Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

June 19 2017 - 5:30PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement

No. 333-214949

Compass Diversified Holdings

Pricing Term Sheet

4,000,000

Shares

7.250% Series A Preferred Shares

June 19, 2017

The information in this

pricing term sheet relates to Compass Diversified Holding’s offering of its 7.250% Series A Preferred Shares (the “Offering”) and should be read together with the preliminary prospectus supplement dated June 19, 2017 relating to

the Offering (the “Preliminary Prospectus Supplement”), including the documents incorporated by reference therein, and the base prospectus dated December 7, 2016, each filed pursuant to Rule 424(b) under the Securities Act of 1933, as

amended, Registration Statement

No. 333-214949.

The information in this communication supersedes the information in the Preliminary Prospectus Supplement and the accompanying prospectus to the extent

inconsistent with the information in the Preliminary Prospectus Supplement. All references to dollar amounts are references to U.S. dollars.

|

|

|

|

|

Issuer:

|

|

Compass Diversified Holdings (the “Trust”)

|

|

|

|

|

Title of Security:

|

|

7.250% Series A Preferred Shares (the “Shares”)

|

|

|

|

|

Size:

|

|

$100,000,000 (4,000,000 Shares)

|

|

|

|

|

Over-allotment Option:

|

|

$15,000,000 (600,000 Shares)

|

|

|

|

|

Liquidation Preference:

|

|

$25.00 per Share

|

|

|

|

|

Maturity:

|

|

Perpetual

|

|

|

|

|

Distribution Rate:

|

|

At a rate per annum equal to 7.250% only when, as and if declared. Distributions on the Shares are

non-cumulative.

|

|

|

|

|

Distribution Payment Dates:

|

|

The 30th of each January, April, July and October, commencing on October 30, 2017 (long initial distribution period).

|

|

|

|

|

Optional Redemption:

|

|

The Shares may be redeemed at the Trust’s option, in whole or in part, at any time on or after July 30, 2022 at a price of $25.00 per Share, plus declared and unpaid distributions to, but excluding, the redemption date,

without payment of any undeclared distributions. Holders of the Shares will have no right to require the redemption of the Shares.

|

|

|

|

|

Tax Redemption:

|

|

If a Tax Redemption Event (as described in the Preliminary Prospectus Supplement) occurs prior to July 30, 2022, the company, at its option, may cause the Trust to redeem the Series A Preferred Shares, in whole but not in part,

upon at least 30 days’ notice, within 60 days of the occurrence of such Tax Redemption Event, out of funds received by the Trust on the corresponding trust preferred interests and legally available therefor, at a price of $25.25 per Series A

Preferred Share, plus declared and unpaid distributions to, but excluding, the redemption date, without payment of any undeclared distributions.

|

|

|

|

|

Repurchase at the Option of Holders upon a Fundamental Change:

|

|

If a Fundamental Change (as described in the Preliminary Prospectus Supplement) occurs, unless, prior to or concurrently with the time we are required to make an offer to repurchase the Series A Preferred Shares, we provide a

redemption notice with respect to all of the outstanding Series A Preferred Shares, we will be required to offer to repurchase the Series A Preferred Shares, out of funds received by the Trust on the corresponding trust preferred interests, at a

purchase price of $25.25 per Series A Preferred Share, plus declared and unpaid distributions to, but excluding, the date of purchase, without payment of any undeclared distributions.

|

|

|

|

|

|

|

|

|

Distribution Rate

Step-Up

Following Failure to make

Repurchase Offer:

|

|

If (i) a Fundamental Change occurs and (ii) we do not give notice prior to the 31st day following the Fundamental Change to repurchase or redeem all the outstanding Series A Preferred Shares, the distribution rate per

annum on the Series A Preferred Shares will increase by 5.00%, beginning on the 31st day following such Fundamental Change. Notwithstanding any requirement that we offer to repurchase or redeem all the outstanding Series A Preferred Shares, the

increase in the distribution rate is the sole remedy to holders in the event we fail to do so, and following any such increase, we will be under no obligation to offer to repurchase or redeem any Series A Preferred Shares.

|

|

|

|

|

Trade Date:

|

|

June 19, 2017

|

|

|

|

|

Expected Settlement Date:

|

|

June 28, 2017 (T+7)

|

|

|

|

|

Public Offering Price:

|

|

$25.00 per Share

|

|

|

|

|

Underwriting Discounts and Commission:

|

|

$0.7875 per Share

|

|

|

|

|

Net Proceeds (before expenses) to the Trust:

|

|

$96,850,000

|

|

|

|

|

Listing:

|

|

The Trust intends to apply to list the Shares on the New York Stock Exchange under the symbol “CODI PR A”.

|

|

|

|

|

CUSIP/ISIN

|

|

20451Q 203/US20451Q2030

|

|

|

|

|

Ratings

|

|

The Series A Preferred Shares will not be rated.

|

|

|

|

|

Joint Book-Running Managers:

|

|

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

UBS Securities LLC

|

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to

which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get

documents for free by visiting EDGAR or the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request by calling Merrill Lynch, Pierce,

Fenner & Smith Incorporated toll-free at

1-800-294-1322,

or UBS Securities LLC toll-free at

1-888-827-7275.

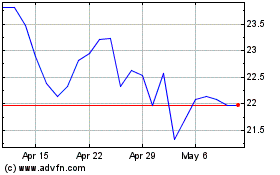

Compass Diversified (NYSE:CODI)

Historical Stock Chart

From Mar 2024 to Apr 2024

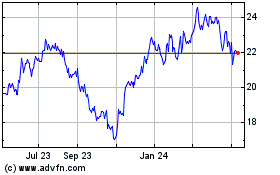

Compass Diversified (NYSE:CODI)

Historical Stock Chart

From Apr 2023 to Apr 2024