on information available to

the Company as of the date of this report and are based on

management’s current views and assumptions. These forward-looking

statements are conditioned upon and also involve a number of known

and unknown risks, uncertainties, and other factors that could

cause actual results, performance or events to differ materially

from those anticipated by these forward-looking statements. Such

risks, uncertainties, and other factors may be beyond the Company’s

control and may pose a risk to the Company’s operating and

financial condition. Such risks and uncertainties include, but are

not limited to: items that may be identified during its financial

statement closing process that cause adjustments to the estimates

included in this report; the uncertainty in global economic

conditions; the impact of the variable demand and adverse pricing

environment for disk drives; the Company’s ability to successfully

qualify, manufacture and sell its disk drive products in increasing

volumes on a cost-effective basis and with acceptable quality; the

impact of competitive product announcements; the Company’s ability

to achieve projected cost savings in connection with restructuring

plans; possible excess industry supply with respect to particular

disk drive products; disruptions to its supply chain or production

capabilities; unexpected advances in competing technologies or

changes in market trends; the development and introduction of

products based on new technologies and expansion into new data

storage markets; the Company’s ability to comply with certain

covenants in its credit facilities with respect to financial ratios

and financial condition tests; currency fluctuations that may

impact the Company’s margins and international sales; cyber-attacks

or other data breaches that disrupt the Company’s operations or

result in the dissemination of proprietary or confidential

information and cause reputational harm; and fluctuations in

interest rates. Information concerning risks, uncertainties and

other factors that could cause results to differ materially from

the expectations described in this press release is contained in

the Company’s Annual Report on Form 10-K filed with the U.S.

Securities and Exchange Commission on August 4, 2017, the

“Risk Factors” section of which is incorporated into this press

release by reference, and other documents filed with or furnished

to the Securities and Exchange Commission. These forward-looking

statements should not be relied upon as representing the Company’s

views as of any subsequent date and the Company undertakes no

obligation to update forward-looking statements to reflect events

or circumstances after the date they were made.

The inclusion of Seagate’s website address in this press release

is intended to be an inactive textual reference only and not an

active hyperlink. The information contained in, or that can be

accessed through, Seagate’s website and social media channels are

not part of this press release.

SEAGATE TECHNOLOGY PLCCONDENSED

CONSOLIDATED BALANCE SHEETS(In

millions)(Unaudited)

September 29, 2017

June 30,2017 (a)

ASSETS Current assets: Cash and cash equivalents $ 2,285 $

2,539 Accounts receivable, net 1,209 1,199 Inventories 1,014 982

Other current assets 316 321 Total current assets 4,824

5,041 Property, equipment and leasehold improvements, net 1,817

1,875 Goodwill 1,237 1,238 Other intangible assets, net 255 281

Deferred income taxes 609 609 Other assets, net 214 224

Total Assets $ 8,956 $ 9,268

LIABILITIES AND EQUITY

Current liabilities: Accounts payable $ 1,539 $ 1,626 Accrued

employee compensation 150 237 Accrued warranty 111 113 Accrued

expenses 658 650 Total current liabilities 2,458 2,626

Long-term accrued warranty 119 120 Long-term accrued income taxes

15 15 Other non-current liabilities 120 122 Long-term debt 5,002

5,021 Total Liabilities 7,714 7,904 Equity: Total Equity

1,242 1,364 Total Liabilities and Equity $ 8,956 $

9,268

(a) The information in this column was derived from the

Company’s audited Consolidated Balance Sheet as of June 30,

2017.

SEAGATE TECHNOLOGY PLCCONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS(In millions, except

per share data)(Unaudited)

For the Three Months Ended

September 29, 2017

September 30, 2016

Revenue $ 2,632 $ 2,797 Cost of revenue 1,896 1,996 Product

development 263 315 Marketing and administrative 145 155

Amortization of intangibles 22 28 Restructuring and other, net 51

82 Total operating expenses 2,377 2,576

Income from operations 255 221 Interest income 7 1

Interest expense (61 ) (50 ) Other, net (13 ) 1 Other

expense, net (67 ) (48 ) Income before income taxes 188 173

Provision for income taxes 7 6 Net income $ 181

$ 167 Net income per share: Basic $ 0.62 $

0.56 Diluted 0.62 0.55 Number of shares used in per share

calculations: Basic 290 299 Diluted 292 301 Cash dividends

declared per ordinary share $ 0.63 $ 0.63

SEAGATE TECHNOLOGY PLCCONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS(In

millions)(Unaudited)

For the Three Months Ended

September 29, 2017

September 30, 2016

OPERATING ACTIVITIES Net income $ 181 $ 167 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization 161 200 Share-based compensation 32

40 Deferred income taxes (3 ) 1 Other non-cash operating

activities, net 1 (7 ) Changes in operating assets and liabilities:

Accounts receivable, net (10 ) 12 Inventories (32 ) (46 ) Accounts

payable (30 ) 101 Accrued employee compensation (87 ) 32 Accrued

expenses, income taxes and warranty 16 89 Other assets and

liabilities 8 2 Net cash provided by operating

activities 237 591

INVESTING ACTIVITIES

Acquisition of property, equipment and leasehold improvements (124

) (140 ) Maturities of short-term investments — 1 Other investing

activities, net (8 ) — Net cash used in investing activities

(132 ) (139 )

FINANCING ACTIVITIES Redemption and repurchase

of debt (22 ) — Taxes paid related to net share settlement of

equity awards (20 ) (23 ) Repurchases of ordinary shares (166 )

(101 ) Dividends to shareholders (184 ) — Proceeds from issuance of

ordinary shares under employee stock plans 29 35 Net

cash used in financing activities (363 ) (89 ) Effect of foreign

currency exchange rate changes on cash, cash equivalents, and

restricted cash 4 — (Decrease) increase in cash, cash

equivalents, and restricted cash (254 ) 363 Cash, cash equivalents,

and restricted cash at the beginning of the period 2,543

1,132 Cash, cash equivalents, and restricted cash at the end

of the period $ 2,289 $ 1,495

Use of non-GAAP financial information

The Company uses non-GAAP measures of adjusted revenue, gross

margin, net income, diluted earnings per share and operating

expenses which are adjusted from results based on GAAP to exclude

certain expenses, gains and losses. These non-GAAP financial

measures may be provided to enhance the user’s overall

understanding of the Company’s current financial performance and

its prospects for the future. Specifically, the Company believes

non-GAAP results provide useful information to both management and

investors as these non-GAAP results exclude certain expenses, gains

and losses that it believes are not indicative of its core

operating results and because it is similar to the approach used in

connection with the financial models and estimates published by

financial analysts who follow the Company.

These non-GAAP results are some of the primary measurements

management uses to assess the Company’s performance, allocate

resources and plan for future periods. Reported non-GAAP results

should only be considered as supplemental to results prepared in

accordance with GAAP, and not considered as a substitute for, or

superior to, GAAP results. These non-GAAP measures may differ from

the non-GAAP measures reported by other companies in its

industry.

SEAGATE TECHNOLOGY

PLCADJUSTMENTS TO GAAP NET INCOME AND DILUTED NET INCOME PER

SHARE(In millions, except per share

amounts)(Unaudited)

For the Three MonthsEnded

September 29,2017

For the Three MonthsEnded

September 30, 2016

Reconciliation of GAAP Net Income: GAAP Net income $ 181 $ 167

Non-GAAP adjustments: Revenue — — Cost of revenue A 26 25 Product

development B 1 — Marketing and administrative C — (1 )

Amortization of intangibles D 21 27 Restructuring and other, net E

51 82 Other expense, net F (1 ) (1 ) Provision for income taxes G —

— Non-GAAP net income $ 279 $ 299

Reconciliation of GAAP Diluted Net Income Per Share: GAAP $

0.62 $ 0.55 Non-GAAP $ 0.96 $ 0.99 Shares used in diluted net

income per share calculation 292 301

A

For the three months ended September 29, 2017, Cost of

revenue has been adjusted on a non-GAAP basis to exclude

amortization of intangibles associated with acquisitions and write

off of certain inventory and other charges related to

restructuring. For the three months ended September 30, 2016, Cost

of revenue has been adjusted on a non-GAAP basis to exclude

amortization of intangibles associated with acquisitions and write

off of certain fixed assets.

B

For the three months ended September 29,

2017, Product development expenses have been adjusted on a non-GAAP

basis to exclude other charges related to restructuring.

C

For the three months ended September 30, 2016, Marketing and

administrative expenses have been adjusted on a non-GAAP basis

primarily to reflect the impact of our disposed data service

business.

D

For the three months ended September 29, 2017 and September 30,

2016, Amortization of intangibles primarily related to our

acquisitions has been excluded on a non-GAAP basis.

E

For the three months ended September 29, 2017 and September 30,

2016, Restructuring and other net, has been adjusted on a non-GAAP

basis primarily related to reductions in our workforce as a result

of our ongoing focus on cost efficiencies in all areas of our

business.

F

For the three months ended September 29, 2017 and September 30,

2016, Other expense, net has been adjusted on a non-GAAP basis to

exclude the impact of our disposed data service business.

G

For the three months ended September 29, 2017 and September 30,

2016, Provision for income taxes represents the tax effects of

non-GAAP adjustments determined using a hybrid with and without

method and effective tax rate for the applicable adjustment and

jurisdiction.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171023005270/en/

Media Contact:Seagate Technology plcHelen Farrier,

408-658-1616helen.farrier@seagate.com

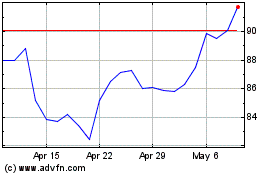

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Aug 2024 to Sep 2024

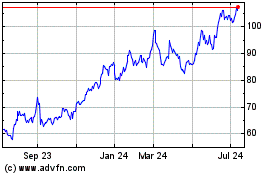

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Sep 2023 to Sep 2024