TICC Announces Results of Operations for the Quarter Ended June 30, 2017

August 08 2017 - 8:00AM

TICC Capital Corp. (Nasdaq:TICC) (“TICC,” the “Company,” “we,” “us”

or “our”) announced today its financial results for the quarter

ended June 30, 2017.

- As of June 30, 2017, net asset value per share was $7.51

compared with the net asset value per share as of March 31, 2017 of

$7.53.

- For the quarter ended June 30, 2017, we recorded net investment

income of approximately $7.5 million, or approximately $0.15 per

share. In the second quarter, we also recorded net realized capital

gains of approximately $0.5 million, and net unrealized

appreciation of approximately $1.0 million. In total we

had a net increase in net assets from operations of approximately

$9.1 million, or approximately $0.18 per share.

- Our core net investment income (“Core NII”) for the quarter

ended June 30, 2017 was approximately $0.18 per share.- Core NII

represents net investment income adjusted for additional cash

distributions received, or entitled to be received (if any, in

either case), on our collateralized loan obligation (“CLO”) equity

investments and also excludes any capital gains incentive fees we

recognize but have no obligation to pay in any period. (See

additional information under “Supplemental Information Regarding

Core Net Investment Income” below).- While our experience

has been that cash flow distributions have historically represented

useful indicators of our CLO equity investments’ annual taxable

income, we believe that current and future cash flow distributions

may represent less accurate indicators of taxable income with

respect to our CLO equity investments than they have in the

past.

- Total investment income for the second quarter of 2017 amounted

to approximately $17.0 million, which represents an increase of

approximately $0.5 million from the first quarter of 2017.- For the

quarter ended June 30, 2017, we recorded investment income from our

portfolio as follows: -

approximately $6.8 million from our debt

investments, - approximately

$9.4 million from our CLO equity investments,

and - approximately $0.8 million

from all other sources.

- Our total expenses for the quarter ended June 30, 2017 were

approximately $9.5 million, up by approximately $0.9 million

compared to the first quarter of 2017. The primary driver of

that increase was higher interest expense for the quarter on our

outstanding debt.

- Our weighted average credit rating on a fair value basis was

2.2 at the end of the second quarter of 2017 (compared to 2.3 at

the end of the first quarter of 2017).

- As announced previously, our board of directors had declared

the following distribution on our common stock:

| |

|

|

|

|

Quarter Ending |

Record Date |

Payment Date |

Amount Per Share

|

|

September 30, 2017 |

September 15, 2017 |

September 29, 2017 |

$0.20 |

- During the second quarter of 2017:- We made investments of

approximately $89.3 million, consisting of approximately $31.3

million in corporate loan and stock investments and approximately

$58.0 million in CLO investments. We received proceeds of

approximately $22.9 million from sales of our CLO investments.- We

received or were entitled to receive proceeds of approximately

$94.6 million from repayments, sales and amortization payments on

our corporate loan and common stock investments. A portion of

those proceeds along with a portion of prior quarter repayments,

sales and amortization payments were applied towards an

approximately $31.4 million partial redemption of the TICC CLO

2012-1 LLC Class A-1 Notes.

- As of June 30, 2017, the weighted average yield of our debt

investments at current cost was approximately 9.5%, compared with

8.4% as of March 31, 2017.

- As of June 30, 2017, the weighted average effective yield of

our CLO equity investments at current cost was approximately 18.4%,

compared with 17.3% as of March 31, 2017.

- As of June 30, 2017, the weighted average cash distribution

yield of our CLO equity investments at current cost was

approximately 25.6%, compared with 24.4% as of March 31, 2017.

- At June 30, 2017, we had no investments on non-accrual

status.

- On July 24, 2017, the Company provided a Notice of Optional

Redemption to the trustee of TICC CLO 2012-1 LLC that it will be

redeeming in full the outstanding amounts of each class of secured

notes on August 25, 2017. The Company intends to use the

restricted cash held by TICC CLO 2012-1 LLC on the redemption date

to redeem each class of secured notes, which is approximately $73.4

million in aggregate. The Company also intends to begin the process

to wind down and dissolve TICC CLO 2012-1 LLC after the completion

of this redemption.

Supplemental Information Regarding Core

Net Investment Income

On a supplemental basis, we provide information relating to core

net investment income, which is a non-GAAP measure. This measure is

provided in addition to, but not as a substitute for, net

investment income determined in accordance with GAAP. Our non-GAAP

measures may differ from similar measures by other companies, even

if similar terms are used to identify such measures. Core net

investment income represents net investment income adjusted for

additional cash distributions received, or entitled to be received

(if any, in either case), on our CLO equity investments and also

excludes any capital gains incentive fees we recognize but have no

obligation to pay in any period. The Company did not recognize any

capital gains incentive fees for the quarter ended June 30,

2017.

Income from investments in the “equity” class securities of CLO

vehicles, for GAAP purposes, is recorded using the effective

interest method based upon an effective yield to the expected

redemption utilizing estimated cash flows compared to the cost,

resulting in an effective yield for the investment; the difference

between the actual cash received or distributions entitled to be

received and the effective yield calculation is an adjustment to

cost. Accordingly, investment income recognized on CLO equity

securities in the GAAP statement of operations differs from the

cash distributions actually received by us during the period

(referred to below as “CLO equity additional distributions”).

Further, in order to continue to qualify to be taxed as a

regulated investment company (“RIC”), we are required, among other

things, to distribute at least 90% of our investment company

taxable income annually. Therefore, core net investment income may

provide a better indication of estimated taxable income for a

reporting period than does GAAP net investment income, although we

can offer no assurance that will be the case as the ultimate tax

character of our earnings cannot be determined until tax returns

are prepared after the end of a fiscal year. We note that these

non-GAAP measures may not be useful indicators of taxable earnings,

particularly during periods of market disruption and

volatility.

The following table provides a reconciliation of net investment

income to core net investment income for the three months ended

June 30, 2017 and June 30, 2016:

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended June 30,

2017 |

|

Three Months

Ended June 30, 2016 |

|

|

| |

Amount |

|

Per Share

Amounts(basic) |

|

|

Amount |

|

Per Share

Amounts(basic) |

|

|

|

| Net investment

income |

$ |

7,541,875 |

|

$ |

0.147 |

|

|

$ |

6,798,806 |

|

$ |

0.132 |

|

|

|

| CLO equity additional

distributions

|

|

1,737,958 |

|

$ |

0.034 |

|

|

|

9,494,983 |

|

$ |

0.184 |

|

|

|

| Core net investment

income |

$ |

9,279,833 |

|

$ |

0.181 |

|

|

$ |

16,293,789 |

|

$ |

0.316 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

We will host a conference call to discuss our second quarter

results today, Tuesday, August 8, 2017 at 10:00 AM ET. Please call

1-888-339-0740 to participate. A replay of the conference call will

be available for approximately 30 days. The replay number is

1-877-344-7529, and the replay passcode is 10111238.

A presentation containing further detail regarding our quarterly

results of operations has been posted under the Investor Relations

section of our website at www.ticc.com.

The following financial statements are unaudited and without

footnotes. Readers who would like additional information

should obtain our Form 10-Q for the period ended June 30, 2017, and

subsequent reports on Form 10-Q as they are filed.

| TICC CAPITAL CORP. |

|

| CONSOLIDATED STATEMENTS OF ASSETS AND

LIABILITIES |

|

| (unaudited) |

|

| |

|

| |

|

|

|

|

June 30, 2017 |

|

December 31, 2016 |

|

| |

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

Non-affiliated/non-control investments (cost: $467,724,988 @

6/30/17; $616,542,612 @ 12/31/16) |

$ |

440,238,676 |

|

|

$ |

578,297,069 |

|

|

| |

Affiliated

investments (cost: $10,467,049 @ 6/30/17; $7,497,229 @

12/31/16) |

|

14,517,716 |

|

|

|

11,626,007 |

|

|

| |

Total investments at fair value (cost: $478,192,037 @ 6/30/17; |

|

|

|

|

| |

$624,039,841 @ 12/31/16) |

|

454,756,392 |

|

|

|

589,923,076 |

|

|

| |

Cash and

cash equivalents |

|

88,751,878 |

|

|

|

8,261,698 |

|

|

| |

Restricted

cash |

|

61,134,714 |

|

|

|

3,451,636 |

|

|

| |

Interest

and distributions receivable |

|

6,820,485 |

|

|

|

9,682,672 |

|

|

| |

Securities

sold not settled |

|

10,209,285 |

|

|

|

7,406 |

|

|

| |

Other

assets |

|

1,487,698 |

|

|

|

1,130,018 |

|

|

| |

|

Total

assets |

$ |

623,160,452 |

|

|

$ |

612,456,506 |

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accrued

interest payable |

$ |

1,608,262 |

|

|

$ |

1,731,111 |

|

|

| |

Investment

advisory fee and net investment income incentive fee payable to

affiliate |

|

3,392,314 |

|

|

|

3,673,381 |

|

|

| |

Securities

purchased not settled |

|

2,956,250 |

|

|

|

- |

|

|

| |

Accrued

expenses |

|

989,825 |

|

|

|

1,089,043 |

|

|

| |

Notes

payable - TICC CLO 2012-1 LLC, net of discount and deferred

issuance costs |

|

71,092,564 |

|

|

|

125,853,720 |

|

|

| |

Convertible

senior notes payable, net of deferred issuance costs |

|

94,369,112 |

|

|

|

94,116,753 |

|

|

| |

6.50%

unsecured notes due 2024, net of deferred issuance costs |

|

62,179,537 |

|

|

|

- |

|

|

| |

|

Total

liabilities |

|

236,587,864 |

|

|

|

226,464,008 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| NET

ASSETS |

|

|

|

|

|

|

|

| |

Common

stock, $0.01 par value, 100,000,000 share authorized; 51,479,409

and 51,479,409 shares issued |

|

|

|

|

| |

and

outstanding, respectively |

|

514,794 |

|

|

|

514,794 |

|

|

| |

Capital in

excess of par value |

|

558,822,643 |

|

|

|

558,822,643 |

|

|

| |

Net

unrealized depreciation on investments |

|

(23,435,645 |

) |

|

|

(34,116,765 |

) |

|

| |

Accumulated

net realized losses on investments |

|

(100,530,769 |

) |

|

|

(95,605,057 |

) |

|

| |

Distributions in excess of net investment income |

|

(48,798,435 |

) |

|

|

(43,623,117 |

) |

|

| |

|

Total net

assets |

|

386,572,588 |

|

|

|

385,992,498 |

|

|

| |

|

Total

liabilities and net assets |

$ |

623,160,452 |

|

|

$ |

612,456,506 |

|

|

| |

|

|

|

|

|

|

|

|

| Net asset

value per common share |

$ |

7.51 |

|

|

$ |

7.50 |

|

|

| |

|

|

|

|

|

|

|

|

| TICC CAPITAL CORP. |

|

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended June 30,

2017 |

|

Three Months Ended June 30,

2016 |

|

Six Months EndedJune 30,

2017 |

|

Six Months EndedJune 30,

2016 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

INVESTMENT INCOME |

|

|

|

|

|

|

|

|

| From

non-affiliated/non-control investments: |

|

|

|

|

|

|

|

|

| |

Interest

income - debt investments |

$ |

6,717,197 |

|

|

$ |

8,370,025 |

|

|

$ |

13,789,404 |

|

|

$ |

16,835,836 |

|

|

| |

Income from

securitization vehicles and investments |

|

9,426,014 |

|

|

|

7,980,865 |

|

|

|

17,995,617 |

|

|

|

13,902,416 |

|

|

| |

Commitment,

amendment fee income and other income |

|

768,682 |

|

|

|

389,965 |

|

|

|

1,510,171 |

|

|

|

849,826 |

|

|

| |

Total investment income from non-affiliated/non-control

investments |

|

16,911,893 |

|

|

|

16,740,855 |

|

|

|

33,295,192 |

|

|

|

31,588,078 |

|

|

| From

affiliated investments: |

|

|

|

|

|

|

|

|

| |

Interest

income - debt investments |

|

100,260 |

|

|

|

80,287 |

|

|

|

182,441 |

|

|

|

159,712 |

|

|

| |

Total

investment income from affiliated investments |

|

100,260 |

|

|

|

80,287 |

|

|

|

182,441 |

|

|

|

159,712 |

|

|

| From

control investments: |

|

|

|

|

|

|

|

|

| |

Interest

income - debt investments |

|

- |

|

|

|

225,385 |

|

|

|

- |

|

|

|

567,219 |

|

|

| |

Total

investment income from control investments |

|

- |

|

|

|

225,385 |

|

|

|

- |

|

|

|

567,219 |

|

|

| |

Total investment income |

|

17,012,153 |

|

|

|

17,046,527 |

|

|

|

33,477,633 |

|

|

|

32,315,009 |

|

|

|

EXPENSES |

|

|

|

|

|

|

|

|

|

| |

Compensation expense |

|

203,339 |

|

|

|

178,955 |

|

|

|

438,373 |

|

|

|

420,140 |

|

|

| |

Investment

advisory fees |

|

2,182,173 |

|

|

|

2,411,762 |

|

|

|

4,452,175 |

|

|

|

6,117,485 |

|

|

| |

Professional fees |

|

589,841 |

|

|

|

1,182,148 |

|

|

|

1,342,234 |

|

|

|

3,207,533 |

|

|

| |

Interest

expense |

|

4,633,367 |

|

|

|

4,434,109 |

|

|

|

8,347,620 |

|

|

|

8,792,881 |

|

|

| |

General and

administrative |

|

651,417 |

|

|

|

796,981 |

|

|

|

1,217,163 |

|

|

|

1,689,884 |

|

|

| |

Total expenses before incentive fees |

|

8,260,137 |

|

|

|

9,003,955 |

|

|

|

15,797,565 |

|

|

|

20,227,923 |

|

|

| |

Net

investment income incentive fees |

|

1,210,141 |

|

|

|

1,243,766 |

|

|

|

2,263,621 |

|

|

|

1,243,766 |

|

|

| |

Total expenses |

|

9,470,278 |

|

|

|

10,247,721 |

|

|

|

18,061,186 |

|

|

|

21,471,689 |

|

|

| Net

investment income |

|

7,541,875 |

|

|

|

6,798,806 |

|

|

|

15,416,447 |

|

|

|

10,843,320 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Net change

in unrealized appreciation/(depreciation) on investments |

|

|

|

|

|

|

|

|

| |

Non-Affiliate/non-control investments |

|

1,499,946 |

|

|

|

43,225,203 |

|

|

|

10,759,231 |

|

|

|

20,331,060 |

|

|

| |

Affiliated

investments |

|

(466,884 |

) |

|

|

1,167,429 |

|

|

|

(78,111 |

) |

|

|

2,103,166 |

|

|

| |

Control

investments |

|

- |

|

|

|

4,400,000 |

|

|

|

- |

|

|

|

5,750,000 |

|

|

| |

Total net change in unrealized appreciation/(depreciation) on

investments |

|

1,033,062 |

|

|

|

48,792,632 |

|

|

|

10,681,120 |

|

|

|

28,184,226 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Net

realized gains/(losses) on investments |

|

|

|

|

|

|

|

|

| |

Non-Affiliated/non-control investments |

|

542,959 |

|

|

|

(4,327,598 |

) |

|

|

(4,925,712 |

) |

|

|

(4,877,603 |

) |

|

| |

Control

investments |

|

- |

|

|

|

(3,000,000 |

) |

|

|

- |

|

|

|

(3,000,000 |

) |

|

| |

Total net realized gains/(losses) on investments |

|

542,959 |

|

|

|

(7,327,598 |

) |

|

|

(4,925,712 |

) |

|

|

(7,877,603 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| Net

increase in net assets resulting from operations |

$ |

9,117,896 |

|

|

$ |

48,263,840 |

|

|

$ |

21,171,855 |

|

|

$ |

31,149,943 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Net

increase in net assets resulting from net investment income per

common share: |

|

|

|

|

|

|

|

|

| |

|

Basic |

$ |

0.15 |

|

|

$ |

0.13 |

|

|

$ |

0.30 |

|

|

$ |

0.21 |

|

|

| |

|

Diluted |

$ |

0.15 |

|

|

$ |

0.13 |

|

|

$ |

0.30 |

|

|

$ |

0.21 |

|

|

| Net

increase in net assets resulting from operations per common

share: |

|

|

|

|

|

|

|

|

| |

|

Basic |

$ |

0.18 |

|

|

$ |

0.94 |

|

|

$ |

0.41 |

|

|

$ |

0.60 |

|

|

| |

|

Diluted |

$ |

0.18 |

|

|

$ |

0.81 |

|

|

$ |

0.41 |

|

|

$ |

0.57 |

|

|

| Weighted

average shares of common stock outstanding: |

|

|

|

|

|

|

|

|

| |

|

Basic |

|

51,479,409 |

|

|

|

51,479,409 |

|

|

|

51,479,409 |

|

|

|

52,241,381 |

|

|

| |

|

Diluted |

|

59,727,707 |

|

|

|

61,512,561 |

|

|

|

59,727,707 |

|

|

|

62,274,533 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributions per share |

$ |

0.20 |

|

|

$ |

0.29 |

|

|

$ |

0.40 |

|

|

$ |

0.58 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

TICC CAPITAL CORP.FINANCIAL HIGHLIGHTS

- UNAUDITED

| |

|

|

|

|

|

|

|

|

|

|

| |

Three MonthsEnded |

Three MonthsEnded |

Six MonthsEnded |

Six

MonthsEnded |

|

| |

June 30,2017 |

June 30,2016 |

June 30,2017 |

June 30,2016 |

|

| |

Per Share

Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net asset value at

beginning of period |

|

$ |

7.53 |

|

|

$ |

5.89 |

|

|

$ |

7.50 |

|

|

$ |

6.40 |

|

|

| |

Net investment

income(1) |

|

|

0.15 |

|

|

|

0.13 |

|

|

|

0.30 |

|

|

|

0.21 |

|

|

| |

Net realized and

unrealized capital gains (losses)(2) |

|

|

0.03 |

|

|

|

0.81 |

|

|

|

0.11 |

|

|

|

0.39 |

|

|

| |

Net change in net asset

value from operations |

|

|

0.18 |

|

|

|

0.94 |

|

|

|

0.41 |

|

|

|

0.60 |

|

|

| |

Distributions per share

from net investment income |

|

|

(0.20) |

|

|

|

(0.29) |

|

|

|

(0.40) |

|

|

|

(0.58) |

|

|

| |

Distributions based on weighted average share impact |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

0.01 |

|

|

| |

Total

distributions(3) |

|

|

(0.20) |

|

|

|

(0.29) |

|

|

|

(0.40) |

|

|

|

(0.57) |

|

|

| |

Effect

of shares repurchased, gross |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

0.11 |

|

|

| |

Net

asset value at end of period |

|

$ |

7.51 |

|

|

$ |

6.54 |

|

|

$ |

7.51 |

|

|

$ |

6.54 |

|

|

| |

Per

share market value at beginning of period |

|

$ |

7.38 |

|

|

$ |

4.80 |

|

|

$ |

6.61 |

|

|

$ |

6.08 |

|

|

| |

Per

share market value at end of period |

|

$ |

6.34 |

|

|

$ |

5.27 |

|

|

$ |

6.34 |

|

|

$ |

5.27 |

|

|

| |

Total

return(4) |

|

|

(11.38) |

% |

|

|

15.83 |

% |

|

|

1.62 |

% |

|

|

(3.03) |

% |

|

| |

Shares

outstanding at end of period |

|

|

51,479,409 |

|

|

|

51,479,409 |

|

|

|

51,479,409 |

|

|

|

51,479,409 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Ratios/Supplemental Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net

assets at end of period (000’s) |

|

|

386,573 |

|

|

|

336,639 |

|

|

|

386,573 |

|

|

|

336,639 |

|

|

| |

Average

net assets (000’s) |

|

|

387,162 |

|

|

|

319,971 |

|

|

|

387,017 |

|

|

|

323,472 |

|

|

| |

Ratio of expenses to

average net assets(5) |

|

|

9.78 |

% |

|

|

12.81 |

% |

|

|

9.33 |

% |

|

|

13.28 |

% |

|

| |

Ratio of net investment

income to average net assets(5) |

|

|

7.79 |

% |

|

|

8.50 |

% |

|

|

7.97 |

% |

|

|

6.70 |

% |

|

| |

Portfolio turnover

rate |

|

|

18.36 |

% |

|

|

11.79 |

% |

|

|

25.23 |

% |

|

|

13.53 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_____________(1) Represents per share net investment income

for the period, based upon average shares outstanding.(2) Net

realized and unrealized capital gains include rounding adjustments

to reconcile change in net asset value per share.(3)

Management monitors available taxable earnings, including net

investment income and realized capital gains, to determine if a tax

return of capital may occur for the year. To the extent the

Company’s taxable earnings fall below the total amount of the

Company’s distributions for that fiscal year, a portion of those

distributions may be deemed a tax return of capital to the

Company’s stockholders. The ultimate tax character of our earnings

cannot be determined until tax returns are prepared after the end

of a fiscal year.(4) Total return equals the increase or

decrease of ending market value over beginning market value, plus

distributions, divided by the beginning market value, assuming

distribution reinvestment prices obtained under the Company’s

distribution reinvestment plan, excluding any discounts. Total

return is not annualized.(5) Annualized.(6) The

following table provides supplemental performance ratios

(annualized) measured for the three months ended June 30, 2017 and

2016: |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three MonthsEnded |

|

Three MonthsEnded |

|

Six MonthsEnded |

|

Six

MonthsEnded |

|

| |

Ratio of expenses to

average net assets: |

|

June 30, 2017 |

|

June 30, 2016 |

|

June 30, 2017 |

|

June 30, 2016 |

|

| |

Expenses

before incentive fees |

|

|

8.53 |

% |

|

|

11.26 |

% |

|

|

8.16 |

% |

|

|

12.51 |

% |

|

| |

Net

investment income incentive fees |

|

|

1.25 |

% |

|

|

1.55 |

% |

|

|

1.17 |

% |

|

|

0.77 |

% |

|

| |

Capital

gains incentive fees |

|

|

- |

% |

|

|

- |

% |

|

|

- |

% |

|

|

- |

% |

|

| |

Ratio of

expenses, excluding interest expense, |

|

|

5.00 |

% |

|

|

7.27 |

% |

|

|

5.02 |

% |

|

|

7.84 |

% |

|

| |

to

average net assets |

|

|

About TICC Capital Corp.

TICC Capital Corp. is a publicly-traded business development

company principally engaged in providing capital to established

businesses, investing in syndicated bank loans and purchasing debt

and equity tranches of collateralized loan obligation vehicles.

Forward-Looking Statements This press release

contains forward-looking statements subject to the inherent

uncertainties in predicting future results and conditions. Any

statements that are not statements of historical fact (including

statements containing the words “believes,” “plans,” “anticipates,”

“expects,” “estimates” and similar expressions) should also be

considered to be forward-looking statements. Certain factors could

cause actual results and conditions to differ materially from those

projected in these forward-looking statements. These factors are

identified from time to time in our filings with the Securities and

Exchange Commission. We undertake no obligation to update such

statements to reflect subsequent events, except as may be required

by law.

Contact:

Bruce Rubin

203-983-5280

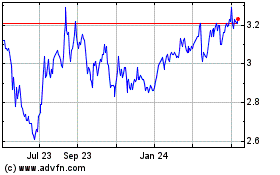

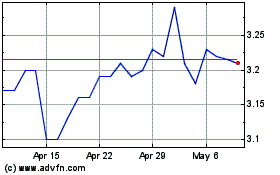

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Apr 2023 to Apr 2024