Siemens and Bombardier in Talks to Form Train Joint Ventures -- Update

July 21 2017 - 4:06PM

Dow Jones News

By Ben Dummett and Jacquie McNish

Siemens AG and Bombardier Inc. are in advanced to talks to

combine their train-making businesses, according to people familiar

with the matter, as they aim to fend off stiffer competition from

consolidating rivals in China.

Germany's Siemens, one of the world's biggest industrial

conglomerates, and Canada's Bombardier, which is also a major plane

maker, are in advance discussions to fold their train operations

into two separate joint ventures. One unit, controlled by Siemens,

would hold the signaling operations of the two companies. The

second, which Bombardier would majority own, would oversee the

rolling-stock operations. Signaling equipment is used to keep

trains clear of each other and rolling stock centers on train

manufacturing.

A spokesman for Siemens declined to comment.

The combined joint ventures would have about EUR15 billion of

annual sales based on 2016 results of both firms' train divisions,

according to one person familiar with the discussions.

Talks are expected to conclude as early as next month, one of

the people said. The discussions were previously reported by

Bloomberg.

The companies expect to reach a deal in the next couple of

weeks, but one person familiar with the negotiations said there are

still some key issues that need to be resolved. As in all complex

merger negotiations, talks could collapse without an agreement.

The talks come at a time when the 2015 merger of Chinese train

makers CSR Corp. and China CNR is forcing rivals to gain scale as a

means to cut costs and access additional customers to boost revenue

and profit. In 2016, Bombardier 's transportation business reported

revenue of $7.57 billion, down almost 9% from the year-ago period.

Earnings before interest and taxes, a profit measure, was also

lower year over year. Siemens' train business has fared better, as

revenue and profit for the fiscal year ended Sept. 30, 2016, grew.

Still, orders fell 23% year over year.

Siemens is the leading supplier of train-signaling equipment,

accounting for about 25% of the global market, compared with

Bombardier's estimated 10% share, according to a report this week

by National Bank of Canada. The report said overlap between the two

companies' rolling-stock businesses could "present some challenges"

with competition authorities. The train-manufacturing arms of

Bombardier and Siemens both are currently based in Germany where

the two rank as the country's largest suppliers.

Bombardier had signaled as far back as 2015 that it was

considering a possible joint venture as part of potential

participation in the consolidation of the sector. At the same time,

the company has always stressed that it wouldn't sell the train

business outright. Bombardier has long maintained that the train

division is attractive as it counterbalances the aerospace

division. It tends to perform better during economic downturns,

when governments increase spending on rail and other infrastructure

projects, and demand for aircraft falters. The opposite is often

true during times of economic expansion.

--Christopher Alessi contributed to this article.

Write to Ben Dummett at ben.dummett@wsj.com and Jacquie McNish

at Jacquie.McNish@wsj.com

(END) Dow Jones Newswires

July 21, 2017 15:51 ET (19:51 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

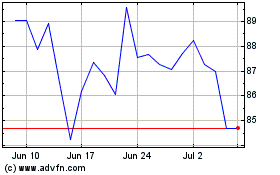

Bombardier (TSX:BBD.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

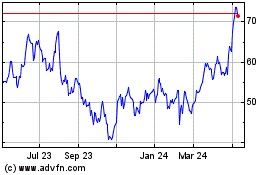

Bombardier (TSX:BBD.B)

Historical Stock Chart

From Apr 2023 to Apr 2024