- Total revenues increased 4% to $10.3

billion in the second quarter

- Shareholders’ net income for the

second quarter was $813 million, or $3.15 per share

- Adjusted income from

operations1 in the second quarter was $750 million,

or $2.91 per share

- Global medical customer

base2 is projected to grow in the range of 500,000 to

600,000 lives in 2017

- Adjusted income from

operations1,3 is now projected to be in the range of

$2.50 billion to $2.58 billion in 2017, or $9.75 to $10.05 per

share4, which represents per share growth of 20% to

24% over 2016

Cigna Corporation (NYSE: CI) today reported second quarter 2017

results with strong performance across the company’s Global Health

Care, Global Supplemental Benefits and Group Disability & Life

segments.

“Our strong second quarter results and significant growth across

our diversified portfolio of businesses demonstrate the focused

execution of our strategy,” said David M. Cordani, President and

Chief Executive Officer. “We continue to drive differentiated value

for our customers, clients and partners, and innovate in a rapidly

changing and dynamic environment.”

Total revenues in the quarter were $10.3 billion, an increase of

4% over second quarter 2016, driven by continued growth in Cigna's

targeted customer segments.

For the second quarter of 2017, shareholders’ net income was

$813 million, or $3.15 per share, compared with $510 million, or

$1.97 per share, for the second quarter of 2016.

Cigna's adjusted income from operations1 for the second quarter

of 2017 was $750 million, or $2.91 per share, compared with $515

million, or $1.98 per share, for the second quarter of 2016. This

reflects significantly increased earnings contributions from each

of our business segments.

Reconciliations of shareholders’ net income to adjusted income

from operations1 are provided on the following page, and on Exhibit

2 of this earnings release.

CONSOLIDATED HIGHLIGHTS

The following table includes highlights of results and

reconciliations of consolidated operating revenues5 to total

revenues and adjusted income from operations1 to shareholders’ net

income:

Consolidated Financial Results (dollars in millions,

customers in thousands): Six Months

Three Months Ended Ended June 30, March

31, June 30, 2017 2016

2017 2017 Total Revenues $ 10,318 $

9,960 $ 10,385 $ 20,703 Net Realized Investment Gains (51)

(67) (46) (97)

Consolidated Operating Revenues5 $ 10,267 $ 9,893 $ 10,339 $ 20,606

Consolidated Earnings, net of taxes Shareholders’ Net

Income $ 813 $ 510 $ 598 $ 1,411 Net Realized Investment Gains (34)

(44) (31) (65) Amortization of Other Acquired Intangible Assets 18

23 20 38 Special Items1 (47) 26

132 85 Adjusted Income from Operations1 $ 750

$ 515 $ 719 $ 1,469 Shareholders’ Net Income,

per share $ 3.15 $ 1.97 $ 2.30 $ 5.45 Adjusted

Income from Operations1, per share $ 2.91 $ 1.98 $

2.77 $ 5.67

- Second quarter 2017 shareholders’ net

income included a special item1 benefit of $47 million after-tax,

or $0.18 per share, associated with the terminated merger agreement

with Anthem, compared with a special item1 charge in second quarter

2016 of $26 million after-tax, or $0.10 per share, for

merger-related transaction costs. The second quarter 2017 special

item benefit1 was driven by a merger-related income tax benefit,

net of transaction costs.

- Cash and marketable investments at the

parent company were $2.2 billion at June 30, 2017 and $2.8 billion

at December 31, 2016.

- Year to date, as of August 3, 2017, the

Company repurchased 7.7 million shares of common stock for

approximately $1.25 billion.

HIGHLIGHTS OF SEGMENT RESULTS

See Exhibit 2 for a reconciliation of adjusted income (loss)

from operations1 to shareholders’ net income.

Global Health

Care

This segment includes Cigna’s Commercial and Government

businesses that deliver medical and specialty health care products

and services to domestic and multi-national clients and customers

using guaranteed cost, retrospectively experience-rated and

administrative services only (“ASO”) funding arrangements.

Specialty health care includes behavioral, dental, disease and

medical management, stop loss and pharmacy-related products and

services.

Financial Results (dollars in millions, customers

in thousands): Six Months Three

Months Ended Ended June 30, March 31,

June 30, 2017 2016 2017

2017 Premiums and Fees $ 7,179 $ 6,943 $ 7,339

$ 14,518 Adjusted Income from Operations1 $ 591 $ 486 $ 610 $ 1,201

Adjusted Margin, After-Tax6 7.3% 6.2% 7.4% 7.4%

As of the

Periods Ended June 30, March 31, December

31,

Customers:

2017 2016 2017

2016 Commercial 15,163 14,543 15,232 14,631 Government

491 598 502 566

Medical2 15,654 15,141 15,734 15,197 Behavioral Care7 26,014

25,312 26,006 25,790 Dental 15,760 14,880 15,788 14,981 Pharmacy

8,902 8,302 8,910 8,461 Medicare Part D 823 1,037 853 972

- Global Health Care delivered strong

results in the second quarter, reflecting consistent performance in

well-positioned growth businesses.

- Second quarter 2017 premiums and fees

increased 3% relative to second quarter 2016, driven by customer

growth and specialty contributions in our Commercial business,

partially offset by enrollment reductions as expected in our

Government business.

- The medical customer base2 at the end

of the second quarter 2017 totaled 15.7 million, an increase of

457,000 customers year to date, driven by organic growth in all of

our Commercial market segments.

- Second quarter 2017 adjusted income

from operations1 and adjusted margin, after-tax6 reflect strong

medical and specialty results, continued effective medical cost

management, favorable prior year reserve development and operating

expense discipline.

- Adjusted income from operations1 for

second quarter 2017 and first quarter 2017 included favorable prior

year reserve development on an after-tax basis of $36 million and

$61 million, respectively. Second quarter of 2016 did not have a

meaningful amount of net prior year development.

- The Total Commercial medical care

ratio8 (“MCR”) of 78.7% for second quarter 2017 reflects strong

performance and effective medical cost management, as well as

favorable prior year development, and the impact of the health

insurance tax moratorium.

- The Total Government MCR8 of 86.1% for

second quarter 2017 reflects solid performance in our Medicare

Advantage and Medicare Part D businesses.

- The second quarter 2017 Global Health

Care operating expense ratio8 of 19.9% reflects the impact of the

health insurance tax moratorium, business mix changes and continued

effective expense management.

- Global Health Care net medical costs

payable9 was approximately $2.59 billion at June 30, 2017 and $2.26

billion at December 31, 2016.

Global Supplemental

Benefits

This segment includes Cigna’s global individual supplemental

health, life and accident insurance business, primarily in Asia,

and Medicare supplement coverage in the United States.

Financial Results (dollars in millions,

policies in thousands):

Six Months Three Months

Ended Ended June 30, March 31, June

30, 2017 2016 2017

2017 Premiums and Fees10 $ 914 $ 800 $ 869 $ 1,783

Adjusted Income from Operations1 $ 105 $ 83 $ 74 $ 179 Adjusted

Margin, After-Tax6 11.0% 9.9% 8.1% 9.6%

As of the Periods

Ended June 30, March 31, December 31,

2017 2016 2017

2016 Policies10 13,058 11,965 12,611 12,151

- Global Supplemental Benefits results

continue to reflect the value created by affordable and

personalized solutions delivered directly to individual consumers

through a diversified set of distribution channels.

- Second quarter 2017 premiums and fees10

grew 14% over second quarter 2016, reflecting continued business

growth.

- Second quarter 2017 adjusted income

from operations1 and adjusted margin, after-tax6 reflect business

growth, favorable claims experience, particularly in South Korea,

and effective operating expense management.

Group Disability and

Life

This segment includes Cigna’s group disability, life and

accident insurance operations.

Financial Results (dollars in

millions):

Six Months Three Months Ended Ended

June 30, March 31, June 30, 2017

2016 2017 2017 Premiums

and Fees $ 1,022 $ 1,012 $ 1,031 $ 2,053 Adjusted Income (Loss)

from Operations1 $ 83 $ (12) $ 68 $ 151 Adjusted Margin, After-Tax6

7.5% (1.1%) 6.1% 6.8%

- Group Disability and Life results

reflect the value created for our customers and clients through

differentiated solutions that enhance health, productivity and

sense of security.

- Second quarter 2017 premiums and fees

are generally in-line with second quarter 2016.

- Second quarter 2017 adjusted income

from operations1 and adjusted margin, after-tax6 reflect further

improvement in disability performance and continued stable life

results.

Corporate & Other

Operations

Adjusted loss from operations1 for Cigna's remaining operations

is presented below:

Financial Results (dollars in

millions):

Six Months Three Months Ended

Ended June 30, March 31, June 30,

2017 2016 2017

2017 Corporate & Other Operations $ (29) $ (42) $

(33) $ (62)

- Second quarter 2017 adjusted loss from

operations1 improved relative to second quarter 2016 primarily due

to favorability in corporate income taxes.

2017 OUTLOOK

Cigna's outlook for full year 2017 consolidated adjusted income

from operations1,3 is in the range of $2.50 billion to $2.58

billion, or $9.75 to $10.05 per share. Cigna’s outlook excludes the

impact of additional prior year reserve development and potential

effects of any future capital deployment.4

(dollars in millions, except where noted

and per share amounts)

Projection for Full-Year Ending December 31, 2017

Adjusted Income (Loss) from Operations1,3

Global Health Care $ 2,100 to 2,140 Global Supplemental Benefits $

310 to 330 Group Disability and Life $ 260 to 280 Ongoing

Businesses $ 2,670 to 2,750 Corporate & Other Operations

$ (170) Consolidated Adjusted Income from Operations1,3 $ 2,500 to

2,580 Consolidated Adjusted Income from Operations, per

share1,3,4 $ 9.75 to 10.05

2017 Operating

Metrics and Ratios Outlook

Total Revenue Growth

3% to 4%

Full Year Total Commercial Medical Care Ratio8 80.5%

to 81.5%

Full Year Total Government Medical Care

Ratio8

84.5% to 85.5%

Full Year Global Health Care Operating

Expense Ratio8

20.5% to 21.5%

Global Medical Customer Growth2

500,000 to 600,000 customers

The foregoing statements represent the Company’s current

estimates of Cigna's 2017 consolidated and segment adjusted income

from operations1,3 and other key metrics as of the date of this

release. Actual results may differ materially depending on a number

of factors. Investors are urged to read the Cautionary Note

Regarding Forward-Looking Statements included in this release.

Management does not assume any obligation to update these

estimates.

This quarterly earnings release and the Quarterly Financial

Supplement are available on Cigna’s website in the Investor

Relations section (http://www.cigna.com/aboutcigna/investors).

Management will be hosting a conference call to review second

quarter 2017 results and discuss full year 2017 outlook beginning

today at 8:00 a.m. EDT. A link to the conference call is available

in the Investor Relations section of Cigna's website located at

http://www.cigna.com/cignadotcom/aboutcigna/investors/events/index.page.

The call-in numbers for the conference call are as follows:

Live Call(888) 324-8113 (Domestic)(517)

308-9070 (International)Passcode: 8042017

Replay(800) 839-1117 (Domestic)(203) 369-3355

(International)

It is strongly suggested you dial in to the conference call by

7:45 a.m. EDT.

Notes:

1.

Adjusted income (loss) from operations

is defined as shareholders’ net income (loss) excluding the

following after-tax adjustments: net realized investment results,

net amortization of other acquired intangible assets and special

items. Special items are identified in Exhibit 2 of this earnings

release.

Adjusted income (loss) from operations

is a measure of profitability used by Cigna’s management because it

presents the underlying results of operations of Cigna’s businesses

and permits analysis of trends in underlying revenue, expenses and

shareholders’ net income. This consolidated measure is not

determined in accordance with accounting principles generally

accepted in the United States (GAAP) and should not be viewed as a

substitute for the most directly comparable GAAP measure,

shareholders’ net income. See Exhibits 1 and 2 for a reconciliation

of adjusted income from operations to shareholders’ net

income.

2.

Global medical customers include

individuals who meet any one of the following criteria: are covered

under a medical insurance policy, managed care arrangement, or

service agreement issued by Cigna; have access to Cigna's provider

network for covered services under their medical plan; or have

medical claims and services that are administered by Cigna.

3.

Management is not able to provide a

reconciliation to shareholders’ net income (loss) on a

forward-looking basis because we are unable to predict, without

unreasonable effort, certain components thereof including (i)

future net realized investment results and (ii) future special

items. These items are inherently uncertain and depend on various

factors, many of which are beyond our control. As such, any

associated estimate and its impact on shareholders’ net income

could vary materially.

4.

The Company’s outlook excludes the

potential effects of any share repurchases or business combinations

that may occur after the date of this earnings release.

5.

The measure “consolidated operating

revenues” is not determined in accordance with GAAP and should not

be viewed as a substitute for the most directly comparable GAAP

measure, “total revenues.” We define consolidated operating

revenues as total revenues excluding realized investment results.

We exclude realized investment results from this measure because

our portfolio managers may sell investments based on factors

largely unrelated to the underlying business purposes of each

segment. As a result, gains or losses created in this process may

not be indicative of past or future underlying performance of the

business. See Exhibit 1 for a reconciliation of consolidated

operating revenues to total revenues.

6.

Adjusted margin, after-tax, is

calculated by dividing adjusted income (loss) from operations by

operating revenues for each segment.

7.

Prior period behavioral care customers

have been revised to conform to current presentation.

8.

Operating ratios are defined as

follows:

•

Total Commercial medical care ratio

represents medical costs as a percentage of premiums for all

commercial risk products, including medical, pharmacy, dental, stop

loss and behavioral products provided through guaranteed cost or

experience-rated funding arrangements in both the United States and

internationally.

•

Total Government medical care ratio

represents medical costs as a percentage of premiums for Medicare

Advantage, Medicare Part D, and Medicaid products.

•

Global Health Care operating expense

ratio represents operating expenses excluding acquisition related

amortization expense as a percentage of operating revenue in the

Global Health Care segment.

9.

Global Health Care medical costs

payable are presented net of reinsurance and other recoverables.

The gross Global Health Care medical costs payable balance was

$2.85 billion as of June 30, 2017 and $2.53 billion as of December

31, 2016.

10.

Cigna owns a 50% noncontrolling

interest in its China joint venture. Cigna's 50% share of the joint

venture’s earnings is reported in Other Revenues using the equity

method of accounting under GAAP. As such, the premiums and fees and

policy counts for the Global Supplemental Benefits segment do not

include the China joint venture.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This press release, and oral statements made with respect to

information contained in this release, may contain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are based on Cigna's

current expectations and projections about future trends, events

and uncertainties. These statements are not historical facts.

Forward-looking statements may include, among others, statements

concerning our projected adjusted income (loss) from operations

outlook for 2017, on both a consolidated and segment basis;

projected total revenue growth and global medical customer growth,

each over year end 2016; projected growth beyond 2017; projected

medical care and operating expense ratios and medical cost trends;

future financial or operating performance, including our ability to

deliver personalized and innovative solutions for our customers and

clients; future growth, business strategy, strategic or operational

initiatives; economic, regulatory or competitive environments,

particularly with respect to the pace and extent of change in these

areas; financing or capital deployment plans and amounts available

for future deployment; our prospects for growth in the coming

years; and other statements regarding Cigna's future beliefs,

expectations, plans, intentions, financial condition or

performance. You may identify forward-looking statements by the use

of words such as “believe,” “expect,” “plan,” “intend,”

“anticipate,” “estimate,” “predict,” “potential,” “may,” “should,”

“will” or other words or expressions of similar meaning, although

not all forward-looking statements contain such terms.

Forward-looking statements are subject to risks and

uncertainties, both known and unknown, that could cause actual

results to differ materially from those expressed or implied in

forward-looking statements. Such risks and uncertainties include,

but are not limited to: our ability to achieve our financial,

strategic and operational plans or initiatives; our ability to

predict and manage medical costs and price effectively and develop

and maintain good relationships with physicians, hospitals and

other health care providers; the impact of modifications to our

operations and processes, including those in our disability

business; our ability to identify potential strategic acquisitions

or transactions and realize the expected benefits of such

transactions; the substantial level of government regulation over

our business and the potential effects of new laws or regulations

or changes in existing laws or regulations; the outcome of

litigation, regulatory audits, investigations, actions and/or

guaranty fund assessments; uncertainties surrounding participation

in government-sponsored programs such as Medicare; the

effectiveness and security of our information technology and other

business systems; unfavorable industry, economic or political

conditions including foreign currency movements; acts of war,

terrorism, natural disasters or pandemics; uncertainty as to the

outcome of the litigation between Cigna and Anthem, Inc. with

respect to the termination of the merger agreement, the reverse

termination fee and/or contract and non-contract damages for claims

each party has filed against the other, including the risk that a

court finds that Cigna has not complied with its obligations under

the merger agreement, is not entitled to receive the reverse

termination fee or is liable for breach of the merger agreement; as

well as more specific risks and uncertainties discussed in our most

recent report on Form 10-K and subsequent reports on Forms 10-Q and

8-K available on the Investor Relations section of www.cigna.com.

You should not place undue reliance on forward-looking statements,

which speak only as of the date they are made, are not guarantees

of future performance or results, and are subject to risks,

uncertainties and assumptions that are difficult to predict or

quantify. Cigna undertakes no obligation to update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise, except as may be required by law.

CIGNA CORPORATION

COMPARATIVE SUMMARY OF FINANCIAL RESULTS (unaudited)

Exhibit 1 (Dollars in millions, except per share amounts)

Three Months Ended Six Months Ended

June 30, June 30, 2017

2016 2017 2016

REVENUES Premiums $ 8,010 $ 7,654 $ 16,113 $

15,400 Fees 1,124 1,127 2,280 2,260 Net investment income 308 294

611 566 Mail order pharmacy revenues 757 748 1,467 1,445 Other

revenues 68 70 135 138 Consolidated

operating revenues 10,267 9,893 20,606 19,809 Net realized

investment gains (losses) 51 67 97 35

Total revenues

$ 10,318 $ 9,960 $ 20,703

$ 19,844

SHAREHOLDERS' NET INCOME (LOSS)

Shareholders' net income $ 813 $ 510 $ 1,411 $ 1,029

After-tax adjustments to reconcile to adjusted income from

operations: Realized investment (gains) losses (34) (44) (65) (23)

Amortization of other acquired intangible assets, net 18 23 38 48

Special items (47) 26 85 62

Adjusted income from

operations (1)

$

750

$

515 $ 1,469 $ 1,116

Adjusted income

(loss) from operations by segment

Global Health Care $ 591 $ 486 $ 1,201 $ 1,030 Global Supplemental

Benefits 105 83 179 150 Group Disability and Life 83

(12) 151 3 Ongoing Operations 779 557 1,531 1,183

Corporate and Other (29) (42) (62) (67)

Total adjusted

income from operations $ 750 $ 515

$ 1,469 $ 1,116

DILUTED EARNINGS PER

SHARE Shareholders' net income $ 3.15 $ 1.97 $ 5.45 $

3.97 After-tax adjustments to reconcile to adjusted income from

operations: Realized investment (gains) losses (0.13) (0.18) (0.25)

(0.09) Amortization of other acquired intangible assets, net 0.07

0.09 0.15 0.18 Special items (0.18) 0.10 0.32 0.24

Adjusted income from operations (1) $ 2.91 $ 1.98

$ 5.67 $ 4.30 Weighted average shares

(in thousands) 258,061 259,500

258,913 259,473 Common shares

outstanding (in thousands)

252,859 256,558

SHAREHOLDERS' EQUITY at June 30,

$ 14,546 $ 13,356

SHAREHOLDERS' EQUITY PER SHARE at June 30,

$ 57.53 $ 52.06

(1) Adjusted income (loss) from operations is defined as

shareholders' net income (loss) excluding the following after-tax

adjustments: realized investment results; net amortization of other

acquired intangible assets; and special items (identified and

quantified on Exhibit 2).

CIGNA CORPORATION

RECONCILIATION OF SHAREHOLDERS' NET INCOME (LOSS) TO ADJUSTED

INCOME (LOSS) FROM OPERATIONS

Exhibit 2 (Dollars

in millions, except per share amounts)

Diluted Global

Group Corporate Earnings Global

Supplemental Disability and Per Share

Consolidated Health Care Benefits and

Life Other Three Months Ended, 2Q17

2Q16 1Q17 2Q17

2Q16 1Q17 2Q17

2Q16 1Q17 2Q17

2Q16 1Q17 2Q17

2Q16 1Q17 2Q17

2Q16 1Q17 Shareholders' net income

(loss) $ 3.15 $ 1.97 $ 2.30 $ 813 $ 510 $ 598 $ 599 $ 487 $ 544 $

101 $ 78 $ 77 $ 97 $ 3 $ 59 $ 16 $ (58 ) $ (82 ) After-tax

adjustments to reconcile to adjusted income (loss) from operations:

Realized investment (gains) losses (0.13 ) (0.18 ) (0.12 ) (34 )

(44 ) (31 ) (22 ) (19 ) (16 ) - - (9 ) (14 ) (15 ) (6 ) 2 (10 ) -

Amortization of other acquired intangible assets, net 0.07 0.09

0.08 18 23 20 14 18 14 4 5 6 - - - - - - Special items:

Long-term care guaranty fund

assessment

- -

0.32

- -

83

- -

68

- - - - -

15

- - - Merger-related transaction costs (1) (0.18 )

0.10 0.19 (47 )

26 49 -

- -

- - - -

- -

(47 ) 26 49 Adjusted

income (loss) from operations $ 2.91 $ 1.98

$ 2.77 $ 750 $ 515

$ 719 $ 591 $ 486 $ 610

$ 105 $ 83 $ 74 $

83 $ (12 ) $ 68 $ (29 ) $

(42 ) $ (33 ) Weighted average shares (in thousands) 258,061

259,500 259,774 Special items, pre-tax:

Long-term care guaranty fund

assessment

$ - $ - $ 129 $ - $ - $ 106 $ - $ - $ - $ - $ - $ 23 $ - $ - $ -

Merger-related transaction costs (1) 16

34 63 -

- - -

- - -

- - 16

34 63 Total $ 16

$ 34 $ 192 $ -

$ - $ 106 $ - $ -

$ - $ - $ - $ 23

$ 16 $ 34 $ 63

(Dollars in millions, except per share

amounts)

Diluted Global Group Corporate

Earnings Global Supplemental Disability

and Six Months Ended June 30, Per Share

Consolidated Health Care Benefits and

Life Other 2017 2016

2017 2016

2017 2016 2017

2016 2017

2016 2017

2016 Shareholders' net income (loss)

$

5.45

$

3.97

$

1,411

$

1,029

$

1,143

$

1,001

$

178

$

137

$

156

$

16

$

(66

)

$

(125

)

After-tax adjustments to reconcile to adjusted income (loss) from

operations:

Realized investment (gains) losses (0.25 ) (0.09 ) (65 ) (23 ) (38

) (7 ) (9 ) 1 (20 ) (13 ) 2 (4 ) Amortization of other acquired

intangible assets, net 0.15 0.18 38 48 28 36 10 12 - - - - Special

items: Long-term care guaranty fund assessment 0.32 - 83 - 68 - - -

15 - - - Merger-related transaction costs (1) -

0.24 2

62 -

- -

- -

- 2

62 Adjusted income (loss) from operations $ 5.67

$ 4.30 $ 1,469

$ 1,116 $ 1,201

$ 1,030 $ 179 $

150 $ 151 $ 3

$ (62 ) $ (67 ) Weighted average shares

(in thousands) 258,913 259,473 Common shares outstanding as of June

30, (in thousands) 252,859 256,558 Special items, pre-tax:

Long-term care guaranty fund assessment $ 129 $ - $ 106 $ - $ - $ -

$ 23 $ - $ - $ - Merger-related transaction costs (1) 79

74 -

-

-

- -

- 79

74 Total $ 208

$ 74 $ 106 $ -

$ - $ - $

23 $ - $ 79

$ 74

(1)

For additional information related to a

one-time tax benefit of approximately $60 million recorded in the

second quarter of 2017, please refer to Note 3 to the Consolidated

Financial Statements in Cigna's Form 10-Q for the period ended June

30, 2017 expected to be filed on August 4, 2017.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170804005123/en/

Cigna CorporationInvestor RelationsWill

McDowell, 215-761-4198orMedia RelationsMatt

Asensio, 860-226-2599

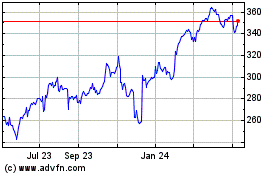

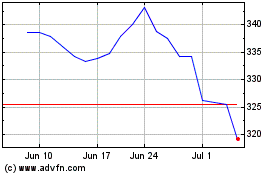

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024