UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11‑K

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

☑

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2016

Or

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ________ to ________

Commission file number 1‑7615

KIRBY 401(k) PLAN

Kirby Corporation

55 Waugh Drive, Suite 1000

Houston, Texas 77007

KIRBY 401(k) PLAN

Index to Financial Statements and Supplemental Schedules

|

|

Page

|

|

|

1

|

|

|

|

|

|

2

|

|

|

|

|

|

3

|

|

|

|

|

|

4

|

|

|

|

|

Supplemental Schedules

|

|

|

|

|

|

|

14

|

|

|

|

|

Supplemental schedules, other than listed above, are omitted because of the absence of the conditions under which they are required.

|

|

Report of Independent Registered Public Accounting Firm

To the Plan Administrator

Kirby 401(k) Plan

Houston, Texas

We have audited the accompanying statement of net assets available for benefits (modified cash basis) of the Kirby 401(k) Plan (the Plan) as of December 31, 2016 and 2015, and the related statement of changes in net assets available for benefits (modified cash basis) for the years then ended. These financial statements are the responsibility of Plan management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

As described in Note 2, these financial statements and supplementary information were prepared on a modified cash basis of accounting, which is a comprehensive basis of accounting other than accounting principles generally accepted in the United States of America.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits (modified cash basis) of the Plan as of December 31, 2016 and 2015, and the changes in net assets available for benefits (modified cash basis) for the years then ended, on the basis of accounting described in Note 2.

The supplementary information in the accompanying schedule of schedule of assets (held at end of year) (modified cash basis) as of December 31, 2016, has been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The supplementary information is presented for the purpose of additional analysis and is not a required part of the financial statements but includes supplemental information required by the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. The supplemental information is the responsibility of Plan management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedules, we evaluated whether the supplementary information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information in the accompanying schedule is fairly stated in all material respects in relation to the financial statements as a whole.

/s/ WEAVER AND TIDWELL, L.L.P.

Houston, Texas

June 28, 2017

KIRBY 401(k) PLAN

Statements of Net Assets Available for Benefits

(Modified Cash Basis)

December 31, 2016 and 2015

|

|

|

2016

|

|

|

2015

|

|

|

Assets:

|

|

|

|

|

|

|

|

Investments, at fair value

|

|

$

|

374,201,330

|

|

|

$

|

349,346,198

|

|

|

Notes receivable from participants

|

|

|

21,168,587

|

|

|

|

20,187,477

|

|

|

Other receivables

|

|

|

159,111

|

|

|

|

58,841

|

|

|

Total assets

|

|

|

395,529,028

|

|

|

|

369,592,516

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

Other liabilities

|

|

|

—

|

|

|

|

—

|

|

|

Total liabilities

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits

|

|

$

|

395,529,028

|

|

|

$

|

369,592,516

|

|

See accompanying notes to financial statements.

KIRBY 401(k) PLAN

Statements of Changes in Net Assets Available for Benefits

(Modified Cash Basis)

Years Ended December 31, 2016 and 2015

|

|

|

2016

|

|

|

2015

|

|

|

Additions to net assets attributed to:

|

|

|

|

|

|

|

|

Contributions from participants

|

|

$

|

21,830,705

|

|

|

$

|

22,724,358

|

|

|

Contributions from employer, net of forfeitures

|

|

|

13,564,807

|

|

|

|

13,303,736

|

|

|

Rollover contributions

|

|

|

3,434,421

|

|

|

|

3,455,595

|

|

|

Dividend and other income

|

|

|

6,491,288

|

|

|

|

11,272,640

|

|

|

Interest income from participants' notes receivable

|

|

|

854,428

|

|

|

|

828,633

|

|

|

Net appreciation (depreciation) in fair value of investments

|

|

|

24,252,276

|

|

|

|

(30,744,799

|

)

|

|

Total additions, net

|

|

|

70,427,925

|

|

|

|

20,840,163

|

|

|

Deductions from net assets attributed to:

|

|

|

|

|

|

|

|

|

|

Benefits paid to participants

|

|

|

44,317,269

|

|

|

|

40,363,338

|

|

|

Investment counselor fees and other

|

|

|

174,144

|

|

|

|

174,393

|

|

|

Total deductions

|

|

|

44,491,413

|

|

|

|

40,537,731

|

|

|

Net increase (decrease)

|

|

|

25,936,512

|

|

|

|

(19,697,568

|

)

|

|

Net assets available for benefits, beginning of year

|

|

|

369,592,516

|

|

|

|

389,290,084

|

|

|

Net assets available for benefits, end of year

|

|

$

|

395,529,028

|

|

|

$

|

369,592,516

|

|

See accompanying notes to financial statements.

KIRBY 401(k) PLAN

Notes to Financial Statements

(Modified Cash Basis)

December 31, 2016 and 2015

The Kirby 401(k) Plan (the Plan) is a defined contribution 401(k) plan for the benefit of employees of Kirby Corporation (the Company) and certain subsidiaries. Employees covered by collective bargaining agreements, the terms of which do not provide for participation in the Plan, are not eligible. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA). Further information relating to the Plan’s provisions is available in the Plan Document.

|

|

(b)

|

Administration of the Plan

|

The general administration of the Plan is the responsibility of the Company (the plan administrator). The plan administrator has broad powers regarding the operation and administration of the Plan and receives no compensation for service to the Plan. Bank of America, N.A. (Bank of America) is the trustee of the Plan.

Each employee is eligible to join the Plan as of the first pay period following completion of three months of service and the attainment of age 18 unless specified otherwise by a collective bargaining agreement. Prior to July 1, 2015, the Plan provided for basic employee pretax contributions to the Plan of up to 3% of covered compensation as defined, and for additional employee pretax contributions to the Plan of up to 17% of covered compensation subject to the provisions of the Internal Revenue Code of 1986, as amended (the Code). Effective July 1, 2015, the Plan was amended to allow Non-Highly Compensated Employees, as defined by the Internal Revenue Service (“IRS”), to contribute up to 47% of covered compensation. Additional employee pretax contributions to the Plan up to 47% of covered compensation are allowed under certain collective bargaining agreements. Participants age 50 or older during the Plan year may also elect to make a “catch‑up” contribution, subject to certain IRS limits ($6,000 in 2016 and 2015). The Company contributes matching employer contributions equal to 100% of basic employee pretax contributions. The Company does not match the additional employee pretax or catch-up contributions. Each participant directs his or her contributions and the Company’s matching contributions between the investment funds offered by the Plan, including Company common stock.

Vessel based employees of Kirby Offshore Marine, LLC (“KOM”) whose employment is covered by collective bargaining agreements receive a non-discretionary employer match and may receive a discretionary employer contribution based on the terms of the applicable collective bargaining agreement.

The Plan allows the employer, at its discretion, to make an additional discretionary employer contribution for eligible employees equal to 5% of the employees covered compensation, as defined by the Plan. Eligible employees are employees of United Holdings, LLC (“United”) and employees of KOM assigned the classification of Vessel Employee as determined by the Company. On March 31, 2017, the Company made a discretionary contribution of $4,218,878 to the Plan for eligible KOM employees for the 2016 Plan year. No discretionary contribution for eligible United employees was made for the 2016 Plan year. On March 31, 2016, the Company made a discretionary contribution of $5,042,519 to the Plan for eligible United and KOM employees for the 2015 Plan year.

(Continued)

KIRBY 401(k) PLAN

Notes to Financial Statements

(Modified Cash Basis)

December 31, 2016 and 2015

The Plan allows the use of forfeited amounts to offset future employer matching contributions. Forfeitures from non-vested accounts of $738,176 and $1,232,862 were used to reduce the Plan’s matching contributions in 2016 and 2015, respectively.

All employees hired or rehired are automatically enrolled at a 3% pretax contribution rate, unless otherwise elected by the participant. In addition, participants may contribute amounts representing rollovers from other qualified plans or from an individual retirement account.

Benefits payments are made to participants upon retirement or termination of employment (or to the beneficiary in the event of death) and are in the form of lump sum or installment distribution payments. A participant may request a loan for up to the lesser of 50% of the participant’s vested interest or $50,000, less the participant’s highest outstanding loan balance during the preceding 12 months. Loans typically bear interest at prime rate plus 1%. Interest rates ranged from 4.25% to 10.25% at December 31, 2016. Loans outstanding at December 31, 2016 mature from January 2, 2017 through July 18, 2028. Loans outstanding upon a participant’s termination of employment are considered deemed distributions if not repaid and are deducted from the participant’s account balance prior to distribution. These amounts are taxed to the participant in the year of the participant’s termination. Active participants who qualify for an in-service withdrawal after attaining 59½ years of age may be paid their benefits in a single sum cash payment or rollover as soon as administratively possible.

The Plan requires automatic distribution of participant accounts upon termination without the participant’s consent of amounts less than $5,000 and greater than $1,000. If the participant does not elect to have the amount paid directly to an eligible retirement plan or receive a distribution directly, then the Plan will pay the distribution to an individual retirement plan designated by the Plan administrator. Amounts less than $1,000 are paid directly to participants upon termination.

Participants are 100% vested in their participant contributions and rollovers, if any. Employer contributions are subject to a six-year vesting schedule. The vesting schedule of employer contributions for employees covered by collective bargaining agreements are specified by that particular agreement. Forfeitures in the amount of $119,112 and $232,862 as of December 31, 2016 and 2015, respectively, were available to offset future employer contributions or plan administrative expenses at the discretion of the Company.

(Continued)

KIRBY 401(k) PLAN

Notes to Financial Statements

(Modified Cash Basis)

December 31, 2016 and 2015

Although it has not expressed any intent to do so, the Company has the right under the Plan to terminate the Plan subject to the provisions of ERISA. In the event of termination, the amounts credited to the accounts of participants will be distributed to the participants after payment of expenses for distribution and liquidation.

Under the Plan, each participant’s account is credited with the participant’s contribution, the Company’s matching contribution, and an allocation of investment income (loss), net of administrative expenses. Investment income (loss) is allocated daily to participants. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

|

|

(h)

|

Administrative Expenses

|

All administrative expenses, unless paid by the Company at its discretion, are paid by the Plan.

The agreement between Bank of America and the Plan includes a revenue sharing arrangement whereby Bank of America receives investment related revenue generated by Plan assets invested in mutual fund holdings sponsored by an affiliate of Bank of America. These deposits are included in dividend and other income in the statement of changes in net assets available for benefits. The funds can be used to pay plan expenses or be allocated to participants. Income from revenue sharing was

$32,350 and $94,542 as of December 31, 2016 and 2015, respectively.

|

(2)

|

Summary of Significant Accounting Policies

|

|

|

(a)

|

Basis of Presentation

|

The accompanying financial statements have been prepared on the modified cash basis, which is a comprehensive basis of accounting other than U.S. generally accepted accounting principles, and is an acceptable method of reporting under Department of Labor regulations. The modified cash basis of accounting utilizes the cash basis of accounting while carrying investments at fair value and recording investment income (loss) on the accrual basis. Consequently, contributions are recognized when received rather than when earned, and expenses are recognized when paid rather than when the obligation is incurred. As of December 31, 2016, $227,502 of employee contributions had not been remitted to the trust and $110,966 of employer contributions were remitted to the trust for the 2016 Plan year. As of December 31, 2015, $273,563 of employee contributions had not been remitted to the trust and $130,981 of employer contributions were remitted to the trust for the 2015 Plan year. As of December 31, 2016 and 2015, excess deferrals of $133 and $9,871, respectively, were held by the trust and distributed to participants subsequent to year end. Under U.S. generally accepted accounting principles, these amounts would have been reflected as accounts receivable and accounts payable, respectively.

(Continued)

KIRBY 401(k) PLAN

Notes to Financial Statements

(Modified Cash Basis)

December 31, 2016 and 2015

Certain other receivables and liabilities are recorded in the statements of net assets available for benefits to reflect the accrued income, pending settlements and other transactions.

Certain reclassifications have been made to prior year presentation to conform to current year presentation.

The preparation of financial statements requires Plan management to make estimates and assumptions that affect the reported amounts of assets, liabilities, and disclosure of contingent assets and liabilities, and changes therein. Actual results could differ from those estimates.

|

|

(c)

|

Investment Valuation and Income Recognition

|

Investments are reported at fair value. Purchases and sales of investments are recorded on a trade date basis. Net appreciation (depreciation) in fair value of investments includes realized gains and losses on investments sold during the year as well as net appreciation (depreciation) of the investments held at the end of the year. Interest and dividend income is accrued in the period earned.

The Plan invests in investment contracts through The Invesco Stable Value Retirement Fund which is a common trust fund that primarily invests in guaranteed investment contracts (“GICs”) and synthetic GICs and is presented at fair value as of December 31, 2016 and 2015.

|

|

(d)

|

Notes Receivable from Participants

|

Notes receivable from participants represent loans that are recorded at their unpaid principal balance plus any accrued but unpaid interest.

Payments to participants are recorded as the benefits are paid.

(Continued)

KIRBY 401(k) PLAN

Notes to Financial Statements

(Modified Cash Basis)

December 31, 2016 and 2015

|

|

(f)

|

New Accounting Pronouncements/Accounting Changes

|

In May 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (ASU) 2015-07, Fair Value Measurement: Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or its equivalent). The ASU removes the requirement to categorize these investments within the fair value hierarchy and also removes the requirement to make certain disclosures. The ASU was effective for fiscal years beginning after December 15, 2015. The Plan’s adoption of this guidance in 2016 was applied retrospectively and did not have a material impact on its financial statements.

In July 2015, FASB issued ASU No. 2015-12, Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): (Part I) Fully Benefit Responsive Investment Contracts, (Part II) Plan Investment Disclosures, (Part III) Measurement Date Practical Expedient. Part I eliminates the requirements to measure the fair value of fully benefit-responsive investment contracts and provide certain disclosures. Contract value is the only required measure for fully benefit-responsive investment contracts. Part II eliminates the requirements to disclose individual investments that represent 5 percent or more of net assets available for benefits and the net appreciation or depreciation in fair value of investments by general type. Part II also simplifies the level of disaggregation of investments that are measured using fair value. Plans will continue to disaggregate investments that are measured using fair value by general type; however, plans are no longer required to also disaggregate investment by nature, characteristics and risks. Further, the disclosure of information about fair value measurements shall be provided by general type of plan asset. Part III is not applicable to the Plan. The ASU is effective for fiscal years beginning after December 15, 2015. Management has elected to adopt Parts I and II. The Plan’s adoption of this guidance in 2016 was applied retrospectively and did not have a material impact on its financial statements.

In February 2017, FASB issued ASU 2017-06, Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965). The amendments of the ASU require a plan’s interest in the master trust and any change in that interest to be presented in separate line items in the statement of net assets available for benefits and in the statement of changes in net assets available for benefits, respectively. Plans with divided interests are no longer required to disclose the percentage interest in the master trust and all plans must disclose the dollar amount of their interest in each of those general types of investments. The amendments further require all plans to disclose (1) their master trust's other asset and liability balances and (2) the dollar amount of the plan's interest in each of those balances. Lastly, the amendments do not require that the investment disclosures relating to the 401 (h) account assets be provided in the health and welfare benefit plan's financial statements. The ASU is effective for fiscal years beginning after December 15, 2018. Early adoption is permitted. This ASU is not applicable to the Plan.

(Continued)

KIRBY 401(k) PLAN

Notes to Financial Statements

(Modified Cash Basis)

December 31, 2016 and 2015

Certain reclassifications have been made to the 2015 financial statements to conform to the 2016 financial statement presentation. These reclassifications had no effect on changes in net assets available for benefits.

|

(3)

|

Investments and Investment Options

|

Each participant has the right to direct his or her contributions and the Company’s matching contributions, once remitted, among the investment funds offered by the Plan. Descriptions of the Plan’s investment fund options are included in the summary plan description provided to all eligible employees.

Participants may direct their investment contributions to the following investment funds: Invesco Stable Value Retirement Fund CL1, Blackrock Russell 2000 Fund, Northern Trust Collective Aggregate Bond Index Fund, Northern Trust Collective All Country World ex-US Index Fund TR2, Northern Trust Collective S&P 500 Index Fund L1, American Beacon Small Cap Value Fund, American Bond Fund of America Class R-6, Blackrock Global Allocation Fund, ClearBridge Small Cap Growth Fund, Delaware Value Fund, Harbor International Fund, Active Multi-Manager Emerging Markets Equity Fund, Principal Investors Global Institutional Fund, Prudential Jennison Large Cap Growth Fund, T. Rowe Price Retirement 2010 Fund, T. Rowe Price Retirement 2015 Fund, T. Rowe Price Retirement 2020 Fund, T. Rowe Price Retirement 2025 Fund, T. Rowe Price Retirement 2030 Fund, T. Rowe Price Retirement 2035 Fund, T. Rowe Price Retirement 2040 Fund, T. Rowe Price Retirement 2045 Fund, T. Rowe Price Retirement 2050 Fund, T. Rowe Price Retirement 2055 Fund and Company common stock.

The Delaware Value Fund was added in 2016. FFI Treasury Fund and T. Rowe Price Equity Income Fund were removed in 2016.

Effective June 1, 2017, a new amendment to the Plan will reduce the Company common stock investment limit to 25% of each participant’s portfolio. The new limit, which formerly was 50%, will apply when participants direct the investment of future contributions and rebalance their entire portfolio.

Stable Value Trust

The Plan invests in the Invesco Stable Value Trust (“Stable Value Trust”) which is a collective trust that has entered into benefit-responsive guaranteed investment contracts and wrapper contracts with various financial institutions. The financial institutions maintain the contributions in investment contracts. The contracts are credited with earnings on the underlying investments and charged for participant withdrawals and administrative expenses.

The guaranteed investment contracts held by the Stable Value Trust are fully benefit-responsive, therefore contract value is the relevant measurement attribute for that portion of the investment. Contract value, as reported to the Plan by the manager of the Stable Value Trust, represents contributions made under the contract, plus earnings, less participant withdrawals and administrative expenses. Participants may ordinarily direct the withdrawal or transfer of all or a portion of their investment at contract value. Therefore, contract value of the guaranteed investment contracts held by the Stable Value Trust is considered fair value.

(Continued)

KIRBY 401(k) PLAN

Notes to Financial Statements

(Modified Cash Basis)

December 31, 2016 and 2015

There are no reserves against contract value for credit risk of the contract issuers or otherwise. The crediting interest rate is based on a formula agreed upon with the issuers.

Certain events limit the ability of the Plan to transact at contract value with the wrap issuer. However, the Plan’s management is not aware of the occurrence or likely occurrence of any such events, which would limit the Plan’s ability to transact at contract value with participants. The issuer may terminate a wrap contract for cause at any time.

|

(4)

|

Concentration of Investments

|

The Plan’s investment in shares of Company common stock represents 12% and 10% of total assets as of December 31, 2016 and 2015, respectively. The Company is engaged in marine transportation and diesel engine services.

Each shareholder is entitled to exercise voting rights attributable to the shares of Company common stock allocated to his or her account and is notified by the trustee prior to the time that such rights are to be exercised. The trustee is instructed by the Plan to vote all non-voted participant shares according to Board of Director recommendations. During 2016 and 2015, the Plan purchased all shares of Company common stock in the open market.

|

(6)

|

Risk and Uncertainties

|

The Plan may invest in common trust funds, mutual funds and Company common stock. Investment securities are exposed to various risks, such as interest rate, market, and credit risks. Due to the level of risk associated with certain investment securities, it is probable that changes in the value of investment securities will occur in the near term.

The Plan may invest in securities with contractual cash flows, such as asset backed securities, collateralized mortgage obligations and commercial mortgage backed securities, including securities backed by subprime mortgage loans. The value, liquidity and related income of those securities are sensitive to changes in economic conditions, including real estate value, delinquencies or defaults, or both, and may be adversely affected by shifts in the market’s perception of the issuers and changes in interest rates.

|

(7)

|

Related Party Transactions

|

One of the Plan investment options includes shares of Company common stock managed by Bank of America. The Company is the plan sponsor and Bank of America is the trustee as defined by the Plan. Therefore, these transactions qualify as party‑in‑interest transactions. These transactions are covered by an exemption from the “prohibited transaction” provisions of ERISA and the Code.

The Plan has participant loans outstanding, which are secured solely by a portion of the participant’s vested account balance, in accordance with the Plan Document.

(Continued)

KIRBY 401(k) PLAN

Notes to Financial Statements

(Modified Cash Basis)

December 31, 2016 and 2015

|

(8)

|

Federal Income Tax Status

|

The IRS has determined and informed the Company by a letter dated March 31, 2008, that the Plan and related trust are designed in accordance with applicable sections of the Internal Revenue Code (IRC). In January 2016, the Plan was restated and the Company filed an application for a renewed favorable determination letter. Although the Plan has been amended and restated since receiving the determination letter in 2008, the Plan administrator believes that the Plan is designed and is currently being operated in compliance with the applicable requirements of the IRC and therefore believes that the Plan is qualified and the related trust is tax‑exempt.

The Plan is currently open to audit under the statute of limitations by the IRS for the 2013 through 2015 tax years. The Plan has not recognized any assets or liabilities related to uncertain tax positions as of December 31, 2016 and 2015.

|

(9)

|

Reconciliation of Financial Statements to Form 5500

|

The following is a reconciliation of net assets available for benefits per the financial statements to the Form 5500:

|

|

|

December 31

|

|

|

|

|

2016

|

|

|

2015

|

|

|

Net assets available for benefits per the financial statements

|

|

$

|

395,529,028

|

|

|

$

|

369,592,516

|

|

|

Adjustment from contract value to fair value for fully benefit-responsive investment contracts

|

|

|

—

|

|

|

|

287,005

|

|

|

Net assets available for benefits per the Form 5500

|

|

$

|

395,529,028

|

|

|

$

|

369,879,521

|

|

The following is a reconciliation of net investment income in fair value of investments per the financial statements to the Form 5500:

|

|

|

Years ended December 31

|

|

|

|

|

2016

|

|

|

2015

|

|

|

Net investment income (loss) in fair value of investments per the financial statements

|

|

$

|

30,743,564

|

|

|

$

|

(19,472,159

|

)

|

|

Interest income from participants' notes receivable

|

|

|

854,428

|

|

|

|

828,633

|

|

|

Adjustment from contract value to fair value for fully benefit-responsive investment contracts as of end of year

|

|

|

—

|

|

|

|

(455,542

|

)

|

|

Net investment income (loss) in fair value of investments per the Form 5500

|

|

$

|

31,597,992

|

|

|

$

|

(19,099,068

|

)

|

KIRBY 401(k) PLAN

Notes to Financial Statements

(Modified Cash Basis)

December 31, 2016 and 2015

As discussed in Note 2, the Plan adopted ASU 2015-12 in the current year. As a result, the Plan no longer identifies the Common Trust fund as a fully benefit-responsive investment contract. The financial statements and the Form 5500 both present the Common Trust fund at fair value measured using the net asset value practical expedient as of December 31, 2016. The Form 5500 measured fair value in a different way as of December 31, 2015.

|

(10)

|

Fair Value Measurements

|

The accounting guidance for using fair value to measure certain assets and liabilities establishes a three tier value hierarchy, which prioritizes the inputs to valuation techniques used in measuring fair value. These tiers include: Level 1, defined as observable inputs such as quoted in active markets for identical assets or liabilities; Level 2, defined as inputs other than quoted prices in active markets that are either directly or indirectly observable; and Level 3, defined as unobservable inputs in which little, if any, market data exists, therefore requiring an entity to develop its own assumptions about the assumptions that market participants would use in pricing the asset or liability.

The following is a description of the valuation methodologies used for Plan’s financial instruments and the classification of such instruments within the valuation hierarchy.

Mutual Funds

These instruments are public investment vehicles valued using the net asset value provided by the administrator of the fund. The net asset value price is quoted on an active market and is classified within Level 1 of the valuation hierarchy.

Company Common Stock

Company common stock is valued at the closing price listed by the New York Stock Exchange and is classified within Level 1 of the valuation hierarchy.

Common Trust Funds

These instruments are investment vehicles valued using the net asset value provided by the administrator of the fund. The net asset value is used as a practical expedient to determine fair value. Each collective trust provides for redemptions by the Plan at reported net asset values per share, with little to no advance notice requirement.

The methods described above may produce a fair value calculation that may not be indicative of net asset value or reflective of future fair values. Furthermore, while the Plan’s valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different estimate of fair value at the reporting date.

KIRBY 401(k) PLAN

Notes to Financial Statements

(Modified Cash Basis)

December 31, 2016 and 2015

The following table summarizes the Plan’s investment assets measured at fair value on a recurring basis at December 31, 2016:

|

|

|

Quoted Prices in Active

Markets

for Identical Assets

(Level 1)

|

|

|

Significant

Observable

Inputs

(Level 2)

|

|

|

Significant

Unobservable

Inputs

(Level 3)

|

|

|

Total

Fair Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mutual funds

|

|

$

|

188,626,982

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

188,626,982

|

|

|

Company common stock

|

|

|

47,468,422

|

|

|

|

-

|

|

|

|

-

|

|

|

|

47,468,422

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets in the fair value hierarchy

|

|

$

|

236,095,404

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

236,095,404

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments measured at net asset value:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common trust funds

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

138,105,926

|

|

|

Investments at fair value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

374,201,330

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table summarizes the Plan’s investment assets measured at fair value on a recurring basis at December 31, 2015:

|

|

|

Quoted Prices in Active

Markets

for Identical Assets

(Level 1)

|

|

|

Significant Observable

Inputs

(Level 2)

|

|

|

Significant

Unobservable

Inputs

(Level 3)

|

|

|

Total

Fair Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mutual funds

|

|

$

|

211,485,371

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

211,485,371

|

|

|

Company common stock

|

|

|

36,827,480

|

|

|

|

-

|

|

|

|

-

|

|

|

|

36,827,480

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets in the fair value hierarchy

|

|

$

|

248,312,851

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

248,312,851

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments measured at net asset value:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common trust funds

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

101,320,352

|

|

|

Investments at fair value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

349,633,203

|

|

Schedule I

KIRBY 401(k) PLAN

EIN 74-1884980, Plan # 004

Schedule H, Part IV, Line 4i – Schedule of Assets ( Held at End of Year)

(Modified Cash Basis)

December 31, 2016

|

Identity of issue, borrower, lessor, or

similar party

|

|

Description of asset

|

|

Current

value

|

|

|

|

|

|

|

|

|

|

Common trust funds:

|

|

|

|

|

|

|

Invesco

|

|

Invesco Stable Value Retirement Fund

|

|

$

|

55,867,828

|

|

|

Blackrock

|

|

Blackrock Russell 2000 Fund

|

|

|

4,860,691

|

|

|

Northern Trust

|

|

Northern Trust Aggregate Bond Index Fund

|

|

|

11,820,900

|

|

|

Northern Trust

|

|

Northern Trust All Country World ex-US Index Fund TR2

|

|

|

16,090,633

|

|

|

Northern Trust

|

|

Northern Trust Collective S&P 500 Index Fund

|

|

|

49,465,874

|

|

|

Total common trust funds

|

|

|

|

|

138,105,926

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds:

|

|

|

|

|

|

|

|

American Beacon

|

|

American Beacon Small Cap Value Fund

|

|

|

21,878,316

|

|

|

American Funds

|

|

American Funds Bond Fund of America

|

|

|

19,323,855

|

|

|

Blackrock

|

|

Blackrock Global Allocation Fund

|

|

|

2,999,747

|

|

|

Clearbridge

|

|

ClearBridge Small Cap Growth Fund

|

|

|

7,186,610

|

|

|

Delaware

|

|

Delaware Value Fund

|

|

|

33,067,164

|

|

|

Harbor

|

|

Harbor International Fund

|

|

|

19,035,972

|

|

|

Northern Trust

|

|

Active Multi-Manager Emerging Markets Equity Fund

|

|

|

4,669,244

|

|

|

Principal Investors

|

|

Principal Investors Global Institutional Fund

|

|

|

5,363,730

|

|

|

Prudential Jennison

|

|

Prudential Jennison Large Cap Growth Fund

|

|

|

39,589,436

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2010 Fund

|

|

|

2,823,587

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2015 Fund

|

|

|

3,775,607

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2020 Fund

|

|

|

13,687,537

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2025 Fund

|

|

|

2,393,239

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2030 Fund

|

|

|

5,218,752

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2035 Fund

|

|

|

983,901

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2040 Fund

|

|

|

5,743,245

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2045 Fund

|

|

|

281,248

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2050 Fund

|

|

|

342,889

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2055 Fund

|

|

|

262,903

|

|

|

Total mutual funds

|

|

|

|

|

188,626,982

|

|

|

|

|

|

|

|

|

|

|

Common stock:

|

|

|

|

|

|

|

|

*Kirby Corporation

|

|

Common stock

|

|

|

47,468,422

|

|

|

|

|

|

|

|

|

|

|

*Participant loans

|

|

Interest rates ranging from 4.25% to 10.25% and maturity dates from January 2, 2017 to July 18, 2028

|

|

|

21,168,587

|

|

|

|

|

|

|

|

|

|

|

Total assets (held at end of year)

|

|

|

|

$

|

395,369,917

|

|

|

*

|

Parties in interest to the Plan

|

See accompanying report of independent registered public accounting firm.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Plan administrator, which administers the Plan, has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Kirby 401(k) Plan

|

|

|

|

|

|

June 28, 2017

|

BY:

|

/s/ C. Andrew Smith

|

|

|

|

C. ANDREW SMITH

|

|

|

|

Chairman of Kirby Corporation Administrative Committee

|

The following document is filed as part of this report.

|

Exhibit

number

|

|

Description

|

|

|

|

Consent of Independent Registered Public Accounting Firm

|

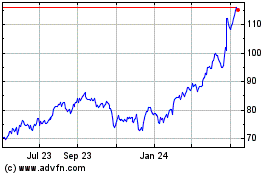

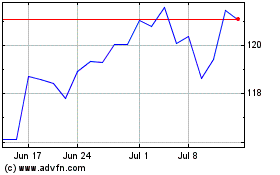

Kirby (NYSE:KEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kirby (NYSE:KEX)

Historical Stock Chart

From Apr 2023 to Apr 2024