RioCan's HIGHLIGHTS for the three and

six months ended June 30, 2017:

RioCan Real Estate Investment Trust (“RioCan”) (TSX:REI.UN) today

announced its financial results for the three and six months ended

June 30, 2017.

"I am very pleased with what we have been able

to accomplish in the first half of 2017. Our Canadian operations

have generated very strong growth in Funds From Operations and our

portfolio is performing well with occupancy levels returning to

near our best of around 97%," said Edward Sonshine Chief Executive

Officer of RioCan. "We are creating substantial value in our

development program, as evidenced by the quality of partners that

we have been able to attract to projects such as Gloucester City

Centre and Sunnybrook Plaza. Our development with Allied Properties

at King and Portland is progressing very well and the office

component is 93% pre-leased. These and other projects currently

well underway will be solid contributors to the continued growth in

Funds From Operations for RioCan."

Financial Highlights

All figures are expressed in Canadian dollars

unless otherwise noted. For further information about RioCan's

results for the three and six months ended June 30, 2017, this

earnings release should be read in conjunction with our unaudited

interim consolidated financial statements ("Consolidated Financial

Statements"), as well as Management's Discussion and Analysis

("MD&A") for the three and six months ended June 30, 2017.

RioCan’s Consolidated Financial Statements are

prepared in accordance with International Financial Reporting

Standards (“IFRS”). Consistent with RioCan’s management framework,

management uses certain financial measures to assess RioCan’s

financial performance, which are not generally accepted accounting

principles (GAAP) under IFRS. For full definitions of these

measures, please refer to “Non-GAAP Measures” in RioCan’s June 30,

2017 Management's Discussion and Analysis. As a result of the sale

of the U.S. operations, we have reported our former U.S. geographic

segment performance as "discontinued operations" with comparative

income statement amounts adjusted to reflect this change, unless

otherwise noted.

Net income from continuing operations

attributable to unitholders

| |

Three months ended June 30, |

|

Six months ended June 30, |

| (in

millions except percentages and per unit values) |

|

2017 |

|

2016 |

% Change |

|

|

|

2017 |

|

2016 |

% Change |

|

| Net

income from continuing operations |

$ |

155.1 |

$ |

142.7 |

8.6 |

% |

|

$ |

318.2 |

$ |

251 |

26.8 |

% |

| Net

income per unit from continuing operations attributable to

unitholders – diluted |

$ |

0.47 |

$ |

0.43 |

9.3 |

% |

|

$ |

0.96 |

$ |

0.74 |

29.7 |

% |

Continuing Operations

Net income from continuing operations attributable to

unitholders for the second quarter of 2017 is $155.1 million

compared to $142.7 million during the same period in 2016,

representing a increase of $12.4 million. Excluding $16.5 million

lower fair value gains versus the comparable period, net income

from continuing operations attributable to unitholders for the

second quarter of 2017 is $142.2 million compared to $113.4 million

in 2016, representing an increase of $28.8 million or 25.4%.

The increase of $28.8 million is largely the net

effect of the following:

- $13.8 million of income primarily due to property acquisitions

(net of dispositions), increased same property performance, and

higher straight line rent revenue;

- $10.3 million in gains related to the sale of

available-for-sale marketable securities;

- $3.5 million in lower interest expense primarily due to

interest savings on the refinancing of aggregate debt at lower

effective rates;

- $2.6 million in lower general and administrative expenses

primarily due to mark to market adjustments associated with certain

cash-settled unit-based compensation costs; and

- $2.3 million in higher property management and asset management

fee income and other income, due mainly to a development fee on a

co-ownership development; partly offset by

- $1.8 million in higher transaction and other costs;

- $1.2 million lower inventory income and deferred tax

recoveries; and

- $1.1 million in lower dividend income from available-for-sale

marketable securities.

Net income from continuing operations attributable to

unitholders for the first half of 2017 is $318.2 million compared

to $250.9 million during the same period in 2016, representing an

increase of $67.3 million. Excluding $4.6 million higher fair value

gains versus the comparable period, net income from continuing

operations attributable to unitholders for the six months ended

June 30, 2017 is $287.3 million compared to $224.6 million in 2016,

representing an increase of $62.7 million or 27.9%.

The increase of $62.7 million is largely the net

effect of the following:

- $23.1 million of income primarily due to property acquisitions

(net of dispositions), higher same property performance and

increased straight line rent revenue;

- $21.8 million in gains related to available-for-sale marketable

securities;

- $7.1 million in interest savings due mainly to lower average

debt balances outstanding as a result of debt repayments using

proceeds from the sale of the U.S. portfolio in 2016, and the

refinancing of debt at lower interest rates;

- $5.3 million in higher earnings from our equity accounted

investments, primarily as a result of fair value gains in our

RioCan-HBC joint venture; and

- $5.3 million in lower internal leasing costs and general and

administrative expenses primarily due to mark to market adjustments

of certain cash-settled unit-based compensation costs.

| Funds From

Operations ("FFO") |

Three months ended June 30, |

Six months ended June 30, |

| (in

millions except percentages and per unit values) |

2017 |

2016 |

% Change |

2017 |

2016 |

% Change |

| FFO from continuing

operatiions |

$ |

145.7 |

$ |

116.1 |

25.5 |

% |

$ |

288.7 |

$ |

224.8 |

28.4 |

% |

| FFO from

discontinued operations |

$ |

0.9 |

$ |

17.0 |

(94.8 |

%) |

$ |

0.7 |

$ |

50.9 |

(98.6 |

%) |

| FFO (i) |

$ |

146.6 |

$ |

133.1 |

10.1 |

% |

$ |

289.4 |

$ |

275.8 |

4.9 |

% |

| FFO per

Unit - diluted |

$ |

0.45 |

$ |

0.41 |

9.7 |

% |

$ |

0.88 |

$ |

0.85 |

4.2 |

% |

| (i)

A non-GAAP measurement. A reconciliation to net income can be

found under “Results of Operations” in RioCan's Management's

Discussion andAnalysis for the period ending June 30, 2017. |

Q2 2017

FFO for the second quarter of 2017 is $146.6

million compared to $133.1 million representing an increase of

approximately $13.5 million or 10.1%. On a basic per unit basis,

FFO is $0.45 compared to $0.41, representing an increase of

9.6%.

Continuing Operations

FFO from continuing operations increased from

$116.1 million in the second quarter of 2016 to $145.7 million in

the second quarter of 2017, an increase of $29.6 million or 25.5%.

The $29.6 million increase in FFO from continuing operations for

the quarter was primarily due to higher NOI of $13.7 million (at

RioCan’s proportionate share) mainly as a result of acquisitions

net of dispositions and growth in same property NOI, $10.3 million

gains related to the sale of available-for-sale marketable

securities, $3.5 million lower interest costs (at RioCan's

proportionate share), $2.6 million lower general and administrative

expenses mainly resulting from mark to market adjustments for

certain cash-settled unit-based compensation, and $1.7 million

higher fee income and other income, partially offset by $1.1

million in lower dividend income on available-for-sale marketable

securities $1.2 million in other costs associated with transactions

that the Trust decided not to pursue further, and $0.6 million

lower inventory sales net of costs.

FFO for the first half of 2017 is $289.4 million

compared to $275.8 million representing an increase of

approximately $13.6 million or 4.9%. On a basic per unit basis, FFO

is $0.89 compared to $0.85, representing an increase of 4.2%,

despite the sale of the U.S. portfolio in May 2016.

Continuing Operations

FFO from continuing operations increased from

$224.8 million in the first half of 2016 to $288.7 million in the

comparable period in 2017, an increase of $63.8 million or 28.4%.

The $63.8 million increase in FFO from continuing operations for

the period was primarily due to higher NOI of $23.1 million (at

RioCan’s proportionate share) mainly as a result of acquisitions

net of dispositions and growth in same property NOI, $21.8 million

gains related to the sale of available-for-sale marketable

securities, $7.0 million lower interest costs (at RioCan's

proportionate share), $4.8 million lower general and administrative

expenses, $4.3 million Series A preferred unit redemption costs in

Q1 2016, $1.6 million less Series A preferred unit distributions,

$1.3 million higher interest income and $1.0 million higher

property management and asset management fee income, partially

offset by $1.8 million lower dividend income from the sale of

available-for-sale marketable securities and $1.2 million in other

costs associated withtransactions that the Trust decided not to

pursue further.

Operational Performance

Same Property NOI Growth

|

|

Three months ended June 30, 0217 |

Six months ended June 30, 2017 |

| Same

Property Growth |

1.9% |

1.7% |

| Refers to

same property NOI growth on a year over year basis. |

Same property NOI increased 1.9% or $3.0 million

in the Second Quarter compared to the same period in 2016.

Approximately $1.6 million of the increase is related to higher

occupancy, renewal rate growth and contractual rent increases and

$1.4 million is due to an increase in NOI from Target backfills and

other expansion and re-development projects completed.

The key performance indicators related to

operating and leasing for the Canadian portfolio over the last

eight quarters are as follows:

| |

2017 |

2016 |

2015 |

|

|

Q2* |

Q1 |

Q4 |

Q3 |

Q2 |

Q1 |

Q4 |

Q3 |

| Committed

occupancy |

96.7 |

% |

96.2 |

% |

95.6 |

% |

95.3 |

% |

95.1 |

% |

94.8 |

% |

94.0 |

% |

93.2 |

% |

| In-place

occupancy |

95.2 |

% |

94.4 |

% |

93.6 |

% |

93.6 |

% |

92.9 |

% |

92.8 |

% |

93.3 |

% |

92.4 |

% |

| Retention rate |

93.9 |

% |

88.6 |

% |

84.0 |

% |

83.1 |

% |

91.6 |

% |

84.4 |

% |

81.4 |

% |

89.8 |

% |

| %

increase in average net rent per sq ft |

4.7 |

% |

8.2 |

% |

8.1 |

% |

6.6 |

% |

3.3 |

% |

6.2 |

% |

4.0 |

% |

8.6 |

% |

| * The

percentage increase in average net rent per square foot declined in

Q2 versus Q1 2017 as a result of a higher volume of renewals at

fixed rental rates, many of which were completed with anchor

tenants in secondary markets, compared to renewals at market rental

rates. |

Other Operating Statistics

- Renewal rents increased on average 4.7% and RioCan's retention

rate increased from 91.6% in Q2 2016 to 93.9% this quarter. The

lower renewal average net rent increase in Q2 2017 in comparison to

Q1 2017 is primarily due to a higher proportion of renewals with

fixed rates many of which were completed with anchor tenants in

secondary markets compared to renewals at market rental rates.

- We expect to generate $13.0 million of annualized net

incremental IFRS rent once all tenants that have signed leases as

of June 30, 2017 take possession of their space. Approximately

40.3% of the incremental IFRS rent relates to the leasing of former

Target space and leasing of other tenant space in development

projects expected to be completed in the second half of 2017;

and

- Consistent with RioCan’s stated strategy, its portfolio is

concentrated in Canada’s six major markets (consisting of Toronto,

Ottawa, Calgary, Edmonton, Montreal and Vancouver). Assets in these

markets contribute approximately 75.2% of RioCan’s annualized

rental revenue as at June 30, 2017 (75.5% at December 31,

2016).

Acquisitions and

Dispositions

Income Producing Property Acquisitions and

Dispositions

During the quarter, we completed the acquisition

of one income property for $16.5 million. During the quarter,

we disposed of one income property (Cambie Street property in

Vancouver, British Columbia) for sale proceeds of $94.2 million at

a capitalization rate of 3.29%.

As at August 3, 2017, RioCan expects to complete

the sale of a portfolio of six chartered bank branches located in

British Columbia at a sale price of $30.3 million, at a

capitalization rate of 3.72%, subject to customary closing

conditions. There is no debt associated with these properties.

Development Property Acquisitions and

Dispositions

We did not acquire any development properties

during the second quarter of 2017. During the quarter, we disposed

of 50% interests in the following two development properties for

gross sale proceeds of $35.2 million.

- Gloucester Residential - On April 21,

2017, RioCan and Killam Apartment REIT announced the creation of a

50/50 Joint Venture to develop a residential community at

Gloucester City Centre in Ottawa, Ontario. The site has zoning

approval for a total of four residential towers containing up to an

aggregate of 840 units. The first phase of the development will be

a 23-storey tower containing approximately 222 units. This leading

edge development will maximize efficiency with the incorporation of

a geothermal energy system for the building’s heating and cooling.

Construction has commenced and occupancy is anticipated in

mid-2019.

- Sunnybrook Plaza - On June 14, 2017, RioCan

completed the sale of a 50% interest in Sunnybrook Plaza to Concert

Properties ("Concert"). RioCan and Concert plan to construct a

16-storey and 11-storey mixed use residential project. Currently,

RioCan and Concert are contemplating that the residential component

will be developed as rental suites.

Development Pipeline

RioCan’s development program is an important

component of its long-term growth strategy and is focused on well-

located urban and suburban properties in the six major markets in

Canada. Often, these are properties that RioCan already owns and

are located directly on, or in proximity, to major transit lines.

RioCan's development program continues to be a significant value

creation driver and will secure diversification and growth for our

future cash flows.

Pipeline Summary

RioCan's overall estimated development pipeline

as at June 30, 2017, represents approximately 24.1 million square

feet of density (at RioCan’s interest). These projects include

commercial space (office and retail), residential rental held for

long-term rental income, condominiums and townhouses for sale, and

density associated with air rights sales. Approximately 3.5 million

square feet of net leaseable area ("NLA") in the estimated

development pipeline is existing NLA which is currently income

producing, therefore the net incremental density included in the

total development pipeline is estimated at 20.6 million square feet

(at RioCan's interest) as of June 30, 2017. Approximately 94.1% or

22.7 million square feet of our overall estimated development

pipeline is residential or mixed-use projects.

A key milestone of the development process and

in creating value for the Trust is the the zoning approval process.

Of the Trust's estimated 24.1 million square feet of development

pipeline (at RioCan's interest) 10.7 million square feet have

zoning approvals, representing approximately 44.6% of total

estimated NLA in the Trust's current estimated development

pipeline. In addition, the Trust has 7.1 million square feet with

zoning applications submitted, representing an additional 29.4% of

the Trust's current development pipeline as of June 30, 2017.

RioCan has categorized its development pipeline

into three primary components: active projects with detailed cost

estimates, active projects with cost estimates in progress, and

future estimated density. As of June 30, 2017, RioCan has active

projects with detailed cost estimates that when complete over the

next six years represent 4.4 million square feet (4.6 million

square feet including Residential Inventory) with total estimated

project costs of $2.2 billion, after projected proceeds from land

and air rights dispositions, of which $1.1 billion of costs have

been incurred to date.

The Trust will continue to fund its development

pipeline through its capital recycling program and strategic

development partnerships.

Completed Developments in 2017

During the Second Quarter, RioCan transferred

$41.8 million in costs to income producing properties pertaining

to232,000 square feet of completed greenfield development and

expansion and redevelopment projects.

Liquidity and Capital

RioCan’s debt and leverage metrics are disclosed

below to help facilitate an understanding of RioCan’s leverage and

its ability to service such leverage. The definitions that

management uses, as well as the calculation methodology for the

ratios included in the table below are described in RioCan's

Management’s Discussion and Analysis for the six months ended June

30, 2017.

|

|

Rolling 12 months ended |

|

|

June 30, 2017 |

|

December 31, 2016 |

| Interest coverage –

RioCan’s proportionate share (i) |

3.74 |

x |

|

3.36 |

x |

| Debt service coverage –

RioCan’s proportionate share (i) |

2.92 |

x |

|

2.61 |

x |

| Fixed charge coverage –

RioCan’s proportionate share (i) |

1.12 |

x |

|

1.10 |

x |

| Debt to Adjusted EBITDA

– RioCan’s proportionate share (i) |

7.51 |

x |

|

8.10 |

x |

| Ratio of total debt to

total assets (RioCan's proportionate share, net of cash and

cash equivalents) |

|

41.5 |

% |

|

|

40.0 |

% |

| Unencumbered assets

(millions) |

$7,128 |

|

|

$6,625 |

|

| % of NOI generated from

unencumbered assets (ii) |

|

52.6 |

% |

|

|

49.5 |

% |

| Unencumbered assets to

unsecured debt |

|

231 |

% |

|

|

240 |

% |

| (i) Refer to section Non-GAAP Measures in

RioCan's MD&A for further details and the calculation of

adjusted EBITDA for the respective periods. |

| (ii)

Ratio is calculated on a continuing operations basis. |

The interest and debt service coverage ratios calculated at

RioCan's proportionate share for the twelve months ended June 30,

2017 improved compared to December 31, 2016 mainly due to lower

interest and debt service costs as a result of the repayment of

debt using the net proceeds from the U.S. sale and interest savings

from mortgage refinancing, partially offset by a decrease in

adjusted EBITDA mainly in connection with our U.S. property

portfolio disposition.

The fixed charge coverage ratio calculated at

RioCan's proportionate share for the twelve months ended June 30,

2017 improved compared to December 31, 2016 mainly due to lower

total fixed charges (interest cost plus unitholder distributions)

partially offset by the same changes in adjusted EBITDA as

described above.

Debt to adjusted EBITDA at RioCan's

proportionate share has decreased to 7.51x for the twelve months

ended June 30, 2017 mainly as a result of lower average debt

balances outstanding, partially offset by a decrease in adjusted

EBITDA mainly in connection with our U.S. property portfolio

disposition in the second quarter of 2016.

Our leverage ratio at RioCan's proportionate

share increased from 40.0% at December 31, 2016 to 41.5% at June

30, 2017 primarily due to the payment of U.S. taxes that have been

accrued in 2016, relating to the sale of our U.S. portfolio in

2016, as well as redemption of the Trust's Series C preferred trust

units on June 30, 2017. We expect our total debt to total asset

ratio to fluctuate between 38% to approximately 42%. Over the next

12 to 18 months, we expect this ratio to rise toward the higher end

of this range.

The percentage NOI generated from unencumbered

assets has improved from 49.5% to 52.6% as we continued to

unencumber assets during the first half of 2017. The unencumbered

assets to unsecured debt ratio, however, decreased from 240% to

231% this period as the increase in our unsecured debt of $333

million, partially driven by tax payments relating to the U.S.

portfolio sale and redemption of the Trust's Series C

preferred units, outpaced the $503 million increase in unencumbered

assets on a relative basis. Overall, we are still well over

our 200% target.

Selected Financial Information

The following includes financial information

prepared by management in accordance with IFRS and based on the

Trust's Consolidated Financial Statements for the period ended June

30, 2017. This financial information does not contain all

disclosures required by IFRS, and accordingly should be read in

conjunction with the Trust's Consolidated Financial Statements and

MD&A for the period ended June 30, 2017, which is available on

RioCan's website and on SEDAR.

|

CONSOLIDATED BALANCE SHEETS |

| (In

thousands of Canadian dollars, except per unit

amounts) |

|

(unaudited) |

| |

| As

at |

June 30, 2017 |

December 31, 2016 |

|

Assets |

|

|

| Investment

properties |

$ |

13,362,936 |

$ |

13,287,038 |

| Deferred tax

assets |

|

10,609 |

|

11,609 |

| Equity accounted

investments |

|

201,084 |

|

185,278 |

| Mortgages and loans

receivable |

|

126,334 |

|

118,017 |

| Residential

inventory |

|

57,878 |

|

48,414 |

| Assets held for

sale |

|

91,780 |

|

60,530 |

| Receivables and other

assets |

|

382,421 |

|

408,508 |

| Cash and

cash equivalents |

|

41,642 |

|

54,366 |

| Total

assets |

$ |

14,274,684 |

$ |

14,173,760 |

|

Liabilities |

|

|

| Debentures payable |

$ |

2,694,789 |

$ |

2,248,024 |

| Mortgages payable |

|

2,611,029 |

|

2,699,935 |

| Lines of credit and

other bank loans |

|

597,738 |

|

705,633 |

| Accounts

payable and other liabilities |

|

405,973 |

|

510,280 |

| Total

liabilities |

$ |

6,309,529 |

$ |

6,163,872 |

|

Equity |

|

|

| Unitholders'

equity: |

|

|

|

Preferred |

$ |

— |

$ |

144,755 |

|

Common |

|

7,965,155 |

|

7,865,133 |

| Total

equity |

|

7,965,155 |

|

8,009,888 |

| Total

liabilities and equity |

$ |

14,274,684 |

$ |

14,173,760 |

|

CONSOLIDATED STATEMENTS OF INCOME |

|

(In thousands of Canadian dollars, except per unit

amounts) |

|

(unaudited) |

|

|

|

|

Three

months ended June 30, |

Six months

ended June 30, |

|

|

|

2017 |

|

2016 |

|

|

2017 |

|

2016 |

|

|

Revenue |

|

|

|

|

| Rental revenue |

$ |

280,862 |

$ |

268,282 |

|

$ |

567,549 |

$ |

543,817 |

|

| Property and asset

management fees |

|

4,770 |

|

3,538 |

|

|

7,753 |

|

6,748 |

|

|

Residential inventory sales |

|

— |

|

3,926 |

|

|

— |

|

9,012 |

|

|

|

|

285,632 |

|

275,746 |

|

|

575,302 |

|

559,577 |

|

| Operating

costs |

|

|

|

|

| Rental operating

costs |

|

|

|

|

|

Recoverable under tenant leases |

|

96,248 |

|

96,796 |

|

|

202,708 |

|

200,941 |

|

|

Non-recoverable costs |

|

4,340 |

|

4,999 |

|

|

8,637 |

|

9,757 |

|

|

Residential inventory cost of sales |

|

— |

|

3,328 |

|

|

— |

|

8,290 |

|

|

|

|

100,588 |

|

105,123 |

|

|

211,345 |

|

218,988 |

|

|

Operating income |

|

185,044 |

|

170,623 |

|

|

363,957 |

|

340,589 |

|

| Other

income |

|

|

|

|

| Interest income |

|

1,716 |

|

1,337 |

|

|

4,004 |

|

2,668 |

|

| Income from equity

accounted investments |

|

2,389 |

|

2,555 |

|

|

8,609 |

|

3,310 |

|

| Fair value gains on

investment properties, net |

|

12,831 |

|

29,286 |

|

|

30,938 |

|

26,343 |

|

|

Investment and other income |

|

13,707 |

|

3,443 |

|

|

29,084 |

|

6,858 |

|

|

|

|

30,643 |

|

36,621 |

|

|

72,635 |

|

39,179 |

|

| Other

expenses |

|

|

|

|

| Interest costs |

|

42,580 |

|

46,076 |

|

|

85,585 |

|

92,703 |

|

| General and

administrative |

|

11,294 |

|

13,941 |

|

|

22,225 |

|

27,074 |

|

| Internal leasing

costs |

|

2,318 |

|

2,407 |

|

|

4,811 |

|

5,230 |

|

|

Transaction and other costs |

|

4,428 |

|

2,678 |

|

|

4,780 |

|

4,597 |

|

|

|

|

60,620 |

|

65,102 |

|

|

117,401 |

|

129,604 |

|

| Income before

income taxes |

|

155,067 |

|

142,142 |

|

|

319,191 |

|

250,164 |

|

| Deferred

income tax expense (recovery) |

|

— |

|

(600 |

) |

|

1,000 |

|

(850 |

) |

| Net income from

continuing operations |

$ |

155,067 |

$ |

142,742 |

|

$ |

318,191 |

$ |

251,014 |

|

| Net

income from discontinued operations |

|

1,405 |

|

128,414 |

|

|

2,852 |

|

167,145 |

|

|

Net income |

$ |

156,472 |

$ |

271,156 |

|

$ |

321,043 |

$ |

418,159 |

|

| Net income

attributable to |

|

|

|

|

|

Unitholders |

$ |

156,472 |

$ |

271,116 |

|

$ |

321,043 |

$ |

418,068 |

|

|

Non-controlling interests |

|

— |

|

40 |

|

|

— |

|

91 |

|

|

|

$ |

156,472 |

$ |

271,156 |

|

$ |

321,043 |

$ |

418,159 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Net income per unit -

basic: |

|

|

|

|

|

|

|

|

|

|

| From

continuing operations |

$ |

0.47 |

$ |

0.43 |

|

$ |

0.96 |

$ |

0.74 |

|

|

From discontinued operations |

|

— |

|

0.39 |

|

|

0.01 |

|

0.52 |

|

|

Net income per unit - basic |

$ |

0.47 |

$ |

0.83 |

|

$ |

0.97 |

$ |

1.26 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Net income per unit -

diluted: |

|

|

|

|

|

|

|

|

|

|

| From

continuing operations |

$ |

0.47 |

$ |

0.43 |

|

$ |

0.96 |

$ |

0.74 |

|

|

From discontinued operations |

|

— |

|

0.39 |

|

|

0.01 |

|

0.51 |

|

|

Net income per unit - diluted |

$ |

0.47 |

$ |

0.83 |

|

$ |

0.97 |

$ |

1.26 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Weighted average number

of units (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

327,063 |

|

325,364 |

|

|

326,921 |

|

324,459 |

|

|

Diluted |

|

327,201 |

|

325,811 |

|

|

327,073 |

|

324,733 |

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

|

|

| (In

thousands of Canadian dollars) |

|

|

|

|

(unaudited) |

|

|

|

|

| |

|

|

|

|

| |

Three months ended June 30, |

Six months ended June 30, |

|

|

2017 |

2016 |

2017 |

2016 |

| Operating

activities |

|

|

|

|

| Net income from: |

|

|

|

|

|

Continuing operations |

$ |

155,067 |

|

$ |

142,742 |

|

$ |

318,191 |

|

$ |

251,014 |

|

|

Discontinued operations |

|

1,405 |

|

|

128,414 |

|

|

2,852 |

|

|

167,145 |

|

| Net

income |

|

156,472 |

|

|

271,156 |

|

|

321,043 |

|

|

418,159 |

|

| Items

not affecting cash: |

|

|

|

|

|

Depreciation and amortization |

|

1,250 |

|

|

1,119 |

|

|

2,845 |

|

|

2,224 |

|

|

Amortization of straight-line rent |

|

(1,999 |

) |

|

(652 |

) |

|

(4,362 |

) |

|

(2,718 |

) |

|

Unit-based compensation expense |

|

1,600 |

|

|

495 |

|

|

2,079 |

|

|

648 |

|

| Income

from equity accounted investments |

|

(2,389 |

) |

|

(2,555 |

) |

|

(8,609 |

) |

|

(3,310 |

) |

| Fair

value gains on investment properties, net |

|

(12,831 |

) |

|

(24,985 |

) |

|

(30,938 |

) |

|

(43,242 |

) |

| Deferred

income taxes (recovery) |

|

— |

|

|

(214,414) |

|

|

1,000 |

|

|

(231,525 |

) |

|

Transaction gains (net) on disposition of: |

|

|

|

|

|

|

|

Available-for-sale securities |

|

(10,280 |

) |

|

— |

|

|

(21,822 |

) |

|

— |

|

| Canadian

investment properties |

|

(629 |

) |

|

— |

|

|

(971 |

) |

|

— |

|

| U.S.

investment properties |

|

— |

|

|

(65,116 |

) |

|

— |

|

|

(65,116 |

) |

|

Adjustments for other changes in working capital items |

|

(26,362 |

) |

|

78,992 |

|

|

(176,177 |

) |

|

83,731 |

|

|

Cash provided by operating

activities |

|

104,832 |

|

|

44,040 |

|

|

84,088 |

|

|

158,851 |

|

|

Investing activities |

|

|

|

|

|

Acquisitions of investment property, net of assumed debt |

|

(7,544 |

) |

|

(77,967 |

) |

|

(12,928 |

) |

|

(123,218 |

) |

|

Construction expenditures on properties under

development |

|

(79,949 |

) |

|

(58,908 |

) |

|

(155,672 |

) |

|

(105,691 |

) |

|

Capital expenditures on income properties: |

|

|

|

|

|

Recoverable and non-recoverable costs |

|

(7,727 |

) |

|

(16,078 |

) |

|

(12,327 |

) |

|

(20,881 |

) |

| Tenant

improvements and external leasing commissions |

|

(11,932 |

) |

|

(15,174 |

) |

|

(20,865 |

) |

|

(23,042 |

) |

| Proceeds

from sale of investment properties |

|

128,218 |

|

|

1,991,612 |

|

|

159,630 |

|

|

2,036,805 |

|

|

Earn-outs on investment properties |

|

— |

|

|

— |

|

|

(1,309 |

) |

|

— |

|

|

Contributions to equity accounted investments |

|

(620 |

) |

|

(24,147 |

) |

|

(13,801 |

) |

|

(24,147 |

) |

|

Distributions received from equity accounted investments |

|

4,823 |

|

|

2,406 |

|

|

7,225 |

|

|

6,500 |

|

| Advances

of mortgages and loans receivable |

|

(2,312 |

) |

|

(425 |

) |

|

(4,562 |

) |

|

(980 |

) |

|

Repayments of mortgages and loans receivable |

|

— |

|

|

13,155 |

|

|

5,129 |

|

|

20,972 |

|

| Proceeds

from sale of available-for-sale securities, net of selling

costs |

|

33,190 |

|

|

— |

|

|

75,968 |

|

|

— |

|

|

Cash provided by investing

activities |

|

56,147 |

|

|

1,814,474 |

|

|

26,488 |

|

|

1,766,318 |

|

|

Financing activities |

|

|

|

|

| Proceeds

from mortgage financing, net of issue costs |

|

85,409 |

|

|

58,373 |

|

|

182,529 |

|

|

109,914 |

|

|

Repayments of mortgage principal |

|

(63,817 |

) |

|

(1,086,774 |

) |

|

(253,215 |

) |

|

(1,233,817 |

) |

| Advances

from bank credit lines, net of issue costs |

|

3,940 |

|

|

100,380 |

|

|

99,471 |

|

|

507,970 |

|

|

Repayment of bank credit lines |

|

(225,028 |

) |

|

(691,079 |

) |

|

(230,028 |

) |

|

(1,050,297 |

) |

| Proceeds

from issuance of debentures, net of issue costs |

|

298,565 |

|

|

— |

|

|

596,948 |

|

|

— |

|

|

Repayment of unsecured debentures |

|

— |

|

|

— |

|

|

(150,000 |

) |

|

— |

|

|

Distributions to common trust unitholders, net of distributions

reinvested |

|

(108,779 |

) |

|

(103,895 |

) |

|

(216,711 |

) |

|

(182,322 |

) |

|

Distributions to preferred trust unitholders |

|

(1,757 |

) |

|

(1,757 |

) |

|

(3,514 |

) |

|

(5,154 |

) |

|

Distributions paid to non-controlling interests |

|

— |

|

|

(91 |

) |

|

— |

|

|

(91 |

) |

| Return

of capital to non-controlling interests |

|

— |

|

|

(782 |

) |

|

— |

|

|

(782 |

) |

| Proceeds

received from issuance of common units, net |

|

215 |

|

|

13,582 |

|

|

720 |

|

|

33,418 |

|

|

Redemption of preferred units |

|

(149,500 |

) |

|

(125,000 |

) |

|

(149,500 |

) |

|

(125,000 |

) |

|

Cash used in financing

activities |

|

(160,752 |

) |

|

(1,837,043 |

) |

|

(123,300 |

) |

|

(1,946,161 |

) |

|

Net change in cash and cash

equivalents |

|

227 |

|

|

21,471 |

|

|

(12,724 |

) |

|

(20,992 |

) |

|

Cash and cash equivalents, beginning of period |

|

41,415 |

|

|

40,855 |

|

|

54,366 |

|

|

83,318 |

|

|

Cash and cash equivalents, end of

period |

$ |

41,642 |

|

$ |

62,326 |

|

$ |

41,642 |

|

$ |

62,326 |

|

Conference Call and Webcast

Interested parties are invited to participate in

a conference call with management on Friday, August 4, 2017 at 8:30

a.m. Eastern time. You will be required to identify yourself and

the organization on whose behalf you are participating.

In order to participate, please dial

647-427-3230 or 1-877-486-4304. If you cannot participate in the

live mode, a replay will be available. To access the replay, please

dial 1-855-859-2056 and enter passcode 47045117#.

Alternatively, to access the simultaneous

webcast, go to the following link on RioCan’s website

http://investor.riocan.com/investor-relations/events-and-presentations/events/ and

click on the link for the webcast. The webcast will be archived 24

hours after the end of the conference call and can be accessed for

120 days.

About RioCan

RioCan is Canada's largest real estate

investment trust with a total enterprise value of approximately

$13.9 billion as at June 30, 2017. RioCan owns and manages Canada’s

largest retail focused portfolio with ownership interests in 299

retail and mixed-use properties, including 15 properties under

development, containing an aggregate net leasable area of 45

million square feet. For the past 25 years, we have shaped the

future, sensibly cultivated growth, and taken our stakeholders and

partners wherever they needed to go. Currently, we have more than

6,350 retail tenants and approximately 660 employees with a

presence from coast to coast. We know that there is a home for

every retailer. Whether we find it today or build it for tomorrow,

we deliver real vision, solid ground. For more information, visit

www.riocan.com.

Non-GAAP Measures

RioCan’s consolidated financial statements are

prepared in accordance with IFRS. Consistent with RioCan’s

management framework, management uses certain financial measures to

assess RioCan’s financial performance, which are not generally

accepted accounting principles (GAAP) under IFRS. The following

measures, RioCan's Interest, RioCan's Proportionate Share,

Funds From Operations (“FFO”), Adjusted Earnings Before Interest,

Taxes, Depreciation and Amortization (“Adjusted EBITDA”), Interest

Coverage Ratio, Debt Service Coverage Ratio, Debt to Adjusted

EBITDA, Net Operating Income ("NOI"), Same Property NOI, Fixed

Charge Coverage, Percentage of NOI Generated from Unencumbered

Assets, Unencumbered Assets to Unsecured Debt, and Total Enterprise

Value, as well as other measures discussed elsewhere in

this release, do not have a standardized definition prescribed by

IFRS and are, therefore, unlikely to be comparable to similar

measures presented by other reporting issuers. RioCan supplements

its IFRS measures with these non-GAAP measures to aid in assessing

the Trust’s underlying performance and reports these additional

measures so that investors may do the same. Non- GAAP measures

should not be considered as alternatives to net earnings or

comparable metrics determined in accordance with IFRS as indicators

of RioCan’s performance, liquidity, cash flow, and profitability.

For a full definition of these measures, please refer to the

“Non-GAAP Measures” in RioCan’s Management Discussion and Analysis

for the period ending June 30, 2017.

Forward-Looking Information

This news release contains forward-looking

information within the meaning of applicable Canadian securities

laws. This information includes, but is not limited to, statements

made in “Financial Highlights”, “Operational Performance",

“Acquisitions and Dispositions”, "Development Pipeline Summary",

Liquidity and Capital" and other statements concerning RioCan’s

objectives, its strategies to achieve those objectives, as well as

statements with respect to management’s beliefs, plans, estimates,

and intentions, and similar statements concerning anticipated

future events, results, circumstances, performance or expectations

that are not historical facts. Forward-looking information

generally can be identified by the use of forward-looking

terminology such as “outlook”, “objective”, “may”, “will”, “would”,

“expect”, “intend”, “estimate”, “anticipate”, “believe”, “should”,

“plan”, “continue”, or similar expressions suggesting future

outcomes or events. Such forward-looking information reflects

management’s current beliefs and is based on information currently

available to management. All forward-looking information in this

News Release is qualified by these cautionary statements.

Forward-looking information is not a guarantee

of future events or performance and, by its nature, is based on

RioCan’s current estimates and assumptions, which are subject to

numerous risks and uncertainties, including those described under

“Risks and Uncertainties” in RioCan's Management's Discussion and

Analysis for the period ended June 30, 2017 ("MD&A"), which

could cause actual events or results to differ materially from the

forward-looking information contained in this News Release. Those

risks and uncertainties include, but are not limited to, those

related to: liquidity and general market conditions; tenant

concentrations and related risk of bankruptcy or restructuring (and

the terms of any bankruptcy or restructuring proceeding), occupancy

levels and defaults, including the failure to fulfill contractual

obligations by the tenant or a related party thereof; lease

renewals and rental increases; the ability to re-lease and find new

tenants for vacant space; retailer competition; changes in

Ontario's rent control legislation; access to debt and equity

capital; interest rate and financing risk; joint ventures and

partnerships; the relative illiquidity of real property; unexpected

costs or liabilities related to acquisitions and dispositions;

development risk associated with construction commitments, project

costs and related approvals; environmental matters; litigation;

reliance on key personnel; unitholder liability; income, sales and

land transfer taxes; and credit ratings.

RioCan currently qualifies as a real estate

investment trust for Canadian tax purposes and intends to qualify

for future years. The Income Tax Act (Canada) contains provisions

which potentially impose tax on publicly traded trusts that qualify

as specified investment flow-through entities (the SIFT

Provisions). However, the SIFT Provisions do not impose tax on a

publicly traded trust which qualifies as a REIT. Should RioCan no

longer qualify as a Canadian REIT under the SIFT Provisions,

certain statements contained in this News Release may need to be

modified. RioCan is still subject to Canadian tax in its

incorporated Canadian subsidiaries.

Our U.S. subsidiary qualified as a REIT for U.S.

income tax purposes up to May 25, 2016, subsequent to the closing

date of the sale of our U.S. property portfolio. For U.S. income

tax purposes, the subsidiary distributed all of its U.S. taxable

income and is entitled to deduct such distributions against its

taxable income. The subsidiary’s qualification as a REIT depends on

the REIT’s satisfaction of certain asset, income, organizational,

distribution, unitholder ownership and other requirements up until

May 25, 2016. Our U.S. subsidiary was subject to a 30% or 35%

withholding tax on distributions of its U.S. taxable income to

Canada. We do not intend to distribute any withholding taxes paid

or payable to our unitholders related to the disposition. Should

RioCan’s U.S. subsidiary no longer qualify as a U.S. REIT for U.S.

tax purposes prior to May 25th, 2016, certain statements contained

in this MD&A may need to be modified.

Other factors, such as general economic

conditions, including interest rate fluctuations, may also have an

effect on RioCan’s results of operations. Material factors or

assumptions that were applied in drawing a conclusion or making an

estimate set out in the forward-looking information may include,

but are not limited to: a stable retail environment; relatively low

and stable interest costs; a continuing trend toward land use

intensification, including residential development in urban

markets; access to equity and debt capital markets to fund, at

acceptable costs, future capital requirements and to enable our

refinancing of debts as they mature; and the availability of

investment opportunities for growth in Canada. For a description of

additional risks that could cause actual results to materially

differ from management’s current expectations, see “Risks and

Uncertainties” in RioCan's MD&A for the period ended June

30,2017, and in “Risks and Uncertainties” in RioCan’s most recent

Annual Information Form. Although the forward- looking information

contained in this News Release is based upon what management

believes are reasonable assumptions, there can be no assurance that

actual results will be consistent with this forward-looking

information. Certain statements included in this News Release may

be considered “financial outlook” for purposes of applicable

Canadian securities laws, and as such the financial outlook may not

be appropriate for purposes other than this News Release. The

forward-looking information contained in this News Release is made

as of the date of this News Release , and should not be relied upon

as representing RioCan’s views as of any date subsequent to the

date of this News Release.

Management undertakes no obligation, except as

required by applicable law, to publicly update or revise any

forward- looking information, whether as a result of new

information, future events or otherwise.

Contact Information:

RioCan Real Estate Investment Trust

Qi Tang

Senior Vice President and Chief Financial Officer

416-866-3033

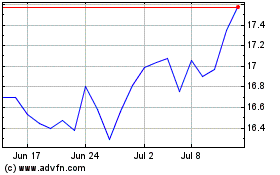

RioCan Real Estate Inves... (TSX:REI.UN)

Historical Stock Chart

From Mar 2024 to Apr 2024

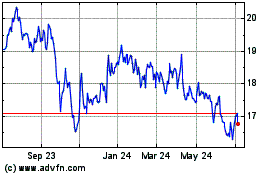

RioCan Real Estate Inves... (TSX:REI.UN)

Historical Stock Chart

From Apr 2023 to Apr 2024