Capital One Revenue Rises in Second Quarter -- Update

July 20 2017 - 6:45PM

Dow Jones News

By AnnaMaria Andriotis

Capital One Financial Corp. reported that its second-quarter

earnings rose 10% from a year prior, to $1.04 billion, beating

analyst estimates.

The credit-card issuer's shares jumped about 4% in aftermarket

trading.

The company reported earnings per share of $1.94. Analysts

polled by Thomson Reuters expected $1.90.

Capital One, which has large credit-card and auto-lending

divisions, reported total net revenue of $6.70 billion, up 7% from

a year prior. Analysts expected $6.67 billion.

Despite beating expectations, borrower performance remains a top

issue for the bank, which is known for its history as a large

subprime-credit-card lender. The company is a good indicator of the

general state of consumers' ability to repay their debts since,

unlike some other card issuers, it primarily doesn't focus on

extending credit to the affluent.

The bank wrote off more delinquent loans as losses and set more

money aside to cover for future losses. Both issues are being

closely watched by credit-card shareholders as concerns grow over

whether consumer credit is in the early stages of

deteriorating.

Credit concerns resurfaced on Thursday after another business in

the sector reported earnings. Shares of Alliance Data Systems

Corp., a large store-card issuer, closed down 9.45% on Thursday,

after the company that had been guiding to a 2017 credit loss rate

in the mid-5% range was noncommittal on its charge-off rate outlook

on its earnings call. ADS also cut 2017 core earnings per share

guidance from $18.50 to $18.10.

Capital One's net charge-off rate for domestic credit cards was

5.11% for the second quarter, down slightly from the first quarter,

but up 1.04 percentage point from 4.07% the year prior.

Provisions for overall credit losses hit $1.8 billion in the

second quarter, down 10% from the prior quarter but up 13% from a

year prior.

From the first quarter, earnings rose 28%. In April, the company

reported first-quarter earnings that missed analyst estimates,

largely due to a 33% jump in provisions for loan losses in the

company's U.S. credit-card business from the previous quarter.

In June, the Federal Reserve conditionally approved Capital

One's capital plan in the regulator's annual "stress tests," saying

the firm would have to resubmit its plan by Dec. 28 to address

shortcomings in its process.

The Fed said Capital One "exhibited material weaknesses in its

capital planning practices." If the revised plan doesn't satisfy

the Fed, the regulator said that it may restrict the firm's capital

distributions. At the time, Capital One Chairman and Chief

Executive Richard Fairbank said the bank is "fully committed to

addressing the Federal Reserve's concerns."

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

July 20, 2017 18:30 ET (22:30 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

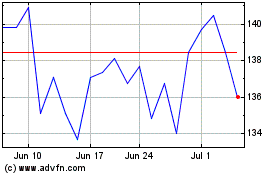

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Aug 2024 to Sep 2024

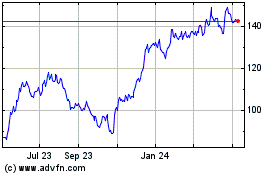

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Sep 2023 to Sep 2024