By Jason Douglas and Stu Woo

LONDON--The U.K. government said it was likely to require

further scrutiny of 21st Century Fox Inc.'s GBP11.7 billion ($15.1

billion) bid to buy the 61% of British TV giant Sky PLC it doesn't

already own--adding another hurdle to Rupert Murdoch's protracted

quest to consolidate control of his trans-Atlantic media

assets.

British Culture Secretary Karen Bradley, who oversees media

mergers in the country, said she was minded to refer the proposal

to U.K. competition authorities after Britain's communications

regulator raised public interest concerns about the deal. The

"minded to" language is used by the government to signal its

intentions, but isn't binding.

Speaking in Parliament, Ms. Bradley said she would make a final

decision on whether to refer the deal after hearing representations

from the parties involved over the next 10 days. Fox and Sky have

until July 14 to respond.

The government's move followed two reports ordered by Ofcom,

Britain's media regulator, into the proposed deal. Ofcom said it

has concluded that allowing Fox to take full control of Sky risked

giving too much control of the U.K. media landscape to the Murdoch

family.

In one report, Ofcom said "the transaction raises public

interest concerns as a result of the risk of increased influence by

members of the Murdoch Family Trust over the U.K. news agenda and

the political process, with its unique presence on radio,

television, in print and online."

Ofcom said proposals by Fox to safeguard the editorial

independence of Sky's news channel helped mitigate its concerns,

but Ms. Bradley said she didn't think those undertakings went far

enough.

Fox said in a statement that it was disappointed that Ms.

Bradley reached that decision, and that it would continue to work

constructively with the U.K. authorities. Sky said it would

continue to engage with the process.

Mr. Murdoch and his family are a major shareholder in both Fox

and News Corp, which owns a number of British newspapers, including

the Sun tabloid and the Times of London. News Corp also owns The

Wall Street Journal.

Mr. Murdoch, who helped create Sky in 1990, has long sought full

control of the broadcaster. He abandoned a previous attempt to buy

out Sky in 2011 after a phone-hacking scandal at one of his

now-defunct papers triggered widespread political and public

outrage.

Full ownership of Sky would further diversify Fox's revenue,

making it less reliant on its North American business and giving it

a cash stream from Sky subscribers.

A second test that Ofcom posed was whether Fox would be a "fit

and proper" owner of Sky. The media watchdog had wide latitude to

define what "fit and proper" meant, and it examined this year's

sexual-harassment scandal at Fox News, interviewing complainants

against the channel. A group of British politicians wrote to the

media watchdog to urge regulators to block the deal, citing among

their concerns the harassment allegations.

Ofcom said Thursday that it considered allegations of sexual and

racial harassment at Fox News "extremely serious and disturbing,"

but said there was no clear evidence that senior executives at Fox

were aware of misconduct before it was escalated to them in July

2016, after which action was taken. Fox has said it is cooperating

with U.S. government probes about the sexual-harassment claims.

"We have concluded that the overall evidence available to date

does not provide a reasonable basis for Ofcom to conclude that, if

Sky were 100% owned and controlled by Fox, it would not be a fit

and proper holder of broadcast licenses," it said.

A fresh antitrust probe could add months to the merger process.

The proposed deal had already gone through a regulatory gauntlet,

including passing muster with European Union regulators, before the

U.K. government called in Ofcom.

If British competition authorities eventually approve the

proposal, Fox must still win over the 75% of minority shareholders,

excluding Fox's stake, to cement the deal. Some investors argued

that Fox's 36% premium on Sky's share wasn't enough. Shares of Sky

have been trading under Fox's offer prices, suggesting

still-significant investor skepticism about a deal.

Sky shares rose about 3% after the decision Thursday, to about

GBP9.86, still below the GBP10.75 offer from Fox. One analyst who

specializes in analyzing takeovers said the move reflects relief

among investors that the deal at least cleared the fit-and-proper

test that some believed would be more onerous to overcome than

antitrust issues.

When Mr. Murdoch helped create Sky, when his British

satellite-TV business merged with a U.K. rival, it started beaming

news, sports and entertainment programming to homes via satellite

before branching out to offer cable-TV and mobile-phone services,

too. It expanded in Europe, creating a European pay-TV giant with

22 million customers in Britain, Ireland, Germany, Austria and

Italy.

Sky owns both nationwide telecommunications services--selling

cable, internet and mobile packages--and the rights to its news,

sports and entertainment programs. As such, there is no U.S.

equivalent to Sky, though AT&T Inc. could become one if

regulators approve its proposal to buy media giant Time Warner

Inc.

Mr. Murdoch first tried to buy Sky in 2010 via News Corp, which

was then a media conglomerate that included both Fox and its

newspaper businesses. In 2011, allegations surfaced that one of

those publications, the News of the World, had hacked into the

phones of politicians, celebrities and, most notably, murdered

teenager Milly Dowler.

Mr. Murdoch apologized and closed the News of the World. In July

2011, News Corp dropped its Sky bid. In 2013, News Corp split into

two companies: Fox, the entertainment arm, and News Corp, which

included the newspaper and publishing businesses.

Ben Dummett contributed to this article.

Write to Jason Douglas at jason.douglas@wsj.com and Stu Woo at

Stu.Woo@wsj.com

(END) Dow Jones Newswires

June 29, 2017 09:28 ET (13:28 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

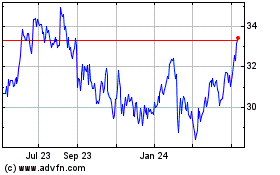

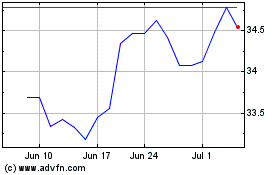

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Aug 2024 to Sep 2024

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Sep 2023 to Sep 2024