UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant [X] Filed by a Party other than the Registrant [ ]

Check the appropriate Box:

[ ] Preliminary Proxy Statement

[ ] Confidential for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[X] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a-12

HomeStreet, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ]Fee computed on table below per Exchange Act Rules 14a-6(i)(l) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(Set forth the amount on which the filing is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total Fee Paid:

[ ]Fee paid previously with preliminary materials.

[ ]Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

AN IMPORTANT REMINDER TO SUBMIT YOUR PROXY TO VOTE AT OUR ANNUAL MEETING OF SHAREHOLDERS ON MAY 25, 2017

HomeStreet, Inc.’s Independent Directors Urge Shareholders to Vote FOR the Reelection of ALL Class III Director Nominees, Including Thomas E. King (Proposal 1)

May 18, 2017

Dear Fellow HomeStreet Shareholder:

In connection with our upcoming Annual Meeting of Shareholders, to be held on May 25, 2017, we are writing to ask for your support by voting in accordance with the recommendations of our Board of Directors on all proposals in our 2017 Proxy Statement, which was filed on April 24, 2017.

In particular, we ask you to consider the extensive experience and qualifications of nominee Thomas E. King and to vote FOR the reelection of Mr. King and the other Class III nominees to our Board of Directors (Proposal 1).

Although the Board has recommended, and continues to recommend, that shareholders vote FOR Mr. King’s reelection, two major proxy advisory firms have split in their recommendation, with one recommending in favor but the other currently recommending to the contrary. The question about Mr. King’s candidacy arises out of the Company’s settlement with the SEC in January 2017 and the fact that Mr. King is the only member of the Audit Committee standing for reelection this year. In order to provide you with additional context beyond our Proxy Statement, we are writing to you to highlight key points regarding the Board and Mr. King’s role in the events preceding and actions taken in response to accounting concerns that ultimately gave rise to the Company’s settlement with the SEC as you consider your vote on the reelection of our Class III nominees.

Among other board committee memberships, Mr. King serves in the crucial role as the chair of the Company’s credit committee. We believe that Mr. King’s extensive experience and qualifications, particularly in banking and credit, are essential to our Board’s understanding and oversight of the Company and the Bank. Mr. King also has extensive knowledge of the banking and credit markets in Southern California, the region where we have seen our most significant growth in recent years.

Background

Between 2006 and 2008 – before its IPO, and prior to Mr. King joining the Board in 2012 – the Company entered into 22 commercial real estate loan agreements with various counterparties. As is customary in our industry, the Company also entered into certain related interest rate swaps

designated as accounting hedges (the “Hedges”) under GAAP (ASC 815). The Hedges require a highly complex and technical accounting test designed to demonstrate their effectiveness, which includes numerous quantitative variables. Since changes in the fair value of the hedged item must ordinarily be recognized as income or expense, hedging is a widely-used and prudent method of reducing the carrying amount of that hedged item. In order to maintain hedge accounting, these hedging relationships must be assessed and declared effective on a quarterly basis.

We would respectfully note that at all times relevant to Mr. King’s candidacy, the Company’s books and records were audited by KPMG LLP (from 2008 to 2014) or Deloitte & Touche LLP (from 2015 to present), and the Company and the Board of Directors (including the Audit Committee) relied upon advice that Mr. King and the Company’s other directors believed to be competent as to the matters entrusted to them. See RCW 23B.08.300(2), which reads in pertinent part: “In discharging the duties of a director, a director is entitled to rely on information, opinions, reports, or statements, including financial statements and other financial data, if prepared or presented by…legal counsel, public accountants, or other persons as to matters the director reasonably believes are within the person's professional or expert competence.” The hedging activities described above are extremely complex (for reference, the seminal guidance from one major accounting firm on this subject is 620 pages long), and naturally requires directors such as Mr. King to seek the independent opinion of the Company’s outside auditors. Once KPMG and Deloitte & Touche had rendered an unqualified opinion as to these matters, neither Mr. King nor any other board member exercising reasonable and appropriate diligence did or could have either the expertise or the fact-specific knowledge necessary to question those opinions.

The SEC’s Allegations

The Securities and Exchange Commission (“SEC”) alleged that one of our employees had caused internal accounting control violations by overseeing a practice that included changing the inputs in the test and, at times, instructing a limited number of other employees to follow such practice. There were only a small number of employees involved in events that gave rise to the accounting errors. The accounting errors related only to the 22 commercial real estate assets mentioned above, and no other assets in the Company’s portfolio.

The SEC Order also alleged that the Company took steps to determine the identity of the presumed “whistleblower” by asking an employee whether he had notified the SEC’s enforcement division of the hedge accounting issues. The SEC further alleged that language in the severance agreements for two employees and a question raised with counsel for a former employee regarding interpreting an indemnity agreement could have had the effect of impeding those employees from speaking with the SEC, although the SEC acknowledged that no one actually failed to speak with the SEC.

We believe that it is also important to recognize what the SEC Order does

not

say. The SEC Order does not find (or even allege) any evidence of fraud or scienter among any of the Company’s employees, and there was no finding from the SEC that the actions of the employees involved in the accounting error acted with an intent to deceive or defraud investors or anyone else. Mr. King in particular was never under investigation, and obviously was not named in the SEC Order. In fact, at no time during the course of the investigation did the SEC ask to speak with Mr. King or request any information about or from him.

Remedial Actions Taken in Response

|

|

|

|

•

|

After management discovered errors in hedge effectiveness testing in October 2014, the Company’s Board of Directors promptly convened a special committee to investigate the hedge accounting issues. Although the Company found that certain adjustments made to its hedge effectiveness tests were incorrect, the Committee found no indication that any treasury employee acted with intent to deceive or defraud.

|

|

|

|

|

•

|

In its next regularly recurring filing, its Form 10-Q in November 2014, the Company promptly disclosed that it had discovered errors in the hedge effectiveness tests. However, the Company determined that the hedging accounting errors, including the amounts of recognizable income at issue, were not material to any reporting statement, so no restatement of financial statements was necessary. The Company’s outside auditors concurred with this assessment, and the SEC did not take any issue with this determination.

|

|

|

|

|

•

|

The Company terminated the swaps related to the affected loans in the fourth quarter of 2014.

|

|

|

|

|

•

|

Since 2008, the Company has not entered into any hedges similar to the ones that gave rise to the errors, and has publicly stated that it “has no plans to reestablish any similar practices or products.”

|

|

|

|

|

•

|

The Company has also terminated any remaining fair value hedge accounting relationships.

|

|

|

|

|

•

|

The Company has revised its standard severance agreement to incorporate language stating that nothing in the agreement limits the employee’s ability to file a charge or complaint or otherwise communicate with any government agency. Additionally, the Company has contacted the employees that had entered into prior versions of the Company’s standard severance agreement and informed them that it does not prohibit them from reporting information to the SEC or seeking and obtaining a whistleblower award.

|

Conclusion

In summary, we believe that the Company has promptly, appropriately, and fully responded to the SEC’s investigation of non-material accounting errors by voluntarily disclosing such errors and taking effective remedial steps to ensure compliance with the applicable regulations. Moreover, the SEC Order and investigation relates entirely to prior periods, not to any ongoing accounting issues, and the agreed upon SEC penalty of $500,000 was immaterial to the Company based on our 2016 operating results (including net income of $58.15 million). Our Board of Directors and Audit Committee responded promptly to provide appropriate oversight and appointed a special committee to investigate and took steps to prevent such errors from happening in the future. We believe that the Company is in a stronger position today as a result of the positive steps that we have taken since the errors were discovered.

Given all of this, we believe that it would be unfair to scapegoat Mr. King or any of our other audit committee members for events that involved a highly technical accounting determination, did not involve any allegations of fraud, were not material to the Company’s financial results, did not result in a restatement, and to which the Board of Directors, its special committee and the Audit Committee responded by taking swift and appropriate action.

We therefore urge you to vote FOR the reelection of Mr. King and the other Class III nominees (Proposal 1) at our upcoming Annual Meeting.

If you have any questions, or need any assistance in submitting your proxy to vote your shares, please call our proxy solicitor, MacKenzie Partners, Inc., at (800) 322-2885.

Thank you for your support.

* * *

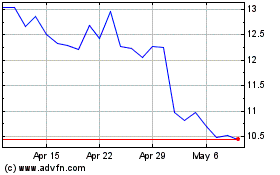

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Mar 2024 to Apr 2024

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Apr 2023 to Apr 2024