UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK PURCHASE, SAVINGS

AND SIMILAR PLANS PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Mark One)

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31,

2016

OR

|

|

|

|

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from

to

Commission File No.: 001-04171

|

|

|

|

|

|

A.

|

FULL TITLE OF THE PLAN AND THE ADDRESS OF THE PLAN, IF DIFFERENT FROM THAT OF THE ISSUER NAMED BELOW:

|

Kellogg Company Savings and Investment Plan

|

|

|

|

|

|

B.

|

NAME OF ISSUER OF THE SECURITIES HELD PURSUANT TO THE PLAN AND THE ADDRESS OF ITS PRINCIPAL EXECUTIVE OFFICE:

|

Kellogg Company

One Kellogg Square

Battle Creek, MI 49016

Kellogg Company

Savings and Investment Plan

Financial Statements and Supplemental Schedule

December 31,

2016

and

2015

Kellogg Company

Savings and Investment Plan

Index

|

|

|

|

|

|

Page(s)

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

2

|

|

|

|

|

Financial Statements

|

|

|

|

|

|

Statements of Net Assets Available for Benefits

|

|

|

December 31, 2016 and 2015

|

|

|

|

|

|

Statements of Changes in Net Assets Available for Benefits

|

|

|

Years Ended December 31, 2016 and 2015

|

|

|

|

|

|

Notes to Financial Statements

|

|

|

December 31, 2016 and 2015

|

|

|

|

|

|

Supplemental Schedule

|

|

|

|

|

|

Schedule H, line 4i - Schedule of Assets (Held at End of Year)

|

|

|

December 31, 2016

|

|

|

|

|

|

Note:

|

Other schedules required by Section 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable.

|

Report of Independent Registered Public Accounting Firm

Plan Administrator and

ERISA Finance Committee of

Kellogg Company Savings & Investment Plan

Battle Creek, MI

We have audited the accompanying statements of net assets available for benefits of the Kellogg Company Savings & Investment Plan (the “Plan”) as of December 31, 2016 and 2015, and the related statements of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2016 and 2015, and the changes in net assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

The accompanying supplemental Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2016 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ BDO USA, LLP

Grand Rapids, Michigan

June 22, 2017

Kellogg Company

Savings and Investment Plan

Statements of Net Assets Available for Benefits

December 31, 2016 and 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Assets

|

|

|

|

|

|

Plan's interest in Master Trust at fair value

|

|

$

|

1,158,754,253

|

|

|

$

|

1,161,597,287

|

|

|

Plan's interest in Master Trust at contract value

|

|

302,940,756

|

|

|

297,170,142

|

|

|

Kellogg Company stock at fair value (Note 1)

|

|

89,449,512

|

|

|

—

|

|

|

Notes receivable from participants

|

|

25,608,477

|

|

|

25,329,225

|

|

|

Total assets

|

|

1,576,752,998

|

|

|

1,484,096,654

|

|

|

Liabilities

|

|

|

|

|

|

Accrued administrative service fees

|

|

714,412

|

|

|

170,734

|

|

|

Accrued trustee fees

|

|

28,455

|

|

|

99,211

|

|

|

Total liabilities

|

|

742,867

|

|

|

269,945

|

|

|

Net assets available for benefits

|

|

$

|

1,576,010,131

|

|

|

$

|

1,483,826,709

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

3

Kellogg Company

Savings and Investment Plan

Statements of Changes in Net Assets Available for Benefits

Years Ended December 31, 2016 and 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Additions:

|

|

|

|

|

|

Contributions:

|

|

|

|

|

|

Employer

|

|

$

|

38,971,516

|

|

|

$

|

37,826,898

|

|

|

Participant

|

|

71,729,877

|

|

|

72,047,138

|

|

|

Rollovers from other qualified plans

|

|

5,464,504

|

|

|

2,346,389

|

|

|

Total contributions

|

|

116,165,897

|

|

|

112,220,425

|

|

|

|

|

|

|

|

|

Earnings on investments:

|

|

|

|

|

|

Plan's interest in income of Master Trust

|

|

104,389,608

|

|

|

15,076,536

|

|

|

Net appreciation/(depreciation) in fair value of Kellogg Company stock

|

|

(439,266

|

)

|

|

—

|

|

|

Dividend income of Kellogg Company stock

|

|

2,494,823

|

|

|

—

|

|

|

Redemption fees

|

|

—

|

|

|

(11,777

|

)

|

|

Total earnings on investments, net

|

|

106,445,165

|

|

|

15,064,759

|

|

|

|

|

|

|

|

|

Interest income on notes receivable from participants

|

|

1,051,946

|

|

|

1,017,967

|

|

|

Total additions

|

|

223,663,008

|

|

|

128,303,151

|

|

|

|

|

|

|

|

|

Deductions:

|

|

|

|

|

|

Participant withdrawals

|

|

(129,116,414

|

)

|

|

(155,698,490

|

)

|

|

Trustee fees

|

|

(157,590

|

)

|

|

(198,843

|

)

|

|

Administrative service fees

|

|

(1,544,143

|

)

|

|

(1,360,374

|

)

|

|

Financial advisory fees

|

|

(661,439

|

)

|

|

(1,038,121

|

)

|

|

Total deductions

|

|

(131,479,586

|

)

|

|

(158,295,828

|

)

|

|

|

|

|

|

|

|

Net increase/(decrease)

|

|

92,183,422

|

|

|

(29,992,677

|

)

|

|

Net assets available for benefits

|

|

|

|

|

|

Beginning of year

|

|

1,483,826,709

|

|

|

1,513,819,386

|

|

|

End of year

|

|

$

|

1,576,010,131

|

|

|

$

|

1,483,826,709

|

|

The accompanying notes are an integral part of these financial statements.

4

Kellogg Company

Savings and Investment Plan

Notes to Financial Statements

Years Ended December 31, 2016 and 2015

|

|

|

|

1.

|

Summary of Significant Accounting Policies

|

Basis of Accounting

The Kellogg Company Savings and Investment Plan (the Plan) operates as a qualified defined contribution plan and was established under Section 401(k) of the Internal Revenue Code. The Plan’s financial statements have been prepared in conformity with accounting principles generally accepted in the United States (GAAP). The accounts of the Plan are maintained on the accrual basis. Expenses of administration are paid by the Plan.

Recent Accounting Pronouncements

In May 2015, the Financial Accounting Standards Board (FASB) issued ASU 2015-07,

Disclosures for Investments in Certain Entities that Calculate Net Asset Value Per Share (or its Equivalent)

. The guidance removes the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the net asset value per share practical expedient. The reporting entity should continue to disclose information on investments for which fair value is measured at net asset value (or its equivalent) as a practical expedient to help users understand the nature and risks of the investments and whether the investments, if sold, are probable of being sold at amounts different from net asset value. The ASU is effective for fiscal years beginning after December 15, 2015. The Plan adopted the updated standard at the beginning of the year ended December 31, 2016 on a retrospective basis. The adoption of this standard did not have a material impact on the financial statements.

In July 2015, the FASB issued ASU 2015-12,

Plan Accounting: Defined Benefit Pension Plans (Topic 960), (ASU 2015-12)

. The amendments in Part I of ASU 2015-12 eliminated the requirements that employee benefit plans measure the fair value of fully benefit–responsive investment contracts and provide the related fair value disclosures, rather these contracts will be measured and disclosed only at contract value. The amendments in Part II of ASU 2015-12 will require plans to disaggregate the investments measured using fair value only by general type, either on the financial statements or in the notes. Part II also eliminated the requirement to disclose the net appreciation/depreciation in fair value of investments by general type and the requirements to disclose individual investments that represent 5% or more of net assets available for benefits. The amendments in Part III of ASU 2015-12 provide a practical expedient to permit plans to measure its investments and investment related accounts as of a month-end date closest to its fiscal year for a plan with a fiscal year end that does not coincide with the end of a calendar month. The amendments in ASU 2015-12 are effective for reporting periods beginning after December 15, 2015.

The Plan adopted the updated standard at the beginning of the year ended December 31, 2016 on a retrospective basis. Certain reclassifications were made on the Statement of Net Assets Available for Benefits to present comparative statements and certain investment disclosures were revised or eliminated as a result of the adoption of the ASU.

In February 2017, the FASB issued ASU 2017-6,

Plan Accounting: Defined Benefit Pension Plans (Topic 960), defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): Employee Benefit Plan Master Trust Reporting

. This update requires disclosure of the dollar amount of the Plan’s interest in each type of investment held by a Master Trust, as well as the Master Trust’s other assets and liabilities on a gross basis and the dollar amount of the Plan’s interest in each balance. The amendments in ASU 2017-6 are effective for fiscal bears beginning after December 15, 2018. Early adoption is permitted. The Plan does not expect the adoption of this guidance to have a significant impact on the Plan’s financial statements. Entities should apply the new guidance on a retrospective basis. The Plan will adopt the updated standard at the beginning of the year ended December 31, 2019.

Kellogg Company

Savings and Investment Plan

Notes to Financial Statements

Years Ended December 31, 2016 and 2015

Investment Valuation and Income Recognition

The Plan’s investments are stated at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between the market participants at the measurement date. See Note 6 for discussion.

The Plan’s interest in income/(loss) of the Kellogg Company Master Trust (Master Trust), which consists primarily of the realized gains or losses on the fair value of the Master Trust investments, dividend and interest income, and the unrealized appreciation/(depreciation) on those investments, is included in the Statements of Changes in Net Assets Available for Benefits.

An investment transaction is accounted for on the date the purchase or sale is executed. Dividend income is recorded on the ex-dividend date; interest income is recorded as earned on an accrual basis.

The net appreciation/(depreciation) in the fair value of investments reflects both realized gains or losses and the change in the unrealized appreciation/(depreciation) of investments held at year-end. Realized gains or losses from security transactions are reported on the average cost method.

Guaranteed Investment Contracts

The Master Trust also invests in synthetic guaranteed investment contracts and a separate account insurance contract, for which GSAM Stable Value, LLC has oversight. The Master Trust enters into a contract with an issuer to receive a rate of return based on underlying investments. For the synthetic contracts, the Master Trust acquires, retains title to and holds the underlying investments in a separately identified custody account. The underlying investments typically include portfolios of fixed income securities or units of fixed income collective trusts. The rate of return is based on a formula described within the terms of the contract (the crediting rate). The incremental value (if any) of the contract itself is based on i) issuer ratings as determined by credit ratings, which are published by rating agencies and ii) the present value of the change in each contract’s replacement cost. At December 31,

2016

and

2015

, the present value of the differential between contract replacement cost and current contract cost was immaterial.

Contract value is the relevant measurement attribute for that portion of the net assets available for benefits attributable to the fully benefit responsive guaranteed investment contracts because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan. Contract value, as reported to the Plan by GSAM Stable Value, LLC, represents contributions made under the contract, plus earnings, less participant withdrawals and administrative expenses. Participants may ordinarily direct the withdrawal or transfer of all or a portion of their investment at contract value.

There are no reserves against contract value for credit risk of the contract issuers or otherwise. The crediting interest rate is based on a formula agreed upon with the issuers, but it may not be less than zero percent. Such interest rates are reviewed on a quarterly basis for resetting.

Certain events limit the ability of the Plan to transact at contract value with the issuer. Such events include the following: (1) amendments to the Plan documents (including complete or partial Plan termination or merger with another plan), (2) bankruptcy of the Plan sponsor or other plan sponsor events (for example, divestitures or spin-offs of a subsidiary) that cause a significant withdrawal from the Plan, or (3) the failure of the trust to qualify for exemption from federal income taxes or any required prohibited transaction exemption under the Employee Retirement Income Security Act of 1974 (ERISA). The Plan administrator does not believe that the occurrence of any such event, which would limit the Plan’s ability to transact at contract value with participants, is probable.

Kellogg Company

Savings and Investment Plan

Notes to Financial Statements

Years Ended December 31, 2016 and 2015

Except for the above, the guaranteed investment contracts do not permit the contract issuers to terminate the agreement prior to the scheduled maturity date at an amount different from contract value.

Allocation of Net Investment Income to Participants

Net investment income is allocated to participant accounts daily, in proportion to their respective ownership on that day.

Participant Withdrawals

Benefit payments to participants are recorded when paid.

Notes Receivable From Participants

Notes receivable from participants are recorded at net realizable value.

Risks and Uncertainties

The Plan provides for various investment options in several investment securities. Investment securities are exposed to various risks, such as interest rate, market and credit. Due to the level of risks associated with certain investment securities and the level of uncertainty related to changes in the value of investment securities, it is at least reasonably possible that changes in risks in the near term would materially affect participants’ account balances and the amounts reported in the Statements of Net Assets Available for Benefits and the Statements of Changes in Net Assets Available for Benefits.

Use of Estimates in the Preparation of Financial Statements

The preparation of financial statements in conformity with GAAP requires the Plan’s management to make estimates and assumptions that affect the reported amounts of Net Assets Available for Benefits at the date of the financial statements and changes in Net Assets Available for Benefits during the reporting period. Actual results could differ from those estimates.

Trustees of the Master Trust and Kellogg Company Stock

Assets of the Plan, held within the Master Trust, are co-invested with the assets of other defined contribution plans sponsored by the Kellogg Company (the Company) in a commingled investment fund known as the Master Trust for which The Northern Trust Company is the trustee.

Effective January 1, 2016, Kellogg Company stock which was previously held within the Master Trust was transferred to separate trusts at the Mercer Trust Company, the trustee of Company stock. Company stock is held within separate Trusts for each Plan.

In 2016, due to the transfer of Kellogg Company stock out of the Master Trust to a separate trustee, the Plan's investment in company stock is presented as a separate plan investment on the Statement of Net Assets for Benefits. In 2015, the company stock is included in the Plan's interest in the Master Trust. In 2016, the related investment earnings from company stock is included in dividend income and net appreciation/(depreciation) in fair value of Kellogg Company stock on the Statement of Changes in Net Assets Available for Benefits. In 2015, the investment earnings from Kellogg Company stock was included in the Plan's interest in income of the Master Trust.

Allocation of Net Investment in Master Trust

The Plan’s allocated share of the Master Trust net assets and investment activities is based upon the total of each individual participant’s share of the Master Trust. The Plan’s net interest in the Master Trust is equal to the net investment in the Master Trust held at The Northern Trust Company.

Kellogg Company

Savings and Investment Plan

Notes to Financial Statements

Years Ended December 31, 2016 and 2015

|

|

|

|

2.

|

Provisions of the Plan

|

The following description of the Plan is provided for general information purposes only. Participants should refer to the Plan document or Summary Plan descriptions for a more comprehensive description of the Plan’s provisions.

Plan Administration

The Plan is administered by the ERISA Finance Committee and the ERISA Administrative Committee appointed by Kellogg Company.

The ERISA Finance Committee has appointed TransAmerica Retirement Services powered by Financial Engines to provide financial advisory services to the Plan and participants not under a collectively bargained agreement.

Redemption Fees

In 2015, the Plan charged a 2% redemption fee for transfers and/or reallocations of units that have been in a fund for less than five business days. Fees collected are used to help offset trustee expenses. In 2016, as a result of changes in recordkeeping policy, the Plan does not charge redemption fees.

Plan Participation and Contributions

Generally, all salaried employees and non-union hourly employees of the Company and its U.S. subsidiaries, and certain union hourly employees covered by a collective bargaining agreement, are eligible to participate in the Plan on the date of hire. Certain locations are subject to auto enrollment into the Plan.

Subject to limitations prescribed by the Internal Revenue Service, participants may elect to contribute from 1% to 50% of their annual wages. Participants were eligible to defer up to $18,000 in

2016

and

2015

. Participants who have attained age 50 before the end of the year are eligible to make catch-up contributions of up to $6,000 in

2016

and

2015

.

Contributions made by salaried and non-union hourly employees are matched by the Company at a 100% rate on the first 3% and a 50% rate on the next 2%, with 12.5% of the Company Match initially invested in Kellogg Company stock. Union hourly employees covered by a collective bargaining agreement may have a different or no Company Match. Employees may contribute to the Plan from their date of hire; however, applicable contributions are not matched by the Company until the participant has completed one year of service. Beginning January 1, 2017, 12.5% of the Company match will not be initially invested in Kellogg Company stock. The full Company Match will be invested per the Plan participants fund selection.

Salaried and non-union hourly employees hired on and after January 1, 2010 receive non-elective employer contributions, equal to a percentage of their compensation. These contributions are made from eligible employees’ date of hire, and are posted to participants’ accounts after each payroll cycle. They are not vested until the participant has completed three years of service. There are a few select unions who also receive a non-elective employer contribution; these unions may or may not also receive a Company Match. The contributions are determined based on a negotiated hourly rate using a 40 hour work week and posted to participants’ account after each payroll cycle.

Employer matching contributions held in Kellogg Company stock can be transferred by a participant at any time to any other investment fund available under the Plan.

Kellogg Company

Savings and Investment Plan

Notes to Financial Statements

Years Ended December 31, 2016 and 2015

Plan participants may elect to invest the contributions and account balances for their accounts in various equity, bond, guaranteed investment contracts, fixed income funds or Kellogg Company stock or a combination thereof in multiples of one percent. Each participant’s account is credited with the participant’s contribution and (a) the Company’s contribution and (b) Plan earnings, and charged with an allocation of administrative and trust expenses. Allocations are based on participant earnings or account balances, as defined.

In addition to the Company contribution described above, employees hired, rehired or who became eligible for the Plan on or after January 1, 2010 , who are not covered by a collective bargaining agreement and who are not eligible to participate in the Kellogg Company Pension Plan will receive a service-based, nonelective Company contribution (Retirement Contribution). The Retirement Contribution is made each pay period, and is based on the employee’s years of service with the Company, as follows:

|

|

|

|

•

|

3% of base pay for service up to 10 years

|

|

|

|

|

•

|

5% of base pay for service of 10 years up to 20 years

|

|

|

|

|

•

|

7% of base pay for service of 20 years or more

|

The Retirement Contribution begins on the eligible employee’s date of hire. Please refer to the Plan document for additional information.

Vesting

Participant account balances are fully vested with regards to participant contributions and the Company matching contributions. The Retirement Contribution will become fully vested upon completion of three years of service. At December 31,

2016

and

2015

forfeited nonvested balances totaled $160,180 and $431,385, respectively. Consistent with the Plan document, amounts forfeited in

2016

and

2015

were used to pay administrative expenses of the Plan and reduce future Retirement Contributions. In

2016

and

2015

, Retirement Contributions were reduced by $1,032,831 and $750,000 respectively, from forfeited nonvested accounts.

Notes Receivable From Participants

Participants may borrow from their fund accounts a minimum of $1,000 up to a maximum equal to the lesser of $50,000 or 50% of their account balance. Participants may have only one loan outstanding at any time. Loan transactions are treated as transfers between the Loan Fund and the other funds. Loan terms range from 12 to 60 months, except for principal residence loans, which must be repaid within 15 years. Interest is paid at a constant rate equal to one percent over the prime rate in the month the loan begins. Interest rates on loans issued during year-ended December 31,

2016

and

2015

was 4.5% and 4.25%, respectively. Principal and interest are paid ratably through payroll deductions. Loans that are uncollectible are defaulted resulting in the outstanding principal being considered a deemed distribution.

Participant Distributions

Participants may request an in-service withdrawal of all or a portion of certain types of contributions under standard in-service withdrawal rules. The withdrawal of any participant contributions which were not previously subject to income tax is restricted by Internal Revenue Service regulations.

Participants who terminate employment before retirement, by reasons other than death or disability, may remain in the Plan or receive payment of their account balances in a lump sum. If the account balance is $1,000 or less, the terminated participant will receive the account balance in a lump sum.

Kellogg Company

Savings and Investment Plan

Notes to Financial Statements

Years Ended December 31, 2016 and 2015

Dependent on employment history, a participant can receive a distribution from the Plan due to retirement either: on or after the date the participant is classified as retired under an applicable defined benefit plan sponsored by the Company in which the Plan participant is a participant or where the Plan participant is not a participant in any defined benefit plan sponsored by the Company, on or after the date he attains age 55 after having completed at least 5 years of service. Upon retirement, disability, or death, a participant’s account balance may be received in a lump sum or installment payments. For any investment in Kellogg Company stock, the participant can elect to receive that portion of their distribution in shares.

Termination

While the Company has expressed no intentions to do so, the Plan may be terminated at any time. In the event of Plan termination, participants will become fully vested in their accounts. After payment of all expenses, at the discretion of the employer, each participant and each beneficiary of a deceased participant will either (a) receive his entire accrued benefit as soon as reasonably possible, provided that the employer does not maintain or establish another defined contribution plan as of the date of termination, or (b) have an annuity purchased through an insurance carrier on his behalf funded by the amount of his entire accrued benefit.

The Plan administrator has received a favorable letter from the Internal Revenue Service dated June 17, 2015 regarding the Plan’s qualification under applicable income tax regulations. The Plan has since been amended and has filed for a favorable letter of determination from the Internal Revenue Service on January 29, 2016. The Plan administrator entered into a closing agreement with the IRS relating to certain plan amendments in order to maintain the tax qualified status of the Plan in May 2015. The Plan administrator believes the Plan is designed and is currently being operated in compliance with the applicable requirements of the Internal Revenue Code.

Accounting principles generally accepted in the United States of America require Plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the Internal Revenue Service. The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2016 and 2015, there are no uncertain tax positions taken or expected to be taken that would require recognition of a liability or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

|

|

|

|

4.

|

Related Party Transactions

|

Certain investments held in the Master Trust are short term investment funds managed by The Northern Trust Company. The Northern Trust Company is the trustee as defined by the Plan and, therefore, these transactions qualify as exempt part-in-interest transactions.

The Plan also holds shares of Kellogg Company stock managed by Mercer Trust Company. Kellogg Company is the Plan sponsor and Mercer Trust Company is a trustee as defined by the Plan and, therefore, these transactions qualify as exempt party-in-interest transactions.

Notes receivable from participants also qualify as exempt part-in-interest transactions.

The Northern Trust Company charges an asset based fee and a flat account based fee which are paid to the trustee as compensation for services performed under the Master Trust agreement. The trustee’s fee is payable monthly and accrued for daily.

Kellogg Company

Savings and Investment Plan

Notes to Financial Statements

Years Ended December 31, 2016 and 2015

Fees paid during

2016

and

2015

for management and other services rendered by parties-in-interest were based on comparable rates for such services. The majority of such fees were paid by the Plan. A portion was returned to the Plan based on revenue sharing arrangements. The revenue sharing amounts received are used to pay the Plan’s administrative expenses.

|

|

|

|

5.

|

Reconciliation of Financial Statements to Form 5500

|

The following is a reconciliation of net assets available for benefits per the financial statements as of December 31, 2016 and 2015 to Form 5500.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Net assets available for benefits per the financial statements

|

|

$

|

1,576,010,131

|

|

|

$

|

1,483,826,709

|

|

|

Adjustment from contract value to fair value for interest in Master Trust related to fully benefit-responsive investment contracts (Note 1)

|

|

556,074

|

|

|

1,915,352

|

|

|

Net assets available for benefits per the Form 5500

|

|

$

|

1,576,566,205

|

|

|

$

|

1,485,742,061

|

|

The following is a reconciliation of the Plan’s interest in income of Master Trust and Trust per the financial statements for the years ended December 31, 2016 and 2015 to Form 5500.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Plan's interest in income of Master Trust per the financial statements

|

|

$

|

104,389,608

|

|

|

$

|

15,076,536

|

|

|

Less:

|

|

|

|

|

|

Redemption fees

|

|

—

|

|

|

(11,777

|

)

|

|

Trustee, administrative and financial advisory fees

|

|

(2,363,172

|

)

|

|

(2,597,338

|

)

|

|

Change in adjustment from contract value to fair value for interest in Master Trust related to fully benefit-responsive investment contracts (Note 1)

|

|

(1,359,278

|

)

|

|

(3,859,263

|

)

|

|

Net investment gain from Master Trust and Trust investment accounts per the Form 5500

|

|

$

|

100,667,158

|

|

|

$

|

8,608,158

|

|

|

|

|

|

6.

|

Fair Value Measurements

|

The Plan’s assets are categorized using a framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are described below:

|

|

|

|

Level 1

|

Inputs to the valuation methodology are unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities.

|

Level 2 Inputs to the valuation methodology include:

|

|

|

|

•

|

Quoted prices for similar assets or liabilities in active markets;

|

|

|

|

|

•

|

Quoted prices for identical or similar assets or liabilities in inactive markets;

|

Kellogg Company

Savings and Investment Plan

Notes to Financial Statements

Years Ended December 31, 2016 and 2015

|

|

|

|

•

|

Inputs other than quoted prices that are observable for the asset or liability; and

|

|

|

|

|

•

|

Inputs that are derived principally from or corroborated by observable market data by correlation or other means.

|

If the asset or liability has a specified (contractual) term, the Level 2 input must be observable for substantially the full term of the asset or liability.

|

|

|

|

Level 3

|

Inputs to the valuation methodology are prices or valuations that require inputs that are both significant to the fair value measurement and unobservable.

|

The asset or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement.

Following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in the methodologies used at December 31,

2016

and

2015

.

|

|

|

|

•

|

Money market funds

: Valued at the net asset value (NAV) of shares held by the Master Trust at year end using the fair value of underlying investments. The underlying investments of the domestic equity collective trust are high-quality money market instruments with short term maturities. Redemptions are allowed on every business day.

|

|

|

|

|

•

|

Common stocks

: Valued at the closing price reported on the active market on which the individual securities are traded.

|

|

|

|

|

•

|

Mutual funds

: Valued at the NAV of shares held by the Master Trust at year end.

|

|

|

|

|

•

|

Commingled funds and Collective trusts:

Commingled funds are valued at the NAV based on information reported by the investment advisor using the audited financial statements of the funds at year end. Collective trusts are valued based upon the NAV of units held by the Master Trust at year end using the contract value of underlying investments. These investments represent fixed income, equity securities, international equity, domestic equity and U.S. debt securities. All funds have daily redemption and are not subject to any redemption restrictions.

|

Kellogg Company

Savings and Investment Plan

Notes to Financial Statements

Years Ended December 31, 2016 and 2015

The following table presents a summary of the Master Trust investments in certain entities that calculate NAV per share as of December 31,

2016

and

2015

:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments at NAV as a practical expedient as of December 31, 2016

|

|

|

|

Fair Value

|

|

Unfunded Commitments

|

|

Redemption Frequency

|

|

Redemption Notice Period

|

|

BlackRock Equity Index

|

|

$

|

364,882,778

|

|

|

$

|

—

|

|

|

Daily

|

|

None

|

|

NL Fund M

|

|

|

|

|

|

|

|

|

|

T. Rowe Price Growth Stock

|

|

115,005,231

|

|

|

—

|

|

|

Daily

|

|

None

|

|

Trust

|

|

|

|

|

|

|

|

|

|

BlackRock U.S. Debt Index

|

|

63,054,097

|

|

|

—

|

|

|

Daily

|

|

None

|

|

NL Fund M

|

|

|

|

|

|

|

|

|

|

BlackRock MSCI ACWI-ex US

|

|

60,003,494

|

|

|

—

|

|

|

Daily

|

|

None

|

|

Index NL Fund M

|

|

|

|

|

|

|

|

|

|

BlackRock Russell 2500 Index

|

|

32,925,228

|

|

|

—

|

|

|

Daily

|

|

None

|

|

NL Fund M

|

|

|

|

|

|

|

|

|

|

Goldman Sachs Collective

|

|

9,108,899

|

|

|

—

|

|

|

Daily

|

|

None

|

|

Short Term Investment Fund

|

|

|

|

|

|

|

|

|

|

Total Investments at NAV as

|

|

|

|

|

|

|

|

|

|

a Practical Expedient

|

|

$

|

644,979,727

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments at NAV as a practical expedient as of December 31, 2015

|

|

|

|

Fair Value

|

|

Unfunded Commitments

|

|

Redemption Frequency

|

|

Redemption Notice Period

|

|

BlackRock Equity Index

|

|

$

|

328,541,552

|

|

|

$

|

—

|

|

|

Daily

|

|

None

|

|

NL Fund M

|

|

|

|

|

|

|

|

|

|

T. Rowe Price Growth Stock

|

|

133,298,511

|

|

|

—

|

|

|

Daily

|

|

None

|

|

Trust

|

|

|

|

|

|

|

|

|

|

BlackRock U.S. Debt Index

|

|

42,862,367

|

|

|

—

|

|

|

Daily

|

|

None

|

|

NL Fund M

|

|

|

|

|

|

|

|

|

|

BlackRock MSCI ACWI-ex US

|

|

38,858,626

|

|

|

—

|

|

|

Daily

|

|

None

|

|

Index NL Fund M

|

|

|

|

|

|

|

|

|

|

BlackRock Russell 2500 Index

|

|

10,728,835

|

|

|

—

|

|

|

Daily

|

|

None

|

|

NL Fund M

|

|

|

|

|

|

|

|

|

|

Goldman Sachs Collective

|

|

17,484,979

|

|

|

—

|

|

|

Daily

|

|

None

|

|

Short Term Investment Fund

|

|

|

|

|

|

|

|

|

|

Northern Trust Collective Short

|

|

688,174

|

|

|

—

|

|

|

Daily

|

|

None

|

|

Term Investment Fund

|

|

|

|

|

|

|

|

|

|

Total Investments at NAV as

|

|

|

|

|

|

|

|

|

|

a Practical Expedient

|

|

$

|

572,463,044

|

|

|

$

|

—

|

|

|

|

|

|

Kellogg Company

Savings and Investment Plan

Notes to Financial Statements

Years Ended December 31, 2016 and 2015

The Plan is subject to master netting agreements, or netting arrangements, with certain counterparties. These agreements govern the terms of certain transactions and reduce the counterparty risk associated with relevant transactions by specifying offsetting mechanisms and collateral posting arrangements at pre-arranged exposure levels. Since different types of transactions have different mechanics and are sometimes traded out of different legal entities of a particular counterparty organization, each type of transaction may be covered by a different master netting arrangement, possibly resulting in the need for multiple agreements with a single counterparty. Master netting agreements are specific to each different asset type; therefore, they allow the company to close out and net its total exposure to a specified counterparty in the event of a default with respect to any and all the transactions governed under a single agreement with the counterparty.

The preceding methods described may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, although the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

The Master Trust and Trust practice regarding the timing of transfers between levels is to measure transfers in at the beginning of the month and transfers out at the end of the month. For the years ended December 31,

2016

and

2015

, the Master Trust had no transfers between Levels 1, 2 or 3.

The major classes of investments of the Master Trust as of December 31,

2016

were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Mutual funds

|

|

$

|

—

|

|

|

$

|

708,244,723

|

|

|

$

|

—

|

|

|

$

|

708,244,723

|

|

|

Investments at Fair Value

|

|

$

|

—

|

|

|

$

|

708,244,723

|

|

|

$

|

—

|

|

|

$

|

708,244,723

|

|

|

Investments measured at net asset value as a practical expedient*

|

|

644,979,727

|

|

|

Total Investments at fair value

|

|

|

|

|

|

|

|

1,353,224,450

|

|

|

Guaranteed investment contracts measured at contract value

|

|

|

|

524,871,910

|

|

|

Total Net Investments of the Master Trust Company

|

|

|

|

$

|

1,878,096,360

|

|

The major classes of investments of the Mercer Trust Company as of December 31,

2016

were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Common stock - Kellogg Company

|

|

$

|

150,774,888

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

150,774,888

|

|

|

Investments at Fair Value

|

|

$

|

150,744,888

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

150,774,888

|

|

Kellogg Company

Savings and Investment Plan

Notes to Financial Statements

Years Ended December 31, 2016 and 2015

The major classes of investments of the Master Trust as of December 31,

2015

were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Mutual funds

|

|

$

|

—

|

|

|

$

|

681,986,581

|

|

|

$

|

—

|

|

|

$

|

681,986,581

|

|

|

Common stock - Kellogg Company

|

|

146,062,223

|

|

|

—

|

|

|

—

|

|

|

146,062,223

|

|

|

Investments at Fair Value

|

|

$

|

146,062,223

|

|

|

$

|

681,986,581

|

|

|

$

|

—

|

|

|

$

|

828,048,804

|

|

|

Investments measured at net asset value as a practical expedient*

|

|

572,463,044

|

|

|

Total Investments at fair value

|

|

|

|

|

|

|

|

1,400,511,848

|

|

|

Guaranteed investment contracts measured at contract value

|

|

|

|

527,591,886

|

|

|

Total Net Investments of the Master Trust

|

|

|

|

$

|

1,928,103,734

|

|

*In accordance with Subtopic 820-10, certain investments that were measured at NAV per share (or its equivalent) have not been classified in the fair value hierarchy. The fair value amount presented in this table are intended to permit reconciliation of the fair value hierarchy to the line items presented in the statement of net assets available for benefit.

Level 3 Gains and Losses

The Master Trust does not contain Level 3 assets for the years ended December 31,

2016

and

2015

.

|

|

|

|

7.

|

Kellogg Company Master Trust

|

The Plan has an interest in the net assets held in the Master Trust in which interests are determined on the basis of cumulative funds specifically contributed on behalf of the Plan adjusted for an allocation of income. Such income allocation is based on the Plan’s funds available for investment during the year.

Kellogg Company

Savings and Investment Plan

Notes to Financial Statements

Years Ended December 31, 2016 and 2015

Kellogg Company Master Trust net assets at December 31,

2016

and

2015

and the changes in net assets for the years ended December 31,

2016

and

2015

are as follows:

Kellogg Company Master Trust Schedule of Net Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

General Investments at fair value

|

|

|

|

|

|

Money Market Funds

|

|

$

|

9,108,899

|

|

|

$

|

17,484,979

|

|

|

Common Stock - Kellogg Company (Note 1)

|

|

—

|

|

|

146,062,223

|

|

|

Commingled Funds/Collective trusts

|

|

635,870,828

|

|

|

554,978,065

|

|

|

Mutual Funds

|

|

708,244,723

|

|

|

681,986,581

|

|

|

General Investments at contract value

|

|

|

|

|

|

Guaranteed Investment Contracts

|

|

524,871,910

|

|

|

527,591,886

|

|

|

Total general investments

|

|

1,878,096,360

|

|

|

1,928,103,734

|

|

|

Pending for securities sold

|

|

1,246,405

|

|

|

1,519,033

|

|

|

Other receivables

|

|

—

|

|

|

43

|

|

|

Total assets

|

|

1,879,342,765

|

|

|

1,929,622,810

|

|

|

Pending for securities purchased

|

|

(645,758

|

)

|

|

(2,086,150

|

)

|

|

Other payables

|

|

4,957

|

|

|

(37,972

|

)

|

|

Net Assets

|

|

$

|

1,878,701,964

|

|

|

$

|

1,927,498,688

|

|

|

Percentage interest held by the Plan

|

|

77.8

|

%

|

|

75.7

|

%

|

Kellogg Company

Savings and Investment Plan

Notes to Financial Statements

Years Ended December 31, 2016 and 2015

Kellogg Company Master Trust

Schedule of Changes in Net Assets Investment Accounts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Earnings on investments

|

|

|

|

|

|

Interest

|

|

$

|

13,712,867

|

|

|

$

|

13,468,214

|

|

|

Dividends

|

|

7,511,468

|

|

|

12,735,191

|

|

|

Net appreciation/(depreciation) in fair value of investments

|

|

|

|

|

|

Common Stock - Kellogg Company (Note 1)

|

|

(3,048

|

)

|

|

14,418,216

|

|

|

Commingled Funds/Collective Trusts

|

|

48,404,714

|

|

|

12,855,937

|

|

|

Mutual Funds

|

|

54,638,083

|

|

|

(27,423,449

|

)

|

|

Net appreciation/(depreciation)

|

|

103,039,749

|

|

|

(149,296

|

)

|

|

Total additions

|

|

124,264,084

|

|

|

26,054,109

|

|

|

Net transfer of assets out of investment account

|

|

(26,249,254

|

)

|

|

(65,161,006

|

)

|

|

Fees and commissions

|

|

(749,331

|

)

|

|

(898,411

|

)

|

|

Kellogg Company stock transferred to Mercer Trust

|

|

(146,062,223

|

)

|

|

—

|

|

|

Total distributions

|

|

(173,060,808

|

)

|

|

(66,059,417

|

)

|

|

Net change in net assets

|

|

(48,796,724

|

)

|

|

(40,005,308

|

)

|

|

Net assets

|

|

|

|

|

|

Beginning of Year

|

|

1,927,498,688

|

|

|

1,967,503,996

|

|

|

End of year

|

|

$

|

1,878,701,964

|

|

|

$

|

1,927,498,688

|

|

Kellogg Company

Savings and Investment Plan

Notes to Financial Statements

Years Ended December 31, 2016 and 2015

As the Plan has a specific interest in the Master Trust, the below table provides the investment risk specific to the Plan based upon the investment programs available to participants as of December 31, 2016 and 2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Program

|

|

2016

|

|

2015

|

|

Stable Income Fund

|

|

57.7

|

%

|

|

56.3

|

%

|

|

Bond Fund

|

|

83.7

|

%

|

|

83.7

|

%

|

|

US Aggregate bond Index Fund

|

|

96.5

|

%

|

|

97.4

|

%

|

|

US Large Company Equity Index Fund

|

|

88.0

|

%

|

|

88.1

|

%

|

|

Small-Mid Company Equity Index Fund

|

|

91.3

|

%

|

|

88.9

|

%

|

|

Large Company Value Fund

|

|

84.7

|

%

|

|

85.9

|

%

|

|

International Equity Fund

|

|

90.2

|

%

|

|

90.4

|

%

|

|

International Equity Index Fund

|

|

95.7

|

%

|

|

95.4

|

%

|

|

Small Company Value Fund

|

|

78.3

|

%

|

|

79.9

|

%

|

|

Small-Mid Company Growth Fund

|

|

75.5

|

%

|

|

75.0

|

%

|

|

Large Company Growth Fund

|

|

84.2

|

%

|

|

83.2

|

%

|

|

Conservative Pre-Mix Portfolio

|

|

81.0

|

%

|

|

82.7

|

%

|

|

Aggressive Pre-Mix Portfolio

|

|

82.8

|

%

|

|

84.3

|

%

|

|

Kellogg Company Stock

|

|

—

|

%

|

|

60.3

|

%

|

Effective January 1, 2017 the Kellogg Company will no longer directly invest 12.5% of Company match funds to Kellogg Company Stock. The 12.5% will be allocated per the Plan participant’s fund election.

Kellogg Company

Savings and Investment Plan

Schedule H, line 4i – Schedule of Assets (Held at End of Year)

December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b)

|

|

(c)

|

|

(e)

|

|

|

|

Identity of Issue, Borrower, Lessor or Similar Party

|

|

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value

|

|

Current Value

|

|

|

|

Plan's interest in Master Trust at fair value

|

|

|

|

$

|

1,461,695,009

|

|

|

|

|

*Kellogg Company Stock at fair value

|

|

|

|

$

|

89,449,512

|

|

|

|

|

|

|

|

|

|

|

|

|

*Participants

|

|

Loans, interest ranging 4.24-9.75%, with due dates at various times through December, 2031.

|

|

$

|

25,608,477

|

|

|

|

|

|

|

|

|

|

|

|

|

*Parties-in interest

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

KELLOGG COMPANY SAVINGS AND INVESTMENT PLAN

|

|

|

By:

|

/s/ Fareed Khan

|

|

Dated: June 22, 2017

|

Name:

Title:

|

Fareed Khan

Senior Vice President and Chief Financial Officer,

Kellogg Company

|

EXHIBIT INDEX

|

|

|

|

|

|

Exhibit

Number

|

Document

|

|

23.1

|

Consent of Independent Registered Public Accounting Firm

|

|

|

|

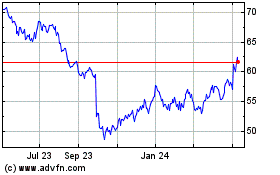

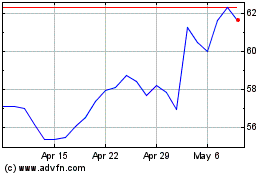

Kellanova (NYSE:K)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kellanova (NYSE:K)

Historical Stock Chart

From Apr 2023 to Apr 2024