Scott Anderson Steps Down as Chairman,

President and CEO

Jim Wiltz to Serve as Interim President and

CEO; John Buck Appointed Chairman

Patterson Companies, Inc. (Nasdaq: PDCO) today announced that

Scott P. Anderson, President, Chief Executive Officer and Chairman

of the Board, will step down from those roles, effective

immediately. Mr. Anderson will continue to serve as a Director

until the 2017 Annual Meeting of Shareholders, but will not stand

for re-election to the Board. James W. Wiltz, a current director

and the Company’s former Chief Executive Officer, will assume the

role of Interim President and Chief Executive Officer and remain on

the Board. John D. Buck, currently the Company’s Lead Director,

will assume the role of non-executive Chairman. The Company’s Board

of Directors has formed a search committee, consisting of Ellen A.

Rudnick, Jody H. Feragen, Neil A. Schrimsher and Mr. Buck, and has

retained Spencer Stuart to begin an immediate search for a

permanent President and Chief Executive Officer.

“On behalf of the Board, I want to thank Scott for his many

contributions to Patterson throughout his tenure. Under his

leadership, Patterson has refined its focus on core, synergistic

markets, modernized its technology platform and enhanced its team

to position the Company to drive innovation, profitable growth and

long-term shareholder value. After careful consideration, Scott and

the Board have mutually determined that now is the time for a new

leader to guide Patterson going forward,” said Mr. Buck. “I also

want to thank Jim for stepping in on an interim basis to lead the

Company that he knows so well. I am confident Patterson is in

excellent hands as the Board conducts a thorough search for the

next leader.”

“I’m pleased to step into the role of Interim CEO,” said Mr.

Wiltz. “I look forward to working with the team as we maintain a

laser-focus on sales execution while ensuring we remain the partner

of choice across our core markets with the right sales, service,

support and product offerings to capitalize on our competitive

strengths and the market opportunities ahead.”

Mr. Anderson said, “It has been my honor to lead this great

Company over the past seven years and to be a part of its growth

story for the past 25 years. We have amazing customers and

employees, all of whom have very bright futures ahead. I look

forward to assisting the Board in the transition and watching the

Company thrive for decades to come.”

Mr. Anderson has agreed to serve in a Special Advisor capacity

to the Company, subject to certain non-compete and non-solicit

provisions and other terms and conditions, and will be available to

the Company to advise on certain matters at its sole request. The

full details of the agreement will be filed with the Securities and

Exchange Commission.

James W. Wiltz Biography

Mr. Wiltz has served as a director of Patterson since March 2001

and held a variety of roles over more than 40 years at Patterson,

before retiring as the Company’s President and Chief Executive

Officer in April 2010, a role he had held since May 2005. Prior to

assuming that role, Mr. Wiltz served as our President and Chief

Operating Officer from April 2003 through May 2005. From 1996 to

2003, Mr. Wiltz served as President of our subsidiary, Patterson

Dental Supply, Inc. Since January 2010, Mr. Wiltz has served as a

director of HealthEast Care System, a non-profit healthcare

provider, and on its finance committee.

Fiscal 2018 Guidance

Patterson reiterated its previously provided earnings guidance

from continuing operations for fiscal 2018:

- GAAP earnings are expected to be in the

range of $1.90 to $2.05 per diluted share.

- Non-GAAP adjusted earnings1 are

expected to be in the range of $2.25 to $2.40 per diluted

share.

- Our non-GAAP adjusted earnings1

guidance excludes the after-tax impact of:

- Deal amortization expense of

approximately $25.5 million ($0.27 per diluted share)

- Integration and business restructuring

expenses of approximately $6.4 million ($0.07 per diluted

share)

- Transaction-related costs of

approximately $0.3 million ($0.00 per diluted share)

The Company’s guidance is for current continuing operations as

well as completed or previously announced acquisitions and does not

include the impact of potential future acquisitions or similar

transactions, if any, or impairments and material restructurings

beyond those previously publicly disclosed. The guidance assumes

North American and international market conditions similar to those

experienced in fiscal 2017.

1Non-GAAP Financial Measures

The Reconciliation of GAAP to non-GAAP Measures table appearing

below is provided to adjust reported GAAP measures, namely earnings

from continuing operations, net income from continuing operations,

and earnings per diluted share from continuing operations, for the

impact of transaction related costs, deal amortization, intangible

asset impairment, integration and business restructuring expenses,

accelerated debt issuance costs and discrete tax matters.

Management believes that these non-GAAP measures may provide a

helpful representation of the Company’s earnings guidance for

fiscal 2018, and enable comparison of financial results between

periods where certain items may vary independent of business

performance. These non-GAAP financial measures are presented

solely for informational and comparative purposes and should not be

regarded as a replacement for corresponding, similarly captioned,

GAAP measures.

About Patterson Companies, Inc.

Patterson Companies, Inc. (Nasdaq: PDCO) is a value-added

distributor serving the dental and animal health markets.

Dental Market

Patterson’s Dental segment provides a virtually complete range

of consumable dental products, equipment and software, turnkey

digital solutions and value-added services to dentists and dental

laboratories throughout North America.

Animal Health Market

Patterson’s Animal Health segment is a leading distributor of

products, services and technologies to both the production and

companion animal health markets in North America and the U.K.

This press release contains certain forward-looking statements,

as defined in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are information of a non-historical

nature and are subject to risks and uncertainties that are beyond

Patterson's ability to control. Forward-looking statements

generally can be identified by words such as "believes," "expects,"

"anticipates," "foresees," "forecasts," "estimates" or other words

or phrases of similar import. It is uncertain whether any of the

events anticipated by the forward-looking statements will transpire

or occur, or if any of them do, what impact they will have on the

results of operations and financial condition of Patterson or the

price of Patterson stock. These forward-looking statements involve

certain risks and uncertainties that could cause actual results to

differ materially from those indicated in such forward-looking

statements, including but not limited to the other risks and

important factors contained and identified in Patterson's filings

with the Securities and Exchange Commission, such as its Quarterly

Reports on Form 10-Q and Annual Reports on Form 10-K, any of which

could cause actual results to differ materially from the

forward-looking statements. Any forward-looking statement in this

press release speaks only as of the date on which it is made.

Except to the extent required under the federal securities laws,

Patterson does not intend to update or revise the forward-looking

statements.

PATTERSON COMPANIES, INC. RECONCILIATION OF GAAP TO

NON-GAAP MEASURES (Dollars in thousands, except per share

amounts) (Unaudited) For the three months

ended April 29, 2017 GAAP

Transaction-related

costs

Deal amortization

Intangible asset

impairment

Integration and business

restructuring expenses

Accelerated debt

issuance costs

Discrete tax matters

Non-GAAP Operating income from continuing

operations $ 96,155 $ 178 $ 9,745 $ — $ 257 $ — $ — $

106,335 Other expense, net (10,368) —

—

— — — — (10,368) Income from continuing operations

before taxes 85,787 178 9,745 — 257 — — 95,967 Income tax expense

24,430 67 3,375 — 98 — 2,383 30,353 Net income from

continuing operations $ 61,357 $ 111 $ 6,370 $ — $ 159 $ —

$ (2,383) $ 65,614 Diluted EPS from continuing operations* $

0.65 $ — $ 0.07 $ — $ — $ — $ (0.03) $ 0.69

Consolidated operating income as a % of sales 6.7% 7.4% Effective

tax rate 28.5% 31.6%

For the three months ended April 30,

2016 GAAP

Transaction-related

costs

Deal amortization

Intangible asset

impairment

Integration and business

restructuring expenses

Accelerated debt

issuance costs

Discrete tax matters

Non-GAAP Operating income from continuing operations $

106,344 $ 567 $ 10,779 $ — $ 1,948 $ — $ — $ 119,638 Other expense,

net (8,543) — — — — — — (8,543) Income from

continuing operations before taxes 97,801 567 10,779 — 1,948 — —

111,095 Income tax expense 32,181 214 3,869 — 736 — —

37,000 Net income from continuing operations $ 65,620 $ 353 $ 6,910

$ — $ 1,212 $ — $ — $ 74,095 Diluted EPS from

continuing operations* $ 0.68 $ — $ 0.07 $ — $ 0.01 $ —

$ — $ 0.77 Consolidated operating income as a % of

sales 7.3 % 8.2 % Effective tax rate 32.9 % 33.3 %

For

the twelve months ended April 29, 2017 GAAP

Transaction-related

costs

Deal amortization

Intangible asset

impairment

Integration and business

restructuring expenses

Accelerated debt

issuance costs

Discrete tax matters

Non-GAAP Operating income from continuing operations $

287,928 $ 1,657 $ 39,957 $ 36,312 $ 6,561 $ — $ — $ 372,415 Other

expense, net (37,047) — — — — — — (37,047) Income

from continuing operations before taxes 250,881 1,657 39,957 36,312

6,561 — — 335,368 Income tax expense 77,093 625 13,769 13,263 2,481

— 4,789 112,020 Net income from continuing operations

$ 173,788 $ 1,032 $ 26,188 $ 23,049 $ 4,080 $ — $

(4,789) $ 223,348 Diluted EPS from continuing operations* $ 1.82 $

0.01 $ 0.27 $ 0.24 $ 0.04 $ — $ (0.05) $ 2.34

Consolidated operating income as a % of sales 5.1 % 6.7 % Effective

tax rate 30.7 % 33.4 %

For the twelve months ended April

30, 2016 GAAP

Transaction-related

costs

Deal amortization

Intangible asset

impairment

Integration and business

restructuring expenses

Accelerated debt

issuance costs

Discrete tax matters

Non-GAAP Operating income from continuing operations $

347,713 $ 13,699 $ 39,468 $ — $ 7,144 $ — $ — $ 408,024 Other

expense, net (46,020) — — — — 5,153 — (40,867) Income

from continuing operations before taxes 301,693 13,699 39,468 —

7,144 5,153 — 367,157 Income tax expense 116,009 3,339 14,051 —

2,701 1,948 (12,300) 125,748 Net income from

continuing operations $ 185,684 $ 10,360 $ 25,417 $ — $ 4,443 $

3,205 $ 12,300 $ 241,409 Diluted EPS from continuing

operations* $ 1.90 $ 0.11 $ 0.26 $ — $ 0.05 $ 0.03 $

0.13 $ 2.47 Consolidated operating income as a % of sales

6.5 % 7.6 % Effective tax rate 38.5 % 34.2 %

* May not sum due to rounding

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170601005726/en/

Patterson Companies, Inc.Ann B. Gugino, 651-686-1600Executive

Vice President & CFOorJohn M. Wright, 651-686-1364Vice

President, Investor Relations

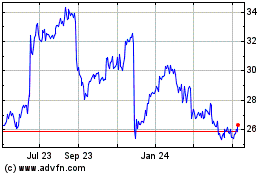

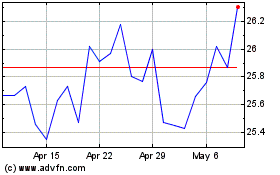

Patterson Companies (NASDAQ:PDCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Patterson Companies (NASDAQ:PDCO)

Historical Stock Chart

From Apr 2023 to Apr 2024