A.M. Best Assigns Issue Credit Ratings to Cigna Corporation’s New Senior Unsecured Notes

September 08 2017 - 3:06PM

Business Wire

A.M. Best has assigned Long-Term Issue Credit Ratings

(Long-Term IRs) of “bbb” to the $600 million 3.050% senior

unsecured notes due 2027 and the $1 billion 3.875% senior unsecured

notes due 2047 that were recently issued by Cigna

Corporation (Cigna) (headquartered in Bloomfield, CT)

[NYSE:CI]. Furthermore, A.M. Best has assigned indicative Long-Term

IRs of “bbb” to senior unsecured debt, “bbb-” to subordinated debt,

“bb+” to junior subordinated debt and “bb+” to preferred shares of

the shelf registration filed in August. The outlook assigned to

these Credit Ratings (ratings) is stable. The existing ratings of

Cigna and its subsidiaries are unchanged.

Cigna intends to use the proceeds from this $1.6 billion bond

offering for its previously announced cash tender offer for up to

$1 billion for its 8.300% notes due 2023, 7.65% notes due 2023,

7.875% debentures due 2027, 8.300% step down notes due 2033, 6.150%

notes due 2036, 5.875% notes due 2041 and 5.375% notes due 2042,

with any remaining proceeds to be used for general corporate

purposes. A.M. Best expects Cigna’s debt-to-capital ratio to remain

below 30%, which is lower than many of its peers. Interest coverage

is expected to remain strong at over 10 times.

Cigna has a good level of financial flexibility, which is

supported by its commercial paper program, parent company cash, a

line of credit agreement and a steady stream of subsidiary

dividends from its subsidiaries and non-regulated entities. The

company’s projected net income is expected to remain strong with

its health, life and disability insurance operations reporting

consistent revenue growth and earnings.

This press release relates to Credit Ratings that have been

published on A.M. Best’s website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please see A.M.

Best’s Recent Rating Activity web page. For

additional information regarding the use and limitations of Credit

Rating opinions, please view Understanding Best’s Credit

Ratings. For information on the proper media use of Best’s

Credit Ratings and A.M. Best press releases, please view

Guide for Media - Proper Use of Best’s Credit Ratings and A.M.

Best Rating Action Press Releases.

A.M. Best is the world’s oldest and most authoritative

insurance rating and information source. For more information,

visit www.ambest.com.

Copyright © 2017 by A.M. Best Rating

Services, Inc. and/or its subsidiaries. ALL RIGHTS

RESERVED.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170908005834/en/

A.M. BestSaurin Parikh, +1 908 439 2200, ext.

5030Financial

Analystsaurin.parikh@ambest.comorSally Rosen, +1 908

439 2200, ext. 5280Senior

Directorsally.rosen@ambest.comorChristopher Sharkey,

+1 908 439 2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorJim Peavy,

+1 908 439 2200, ext. 5644Director, Public

Relationsjames.peavy@ambest.com

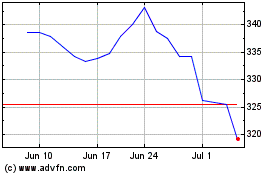

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

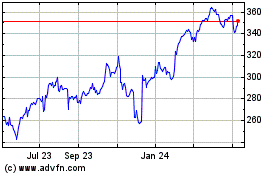

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024