$1.3 billion transaction will expand the

company’s presence in key markets with complementary locations,

fleet and customer mix

Expected to be immediately accretive with

substantial synergies

United Rentals, Inc. (NYSE: URI) (“United Rentals” or “the

company”) and Neff Corporation, operating as Neff Rental (“Neff”),

today announced that they have entered into a definitive agreement

under which United Rentals will acquire Neff for $25 per share in

cash, representing a total purchase price of approximately $1.3

billion. The transaction is expected to be immediately accretive to

cash EPS and free cash flow.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20170816006130/en/

Neff is one of the 10 largest U.S. equipment rental companies,

with a presence in 14 states and a concentration in southern

geographies. Based in Miami, Fla., Neff offers earthmoving,

material handling, aerial and other equipment rental solutions to

its more than 15,500 construction and industrial customers.

Approximately 1,200 Neff employees and 69 branches serve end

markets in the infrastructure, non-residential, energy, municipal

and residential construction sectors.

For the full year 2017, Neff is expected to generate $207

million of adjusted EBITDA at a 49.5% margin on $419 million of

total revenue. As of June 30, 2017, Neff had approximately $867

million of fleet based on original equipment cost.

The boards of directors of United Rentals and Neff unanimously

approved the agreement. Private investment funds managed by Wayzata

Investment Partners LLC, which hold approximately 62.7% of the

outstanding common shares of Neff, have executed a written consent

to approve the transaction, thereby providing the required

stockholder approval. The transaction is expected to close in the

fourth quarter of 2017, subject to Hart-Scott-Rodino clearance and

customary conditions.

Immediately prior to entering into the definitive merger

agreement with United Rentals, Neff terminated its previously

announced merger agreement with H&E Equipment Services, Inc. In

connection with this termination, United Rentals has paid H&E a

termination fee of approximately $13.2 million on behalf of

Neff.

The company plans to update its 2017 financial outlook to

reflect the combined operations upon completion of the

transaction.

Strong Strategic Rationale

- Neff’s branch footprint and

complementary fleet mix will add efficiencies of scale in key

market areas, particularly fast-growing southern geographies.

- Neff’s established presence in the

infrastructure sector dovetails with the company’s Project XL

vertical growth initiatives, and is expected to lead to attractive

revenue synergies through the cross-selling of United Rentals’

broader fleet, including its specialty offerings.

- The combined operations will benefit

from the expansion of earthmoving as a component of United Rentals’

fleet mix, as well as Neff’s best-in-class expertise in managing

large earthmoving categories.

- Neff shares many cultural similarities

with United Rentals, including a customer-first business philosophy

and a strong focus on safety.

- As part of the United Rentals family,

Neff employees will bring a wealth of experience to the combined

organization. They will benefit from industry-leading technology,

training, safety programs and other resources, and have greater

opportunities for career development within the larger

company.

Robust Financial Drivers

- The company expects to realize

significant cost synergies in operational efficiencies and

corporate overhead, with a targeted adjusted EBITDA impact of

approximately $35 million by the end of year two.

- The company expects to realize

approximately $220 million in net present value of tax benefits

included in the $1.3 billion purchase price.

- Net of synergies, the purchase price

represents a multiple of 5.4 times adjusted EBITDA for the year

ended December 31, 2017, and an adjusted purchase multiple of 4.5

times, including the net present value of acquired tax

benefits.

- The acquisition is expected to be

immediately accretive to cash earnings per share and to free cash

flow generation.

- Return on invested capital is expected

to exceed the cost of capital within 18 months of closing, with an

attractive IRR and NPV.

- The company expects to maintain a pro

forma leverage ratio of under 3 times, with a strong deleveraging

path post-close.

- The transaction is not conditioned on

financing. United Rentals expects to use a combination of cash,

existing capacity under its ABL facility, and newly issued debt to

fund the transaction and related expenses.

CEO Comments

Michael Kneeland, president and chief executive officer of

United Rentals, said, “The acquisition of Neff is a significant

opportunity for us to augment long-term returns for our investors,

and build value for our customers and employees. We expect this

transaction to be accretive to both our financial performance and

customer-facing operations, with an important cross-selling

component. The strategic rationale passed every litmus test with

flying colors.”

Kneeland continued, “With the successful integration of NES

largely behind us, we’re prepared to move forward with another

smooth transition in our landmark 20th year. We’re excited to

realize the opportunities of this combination and leverage the many

areas where we’re stronger together. Neff has a customer-focused

team with seasoned field operators, a rigorous commitment to

safety, and specialized expertise. We look forward to welcoming

them as an important part of our future.”

Graham Hood, chief executive officer of Neff, commented, “United

Rentals is an industry leader in equipment rentals, and as a result

of this transaction, our employees and customers will benefit from

the combined company’s expanded geographic footprint and

diversified offering. We look forward to working with the United

Rentals management team as we bring these companies together and

leverage the compatible strengths of both businesses.”

Key Acquisition and Transaction Statistics (financial

information in millions)

Purchase Price $ 1,317 Present Value of

Acquired Tax Assets $ 220 Total Revenues (2017E) $ 419 Adjusted

EBITDA (2017E) $ 207 Estimated Annualized Cost Synergies Achieved

by End of Year Two $ 35 Estimated Annualized Cross-selling Benefits

Achieved by End of Year Three $ 15 Original Equipment Cost of Fleet

$ 867 Employees

~1,170

Rental Branches

69

Customers

~15,500

Morgan Stanley & Co. LLC and Centerview Partners acted as

financial advisors to United Rentals, and Sullivan & Cromwell

LLP acted as the company’s legal advisor. Deutsche Bank acted as

financial advisor to Neff Corporation, and Akin Gump Strauss Hauer

& Feld LLP acted as Neff’s legal advisor.

Presentation and Conference Call / Webcast

United Rentals will hold a conference call tomorrow, Thursday,

August 17, 2017, at 8:30 a.m. Eastern Time. The conference call

number is 855-458-4217 (international: 574-990-3605). The

conference call will also be available live by audio webcast at

unitedrentals.com, where it will be archived for 30 days. The

replay number for the call is 404-537-3406, passcode is

72555593.

Non-GAAP Measures

Adjusted EBITDA is a non-GAAP financial measure as defined under

the rules of the Securities and Exchange Commission. United Rentals

believes that this non-GAAP financial measure provides useful

information about the proposed transaction; however, it should not

be considered as an alternative to GAAP net income. A

reconciliation between Neff’s expected net income and Adjusted

EBITDA, as well as other financial data, is provided in the

investor presentation available on the company’s website.

About United Rentals

United Rentals, Inc. is the largest equipment rental company in

the world. The company has an integrated network of 960 rental

locations in 49 states and every Canadian province. The company’s

approximately 13,700 employees serve construction and industrial

customers, utilities, municipalities, homeowners and others. The

company offers approximately 3,300 classes of equipment for rent

with a total original cost of $10.3 billion. United Rentals is a

member of the Standard & Poor’s 500 Index, the Barron’s 400

Index and the Russell 3000 Index® and is headquartered in Stamford,

Conn. Additional information about United Rentals is available at

unitedrentals.com.

About Neff Corporation

Neff is a leading regional equipment rental company in the

United States, focused on the fast growing Sunbelt States. Based in

Miami, FL, the company offers a broad array of equipment rental

solutions for its more than 15,000 customers, focusing on key end

user markets including infrastructure, non-residential

construction, energy and municipal and residential construction.

Neff has 69 branches, approximately 1,160 employees and a broad

fleet of equipment, including earthmoving, material handling,

aerial and other rental equipment to meet specific customer

needs.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, and the Private Securities Litigation Reform Act of

1995, known as the PSLRA. Forward-looking statements involve

significant risks and uncertainties that may cause results to

differ materially from those set forth in the statements. These

statements are based on current plans, estimates and projections,

and, therefore, you should not place undue reliance on them. No

forward-looking statement, including the updated financial outlook

set forth above and any such statement concerning the completion

and anticipated benefits of the proposed transaction, can be

guaranteed, and actual results may differ materially from those

projected. United Rentals undertakes no obligation to publicly

update any forward-looking statement, whether as a result of new

information, future events or otherwise. Forward-looking statements

are not historical facts, but rather are based on current

expectations, estimates, assumptions and projections about the

business and future financial results of the equipment rental

industries, and other legal, regulatory and economic developments.

We use words such as “anticipates,” “believes,” “plans,” “expects,”

“projects,” “future,” “intends,” “may,” “will,” “should,” “could,”

“estimates,” “predicts,” “potential,” “continue,” “guidance,”

“2017E” (to denote 2017 expected) and similar expressions to

identify these forward-looking statements that are intended to be

covered by the safe harbor provisions of the PSLRA. Actual results

could differ materially from the results contemplated by these

forward-looking statements due to a number of factors, including,

but not limited to, those described in the SEC reports filed by

United Rentals and Neff, as well as the possibility that (1) United

Rentals may be unable to obtain regulatory approvals required for

the proposed transaction or may be required to accept conditions

that could reduce the anticipated benefits of the acquisition as a

condition to obtaining regulatory approvals; (2) the length of time

necessary to consummate the proposed transaction may be longer than

anticipated; (3) problems may arise in successfully integrating the

businesses of United Rentals and Neff, including, without

limitation, problems associated with the potential loss of any key

employees of Neff; (4) the proposed transaction may involve

unexpected costs, including, without limitation, the exposure to

any unrecorded liabilities or unidentified issues that we fail to

discover during the due diligence investigation of Neff which will

not be subject to indemnification or reimbursement by Neff, as well

as potential unfavorable accounting treatment and unexpected

increases in taxes; (5) our businesses may suffer as a result of

uncertainty surrounding the proposed transaction, any adverse

effects on our ability to maintain relationships with customers,

employees and suppliers, or the inherent risk associated with

entering a geographic area or business; and (6) the industry may be

subject to future risks that are described in the “Risk Factors”

section of the Annual Reports on Form 10-K, Quarterly Reports on

Form 10-Q and other documents filed from time to time with the SEC

by United Rentals and Neff. United Rentals and Neff give no

assurance that they will achieve their expectations and do not

assume any responsibility for the accuracy and completeness of the

forward-looking statements.

The foregoing list of factors is not exhaustive. You should

carefully consider the foregoing factors and the other risks and

uncertainties that affect the businesses of United Rentals and Neff

described in the “Risk Factors” section of their respective Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q and other

documents filed from time to time with the SEC. All forward-looking

statements included in this document are based upon information

available to United Rentals and Neff, as applicable, on the date

hereof; and United Rentals and Neff assume no obligations to update

or revise any such forward-looking statements.

Additional Information and Where to Find It

In connection with the proposed acquisition, Neff intends to

prepare an information statement in preliminary and definitive form

for its stockholders containing the information with respect to the

proposed merger specified in Schedule 14C promulgated under the

Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and describing the proposed merger. Neff’s stockholders are urged

to carefully read the information statement regarding the proposed

merger and any other relevant documents in their entirety when they

become available because they will contain important information

about the proposed acquisition. You may obtain copies of all

documents filed with the SEC regarding the proposed merger, free of

charge, at the SEC’s website, http://www.sec.gov, or on the

Investor Relations section of Neff’s website (www.neffrental.com),

or by directing a request to Neff by mail or telephone as set forth

above. Investors are also urged to read the current report on Form

8-K to be filed by Neff regarding the proposed merger, which will

also contain important information.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170816006130/en/

United Rentals, Inc.Ted Grace, 203-618-7122Cell:

203-399-8951tgrace@ur.comorNeff CorporationMark IrionChief

Financial OfficerorBrian CoolidgeDirector of Financial

Reporting305-513-3350InvestorRelations@neffcorp.com

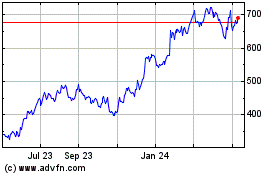

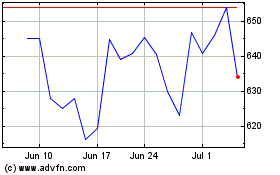

United Rentals (NYSE:URI)

Historical Stock Chart

From Mar 2024 to Apr 2024

United Rentals (NYSE:URI)

Historical Stock Chart

From Apr 2023 to Apr 2024