ByPaul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

Holiday shopping and shipping is about to get more expensive.

United Parcel Service Inc. is adding a surcharge onto most online

orders around the Black Friday weekend and the week before

Christmas, the latest move by package carriers to recoup the big

investments they make in peak-season deliveries and the higher

costs that come with e-commerce business. The surcharge is a first

for UPS, and the WSJ's Paul Ziobro writes that it's among the

growing add-on charges that have retailers facing the prospect of

either eating the higher costs or passing them along by raising

prices. The explosion in online shopping has created a kind of

tug-of-war between parcel carriers and retailers over the thinner

margins and added complications of delivering goods to homes. The

new UPS charges will apply only to the busiest shopping days, and

only to residential deliveries. That may push retailers to scale up

strategies like in-store pickups of online purchases, something it

appears UPS would also like to see.

Blue Apron Holdings Inc. is pushing forward an initial public

offering just as food delivery is getting big new attention, but

it's unclear whether that will help the startup. The WSJ's Ezequiel

Minaya reports the company is at the center of a growing meal-kit

delivery business that is carving into sales of traditional grocery

stores as consumer change their food-buying habits. With shares

expected to price between $15 and $17, Blue Apron is going public

just as Amazon.com Inc. is plunging into the grocery business,

raising big new questions both for legacy supermarkets and

startups. Amazon's entry could change the game for companies like

Blue Apron and Instacart that have used new technology and refined

logistics to pioneer new paths for food delivery. Blue Apron has

gained nearly $800 million in annual revenue so far, but the debt

and losses also are growing, and well-funded competition from

Amazon could make profits even harder to deliver.

Amazon's surprise deal to buy Whole Foods Market Inc. could

speed up efforts to bring more digital tools like data analytics to

supply chains. Gartner Inc. chief forecaster John Lovelock tells

the WSJ's Angus Loten the "notoriously short shelf life" of food

may push Amazon to put its technology to work across Whole Foods'

distribution channels, from warehousing to deliveries and other

logistics areas. That will give Amazon another area to test its

ability to tie analytics to more sophisticated, data-driven

marketing strategies. Many big grocers already are implementing new

tools to more closely align inventory management and marketing.

Kroger Co. has started using cameras and infrared sensors to track

foot traffic in its stores, and the company is testing sensor-laden

interactive shelves that can detect shoppers in the aisles via

their smartphones and provide personalized pricing and product

suggestions as they shop.

E-COMMERCE

Alibaba Group Holding Ltd. is trying to get U.S. entrepreneurs

to help flip the script on U.S. trade with China. In a two-day

event in Detroit, Alibaba chairman Jack Ma is offering an expected

3,000 U.S. small-business owners tips on how to market and ship

wares to Chinese consumers. It's part of an increasingly urgent

competition between Alibaba and Chinese rival JD.com to tap into

the U.S. market, the WSJ's Liza Lin and Laura Stevens report, and

to corral customers that are starting to move away from the big

sites and toward niche e-commerce providers. To do that, Alibaba

will have to convince sellers it's conquered its problem with

counterfeits. The U.S. last year reinstated Alibaba's Taobao site

to a list of "notorious" marketplaces for fakes, and some U.S.

exporters say they've lost business to cheaper, Chinese-made

knockoffs. Still, American sellers will be tempted by China's $771

billion online retailing market, which is larger than the U.S.

market.

QUOTABLE

IN OTHER NEWS

U.S. new-home construction fell 5.5 % in May, the third straight

monthly decline. (WSJ)

Japan's exports jumped 14.9% in May, the strongest jump since

January 2015. (WSJ)

The unemployment rates in California and six other states fell

to record lows last month. (WSJ)

The U.K. and the European Union concluded their first day of

negotiations over Britain's departure from the bloc. (WSJ)

General Motors Co. will eliminate a shift at a sedan plant in

Kansas City, Kan., laying off about 1,000 people. (WSJ)

Cruise Automation, the startup owned by GM, is creating a

mapping business, a move that could help the auto giant in the race

to develop self-driving vehicles. (WSJ)

A new generation of aerospace startups is disrupting the

attention to traditional operators at this year's Paris

International Air Show. (WSJ)

Boeing Co. lifted its annual 20-year forecast for plane

deliveries to 41,030 jetliners with a value topping $6 trillion at

list prices. (WSJ)

Auto hauler and logistics provider Jack Cooper has reached a

deal with bondholders to restructure more than $400 million in

debt. (WSJ)

Three years after the price of crude began its rapid descent,

the oil industry and investors are finally resigned to the idea of

lower prices for a long period. (WSJ)

EQT Corp. agreed to buy Rice Energy Inc. for $6.7 billion, the

latest proposed tie-up between energy producers after low oil

prices roiled the industry. (WSJ)

Striking truck drivers picketing at the ports of Los Angeles and

Long Beach caused some traffic delays but operations continued

normally at cargo terminals. (Los Angeles Daily News)

Auto supplier Robert Bosch GmbH will build a $1.1 billion

semiconductor plant in Dresden, Germany to meet surging demand for

components for self-driving vehicles. (Bloomberg)

The chief executive of China's JD.com says drones and other

robotics technology should help parcel carriers pare their

logistics costs. (CNBC)

German shipping investment group MPC Container Ships plans to

expand its holdings to 50 vessels and seek a public stock offering

in New York. (Lloyd's List)

DAT says U.S. truckload spot market volume rose 7.3% in May to

its highest level since September 2015. (DC Velocity)

Diesel fuel prices in the U.S. dipped to the lowest level in six

months. (Commercial Carrier Journal)

More luxury fashion brands are buying farms to have better

control of their supply chains. (Business of Fashion)

Egypt will buy 100 new multi-use locomotives from General

Electric Co. for $575 million to upgrade its rail network.

(Reuters)

DHL Express will buy four more A330-300 passenger-to-freighter

conversions from ST Aerospace subsidiary Elbe Flugzeugwerke. (Air

Cargo News)

The share of sellers who use Fulfillment by Amazon is growing in

all countries where Amazon offers the service for its marketplace

users. (Ecommerce News)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin , @jensmithWSJand @EEPhillips_WSJand follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

June 20, 2017 06:47 ET (10:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

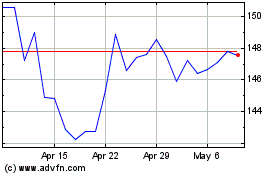

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

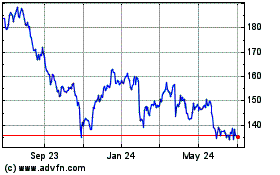

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2023 to Apr 2024