Cumulative Deployments Exceeded 1 GW

Sunrun (Nasdaq:RUN), the nation’s largest dedicated provider of

residential solar, storage and energy services, today announced

financial results for the second quarter ended June 30, 2017.

Second Quarter 2017 Operating Highlights

- Total deployments of 76 MW, an increase of 16%

year-over-year

- Net Present Value of $74 million created, an increase of 56%

year-over-year

- Creation Cost per watt improved by 10% year-over-year

- Cumulative MW deployed of 1,027 MW, an increase of 42%

year-over-year

- Net Earning Assets exceeded $1 billion, reflecting a 29%

increase year-over-year

“We are pleased to deliver Q2 results that exceeded our guidance

and are proud that our customers have now saved $150 million and

represent over 1 GW of clean power resources,” said Lynn Jurich,

Sunrun’s chief executive officer. “We continue to innovate

and expand, having launched in seven new markets this year while

also exploring more ways distributed energy resources can deliver

value to consumers and modernize our energy infrastructure.”

Key Operating Metrics

In the second quarter of 2017, MW deployed increased to 76 MW

from 65 MW in the second quarter of 2016, a 16% year-over-year

increase.

In the second quarter of 2017, MW booked were 88 MW, an increase

of 28% from the second quarter of 2016.

Creation Cost per watt was $3.37 in the second quarter of 2017

compared to $3.75 in the second quarter of 2016, an improvement of

10% year-over-year. NPV per watt in the second quarter of 2017 was

$1.10 compared to $0.86 in the second quarter of 2016.

NPV created in the second quarter of 2017 was $74 million,

a 56% increase from $47 million in the second quarter of

2016. Project Value per watt was $4.47, compared to $4.61 in the

second quarter of 2016.

Gross Earning Assets as of June 30, 2017 were $1.9 billion. Net

Earning Assets as of June 30, 2017 were $1.1 billion, up $246

million, or 29% from the prior year.

Financing

Activities

As of August 7, 2017, our project finance pipeline remains

robust, with closed transactions and executed terms sheets that

provide us expected tax equity runway into Q2 of 2018 and

back-leverage capacity into Q4 of 2017.

Second Quarter 2017 GAAP Results

Operating leases and incentives revenue grew 44% year-over-year

to $65.3 million. Solar energy systems and product sales declined

6% year-over-year to $72.5 million. Total revenue grew to $137.8

million in the second quarter of 2017, up $15.3 million, or 12%

year-over-year.

Total cost of revenue was $108.1 million, an increase of 8%

year-over-year. Total operating expenses were $170.8 million, a

decline of 0.1% year-over-year.

Net income available to common stockholders was $25.1 million in

the second quarter of 2017, compared to net income available to

common stockholders of $12.7 million in the first quarter of

2017.

Diluted net earnings per share available to common shareholders

was $0.23 per share.

Guidance for Q3 and Full Year 2017

The following statements are based on current expectations.

These statements are forward-looking and actual results may differ

materially.

In Q3, we expect to deploy approximately 88 MW, reflecting 15%

growth for the first three quarters of 2017 compared to the prior

year.

For the full year 2017, we continue to expect to deploy 325 MWs,

reflecting 15% year-over-year growth.

Conference Call Information

Sunrun is hosting a conference call for analysts and investors

to discuss its second quarter 2017 results and outlook for its

third quarter 2017 at 2:00 p.m. Pacific Time today, August 7, 2017.

A live audio webcast of the conference call along with supplemental

financial information will be accessible via the “Investor

Relations” section of the Company’s website at

http://investors.sunrun.com. The conference call can also be

accessed live over the phone by dialing (877) 470-1078 (domestic)

or (615) 247-0087 (international) using ID #56202038. A replay will

be available following the call via the Sunrun Investor Relations

website or for one week at the following numbers (855) 859-2056

(domestic) or (404) 537-3406 (international) using ID

#56202038.

About

Sunrun

Sunrun (Nasdaq:RUN) is the nation’s largest dedicated

residential solar, storage and energy services company with a

mission to create a planet run by the sun. Since establishing the

solar as a service model in 2007, Sunrun leads the industry in

providing clean energy to homeowners with little to no upfront cost

and at a savings to traditional electricity. The company designs,

installs, finances, insures, monitors and maintains the systems,

while families receive predictable pricing for 20 years or more.

The company also offers Sunrun BrightBoxTM solar power generation

with smart inverter technology and home battery storage. For more

information, please visit: www.sunrun.com.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934

and the Private Securities Litigation Reform Act of 1995, including

statements regarding our future financial and operating guidance,

operational and financial results such as growth, value creation,

MW bookings and deployments, gross and net earning assets, project

value, estimated creation costs and NPV, and the assumptions

related to the calculation of the foregoing metrics, as well as our

expectations regarding our growth and financing capacity. The risks

and uncertainties that could cause our results to differ materially

from those expressed or implied by such forward-looking statements

include, but are not limited to: the availability of additional

financing on acceptable terms; changes in the retail prices of

traditional utility generated electricity; changes in policies and

regulations including net metering and interconnection limits or

caps; the availability of rebates, tax credits and other

incentives; the availability of solar panels and other raw

materials; our limited operating history, particularly as a new

public company; our ability to attract and retain our relationships

with third parties, including our solar partners; our ability to

meet the covenants in our investment funds and debt facilities; and

such other risks identified in the reports that we file with the

U.S. Securities and Exchange Commission, or SEC, from time to time.

All forward-looking statements in this press release are based on

information available to us as of the date hereof, and we assume no

obligation to update these forward-looking statements.

| Consolidated Balance Sheets(In

Thousands) |

| |

| |

|

June 30, 2017 |

|

December 31, 2016 |

| |

|

(Unaudited) |

|

|

|

Assets |

|

|

|

|

| Current

assets: |

|

|

|

|

| Cash |

|

$ |

211,321 |

|

|

$ |

206,364 |

|

|

Restricted cash |

|

15,672 |

|

|

11,882 |

|

| Accounts

receivable, net |

|

64,030 |

|

|

60,258 |

|

| State tax

credits receivable |

|

— |

|

|

13,713 |

|

|

Inventories |

|

52,744 |

|

|

67,326 |

|

| Prepaid

expenses and other current assets |

|

12,575 |

|

|

9,802 |

|

|

Total current assets |

|

356,342 |

|

|

369,345 |

|

|

Restricted cash |

|

5,952 |

|

|

6,117 |

|

| Solar

energy systems, net |

|

2,951,260 |

|

|

2,629,366 |

|

| Property

and equipment, net |

|

41,774 |

|

|

48,471 |

|

|

Intangible assets, net |

|

16,397 |

|

|

18,499 |

|

|

Goodwill |

|

87,543 |

|

|

87,543 |

|

| Prepaid

tax asset |

|

— |

|

|

378,541 |

|

| Other

assets |

|

29,834 |

|

|

34,936 |

|

|

Total assets |

|

$ |

3,489,102 |

|

|

$ |

3,572,818 |

|

| Liabilities and

total equity |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Accounts

payable |

|

$ |

75,336 |

|

|

$ |

66,018 |

|

|

Distributions payable to noncontrolling interests and redeemable

noncontrolling interests |

|

13,212 |

|

|

10,654 |

|

| Accrued

expenses and other liabilities |

|

52,961 |

|

|

59,261 |

|

| Deferred

revenue, current portion |

|

70,601 |

|

|

70,849 |

|

| Deferred

grants, current portion |

|

8,363 |

|

|

8,011 |

|

| Capital

lease obligations, current portion |

|

8,525 |

|

|

10,015 |

|

| Recourse

debt, current portion |

|

247,000 |

|

|

— |

|

| Long-term

non-recourse debt, current portion |

|

18,883 |

|

|

14,153 |

|

| Lease

pass-through financing obligation, current portion |

|

5,869 |

|

|

5,823 |

|

|

Total current liabilities |

|

500,750 |

|

|

244,784 |

|

| Deferred

revenue, net of current portion |

|

578,484 |

|

|

583,401 |

|

| Deferred

grants, net of current portion |

|

222,184 |

|

|

226,893 |

|

| Capital

lease obligations, net of current portion |

|

8,745 |

|

|

12,965 |

|

| Recourse

debt, net of current portion |

|

— |

|

|

244,000 |

|

| Long-term

non-recourse debt, net of current portion |

|

761,349 |

|

|

639,870 |

|

| Lease

pass-through financing obligation, net of current portion |

|

139,249 |

|

|

137,958 |

|

| Other

liabilities |

|

10,682 |

|

|

5,457 |

|

| Deferred

tax liabilities |

|

54,376 |

|

|

415,397 |

|

|

Total liabilities |

|

2,275,819 |

|

|

2,510,725 |

|

| Redeemable

noncontrolling interests |

|

163,077 |

|

|

137,907 |

|

|

Total stockholders’ equity |

|

721,227 |

|

|

672,961 |

|

|

Noncontrolling interests |

|

328,979 |

|

|

251,225 |

|

|

Total equity |

|

1,050,206 |

|

|

924,186 |

|

|

Total liabilities, redeemable noncontrolling interests and

total equity |

|

$ |

3,489,102 |

|

|

$ |

3,572,818 |

|

| Consolidated Statements of

Operations(In Thousands, Except Per Share Amounts) |

| |

| |

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| Revenue: |

|

|

|

|

|

|

|

|

| Operating

leases and incentives |

|

$ |

65,337 |

|

|

$ |

45,394 |

|

|

$ |

113,435 |

|

|

$ |

79,934 |

|

| Solar

energy systems and product sales |

|

72,511 |

|

|

77,144 |

|

|

128,530 |

|

|

141,347 |

|

| Total

revenue |

|

137,848 |

|

|

122,538 |

|

|

241,965 |

|

|

221,281 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

| Cost of

operating leases and incentives |

|

47,114 |

|

|

38,608 |

|

|

91,450 |

|

|

76,708 |

|

| Cost of

solar energy systems and product sales |

|

60,938 |

|

|

61,600 |

|

|

110,369 |

|

|

119,112 |

|

| Sales and

marketing |

|

32,784 |

|

|

43,716 |

|

|

64,460 |

|

|

86,904 |

|

| Research

and development |

|

3,710 |

|

|

2,373 |

|

|

6,706 |

|

|

4,836 |

|

| General

and administrative |

|

25,230 |

|

|

23,614 |

|

|

49,851 |

|

|

46,862 |

|

|

Amortization of intangible assets |

|

1,051 |

|

|

1,051 |

|

|

2,102 |

|

|

2,103 |

|

| Total

operating expenses |

|

170,827 |

|

|

170,962 |

|

|

324,938 |

|

|

336,525 |

|

| Loss from

operations |

|

(32,979 |

) |

|

(48,424 |

) |

|

(82,973 |

) |

|

(115,244 |

) |

| Interest expense,

net |

|

16,602 |

|

|

13,063 |

|

|

31,879 |

|

|

24,578 |

|

| Other expenses

(income), net |

|

208 |

|

|

30 |

|

|

683 |

|

|

(502 |

) |

| Loss before income

taxes |

|

(49,789 |

) |

|

(61,517 |

) |

|

(115,535 |

) |

|

(139,320 |

) |

| Income tax expense |

|

15,453 |

|

|

3,210 |

|

|

22,791 |

|

|

3,210 |

|

| Net loss |

|

(65,242 |

) |

|

(64,727 |

) |

|

(138,326 |

) |

|

(142,530 |

) |

| Net loss attributable

to noncontrolling interests and redeemable noncontrolling

interests |

|

(90,364 |

) |

|

(97,370 |

) |

|

(176,175 |

) |

|

(188,307 |

) |

| Net income available to

common stockholders |

|

$ |

25,122 |

|

|

$ |

32,643 |

|

|

$ |

37,849 |

|

|

$ |

45,777 |

|

| Net income per share

available to common stockholders |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.24 |

|

|

$ |

0.32 |

|

|

$ |

0.36 |

|

|

$ |

0.45 |

|

|

Diluted |

|

$ |

0.23 |

|

|

$ |

0.31 |

|

|

$ |

0.35 |

|

|

$ |

0.44 |

|

| Weighted average shares

used to compute net income per share available to common

stockholders |

|

|

|

|

|

|

|

|

|

Basic |

|

105,093 |

|

|

101,969 |

|

|

104,568 |

|

|

101,621 |

|

|

Diluted |

|

107,347 |

|

|

104,768 |

|

|

106,911 |

|

|

104,494 |

|

| Consolidated Statements of Cash

Flows(In Thousands) |

| |

| |

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| Operating

activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(65,242 |

) |

|

$ |

(64,727 |

) |

|

$ |

(138,326 |

) |

|

$ |

(142,530 |

) |

| Adjustments to

reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization, net of amortization of deferred

grants |

|

33,572 |

|

|

24,968 |

|

|

65,282 |

|

|

46,564 |

|

| Deferred

income taxes |

|

15,451 |

|

|

3,210 |

|

|

22,788 |

|

|

3,210 |

|

|

Stock-based compensation expense |

|

5,515 |

|

|

4,838 |

|

|

11,389 |

|

|

8,647 |

|

| Noncash

interest expense |

|

3,550 |

|

|

1,833 |

|

|

9,481 |

|

|

5,335 |

|

| Interest

on lease pass-through financing obligations |

|

2,988 |

|

|

3,017 |

|

|

5,949 |

|

|

6,019 |

|

| Reduction

in lease pass-through financing obligations |

|

(4,616 |

) |

|

(5,255 |

) |

|

(9,162 |

) |

|

(9,491 |

) |

| Other

noncash losses and expenses |

|

1,692 |

|

|

1,267 |

|

|

4,590 |

|

|

2,924 |

|

| Changes

in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts

receivable |

|

(10,577 |

) |

|

289 |

|

|

(4,215 |

) |

|

3,884 |

|

|

Inventories |

|

6,859 |

|

|

6,475 |

|

|

14,582 |

|

|

(16,839 |

) |

| Prepaid

and other assets |

|

(1,413 |

) |

|

1,595 |

|

|

(2,854 |

) |

|

(2,760 |

) |

| Accounts

payable |

|

6,993 |

|

|

214 |

|

|

2,636 |

|

|

(9,889 |

) |

| Accrued

expenses and other liabilities |

|

4,162 |

|

|

3,535 |

|

|

(11,283 |

) |

|

3,218 |

|

| Deferred

revenue |

|

(3,284 |

) |

|

(2,277 |

) |

|

(4,314 |

) |

|

3,295 |

|

| Net cash

used in operating activities |

|

(4,350 |

) |

|

(21,018 |

) |

|

(33,457 |

) |

|

(98,413 |

) |

| Investing

activities: |

|

|

|

|

|

|

|

|

| Payments

for the costs of solar energy systems, leased and to be leased |

|

(188,577 |

) |

|

(167,843 |

) |

|

(356,726 |

) |

|

(332,472 |

) |

| Purchases

of property and equipment |

|

(1,854 |

) |

|

(3,185 |

) |

|

(4,464 |

) |

|

(8,208 |

) |

| Business

acquisition, net of cash acquired |

|

— |

|

|

(5,000 |

) |

|

— |

|

|

(5,000 |

) |

| Net cash

used in investing activities |

|

(190,431 |

) |

|

(176,028 |

) |

|

(361,190 |

) |

|

(345,680 |

) |

| Financing

activities: |

|

|

|

|

|

|

|

|

| Proceeds

from state tax credits, net of recapture |

|

(217 |

) |

|

(79 |

) |

|

13,171 |

|

|

9,123 |

|

| Proceeds

from issuance of recourse debt |

|

34,000 |

|

|

116,400 |

|

|

91,400 |

|

|

257,400 |

|

| Repayment

of recourse debt |

|

(34,400 |

) |

|

(65,000 |

) |

|

(88,400 |

) |

|

(212,000 |

) |

| Proceeds

from issuance of non-recourse debt |

|

161,300 |

|

|

83,346 |

|

|

199,525 |

|

|

189,746 |

|

| Repayment

of non-recourse debt |

|

(79,926 |

) |

|

(14,383 |

) |

|

(84,830 |

) |

|

(16,543 |

) |

| Payment

of debt fees |

|

(4,955 |

) |

|

(2,908 |

) |

|

(4,955 |

) |

|

(12,277 |

) |

| Proceeds

from lease pass-through financing obligations |

|

1,614 |

|

|

3,059 |

|

|

3,062 |

|

|

12,805 |

|

|

Contributions received from noncontrolling interests and redeemable

noncontrolling interests |

|

140,980 |

|

|

84,677 |

|

|

303,545 |

|

|

239,621 |

|

|

Distributions paid to noncontrolling interests and redeemable

noncontrolling interests |

|

(11,748 |

) |

|

(8,271 |

) |

|

(24,635 |

) |

|

(18,257 |

) |

|

(Payments) proceeds from exercises of stock options, net of

withholding taxes on restricted stock units and issuance of shares

in connection with the Employee Stock Purchase Plan |

|

642 |

|

|

3,164 |

|

|

(425 |

) |

|

3,616 |

|

| Offering

costs paid related to initial public offering |

|

— |

|

|

— |

|

|

— |

|

|

(437 |

) |

| Payment

of capital lease obligations |

|

(2,513 |

) |

|

(3,301 |

) |

|

(5,262 |

) |

|

(6,416 |

) |

| Change in

restricted cash |

|

(2,466 |

) |

|

(751 |

) |

|

(2,592 |

) |

|

1,068 |

|

| Net cash

provided by financing activities |

|

202,311 |

|

|

195,953 |

|

|

399,604 |

|

|

447,449 |

|

| |

|

|

|

|

|

|

|

|

| Net change in cash |

|

7,530 |

|

|

(1,093 |

) |

|

4,957 |

|

|

3,356 |

|

| Cash, beginning of

period |

|

203,791 |

|

|

208,313 |

|

|

206,364 |

|

|

203,864 |

|

| Cash, end of

period |

|

$ |

211,321 |

|

|

$ |

207,220 |

|

|

$ |

211,321 |

|

|

$ |

207,220 |

|

| Key Operating Metrics and Financial

Metrics |

| |

|

Three Months Ended June 30, |

|

|

| |

|

2017 |

|

|

2016 |

|

|

| MW Booked (during the

period)(1) |

|

|

88 |

|

|

|

69 |

|

|

| MW Deployed (during the

period) |

|

|

76 |

|

|

|

65 |

|

|

| Cumulative MW Deployed

(end of period) |

|

|

1,027 |

|

|

|

721 |

|

|

| Gross Earning Assets

under Energy Contract (end of period)(in millions)(2) |

|

$ |

1,229 |

|

|

$ |

992 |

|

|

| Gross Earning Assets

Value of Purchase or Renewal (end of period)(in millions) |

|

$ |

665 |

|

|

$ |

507 |

|

|

| Gross Earning Assets

(end of period)(in millions) |

|

$ |

1,894 |

|

|

$ |

1,499 |

|

|

| Net Earning

Assets (end of period)(in millions)(2) |

|

$ |

1,089 |

|

|

$ |

843 |

|

|

|

|

Three Months Ended June 30, |

|

| |

|

2017 |

|

|

2016 |

|

| Project Value,

Contracted Portion (per watt) |

|

$ |

3.89 |

|

|

$ |

4.03 |

|

| Project Value, Renewal

Portion (per watt) |

|

$ |

0.58 |

|

|

$ |

0.58 |

|

| Total Project Value

(per watt) |

|

$ |

4.47 |

|

|

$ |

4.61 |

|

| Creation Cost (per

watt)(3) |

|

$ |

3.37 |

|

|

$ |

3.75 |

|

| Unlevered NPV (per

watt)(2) |

|

$ |

1.10 |

|

|

$ |

0.86 |

|

| NPV (in

millions)(2) |

|

$ |

74 |

|

|

$ |

47 |

|

|

(1) |

|

The

presentation of MW Booked for periods prior to December 31, 2016

reflects changes made to the calculation methodology as further

described in our Annual Report on Form 10-K filed with the SEC on

March 8, 2017.

|

| (2) |

|

Numbers may

not sum due to rounding. |

| (3) |

|

The

presentation of Creation Cost for periods prior to December 31,

2016 reflects changes made to the calculation methodology as

further described in our Fourth Quarter 2016 earnings presentation

available on our investor relations website. |

Definitions

Creation Cost includes (i) certain installation

and general and administrative costs after subtracting the gross

margin on solar energy systems and product sales divided by watts

deployed during the measurement period and (ii) certain sales and

marketing expenses under new Customer Agreements, net of

cancellations during the period divided by the related watts

deployed.

Customers refers to all residential homeowners

(i) who have executed a Customer Agreement or cash sales agreement

with us and (ii) for whom we have internal confirmation that the

applicable solar energy system has reached notice to proceed or

“NTP”, net of cancellations.

Customer Agreements refers to, collectively,

solar power purchase agreements and solar leases.

Gross Earning Assets represents the net cash

flows (discounted at 6%) we expect to receive during the initial

20-year term of our Customer Agreements for systems that have been

deployed as of the measurement date, plus a discounted estimate of

the value of the Customer Agreement renewal term or solar energy

system purchase at the end of the initial term. Gross Earning

Assets excludes estimated cash distributions to investors in

consolidated joint ventures and estimated operating, maintenance

and administrative expenses for systems deployed as of the

measurement date. In calculating Gross Earning Assets, we deduct

estimated cash distributions to our cash equity financing

providers. In calculating Gross Earning Assets, we do not deduct

customer payments we are obligated to pass through to investors in

lease pass-throughs as these amounts are reflected on our balance

sheet as long-term and short-term lease pass-through obligations,

similar to the way that debt obligations are presented. In

determining our finance strategy, we use lease pass-throughs and

long-term debt in an equivalent fashion as the schedule of payments

of distributions to lease pass-through investors is more similar to

the payment of interest to lenders than the internal rates of

return (IRRs) paid to investors in other tax equity structures.

Gross Earning Assets Under Energy

Contract represents the net cash flows during the initial

(typically 20 year) term of our Customer Agreements (less

substantially all value from SRECs prior to July 1, 2015), for

systems deployed as of the measurement date.

Gross Earning Assets Value

of Purchase or

Renewal is the forecasted net present value we

would receive upon or following the expiration of the initial

Customer Agreement term (either in the form of cash payments during

any applicable renewal period or a system purchase at the end of

the initial term), for systems deployed as of the measurement

date.

MW Booked represents the aggregate megawatt

production capacity of our solar energy systems, whether sold

directly to customers or subject to an executed Customer Agreement,

for which we have confirmation that the systems have reached NTP,

net of cancellations.

MW Deployed represents the aggregate megawatt

production capacity of our solar energy systems, whether sold

directly to customers or subject to executed Customer Agreements,

for which we have (i) confirmation that the systems are installed

on the roof, subject to final inspection or (ii) in the case of

certain system installations by our partners, accrued at least 80%

of the expected project cost.

Net Earning Assets represents Gross Earning

Assets less both project level debt and Lease Pass-Through

Financing Obligation, as of the same measurement date. Because

estimated cash distributions to our cash equity financing partners

are deducted from Gross Earning Assets, a proportional share of the

corresponding project level debt is deducted from Net Earning

Assets.

NPV equals Unlevered NPV multiplied by leased

megawatts deployed in period.

NTP or Notice to Proceed refers to our internal

confirmation that a solar energy system has met our installation

requirements for size, equipment and design.

Project Value represents the value of upfront

and future payments by customers, the benefits received from

utility and state incentives, as well as the present value of net

proceeds derived through investment funds. Specifically, Project

Value is calculated as the sum of the following items (all measured

on a per-watt basis with respect to megawatts deployed under

Customer Agreements during the period): (i) estimated Gross Earning

Assets, (ii) utility or upfront state incentives,

(iii) upfront payments from customers for deposits and partial

or full prepayments of amounts otherwise due under Customer

Agreements and which are not already included in Gross Earning

Assets and (iv) finance proceeds from tax equity investors,

excluding cash true-up payments or the value of asset contributions

in lieu of cash true-up payments made to investors. Project Value

includes contracted SRECs for all periods after July 1, 2015.

Unlevered NPV equals the difference between

Project Value and estimated Creation Cost on a per watt basis.

Investor Relations Contact:

Patrick Jobin

Vice President, Finance & Investor Relations

Investors@sunrun.com

(415) 638-4007

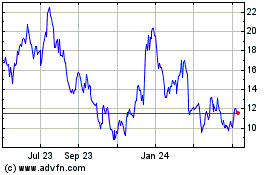

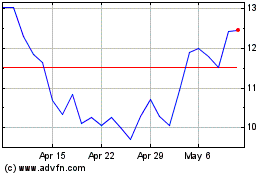

Sunrun (NASDAQ:RUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sunrun (NASDAQ:RUN)

Historical Stock Chart

From Apr 2023 to Apr 2024