Visa Lifts Financial Targets -- WSJ

July 21 2017 - 3:02AM

Dow Jones News

Payment network beats expectations as transactions swell; global

recovery cited

By Maria Armental and AnnaMaria Andriotis

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 21, 2017).

Visa Inc. raised its financial targets for the year as its

quarterly results beat Wall Street expectations, driven by a higher

number of transactions.

Profit surged to $2.06 billion, or 86 cents a Class A share,

from $412 million, or 17 cents a share, a year earlier when results

were hurt by charges related to the acquisition of its European

operations. Net operating revenue rose 26% to $4.57 billion.

Analysts surveyed by Thomson Reuters had expected profit of 81

cents a share on $4.36 billion in net operating revenue.

Visa shares, which have been trading at all-time highs, rose

1.2% to $99.37 after hours.

Operating expenses rose by 31% after adjustments, largely tied

to the Visa Europe acquisition that the company completed in June

2016.

San Francisco-based Visa has delivered a string of earnings

beats fueled by a growing credit-card market. Payments volume for

the quarter rose 38% from a year earlier on a constant-dollar basis

to $1.9 trillion, while total processed transactions rose 44% to

28.5 billion.

Visa is the network for many in-demand credit cards, including

the J.P. Morgan Chase Sapphire Reserve card, and has also benefited

from Costco Wholesale Corp. cards' switch to the Visa network from

American Express. Visa processes credit- and debit-card

transactions and makes most of its money from transaction-related

fees.

The company is also benefiting from the global economic

recovery, said Vasant Prabhu, Visa's chief financial officer, on

the company's earnings call. Visa's cross-border volume, which is

when cardholders use Visa cards outside of the country they are

issued in, increased 11% on a constant dollar basis from a year

prior when Europe is included in last year's results.

Visa is also trying to make inroads in China. Chief Executive Al

Kelly provided updates on the company's long-running effort to

enter the Chinese market. Mr. Kelly said on the earnings call that

the company filed an application on Wednesday with the People's

Bank of China for a domestic license. The company has been trying

to get more of its cards to be issued by Chinese banks to consumers

for use inside the country.

The U.S. and Chinese governments reached an agreement in May

that is supposed to result in more access to the Chinese economy

for electronic-payments providers. That reignited hopes that Visa

and Mastercard may get more market share in China.

With one quarter to go, Visa again raised financial targets for

the current business year, saying it now expects adjusted profit to

increase about 20%, compared with its earlier view of an increase

at the high end of the midteens. It also expects net revenue to

increase about 20%, up from its previous view of an increase at the

high end of 16% to 18%.

On the earnings call, Mr. Kelly reiterated the company's

commitment to get more customers to stop using cash -- a key piece

of Visa's growth strategy. The company last week announced an

initiative that offers up to 50 restaurants and food vendors in the

U.S. $10,000 apiece to pay for technology upgrades and marketing

costs if they agree to stop accepting cash from customers.

Visa accounted for 59% of purchase volume on U.S. general

purpose credit and debit cards last year, compared with

Mastercard's 25% market share, according to the Nilson Report, a

trade publication.

Write to Maria Armental at maria.armental@wsj.com and AnnaMaria

Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

July 21, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

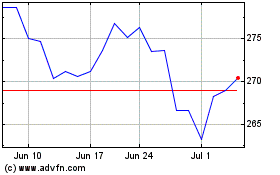

Visa (NYSE:V)

Historical Stock Chart

From Aug 2024 to Sep 2024

Visa (NYSE:V)

Historical Stock Chart

From Sep 2023 to Sep 2024