|

UNITED STATES

|

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

Washington, D.C. 20549

|

|

|

|

|

|

SCHEDULE 14A

|

|

|

|

|

|

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act

of 1934

(Amendment

No.

)

|

|

|

|

|

|

Filed

by the Registrant

[X]

|

|

|

|

|

|

Filed

by a Party other than the Registrant

[ ]

|

|

|

|

|

|

Check

the appropriate box:

|

|

|

[

]

|

Preliminary

Proxy Statement

|

|

|

[

]

|

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

|

[X]

|

Definitive

Proxy Statement

|

|

|

[

]

|

Definitive

Additional Materials

|

|

|

[

]

|

Soliciting

Material under

§

240.14a-12

|

|

|

|

|

|

CHROMADEX

CORPORATION

|

|

|

(Name

of Registrant as Specified In Its Charter)

|

|

|

|

|

|

|

|

|

(Name

of Person(s) Filing Proxy Statement, if other than the

Registrant)

|

|

|

|

|

|

Payment

of Filing Fee (Check the appropriate box):

|

|

|

[X]

|

No fee

required.

|

|

|

[

]

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and

0-11.

|

|

|

|

(1)

|

Title

of each class of securities to which transaction

applies:

|

|

|

|

|

|

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was

determined):

|

|

|

|

|

|

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

|

|

|

[

]

|

Fee

paid previously with preliminary materials.

|

|

|

[

]

|

Check

box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by

registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

|

|

|

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

(3)

|

Filing

Party:

|

|

|

|

|

|

|

|

|

(4)

|

Date

Filed:

|

|

|

|

|

|

|

|

|

|

|

|

ChromaDex Corporation

10005 Muirlands Blvd, Suite G

Irvine, CA 92618

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST 10, 2017

June 20

, 2017

To the

stockholders of ChromaDex Corporation:

You are

cordially invited to attend the Special Meeting of Stockholders

(the

“

Special

Meeting

”

) of ChromaDex

Corporation, a Delaware corporation (the

“

Company

”

). The meeting will be held on

August 10

, 2017, at 11:00 am

local time, at the Company

’

s offices located at 10005 Muirlands

Blvd, Suite G, Irvine, CA 92618 for the following purposes, as more

fully described in the accompanying proxy statement (the

“

Proxy

Statement

”

):

|

(1)

|

To

approve the issuance of Common Stock in connection with a financing

transaction; and

|

|

|

|

|

(2)

|

To

transact other business that may properly come before the meeting

and any postponement(s) or adjournment(s) thereof.

|

Pursuant

to the bylaws of the Company, the Board of Directors has fixed the

close of business on

June

19

, 2017 as the record date (the

“

Record Date

”

) for determination of stockholders

entitled to notice and to vote at the Special Meeting and any

adjournment thereof. Holders of the Company

’

s Common Stock are entitled to vote

at the Special Meeting.

In

accordance with rules

and

regulations adopted by the U.S. Securities and Exchange Commission

(the

“

SEC

”

), we have elected to provide our

beneficial owners and stockholders of record access to our proxy

materials over the Internet. Beneficial owners are stockholders

whose shares are held in the name of a broker, bank or other agent

(i.e., in

“

street

name

”

). Accordingly, a

Notice of Internet Availability of Proxy Materials (the

“

Notice

”

) will be mailed on or about

June 23,

2017 to our beneficial

owners and stockholders of record who owned our Common Stock at the

close of business on

June

19

, 2017. Beneficial owners and stockholders of record will

have the ability to access the proxy materials on a website

referred to in the Notice or request a printed set of the proxy

materials be sent to them by following the instructions in the

Notice. Beneficial owners and stockholders of record who have

previously requested to receive paper copies of our proxy materials

will receive paper copies of the proxy materials instead of a

Notice.

|

|

BY

ORDER OF THE BOARD OF DIRECTORS

/s/

Stephen Allen

Chairman

of the Board

|

You are cordially invited to attend the meeting in person. Whether

or not you expect to attend the meeting, please complete, date,

sign and return the proxy mailed to you, or vote over the telephone

or the internet as instructed in these materials, as promptly as

possible in order to ensure your representation at the meeting. A

return envelope (which is postage prepaid if mailed in the United

States) has been provided for your convenience. Even if you have

voted by proxy, you may still vote in person if you attend the

meeting. Please note, however, that if your shares are held of

record by a broker, bank or other nominee and you wish to vote at

the meeting, you must obtain a proxy issued in your name from that

record holder.

ChromaDex Corporation

10005 Muirlands Blvd, Suite G

Irvine, CA 92618

PROXY STATEMENT

FOR

THE SPECIAL MEETING OF STOCKHOLDERS

AUGUST 10, 2017

The

enclosed proxy is solicited by the board of directors (

“

Board of Directors

”

) of ChromaDex Corporation (the

“

Company

”

or

“

ChromaDex

”

), in connection with the Special

Meeting of Stockholders (the

“

Special Meeting

”

) of the Company, to be held on

August 10

, 2017, at 11:00 am

local time, at 10005 Muirlands Blvd, Suite G, Irvine, CA

92618.

At the

Special Meeting, you will be asked to consider and vote upon the

following matters:

|

(1)

|

To

approve the issuance of Common Stock in connection with a financing

transaction; and

|

|

|

|

|

(2)

|

To

transact other business that may properly come before the meeting

and any postponement(s) or adjournment(s) thereof.

|

|

|

|

The

Board of Directors has fixed the close of business on

June 19

, 2017 as the record date (the

“

Record Date

”

) for determining stockholders

entitled to notice of and to vote at the Special Meeting and any

adjournment thereof.

In

accordance with rules

and

regulations adopted by the U.S. Securities and Exchange Commission

(the

“

SEC

”

), we have elected to provide our

beneficial owners and stockholders of record access to our proxy

materials over the Internet. Beneficial owners are stockholders

whose shares are held in the name of a broker, bank or other agent

(i.e., in

“

street

name

”

). Accordingly, a

Notice of Internet Availability of Proxy Materials (the

“

Notice

”

) will be mailed on or

about

June 23

, 2017 to our

beneficial owners and stockholders of record who owned our Common

Stock at the close of business on

June 19

, 2017. Beneficial owners and

stockholders of record will have the ability to access the proxy

materials on a website referred to in the Notice or request a

printed set of the proxy materials be sent to them by following the

instructions in the Notice. Beneficial owners and stockholders of

record who have previously requested to receive paper copies of our

proxy materials will receive paper copies of the proxy materials

instead of a Notice.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE SPECIAL MEETING TO BE HELD ON AUGUST 10, 2017: THE NOTICE,

PROXY STATEMENT AND PROXY CARD ARE AVAILABLE AT

WWW.CHROMADEX.COM

,

INVESTOR RELATIONS SECTION.

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND

VOTING

Why did I receive in the mail a Notice of Internet Availability of

Proxy Materials instead of a full set of Proxy

Materials?

We are

pleased to take advantage of the SEC rule

that allows companies to furnish

their proxy materials over the Internet. Accordingly, we have sent

to our beneficial owners and stockholders of record a Notice of

Internet Availability of Proxy Materials. Instructions on how to

access the proxy materials over the Internet or to request a paper

copy may be found in the Notice. Our stockholders may request to

receive proxy materials in printed form by mail or electronically

on an ongoing basis. A stockholder

’

s election to receive proxy

materials by mail or electronically by email will remain in effect

until the stockholder terminates its election.

We

intend to mail the Notice on or about June 23, 2017 to all

stockholders of record entitled to vote at the Special

Meeting.

How do I attend the Special Meeting?

The

meeting will be held on

August

10

, 2017 at 11:00 am local time at the Company

’

s offices located at 10005 Muirlands

Blvd, Suite G, Irvine, CA 92618. Directions to the Special Meeting

may be found at www.chromadex.com.

Information on how

to vote in person at the Special Meeting is discussed

below.

Who can vote at the Special Meeting?

Only

stockholders of record at the close of business on June 19, 2017

will be entitled to vote at the Special Meeting. On this record

date, there were

46,093,894

shares of Common Stock

outstanding and entitled to vote.

Stockholders of Record: Shares Registered in Your Name

If

on

June 19

, 2017 your

shares were registered directly in your name with the

Company

’

s transfer agent,

Equity Stock Transfer, LLC, then you are a stockholder of record.

As a stockholder of record, you may vote in person at the meeting

or vote by proxy. Whether or not you plan to attend the meeting, we

urge you to fill out and return the enclosed proxy card to ensure

your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or

Bank

If

on

June 19

, 2017 your

shares were held, not in your name, but rather in an account at a

brokerage firm, bank, dealer or other similar organization, then

you are the beneficial owner of shares held in

“

street name

”

and the Notice is being forwarded

to you by that organization. The organization holding your account

is considered to be the stockholder of record for purposes of

voting at the Special Meeting. As a beneficial owner, you have the

right to direct your broker or other agent regarding how to vote

the shares in your account. You are also invited to attend the

Special Meeting. However, since you are not the stockholder of

record, you may not vote your shares in person at the meeting

unless you request and obtain

a valid proxy from your broker or

other agent.

What am I voting on?

There

is one matter scheduled for a vote:

●

To approve the

issuance of Common Stock in connection with a financing

transaction.

What if another matter is properly brought before the Special

Meeting?

The

Board of Directors knows of no other matters that will be presented

for consideration at the Special Meeting. If any other matters are

properly brought before the meeting, it is the intention of the

persons named in the accompanying proxy to vote on those matters in

accordance with their best judgment.

Who may attend the Special Meeting?

Record

holders and beneficial owners may attend the Special

Meeting.

If your

shares are held in street name, you will need to bring a copy of a

brokerage statement or other documentation reflecting your stock

ownership as of the Record Date.

How do I vote?

You may

vote

“

For

”

or

“

Against

”

the proposal, or abstain from

voting.

The

procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you

are a stockholder of record, you may vote in person at the Special

Meeting, vote by proxy over the telephone, vote by proxy through

the internet or vote by proxy using a proxy card that you may

request or that we may elect to deliver at a later time. Whether or

not you plan to attend the meeting, we urge you to vote by proxy to

ensure your vote is counted. You may still attend the meeting and

vote in person even if you have already voted by

proxy.

●

To vote in person,

come to the Special Meeting and we will give you a ballot when you

arrive.

●

To vote over the

telephone, dial toll-free 1-855-557-4647 using a touch-tone phone

and follow the recorded instructions. You will be asked to provide

the company number and control number from the Notice. Your

telephone vote must be received by 6:00 p.m., Eastern Time on

August 9, 2017 to be counted.

●

To vote through the

internet, go to http://www.equitystock.com

to complete an

electronic proxy card. You will be asked to provide the company

number and control number from the Notice. Your internet vote must

be received by 6:00 p.m., Eastern Time on August 9, 2017 to be

counted.

●

To vote using the

proxy card, simply complete, sign and date the proxy card that may

be delivered

and return it

promptly in the envelope provided. If you return your signed proxy

card to us before the Special Meeting, we will vote your shares as

you direct.

Beneficial Owner: Shares Registered in the Name of Broker or

Bank

If you

are a beneficial owner of shares registered in the name of your

broker, bank, or other agent, you should have received a Notice

containing voting instructions from that organization rather than

from the Company. Simply follow the voting instructions in the

Notice to ensure that your vote is counted. To vote in person at

the Special Meeting, you must obtain a valid proxy from your

broker, bank or other agent. Follow the instructions from your

broker or bank included with these proxy materials, or contact your

broker or bank to request a proxy form.

How many votes do I have?

On each

matter to be voted upon, you have one vote for each share of Common

Stock you own as of

June

19

, 2017.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you

are a stockholder of record and do not vote by completing your

proxy card, by telephone, through the internet

or in person at

the Special Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or

Bank

If you

are a beneficial owner and do not instruct your broker, bank, or

other agent how to vote your shares, the broker or nominee may not

vote your shares for the proposal without your instructions,

because the proposal is deemed to be a

“

non-routine

”

matter by the New York Stock

Exchange (

“

NYSE

”

).

What if I return a proxy card or otherwise vote but do not make

specific choices?

If you

return a signed and dated proxy card or otherwise vote without

marking voting selections, your shares will be voted

“

For

”

the proposal to approve the

issuance of Common Stock in connection with the financing

transaction. If any other matter is properly presented at the

meeting, your proxyholder (one of the individuals named on your

proxy card) will vote your shares using his or her best

judgment.

Who is paying for this proxy solicitation?

We will

pay for the entire cost of soliciting proxies. In addition to these

proxy materials, our directors and employees may also solicit

proxies in person, by telephone, or by other means of

communication. Directors and employees will not be paid any

additional compensation for soliciting proxies.

We may also

reimburse brokerage firms, banks and other agents for the cost of

forwarding proxy materials to beneficial owners. We have retained

Okapi Partners LLC (

“

Okapi

”

) for solicitation and advisory

services in connection with the solicitation relating to the

Special Meeting. Okapi has earned fees of $7,500 through the date

of this proxy statement, and may earn additional fees for its

services going forward. We will also reimburse Okapi for reasonable

out-of-pocket expenses.

What does it mean if I receive more than one Notice?

If you

receive more than one Notice, your shares may be registered in more

than one name or in different accounts. Please follow the voting

instructions on the Notices to ensure that all of your shares are

voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes.

You can revoke your proxy at any time before the final vote at the

meeting. If you are the record holder of your shares, you may

revoke your proxy in any one of the following ways:

●

You may submit

another properly completed proxy card with a later

date.

●

You may send a

timely written notice that you are revoking your proxy to the

Secretary, c/o ChromaDex Corporation, 10005 Muirlands Blvd, Suite

G, Irvine, CA 92618.

●

You may attend the

Special Meeting and vote in person. Simply attending the meeting

will not, by itself, revoke your proxy.

Your

most current proxy card or telephone or internet proxy is the one

that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or

Bank

If your

shares are held by your broker or bank as a nominee or agent, you

should follow the instructions provided by your broker or

bank.

How are votes counted?

Votes

will be counted by the inspector of election appointed for the

meeting, who will separately count, for the proposal to approve the

issuance of Common Stock in connection with the financing

transaction, votes

“

For,

”

“

Against,

”

abstentions and broker

non-votes.

What are “broker non-votes”?

As

discussed above, when a beneficial owner of shares held in

“

street name

”

does not give instructions to the

broker or nominee holding the shares as to how to vote on matters

deemed by the NYSE to be

“

non-routine,

”

the broker or nominee cannot vote

the shares. These unvoted shares are counted as

“

broker non-votes.

”

How many votes are needed for the proposal to pass?

To

pass, the proposal to approve the issuance of Common Stock in

connection with the financing transaction must receive a

“

For

”

vote from the majority of shares

present and entitled to vote either in person or by proxy. If you

“

Abstain

”

from voting on the proposal, it

will have the same effect as an

“

Against

”

vote. Broker non-votes will have no

effect on the proposal. For clarity, pursuant to NASDAQ listing

rules, shares issued to the Purchasers (as defined below) in the

First Tranche and Second Tranche (each as defined below) are not

entitled to vote on the proposal. However, should any other

business come properly before the Special Meeting, the shares

issued to the Purchasers in the First Tranche and Second Tranche

will be entitled to vote on any such business.

What constitutes a quorum?

To

carry on business at the Special Meeting, we must have a

quorum.

A quorum is

present when a majority of the shares entitled to vote, as of the

Record Date, are represented in person or by proxy.

Thus,

holders representing at

least

23,046,948

votes

must be represented in person or by proxy to have a

quorum.

Your shares

will be counted towards the quorum only if you submit a valid proxy

(or one is submitted on your behalf by your broker, bank or other

nominee) or if you vote in person at the Special

Meeting.

Abstentions

and broker non-votes will be counted towards the quorum

requirement.

Shares

owned by us are not considered outstanding or considered to be

present at the Special Meeting.

If there is not a quorum at the

Special Meeting, our stockholders may adjourn the

meeting.

What should I do if I have other questions?

If you

have any questions or require any assistance with voting your

shares, please contact our proxy solicitor, Okapi, toll free at

(877) 629-6355.

How can I find out the results of the voting at the Special

Meeting?

Preliminary

voting results will be announced at the Special Meeting. Final

voting results will be published in a Current Report on

Form

8-K, which we will

file within four business days of the meeting.

PROPOSAL 1:

ISSUANCE OF COMMON STOCK

IN CONNECTION WITH A FINANCING TRANSACTION

Background

The key

terms of the agreements relating to the financing transaction are

summarized below. Copies of the related agreements have been filed

as (i) Exhibit 99.1 to our Current Report on Form 8-K, filed with

the SEC on April 27, 2017, (ii) Exhibit 99.1 to our Current Report

on Form 8-K filed with the SEC on May 2, 2017, and (iii) Exhibit

99.1 to our Current Report on Form 8-K filed with the SEC on May

25, 2017, and you are encouraged to review the full text of such

agreements. The descriptions set forth below are not complete and

are qualified in their entirety by reference to the full text of

the financing agreements filed with the Current Reports on Form 8-K

referenced above.

The Private Placement

On

April 26, 2017, we entered into a Securities Purchase Agreement (as

amended, the

“

Purchase

Agreement

”

) with Champion

River Ventures Limited and Pioneer Step Holdings Limited

(collectively, the

“

Purchasers

”

), pursuant to which we agreed to

sell and issue up to $25.0 million of our Common Stock at a

purchase price of $2.60 per share in three tranches of

approximately $3.5 million, $16.4 million and $5.1 million,

respectively (the

“

Financing

”

).

On

April 27, 2017, we completed the first tranche under the Purchase

Agreement (the

“

First

Tranche

”

), pursuant to

which we issued 1,346,154 shares of our Common Stock to the

Purchasers. On May 24, 2017, we completed the second tranche under

the Purchase Agreement (the

“

Second Tranche

”

), pursuant to which we issued

6,303,814 shares of our Common Stock to the

Purchasers.

We are

seeking stockholder approval to issue an additional 1,965,417

shares of our Common Stock in the third tranche under the Purchase

Agreement for gross proceeds of approximately $5.1 million (the

“

Third

Tranche

”

). If stockholder

approval of the Third Tranche is obtained at the Special Meeting,

the Third Tranche is expected to occur promptly after the Special

Meeting.

THIS

PROXY STATEMENT IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF

AN OFFER TO BUY ANY OF OUR SECURITIES. THE SECURITIES REFERRED TO

IN THIS PROXY STATEMENT HAVE NOT BEEN REGISTERED UNDER THE

SECURITIES ACT OF 1933, AS AMENDED (THE

“

SECURITIES ACT

”

), OR ANY STATE SECURITIES LAWS, AND

MAY NOT BE OFFERED OR SOLD ABSENT SUCH REGISTRATION UNDER THE

SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES

LAWS OR AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS

THEREOF.

The

sale and issuance of our shares of Common Stock to the Purchasers

is being made in reliance on the exemption from the registration

requirements of the Securities Act by virtue of Section 4(a)(2)

thereof and Rule 506 of Regulation D thereunder. In connection with

the Purchasers

’

execution

of the Purchase Agreement, the Purchasers

’

represented to us that they are

each an

“

accredited

investor

”

as defined in

Regulation D of the Securities Act and that the securities

purchased by them were acquired solely for their own account and

for investment purposes and not with a view to the future sale or

distribution.

Director Designation Rights

The

Purchase Agreement requires that the Board of Directors increase

the number of authorized directors so as to create two vacant seats

on the Board of Directors, which vacancies shall be filled with

nominees selected by the Purchasers on a date following our 2017

Annual Meeting of Stockholders. This Proposal 1 does not relate to

the election of such nominees. We anticipate that the nominees

selected by the Purchasers will be nominated for re-election by our

stockholders at our 2018 Annual Meeting of

Stockholders.

Registration Rights

In

connection with the Purchase Agreement, on April 29, 2017, we

entered into a Registration Rights Agreement with the Purchasers

(the

“

Registration Rights

Agreement

”

). Pursuant to

the Registration Rights Agreement, we agreed to (i) file one or

more registration statements with the SEC to cover the resale of

the shares sold pursuant to the Purchase Agreement by the

Purchasers, (ii) use reasonable best efforts to have all such

registration statements declared effective within the timeframes

set forth in the Registration Rights Agreement, and (iii) use

commercially reasonable efforts to keep such registration

statements effective during the timeframes set forth in the

Registration Rights Agreement. In the event that such registration

statements are not filed or declared effective within the

timeframes set forth in the Registration Rights Agreement, any such

effective registration statements subsequently become unavailable,

or the Purchasers are unable to sell the shares sold pursuant to

the Purchase Agreement because we have failed to satisfy the

current public information requirement of Rule 144 under the

Securities Act, we would be required to pay liquidated damages to

the Purchasers equal to 1.0% of the aggregate purchase price per

month for each default (up to a maximum of 5% of such aggregate

purchase price).

Board of Directors Recommendation

The

Board of Directors believes the approval of this Proposal 1 by our

stockholders is in the best interests of the Company and our

stockholders. First and most critically, the Board of Directors

believes that receiving the proceeds from the Third Tranche

significantly enhances the Company

’

s ability to execute on its current

business plan, including to develop the Company

’

s direct to consumer (

“

DTC

”

) product. The Board of Directors

also believes that approval of this Proposal 1 will increase the

Purchasers

’

and their

affiliates

’

ability to

participate in the Company

’

s future financings, if they so

choose, and that the Purchasers and their affiliates are a valuable

potential future financing source for the Company. To the extent

that the Purchasers are not able to, or choose not to, participate

in any future financing transaction of the Company because this

Proposal 1 is not approved, the Board of Directors believes that

the Company will lose this valuable potential financing source and

that the Company may be challenged to find similar financing

sources that are willing to provide additional financing to the

Company on terms agreeable to the Company. The Board of Directors

also believes that permitting the Purchasers to purchase additional

shares of Common Stock in the Third Tranche would be in the best

interests of the Company

’

s other stockholders because any

such purchase would be expected to further align the

Purchasers

’

interests

with the interests of our other stockholders and the success of the

Company.

Reason for Stockholder Approval

Our

Common Stock is listed on The NASDAQ Capital Market, and, as such,

we are subject to the NASDAQ Marketplace Rules, including NASDAQ

Listing Rule 5635. NASDAQ Listing Rule 5635(d) requires stockholder

approval prior to the sale, issuance or potential issuance by the

issuer of common stock (or securities convertible into or

exercisable common stock) equal to 20% or more of the common stock

or 20% or more of the voting power outstanding before the issuance

for less than the greater of book or market value of the stock, in

connection with a transaction other than a public offering. If the

Third Tranche occurs, the total number of shares of our Common

Stock sold in the Financing will exceed 20% of the total number of

shares of our Common Stock issued and outstanding on the date the

Purchase Agreement was executed. All of our Common Stock sold or to

be sold and issued in the Financing has been priced at $2.60 per

share, which was less than $3.18, the consolidated closing bid

price per share of our Common Stock as reported on The NASDAQ

Capital Market immediately preceding the election of the Purchasers

to consummate the Second Tranche and, as such, the Third Tranche

requires stockholder approval pursuant to NASDAQ Listing Rule

5635(d).

In

addition, NASDAQ Listing Rule 5635(b) requires stockholder approval

for issuances of securities that will result in a

“

change of control

”

of the issuer and NASDAQ may deem a

change of control to occur when, as a result of an issuance, an

investor or a group would own, or have the right to acquire, 20% or

more of the outstanding shares of common stock or voting power and

such ownership or voting power of an issuer would be the largest

ownership position of the issuer. Each Purchaser has the right to

nominate a director to our Board of Directors, and, should the

Third Tranche close, the Purchasers would collectively beneficially

own more than 20% of the outstanding shares of our Common Stock,

and, as such, the Third Tranche may be deemed to require

stockholder approval pursuant to NASDAQ Listing Rule

5635(b).

Use of Proceeds

A

portion of the net proceeds received from the First Tranche and

Second Tranche have been used for general corporate purposes and we

anticipate that the remaining net proceeds from the First Tranche

and the Second Tranche and the net proceeds from the Third Tranche,

if approved, will be used for working capital and general corporate

purposes, which may include for our DTC initiative, research and

development expenses, capital expenditures, regulatory affairs

expenditures, clinical trial expenditures and acquisitions of new

technologies and investments. As of the date of this solicitation,

we cannot specify with certainty all of the particular uses of the

proceeds. Accordingly, we will retain broad discretion over the use

of such proceeds. Pending the application of the net proceeds, we

may invest the proceeds in marketable securities and short-term

investments.

Overall Effect of the Proposal

If

approved, this Proposal 1 would result in an increase by 1,965,417

shares in the number of shares of our Common Stock outstanding,

and, as a result, current stockholders who are not participating in

the Financing would own a smaller percentage of our outstanding

Common Stock and, accordingly, a smaller percentage interest in the

voting power, liquidation value and book value of our Common Stock.

The sale or resale of any of our Common Stock issued pursuant to

the Financing could cause the market price of our Common Stock to

decline.

This

approval would not limit our ability to engage in a public

offering, as defined by NASDAQ, or to issue or sell a number of

shares of our Common Stock (including shares issuable upon

conversion or exercise of convertible debt, warrants or other

securities exercisable for or convertible into our Common Stock)

that is less than 20% of the outstanding shares on terms that might

or might not be similar to those in this Proposal 1.

Vote Required

The

affirmative vote of a majority of all of the votes present or

represented and entitled to vote at the Special Meeting is required

to approve this Proposal 1. For clarity, pursuant to NASDAQ listing

rules, shares issued to the Purchasers in the First Tranche and

Second Tranche are not entitled to vote on this Proposal

1.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE IN FAVOR OF

PROPOSAL 1.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT

As of

May 25, 2017, there were approximately 46,093,894 shares of our

Common Stock outstanding.

The following table sets

forth certain information regarding the ownership of our Common

Stock as of May 25, 2017 by: each person known to us to

beneficially own more than 5% of our Common Stock; each director;

each of our named executive officers; and all directors and

executive officers as a group.

We calculated beneficial

ownership according to Rule 13d-3 of the Securities Exchange Act of

1934, as amended, as of that date.

Shares issuable upon exercise

of options or warrants that are exercisable within 60 days after

May 25, 2017 are included as beneficially owned by the

holder.

Beneficial

ownership generally includes voting and dispositive power with

respect to securities.

Unless otherwise indicated

below, the persons and entities named in the table have sole voting

and sole dispositive power with respect to all shares beneficially

owned. This table is based upon information supplied by officers,

directors and principal stockholders and Schedules 13D and 13G

filed with the SEC.

|

Name of Beneficial Owner (1)

|

Shares of Common Stock Beneficially Owned (2)

|

Aggregate Percentage Ownership

|

|

|

|

|

|

Champion River

Ventures Limited (3)

|

4,589,980

|

9.96

%

|

|

Dr. Phillip Frost

(4)

|

3,558,410

|

7.71

%

|

|

Pioneer Step

Holdings Limited (5)

|

3,059,988

|

6.64

%

|

|

Michael Brauser

(6)

|

3,055,467

|

6.61

%

|

|

Barry Honig

(7)

|

2,409,312

|

5.23

%

|

|

Black Sheep, FLP

(8)

|

2,075,052

|

4.50

%

|

|

Directors

|

|

|

|

Stephen Allen

(9)

|

133,334

|

*

|

|

Stephen Block

(10)

|

219,996

|

*

|

|

Jeff Baxter

(11)

|

89,167

|

*

|

|

Kurt

Gustafson

|

-

|

*

|

|

Steven

Rubin

|

-

|

*

|

|

Frank L. Jaksch Jr.

(12)

|

3,448,964

|

7.30

%

|

|

Robert Fried

(13)

|

708,207

|

1.53

%

|

|

Named Executive Officers

|

|

|

|

Frank L. Jaksch

Jr., Chief Executive Officer

|

|

|

|

Robert Fried,

President and Chief Strategy Officer

|

|

|

|

Thomas C. Varvaro,

Chief Financial Officer (14)

|

773,462

|

1.66

%

|

|

Troy Rhonemus,

Chief Operating Officer (15)

|

265,408

|

*

|

|

All directors and executive officers as a group

|

|

|

|

(7 Directors plus Chief Financial Officer

|

|

|

|

and Chief Operating

Officer)

(16)

|

5,638,537

|

11.59

%

|

*

Represents less than 1%.

(1)

Addresses for

certain of the beneficial owners listed are: Dr. Phillip Frost,

4400 Biscayne Blvd., Suite 1500, Miami, FL 33137; Michael Brauser,

4400 Biscayne Blvd., Suite 850, Miami, FL 33137; Barry Honig, 555

South Federal Highway, #450, Boca Raton, FL 33432; and Black Sheep,

FLP 6 Palm Hill Drive, San Juan Capistrano, CA 92675.

(2)

Beneficial

ownership is determined in accordance with the rules of the SEC and

includes voting or dispositive power with respect to shares

beneficially owned. Unless otherwise specified, reported ownership

refers to both voting and dispositive power. Shares of Common Stock

issuable upon the exercise of stock options or warrants within the

next 60 days are deemed to be converted and beneficially owned by

the individual or group identified in the Aggregate Percentage

Ownership column.

(3)

Based on beneficial

ownership reported on form Schedule 13D filed with SEC on May 26,

2017, (i) Champion River Ventures Limited (

“

Champion River

”

) beneficially owned and had sole

voting and dispositive power with respect to 4,589,980 shares (the

“

Champion

Shares

”

), (ii) Prime Tech

Global Limited (

“

Prime

Tech

”

), by virtue of

being the sole shareholder of Champion River, may be deemed to

beneficially own and have sole voting and dispositive power with

respect to the Champion Shares, (iii) Mayspin Management Limited

(

“

Mayspin

”

), by virtue of being the sole

shareholder of Prime Tech, may be deemed to beneficially own and

have sole voting and dispositive power with respect to the Champion

Shares, and (iv) Li Ka Shing, by virtue of being the sole

shareholder of Mayspin, may be deemed to beneficially own and have

sole voting and dispositive power with respect to the Champion

Shares. In addition, as set forth in the Schedule 13D, pursuant to

a Securities Purchase Agreement dated April 26, 2017 (the

“

Purchase

Agreement

”

) between

Champion River, Pioneer Step Holdings Limited (

“

Pioneer Step

”

) and the Company, until the final

closing of the transactions contemplated by the Purchase Agreement,

each of Champion River and Pioneer Step may be deemed to be members

of a

“

group

”

, as defined in Rule 13d-5 of the

Exchange Act and therefore may be deemed to beneficially own the

shares beneficially owned by each other solely for such purposes.

Each of Champion River, Prime Tech, Mayspin and Li Ka Shing have

disclaimed beneficial ownership of any Pioneer Shares and the

Champion Shares reported in the table do not include any of the

Pioneer Shares. The registered office address for Champion River

and Mayspin is Vistra Corporate Services Centre, Wickhams Cay II,

Road Town, Tortola, VG1110, British Virgin Islands and the

registered office address for PrimeTech is P.O. Box 901, East Asia

Chambers, Road Town, Tortola, British Virgin Islands, and the

correspondence address for each of Champion River, PrimeTech, and

Mayspin is c/o 7/F, Cheung Kong Center, 2 Queen

’

s Road Central, Hong Kong. The

business address of Li Ka Shing is c/o 7/F, Cheung Kong Center, 2

Queen

’

s Road Central,

Hong Kong.

(4)

Based on beneficial

ownership reported on form Schedule 13D filed with SEC on September

14, 2016. Includes 1,354,479 shares of Common Stock and 88,889

warrants to purchase Common Stock held by Frost Gamma Investments

Trust of which Dr. Phillip Frost is the trustee. Frost Gamma

Limited Partnership is the sole and exclusive beneficiary of Frost

Gamma Investments Trust. Dr. Frost is one of two limited partners

of Frost Gamma Limited Partnership. The general partner of Frost

Gamma Limited Partnership is Frost Gamma, Inc. and the sole

stockholder of Frost Gamma, Inc. is Frost-Nevada Corporation. Dr.

Frost is also the sole stockholder of Frost-Nevada Corporation.

Includes 2,115,042 shares held by Phillip and Patricia Frost

Philanthropic Foundation, Inc. of which Dr. Phillip Frost is

President.

(5)

Based on beneficial

ownership reported on form Schedule 13D filed with SEC on May 26,

2017, (i) Pioneer Step Holdings Limited (

“

Pioneer Step

”

) beneficially owned and had sole

voting and dispositive power with respect to 3,059,988 shares (the

“

Pioneer

Shares

”

) and (ii) Chau

Hoi Shuen Solina Holly, by virtue of being the sole shareholder of

Pioneer Step, may be deemed to beneficially own and have sole

voting and dispositive power with respect to the Pioneer Shares. In

addition, as set forth in the Schedule 13D, pursuant to the

Purchase Agreement, until the final closing of the transactions

contemplated by the Purchase Agreement, each of Pioneer Step and

Champion River may be deemed to be members of a

“

group

”

, as defined in Rule 13d-5 of the

Exchange Act and therefore may be deemed to beneficially own the

shares beneficially owned by each other solely for such purposes.

Each of Pioneer Step and Solina Chau have disclaimed beneficial

ownership of any Champion Shares and the Pioneer Shares reported in

the table do not include any of the Champion Shares. The registered

office address for Pioneer Step is Vistra Corporate Services

Centre, Wickhams Cay II, Road Town, Tortola, VG1110, British Virgin

Islands and its correspondence address is c/o 29th Floor, Harbour

Centre, 25 Harbour Road, Wanchai, Hong Kong. The business address

of Solina Chau is c/o 29th Floor, Harbour Centre, 25 Harbour Road,

Wanchai, Hong Kong.

(6)

Based on beneficial

ownership reported on form Schedule 13G filed with SEC on October

16, 2015 and Common Stock and warrants issued in a registered

direct offering on November 9, 2015. Includes 403,033 shares

directly held by Michael Brauser; 1,208,810 shares held by Michael

& Betsy Brauser TBE, 290,424 shares of Common Stock and 40,000

warrants held by Grander Holdings, Inc. 401K Profit Sharing Plan of

which Mr. Brauser is a trustee; 114,286 shares held by the Brauser

2010 GRAT of which Mr. Brauser is a trustee; 114,286 shares held by

Birchtree Capital, LLC of which Mr. Brauser is the manager; 564,286

shares held by BMB Holdings, LLLP of which Mr. Brauser is the

manager of its general partner and 238,095 shares held by Betsy

Brauser Third Amended Trust Agreement beneficially owned by Mr.

Brauser

’

s spouse which

are disclaimed by him. Includes 82,247 stock options exercisable

within 60 days.

(7)

Based on beneficial

ownership reported on form Schedule 13G filed with SEC on February

10, 2017. Includes (i) 1,800,418 shares of Common Stock held by

Barry Honig and (ii) 608,894 shares of Common Stock held by Renee

401K. Excludes (i) 68,888 shares of Common Stock underlying

warrants held by GRQ Consultants, Inc. 401K (

“

401K

”

) and (ii) 68,889 shares of Common

Stock underlying warrants held by GRQ Consultants, Inc. Roth 401K

FBO Barry Honig (

“

Roth

401K

”

), both of which

contain a 4.99% beneficial ownership blocker. Barry Honig is the

trustee of both 401K and Roth 401K and in such capacity has voting

and dispositive power over the securities held by such

entities.

(8)

Black Sheep, FLP is

a family limited partnership the co-general partners of which are

Frank L. Jaksch, Jr. and Tricia Jaksch and the sole limited

partners of which are Frank L. Jaksch, Jr., Tricia Jaksch and the

Jaksch Family Trust.

(9)

Includes 128,334

stock options exercisable within 60 days.

(10)

Includes 203,329

stock options exercisable within 60 days.

(11)

Includes 89,167

stock options exercisable within 60 days.

(12)

Includes 2,075,052

shares owned by Black Sheep, FLP beneficially owned by Mr. Jaksch

because he has shared voting power and shared dispositive power for

such shares. Includes 201,557 shares directly owned by Mr. Jaksch.

Includes 1,172,355 stock options exercisable within 60

days.

(13)

Direct ownership of

573,241 shares of Common Stock. Indirect ownership through 6,744

shares held by Jeremy Fried and 6,000 shares held by Benjamin

Fried, who are both sons of Robert Fried. Includes 122,222 stock

options exercisable within 60 days.

(14)

Includes 604,460

stock options exercisable within 60 days.

(15)

Direct ownership of

6,667 shares of Common Stock. Indirect ownership through Toni

Rhonemus IRA of 6,134 shares beneficially owned by Toni Rhonemus

who is Mr. Rhonemus

’

wife. Includes 252,607 stock options exercisable within 60

days.

(16)

Includes the shares

and stock options included above in footnotes (9) through

(15).

OTHER BUSINESS

As of

the date of this proxy statement, the management of the Company has

no knowledge of any business that may be presented for

consideration at the Special Meeting, other than that described

above. As to other business, if any, that may properly come before

the Special Meeting, or any adjournment thereof, it is intended

that the proxy hereby solicited will be voted in respect of such

business in accordance with the best judgment of the proxy

holders.

|

|

BY

ORDER OF THE BOARD OF DIRECTORS

/s/ Stephen Allen

Chairman

of the Board

June 20

, 2017

|

CHROMADEX CORPORATION

REVOCABLE PROXY SOLICITED BY THE BOARD OF DIRECTORS

FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST 10, 2017

The

undersigned stockholder of ChromaDex Corporation (the

“

Company

”

) hereby appoints each of Stephen

Allen and Thomas C. Varvaro as its attorneys, agents and proxies,

each with the power to appoint his substitute, and hereby

authorizes them to represent and to vote as the undersigned has

designated, all the shares of Common Stock of the Company held by

the undersigned at the special meeting of stockholders of the

Company (the

“

Special

Meeting

”

)

to be held at the

offices of ChromaDex Corporation, 10005 Muirlands Boulevard, Suite

G, Irvine, CA 92618, at 11:00 a.m., local time on

August 10

, 2017 and at any and all

postponements or adjournments thereof, with all powers that the

undersigned would possess if personally present, on the following

matters and in accordance with the following instructions, with

discretionary authority as to any other business that may properly

come before the meeting.

The

Board of Directors recommends a vote

“

FOR

”

the proposal listed

below.

|

|

Proposal 1.

|

Approval of Issuance of Common Stock in Connection with a Financing

Transaction

|

|

☐

FOR

|

☐

AGAINST

|

|

☐

ABSTAIN

|

THIS PROXY, WHEN PROPERLY EXECUTED AND RETURNED, WILL BE VOTED IN

THE MANNER DIRECTED BY THE UNDERSIGNED STOCKHOLDER. IF NO DIRECTION

IS GIVEN, THIS PROXY WILL BE VOTED FOR PROPOSAL 1, AS MORE

SPECIFICALLY DESCRIBED IN THE PROXY STATEMENT, AND IN THE

DISCRETION OF THE PROXY HOLDERS UPON ANY OTHER BUSINESS AS MAY

PROPERLY COME BEFORE THE SPECIAL MEETING OR ANY ADJOURNMENT OR

POSTPONEMENT THEREOF.

The

undersigned hereby ratifies and confirms all that said attorneys

and proxies, or any of them, or their substitutes, shall lawfully

do or cause to be done because of this proxy. The undersigned

acknowledges receipt of the Notice of Special Meeting and the Proxy

Statement which accompanies such notice.

|

|

|

|

|

|

|

DATED:

__________, 2017

|

|

|

|

(Name)

|

|

|

|

|

|

|

|

|

|

|

|

(Signature)

|

|

|

|

|

|

|

|

|

|

|

|

(Signature,

if held jointly)

|

Sign

exactly as name(s) appear(s) on stock certificate(s). If stock is

held jointly, each holder must sign. If signing is by attorney,

executor, administrator, trustee or guardian, give full title as

such. A corporation or partnership must sign by an authorized

officer or general partner, respectively.

PLEASE SIGN, DATE AND RETURN THIS

PROXY IN THE ENVELOPE PROVIDED TO EQUITY STOCK TRANSFER C/O MOHIT

BHANSALI AT 237 W 37

TH

ST. SUITE 602, NEW YORK, NY

10018.

You may

also submit your proxy facsimile to (646) 201-9006 or

electronically on the Internet by going to

http://www.equitystock.com

and following the instructions provided therein.

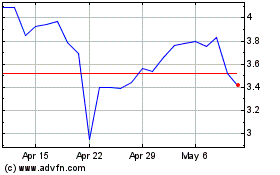

ChromaDex (NASDAQ:CDXC)

Historical Stock Chart

From Aug 2024 to Sep 2024

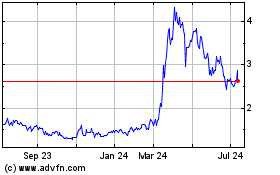

ChromaDex (NASDAQ:CDXC)

Historical Stock Chart

From Sep 2023 to Sep 2024