Additional Proxy Soliciting Materials (definitive) (defa14a)

May 30 2017 - 11:45AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act

of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐ Preliminary Proxy Statement

|

|

☐

Confidential, for Use of the Commission Only(as permitted

by Rule 14a-6(e)(2))

|

|

☐ Definitive Proxy

Statement

|

|

|

|

|

|

☒ Definitive Additional Materials

|

|

|

|

|

|

|

☐ Soliciting Material Pursuant to §240.14a-12

|

|

|

E

XXON

M

OBIL

C

ORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and

state how it was determined):

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

Rites of engagement

By

Jeff Woodbury

Shareholders will gather in Dallas tomorrow for the 135

th

annual meeting in ExxonMobil’s

long history.

As

Suzanne McCarron noted last year

, ExxonMobil’s annual meeting is a two-way street of engagement, not just a “State of the

Union” address from our chairman and CEO, Darren Woods, about the health of the company. It offers an opportunity for shareholders to share their comments and questions with our management and board of directors.

This once-yearly event is not the only avenue for shareholders to express their thoughts to ExxonMobil.

The reality is that we have a robust program of engagement with shareholders throughout the year. For example, over the past 12 months we have had direct engagement

– in-person meetings, phone conversations, correspondence, webcasts, etc. – with diverse groups and individuals representing about a quarter of ExxonMobil’s 4.2 billion outstanding shares.

These regular discussions and meetings help shape the approach we take to our business and to the environment in which we operate. The influence of outside stakeholders

can be seen in many of our company publications and disclosures, particularly the

Corporate Citizenship Report

, as well as the newly released

Energy & Carbon Summary

that was published along with

ExxonMobil’s

2017 proxy statement

.

Investor engagement covers a range of issues. In recent years, the topic of managing the potential risks of climate

change has been present in many of these discussions – discussions that inform our deliberations and have helped ExxonMobil clarify and articulate our positions.

We embrace the opportunity in these discussions, as well as at the annual meeting, to highlight our work in the search

for solutions – particularly the

development of technologies

to increase efficiency and to supply lower-emissions energy both economically and sustainably.

Over the course of a year, shareholders will put forth any number of proposals from a number of perspectives covering a host of topics.

In many of these instances, when we meet we are able to forge consensus, benefiting both parties. When we are unable to come to an agreement, those proposals are then

put to a vote at the annual meeting.

This year there are

nine such shareholder proposals

. For many of these, the corporation agrees with the underlying

objective of the proposal – we just have a different view on the best means to achieve it.

Every shareholder should come to an ExxonMobil annual meeting at

some point in his or her lifetime – like a tour of Wall Street and the New York Stock Exchange, it is a visible reminder of the strength of publicly traded companies and the role of the capital markets in underpinning not only the American but

the global economy.

If you can’t make it in person tomorrow, you can still follow along via webcast. I encourage everyone to tune in at 9:30 a.m. CT.

Jeff Woodbury is ExxonMobil’s vice president of investor relations and corporate secretary.

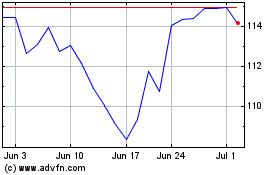

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

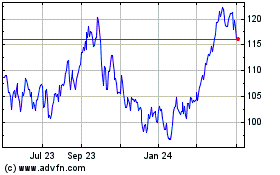

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024