Fifth Third Bank Accelerates its Business Line of Credit Process for Small Business Owners

July 06 2017 - 1:06PM

Business Wire

New Improvements Increase Speed from

Application to Funding

Fifth Third Bancorp (NASDAQ: FITB) shared today that it is

making it easier for small business owners to get access to

capital. The Bank implemented changes to its Fifth Third Business

Line of Credit, providing timely capital within three to five days

for everyday operating expenses, equipment and inventory costs.

“At Fifth Third, we recognize there are situations that arise

when a small business owner needs access to funds quickly in order

to keep their business running,” said Kala Gibson, head of Business

Banking for Fifth Third Bank. “We want to make sure we can help our

customers when the need arises; not a month from when the need

occurs.”

In a recent YouGov survey of small business owners commissioned

by Fifth Third Bank, respondents said a lack of funds was the

largest obstacle holding owners back from growth in 2017. With a

focus on serving its customers and keeping them at the center of

every decision, Fifth Third is now capable to provide a quicker

decision and fast access to funding.

Additional features of the Fifth Third Business Line of Credit

include:

- Credit lines with up to $100,000 with

no collateral requirement1

- Low variable APRs of 6.74% to 10.74%.

APRs will vary with the market based on the Prime Rate2

- No origination fee or application

fee

- Convenient access to funds via check,

card or online

Small business owners can use the line of credit to meet a

one-time borrowing need, consolidate high-interest balances and

more.

“We heard from our customers and listened to their feedback,”

added Jimm Bell, director of Card Services for Fifth Third Bank.

“The quick and easy application process and the expedited timeline

between application and funding allow us to step up to the plate

for our customers and deliver a Fifth Third better on their

experience.”

For more information about the Fifth Third Business Line of

Credit, visit http://commercialbank.53.com/bloc.

About Fifth Third Business

Banking

For more than a century, Fifth Third has helped small businesses

find unique solutions for growth. In 2016, Fifth Third made a $10

billion lending goal to small businesses between 2016 and 2020 as

part of its $30 billion Community Commitment. This includes

additional funding for technical assistance programs to drive small

business development and growth.

About Fifth Third

Fifth Third Bancorp is a diversified financial services company

headquartered in Cincinnati, Ohio. As of March 31, 2017, the

Company had $140 billion in assets and operated 1,155 full-service

Banking Centers and 2,471 ATMs in Ohio, Kentucky, Indiana,

Michigan, Illinois, Florida, Tennessee, West Virginia, Georgia and

North Carolina. Fifth Third operates four main businesses:

Commercial Banking, Branch Banking, Consumer Lending, and Wealth

& Asset Management. As of March 31, 2017, Fifth Third also had

a 17.8 percent interest in Vantiv Holding, LLC. Fifth Third is

among the largest money managers in the Midwest and, as of March

31, 2017, had $323 billion in assets under care, of which it

managed $33 billion for individuals, corporations and

not-for-profit organizations through its Trust, Brokerage and

Insurance businesses. Investor information and press releases can

be viewed at www.53.com. Fifth Third’s common stock is traded on

the Nasdaq® Global Select Market under the symbol “FITB.” Fifth

Third Bank was established in 1858. Member FDIC, Equal Housing

Lender.

Notices & Disclosures

1. All Business Loans and Lines of Credit are

subject to credit review and approval.

2. For full terms and conditions, please

visit http://commercialbank.53.com/bloc.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170706005195/en/

Fifth Third BancorpShandi Huber, 513-534-8894

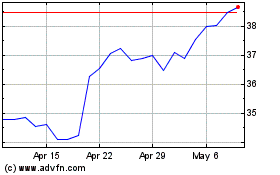

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Mar 2024 to Apr 2024

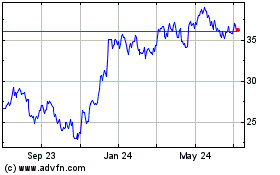

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Apr 2023 to Apr 2024