As filed with the Securities and Exchange Commission on May 24, 2017

Securities Act Registration No. 333-214506

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

N-2

☒

Registration Statement under the Securities Act of 1933

☐

Pre-Effective

Amendment No.

☒

Post-Effective Amendment No. 2

GOLDMAN SACHS

BDC, INC.

(Exact Name of Registrant as Specified in the Charter)

200 West Street

New

York, New York 10282

(Address of Principal Executive Offices)

Registrant’s Telephone Number, including Area Code: (212)

902-0300

Jonathan Lamm

Neena

Reddy

Goldman Sachs BDC, Inc.

200 West Street

New

York, New York 10282

(Name and Address of Agent for Service)

Copies of information to:

|

|

|

|

|

|

|

Stuart Gelfond, Esq.

Joshua Wechsler, Esq.

Fried, Frank, Harris, Shriver & Jacobson LLP

One New York Plaza

New York, New York

10004

Telephone: (212)

859-8000

Facsimile: (212)

859-4000

|

|

Geoffrey R.T. Kenyon, Esq.

Thomas J. Friedmann, Esq.

William J. Tuttle, Esq.

Dechert LLP

One International Place, 40

th

Floor

100 Oliver Street

Boston,

Massachusetts 02110

Telephone: (617)

728-7100

Facsimile:

(617)426-6567

|

|

Margery K. Neale, Esq.

James G. Silk, Esq.

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New

York, New York 10019

Telephone: (212)

728-8000

Facsimile: (212)

728-9294

|

Approximate date of proposed public offering:

From time to time after the effective date of this Registration Statement

If any securities being registered on this form will be offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933,

other than securities offered in connection with dividend or interest reinvestment plans, check the following box ☒

EXPLANATORY NOTE

This Post-Effective Amendment No. 2 to the Registration Statement on Form

N-2

(File

No. 333-214506)

of Goldman Sachs BDC, Inc. (the “Registration Statement”) is being filed pursuant to Rule 462(d) under the Securities Act of 1933, as amended (the “Securities Act”), solely

for the purpose of filing exhibits to the Registration Statement. Accordingly, this Post-Effective Amendment No. 2 consists only of a facing page, this explanatory note and Part C of the Registration Statement, which sets forth the exhibits to

the Registration Statement. This Post-Effective Amendment No. 2 does not modify any other part of the Registration Statement. Pursuant to Rule 462(d) under the Securities Act, this Post-Effective Amendment No. 2 shall become effective

immediately upon filing with the Securities and Exchange Commission. The contents of the Registration Statement are hereby incorporated by reference.

GOLDMAN SACHS BDC, INC.

PART C

OTHER

INFORMATION

Item 25. Financial Statements and Exhibits

(1) Financial Statements

The following

financial statements of Goldman Sachs BDC, Inc. are provided in Part A of this Registration Statement.

Audited Financial Statements

|

|

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

|

|

F-2

|

|

|

|

|

|

Statements of Assets and Liabilities as of December 31, 2015 and December 31,

2014

|

|

|

F-3

|

|

|

|

|

|

Statements of Operations for the years ended December 31, 2015 and December 31, 2014 and

December 31, 2013

|

|

|

F-4

|

|

|

|

|

|

Statements of Changes in Net Assets for the years ended December 31, 2015 and

December 31, 2014 and December 31, 2013

|

|

|

F-5

|

|

|

|

|

|

Statements of Cash Flows for the years ended December 31, 2015 and December 31, 2014 and

December 31, 2013

|

|

|

F-6

|

|

|

|

|

|

Schedules of Investments as of December 31, 2015 and December 31, 2014

|

|

|

F-7

|

|

|

|

|

|

Notes to Financial Statements

|

|

|

F-13

|

|

|

|

|

|

Interim Unaudited Financial Statements

|

|

|

|

|

|

|

|

|

Statements of Assets and Liabilities as of September 30, 2016 (Unaudited) and

December 31, 2015

|

|

|

F-46

|

|

|

|

|

|

Statements of Operations for the three and nine months ended September 30, 2016 (Unaudited)

and September 30, 2015 (Unaudited)

|

|

|

F-47

|

|

|

|

|

|

Statements of Changes in Net Assets for the nine months ended September 30, 2016 (Unaudited)

and September 30, 2015 (Unaudited)

|

|

|

F-48

|

|

|

|

|

|

Statements of Cash Flows for the nine months ended September 30, 2016 (Unaudited) and

September 30, 2015 (Unaudited)

|

|

|

F-49

|

|

|

|

|

|

Schedules of Investments as of September 30, 2016 (Unaudited) and December 31,

2015

|

|

|

F-50

|

|

|

|

|

|

Notes to Financial Statements (Unaudited)

|

|

|

F-56

|

|

(2) Exhibits

|

(a)(1)

|

Certificate of Incorporation (incorporated by reference to Exhibit (a) to

pre-effective

Amendment No. 7 to the Company’s Registration Statement on Form

N-2

(file no.

333-187642),

filed on March 3, 2015).

|

|

(b)

|

Bylaws (incorporated by reference to Exhibit (a) to

pre-effective

Amendment No. 7 to the Company’s Registration Statement on Form

N-2

(file no.

333-187642),

filed on March 3, 2015).

|

|

(d)(1)

|

Indenture, dated October 3, 2016, between Goldman Sachs BDC, Inc. and Wells Fargo Bank, National Association, as Trustee (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K

(file no.

814-00998),

filed on October 3, 2016).

|

C-1

|

(d)(2)

|

Form of 4.50% Convertible Note Due 2022 (incorporated by reference to Exhibit 4.2 to the Company’s Current Report on

Form 8-K

(file no.

814-00998),

filed on October 3, 2016).

|

|

(d)(3)

|

Form of Indenture (incorporated by reference to Exhibit (d)(3) to the Company’s Registration Statement on

Form N-2

(File

no. 333-214506),

filed on January 19, 2017).

|

|

(d)(4)

|

Form of Subscription Certificate (incorporated by reference to Exhibit (d)(4) to the Company’s Registration Statement on

Form N-2

(File no.

333-214506),

filed on January 19, 2017).

|

|

(d)(5)

|

Form of Subscription Agent Agreement (incorporated by reference to Exhibit (d)(5) to the Company’s Registration Statement on

Form N-2

(File no.

333-214506),

filed on January 19, 2017).

|

|

(d)(6)

|

Form of Warrant Agreement (incorporated by reference to Exhibit (d)(6) to the Company’s Registration Statement on

Form N-2

(File no.

333-214506),

filed on January 19, 2017).

|

|

(d)(7)

|

Form of Certificate of Designations for Preferred Stock (incorporated by reference to Exhibit (d)(7) to the Company’s Registration Statement on Form

N-2

(File no.

333-214506),

filed on January 19, 2017).

|

|

(d)(8)

|

Statement of Eligibility of Trustee on Form

T-1

(incorporated by reference to Exhibit (d)(8) to the Company’s Registration Statement on Form

N-2

(File no.

333-214506),

filed on January 19, 2017).

|

|

(e)

|

Dividend Reinvestment Plan, amended as of August 2, 2016 (incorporated by reference to Exhibit 10.2 to the to the Company’s Quarterly Report on Form

10-Q

(file no.

814-00998),

filed on August, 2016).

|

|

(g)

|

Amended and Restated Investment Management Agreement, dated as of January 1, 2015, between the Company and Goldman Sachs Asset Management, L.P. (incorporated by reference to Exhibit (g) to

pre-effective

Amendment No. 7 to the Company’s Registration Statement on Form

N-2

(file no.

333-187642),

filed on

March 3, 2015.)

|

|

(h)(1)

|

Form of Underwriting Agreement for Equity Securities (incorporated by reference to Exhibit (h)(1) to the Company’s Registration Statement on Form

N-2

(File no.

333-214506),

filed on January 19, 2017).

|

|

(h)(2)

|

Underwriting Agreement, dated May 18, 2017, among the Company, the Adviser and the several underwriters named in Schedule A thereto.

|

|

(j)

|

Custody Agreement, dated as of April 1, 2013, between Registrant and State Street Bank and Trust Company (incorporated by reference to Exhibit (j) to

pre-effective

Amendment No. 8 to the Company’s Registration Statement on Form

N-2

(file

no. 333-187642),

filed on March 10, 2015).

|

|

(k)(1)

|

Administration Agreement, dated as of April 1, 2013, between the Company and the Adviser (incorporated by reference to Exhibit (k)(3) to

pre-effective

Amendment No. 7 to

the Company’s Registration Statement on Form

N-2

(file no.

333-187642),

filed on March 3, 2015).

|

|

(k)(2)

|

Senior Secured Revolving Credit Agreement, dated as of September 19, 2013 among the Company, as Borrower, the Lenders party thereto, and SunTrust Bank, as Administrative Agent (incorporated by reference to Exhibit

(k)(5) to

pre-effective

Amendment No. 8 to the Company’s Registration Statement on Form

N-2

(file no.

333-187642),

filed on March 10, 2015).

|

|

(k)(3)

|

First Omnibus Amendment to Senior Secured Revolving Credit Agreement and Guarantee and Security Agreement, dated as of October 3, 2014 among the Company, as Borrower, the Lenders party thereto, and SunTrust Bank,

as Administrative Agent and as Collateral Agent (incorporated by reference to Exhibit 10.1 to the Company’s Quarterly Report on Form

10-Q

(file

no. 001-35851),

filed on May 14, 2015).

|

C-2

|

(k)(4)

|

Joinder Agreement, dated as of January 16, 2015, by HSBC Bank USA, National Association, as Assuming Lender, in favor of the Company as Borrower, and SunTrust Bank, as administrative agent under the Revolving

Credit Facility (incorporated by reference to Exhibit 10.2 to the Company’s Quarterly Report on Form

10-Q

(file no.

001-35851),

filed on May 14, 2015).

|

|

(k)(5)

|

Joinder Agreement, dated as of March 27, 2015, by CIT Finance LLC, as Assuming Lender, in favor of the Company as Borrower, and Sun Trust Bank, as administrative agent under the Revolving Credit Facility

(incorporated by reference to Exhibit 10.3 to the Company’s Quarterly Report on Form

10-Q

(file no.

001-35851),

filed on May 14, 2015).

|

|

(k)(6)

|

Second Amendment to Senior Secured Revolving Credit Agreement, dated as of November 4, 2015, among Goldman Sachs BDC, Inc., as Borrower, the Lenders party thereto, SunTrust Bank, as Administrative Agent and as

Collateral Agent, and, solely with respect to Section 5.9, DDDS BL, LLC (incorporated by reference to Exhibit 10.1 to the Company’s Form

8-K

(File No. 814-00998),

filed on November 5, 2015).

|

|

(k)(7)

|

Third Amendment to Senior Secured Revolving Credit Agreement, dated as of December 16, 2016, among Goldman Sachs BDC, Inc., as Borrower, the Lenders party thereto, and SunTrust Bank, as Administrative Agent and as

Collateral Agent (incorporated by reference to Exhibit 10.1 to the Company’s Form

8-K

(File

No. 814-00998),

filed on December 21, 2016).

|

|

(k)(8)

|

Amended and Restated Investment Management Agreement, dated as of January 1, 2015, between the Company and Goldman Sachs Asset Management, L.P. (incorporated by reference to Exhibit (g) to

pre-effective

Amendment No. 7 to the Company’s Registration Statement on Form

N-2

(file no.

333-187642),

filed on

March 3, 2015.)

|

|

(k)(9)

|

Senior Credit Fund, LLC Limited Liability Company Agreement, dated as of July 18, 2014, between Goldman Sachs BDC, Inc. and Regents of the University of California (incorporated by reference to Exhibit (k)(6) to

pre-effective

Amendment No. 7 to the Company’s Registration Statement on Form

N-2

(file no.

333-187642),

filed on

March 3, 2015).

|

|

(k)(10)

|

First Amendment to Senior Credit Fund, LLC Limited Liability Company Agreement, dated as of October 1, 2014, between Goldman Sachs BDC, Inc. and Regents of the University of California (incorporated by reference to

Exhibit (k)(6)(a) to

pre-effective

Amendment No. 10 to the Company’s Registration Statement on Form

N-2

(file no.

333-187642),

filed on March 17, 2015).

|

|

(k)(11)

|

Transfer Agency and Services Agreement, effective as of May 2, 2016, by and between the Company, Computershare Inc. and Computershare Trust Company, N.A. (incorporated by reference to Exhibit 10.2 to the to the

Company’s Quarterly Report on Form

10-Q

(file no.

814-00998),

filed on May 9, 2016).

|

|

(k)(12)

|

License Agreement, dated as of April 1, 2013, between the Registrant and the Goldman, Sachs & Co. (incorporated by reference to Exhibit (k)(4) to

pre-effective

Amendment No. 7 to the Company’s Registration Statement on Form

N-2

(file no. 333-187642),

filed on March 3, 2015).

|

|

(l)(1)

|

Opinion and Consent of Fried, Frank, Harris, Shriver & Jacobson LLP, dated January 18, 2017 (incorporated by reference to Exhibit (l) to the Company’s Registration Statement on Form

N-2

(File no.

333-214506),

filed on January 19, 2017).

|

|

(l)(2)

|

Opinion and Consent of Fried, Frank, Harris, Shriver & Jacobson LLP, dated May 24, 2017.

|

|

(n)(1)

|

Independent Registered Public Accounting Firm Consent (incorporated by reference to Exhibit (n)(1) to the Company’s Registration Statement on Form

N-2

(File no.

333-214506),

filed on December 23, 2016).

|

|

(n)(2)

|

Report of Independent Registered Public Accounting Firm regarding “Senior Securities” table contained herein (incorporated by reference to Exhibit (n)(2) to the Company’s Registration Statement on Form

N-2

(File no.

333-214506),

filed on November 8, 2016).

|

C-3

|

|

|

|

|

(n)(3)

|

|

Independent Registered Public Accounting Firm Consent (incorporated by reference to Exhibit (n)(3) to Post-Effective Amendment No. 1 to the Company’s Registration Statement on Form N-2 (File No. 333-214506), filed on May 18,

2017).

|

|

|

|

|

(o)

|

|

Not applicable.

|

|

|

|

|

(p)

|

|

Not applicable.

|

|

|

|

|

(q)

|

|

Not applicable.

|

|

|

|

|

(r)(1)

|

|

Code of Ethics of the Registrant (incorporated by reference to Exhibit (r)(1) to the Company’s Registration Statement on Form N-2 (File no. 333-214506), filed on November 8, 2016).

|

|

|

|

|

(r)(2)

|

|

Code of Ethics of Goldman Sachs Asset Management, L.P. (incorporated by reference to Exhibit (r)(2) to pre-effective Amendment No. 8 to the Company’s Registration Statement on Form N-2 (file no. 333-187642), filed on March

10, 2015).

|

|

|

|

|

(s)(1)

|

|

Form of Preliminary Prospectus Supplement for Common Stock Offerings (incorporated by reference to Exhibit (s)(1) to the Company’s Registration Statement on Form N-2 (File no. 333-214506), filed on January 19,

2017).

|

|

|

|

|

(s)(2)

|

|

Form of Preliminary Prospectus Supplement for Preferred Stock Offerings (incorporated by reference to Exhibit (s)(2) to the Company’s Registration Statement on Form N-2 (File no. 333-214506), filed on January 19,

2017).

|

|

|

|

|

(s)(3)

|

|

Form of Preliminary Prospectus Supplement for Warrant Offerings (incorporated by reference to Exhibit (s)(3) to the Company’s Registration Statement on Form N-2 (File no. 333-214506), filed on January 19, 2017).

|

|

|

|

|

(s)(4)

|

|

Form of Preliminary Prospectus Supplement for Debt Securities Offerings (incorporated by reference to Exhibit (s)(4) to the Company’s Registration Statement on Form N-2 (File no. 333-214506), filed on January 19,

2017).

|

|

|

|

|

(s)(5)

|

|

Form of Preliminary Prospectus Supplement for Subscription Rights Offerings (incorporated by reference to Exhibit (s)(5) to the Company’s Registration Statement on Form N-2 (File no. 333-214506), filed on January 19,

2017).

|

Item 26. Marketing Arrangements

The information contained under the heading “Plan of Distribution” on this Registration Statement is incorporated herein by reference

and any information concerning any underwriters for a particular offering will be contained in the prospectus supplement related to that offering.

Item 27. Other Expenses of Issuance and Distribution

|

|

|

|

|

|

|

Securities and Exchange Commission registration fee

|

|

$

|

23,180

|

|

|

Financial Industry Regulatory Authority fees

|

|

|

30,500

|

|

|

New York Stock Exchange Listing fees

|

|

|

29,350

|

|

|

Printing expenses

|

|

|

58,869

|

|

|

Legal fees and expenses

|

|

|

700,000

|

|

|

Accounting fees and expenses

|

|

|

40,000

|

|

|

Miscellaneous

|

|

|

15,000

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

896,899

|

|

|

|

|

|

|

|

Note: All listed amounts, except the SEC registration fee and the FINRA filing fee, are estimates.

C-4

Item 28. Persons Controlled by or Under Common Control with Registrant

The following list sets forth our subsidiary, the state under whose laws the subsidiary is organized and the voting securities owned by us,

directly or indirectly, in such subsidiary:

|

|

|

|

|

|

|

My-On

BDC Blocker, LLC (Delaware)

|

|

|

100.0

|

%

|

Item 29. Number of Holders of Securities

The following table sets forth the approximate number of record holders of the Registrant’s securities as of March 31, 2017.

|

|

|

|

|

|

|

Title of Class

|

|

Number of Record

Holders

|

|

|

Common shares, par value $0.001 per share

|

|

|

1

|

|

|

Convertible Notes due 2022

|

|

|

1

|

|

Item 30. Indemnification

As permitted by Section 102 of the DGCL, the Registrant has adopted provisions in its certificate of incorporation, as amended, that limit

or eliminate the personal liability of its directors for a breach of their fiduciary duty of care as a director. The duty of care generally requires that, when acting on behalf of the Registrant, directors exercise an informed business judgment

based on all material information reasonably available to them. Consequently, a director will not be personally liable to the Registrant or its stockholders for monetary damages or breach of fiduciary duty as a director, except for liability for:

any breach of the director’s duty of loyalty to the Registrant or its stockholders; any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law; any act related to unlawful stock repurchases,

redemptions or other distributions or payment of dividends; or any transaction from which the director derived an improper personal benefit. These limitations of liability do not affect the availability of equitable remedies such as injunctive

relief or rescission.

The Registrant’s certificate of incorporation and bylaws each provide that all directors, officers, employees

and agents of the Registrant will be entitled to be indemnified by us to the fullest extent permitted by the DGCL, subject to the requirements of the Investment Company Act. Under Section 145 of the DGCL, the Registrant is permitted to offer

indemnification to its directors, officers, employees and agents.

Section 145(a) of the DGCL empowers the Registrant to indemnify any

person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the Registrant)

by reason of the fact that the person is or was a director, officer, employee or agent of the Registrant, or is or was serving at the request of the Registrant as a director, officer, employee or agent of another corporation, partnership, joint

venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding if (1) such

person acted in good faith, (2) in a manner such person reasonably believed to be in or not opposed to the best interests of the Registrant and (3) with respect to any criminal action or proceeding, such person had no reasonable cause to

believe the person’s conduct was unlawful.

Section 145(b) of the DGCL empowers the Registrant to indemnify any person who was

or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the Registrant to procure a judgment in its favor by reason of the fact that the person is or was a director, officer,

employee or agent of the Registrant, or is or was serving at the request of the Registrant as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses (including

attorneys’ fees) actually and reasonably incurred by such person in connection with the defense or settlement of such action or suit if such person acted in good faith and in a manner the person reasonably believed to be in, or not opposed to,

the best interests of the Registrant, and except that no indemnification may be made in respect of any claim, issue or matter as to which such person has been adjudged to be liable to the Registrant unless and only to the extent that the Delaware

Court of Chancery or the court in which such action or suit was brought determines upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to

indemnity for such expenses which the Court of Chancery or such other court deems proper.

C-5

Section 145(c) of the DGCL provides that to the extent that a present or former director or

officer of the Registrant has been successful, on the merits or otherwise, in defense of any action, suit or proceeding referred to in subsections (a) and (b) of Section 145, or in defense of any claim, issue or matter therein, such

person shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection with such action, suit or proceeding.

Section 145(d) of the DGCL provides that in all cases in which indemnification is permitted under subsections (a) and (b) of

Section 145 (unless ordered by a court), it will be made by the Registrant only if it is consistent with the Investment Company Act and as authorized in the specific case upon a determination that indemnification of the present or former

director, officer, employee or agent is proper in the circumstances because the person to be indemnified has met the applicable standard of conduct set forth in those subsections. Such determination must be made, with respect to a person who is a

director or officer at the time of such determination, (1) by a majority vote of the directors who are not parties to such action, suit or proceeding, even though less than a quorum, or (2) by a committee of such directors designated by

majority vote of such directors, even though less than a quorum, or (3) if there are no such directors, or if such directors so direct, by independent legal counsel in a written opinion or (4) by the stockholders.

Section 145(e) authorizes the Registrant to pay expenses (including attorneys’ fees) incurred by an officer or director of the

Registrant in defending any civil, criminal, administrative or investigative action, suit or proceeding in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of the person to whom the

advancement will be made to repay the advanced amounts if it is ultimately determined that he or she was not entitled to be indemnified by the Registrant as authorized by Section 145. Section 145(e) also provides that such expenses

(including attorneys’ fees) incurred by former directors and officers or other employees and agents of the Registrant, or persons serving at the request of the Registrant as directors, officers, employees or agents of another corporation,

partnership, joint venture, trust or other enterprise may be so paid upon such terms and conditions, if any, as the Registrant deems appropriate.

Section 145(f) provides that indemnification and advancement of expenses provided by, or granted pursuant to, the other subsections of such

Section are not to be deemed exclusive of any other rights to which those seeking indemnification or advancement of expenses may be entitled under any bylaw, agreement, vote of stockholders or disinterested directors, or otherwise.

Section 145(g) authorizes the Registrant to purchase and maintain insurance on behalf of its current and former directors, officers,

employees and agents (and on behalf of any person who is or was serving at the request of the Registrant as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise) against any liability

asserted against such person and incurred by such person in any such capacity, or arising out of such person’s status as such, regardless of whether the Registrant would have the power to indemnify such persons against such liability under

Section 145.

Section 102(b)(7) of the DGCL allows the Registrant to provide in its certificate of incorporation a provision

that limits or eliminates the personal liability of a director of the Registrant to the Registrant or its stockholders for monetary damages for breach of fiduciary duty as a director, provided that such provision may not limit or eliminate the

liability of a director (1) for any breach of the director’s duty of loyalty to the Registrant or its stockholders, (2) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law,

(3) under Section 174 of the DGCL, relating to unlawful payment of dividends or unlawful stock purchases or redemption of stock or (4) for any transaction from which the director derived an improper personal benefit. Our certificate

of incorporation will provide that our directors will not be liable to us or our stockholders for monetary damages for breach of fiduciary duty as a director to the fullest extent permitted by the current DGCL or as the DGCL may hereafter be

amended.

The Administration Agreement provides that we shall indemnify and hold the administrator harmless from all loss, cost, damage

and expense, including reasonable fees and expenses for counsel, incurred by the administrator resulting from any claim, demand, action or suit in connection with the administrator’s acceptance of

C-6

the Administration Agreement, any action or omission by it in the performance of its duties hereunder, or as a result of acting upon any instructions reasonably believed by it to have been duly

authorized by us or upon reasonable reliance on information or records given or made by us or our Investment Adviser, provided that this indemnification shall not apply to actions or omissions of the administrator, its officers or employees in cases

of its or their own negligence, bad faith or willful misconduct.

We expect that each underwriting agreement will provide that we will

indemnify the underwriters against specified liabilities for actions taken in their capacities as such, including liabilities under the Securities Act, or contribute to payments that the underwriters may be required to make in respect thereof.

Insofar as indemnification for liability arising under the Securities Act may be permitted to directors, officers and controlling persons of

the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is,

therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful

defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by

controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

Item 31. Business and Other Connections of Our Investment Adviser

A description of any other business, profession, vocation or employment of a substantial nature in which our Investment Adviser, and each

managing director, director or executive officer of our Investment Adviser, is or has been during the past two fiscal years, engaged in for his or her own account or in the capacity of director, officer, employee, partner or trustee, is set forth in

Part A of this Registration Statement in the section entitled “Management.” Additional information regarding our Investment Adviser and its officers and directors is set forth in its Form ADV, as filed with the Securities and Exchange

Commission (SEC File

No. 801-37591),

and is incorporated herein by reference.

Item 32. Locations of

Accounts and Records

All accounts, books and other documents required to be maintained by Section 31(a) of the Investment Company Act

of 1940, and the rules thereunder are maintained at the offices of:

|

|

(1)

|

the Registrant, Goldman Sachs BDC, Inc., c/o Goldman Sachs Asset Management, L.P., 200 West Street, New York, New York 10282;

|

|

|

(2)

|

the Transfer Agent, Computershare Trust Company, N.A., 250 Royall Street, Canton, Massachusetts 02021;

|

|

|

(3)

|

the Custodian, State Street Bank and Trust Company, One Lincoln Street, Boston, Massachusetts 02111; and

|

|

|

(4)

|

the Investment Adviser, Goldman Sachs Asset Management, L.P., 200 West Street, New York, New York 10282.

|

Item 33. Management Services

Not

applicable.

C-7

Item 34. Undertakings

|

|

1.

|

The Registrant undertakes to suspend the offering of shares until the prospectus is amended if (1) subsequent to the effective date of its registration statement, the net asset value declines more than ten percent

from its net asset value as of the effective date of the registration statement; or (2) the net asset value increases to an amount greater than the net proceeds as stated in the prospectus.

|

|

|

3.

|

If the securities being registered are to be offered to existing shareholders pursuant to warrants or rights, and any securities not taken by shareholders are to be reoffered to the public, the Registrant undertakes to

supplement the prospectus, after the expiration of the subscription period, to set forth the results of the subscription offer, the transactions by underwriters during the subscription period, the amount of unsubscribed securities to be purchased by

underwriters, and the terms of any subsequent reoffering thereof. If any public offering by the underwriters of the securities being registered is to be made on terms differing from those set forth on the cover page of the prospectus, the Registrant

undertakes to file a post-effective amendment to set forth the terms of such offering.

|

|

|

4.

|

The Registrant undertakes:

|

|

|

(a)

|

to file, during any period in which offers or sales are being made, a post-effective amendment to the registration statement:

|

|

|

(1)

|

to include any prospectus required by Section 10(a)(3) of the Securities Act;

|

|

|

(2)

|

to reflect in the prospectus any facts or events after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a

fundamental change in the information set forth in the registration statement; and

|

|

|

(3)

|

to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

|

|

|

(b)

|

that, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the

offering of those securities at that time shall be deemed to be the initial bona fide offering thereof;

|

|

|

(c)

|

to remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering;

|

|

|

(d)

|

that, for the purpose of determining liability under the Securities Act to any purchaser, if the Registrant is subject to Rule 430C: Each prospectus filed pursuant to Rule 497(b), (c), (d) or (e) under the

Securities Act as part of a registration statement relating to an offering, other than prospectuses filed in reliance on Rule 430A under the Securities Act, shall be deemed to be part of and included in the registration statement as of the date it

is first used after effectiveness; provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the

registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or

prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use; and

|

|

|

(e)

|

that for the purpose of determining liability of the undersigned Registrant under the Securities Act to any purchaser in the initial distribution of securities, the undersigned Registrant undertakes that in a primary

offering of securities of the Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the

following communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to the purchaser:

|

|

|

(1)

|

any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 497 under the Securities Act;

|

C-8

|

|

(2)

|

the portion of any advertisement pursuant to Rule 482 under the Securities Act relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the

undersigned Registrant; and

|

|

|

(3)

|

any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

|

|

|

5.

|

The Registrant undertakes that:

|

|

|

(a)

|

For the purpose of determining any liability under the Securities Act, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form

of prospectus filed by the Registrant pursuant to Rule 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared effective; and

|

|

|

(b)

|

For the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities

offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

C-9

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended (the “Securities Act”), the Registrant has duly caused this

Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in The City of New York, State of New York on the 24th day of May 2017.

|

|

|

|

|

GOLDMAN SACHS BDC, INC.

|

|

|

|

|

By:

|

|

/s/ Brendan McGovern

|

|

Name:

|

|

Brendan McGovern

|

|

Title:

|

|

Chief Executive Officer and President

|

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed by the

following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ Brendan McGovern

Brendan McGovern

|

|

Chief Executive Officer and President

(Principal Executive Officer)

|

|

May 24, 2017

|

|

|

|

|

|

/s/ Jonathan Lamm

Jonathan Lamm

|

|

Chief Financial Officer and Treasurer

(Principal Financial Officer)

|

|

May 24, 2017

|

|

|

|

|

|

/s/ Carmine Rossetti

Carmine Rossetti

|

|

Principal Accounting Officer

|

|

May 24, 2017

|

|

|

|

|

|

*

Jaime Ardila

|

|

Director

|

|

May 24, 2017

|

|

|

|

|

|

*

Ashok N. Bakhru

|

|

Director

|

|

May 24, 2017

|

|

|

|

|

|

*

Janet F. Clark

|

|

Director

|

|

May 24, 2017

|

|

|

|

|

|

*

Ross J. Kari

|

|

Director

|

|

May 24, 2017

|

|

|

|

|

|

*

Ann B. Lane

|

|

Director

|

|

May 24, 2017

|

|

|

|

|

|

*

Katherine Uniacke

|

|

Director

|

|

May 24, 2017

|

|

|

|

|

|

By:

|

|

/s/ Caroline Kraus

|

|

Caroline Kraus

|

|

Attorney-in

Fact

|

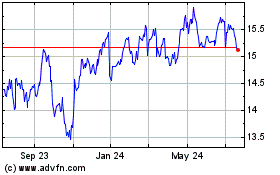

Goldman Sachs BDC (NYSE:GSBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

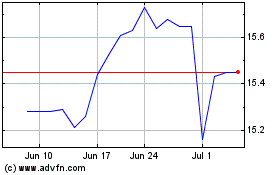

Goldman Sachs BDC (NYSE:GSBD)

Historical Stock Chart

From Apr 2023 to Apr 2024